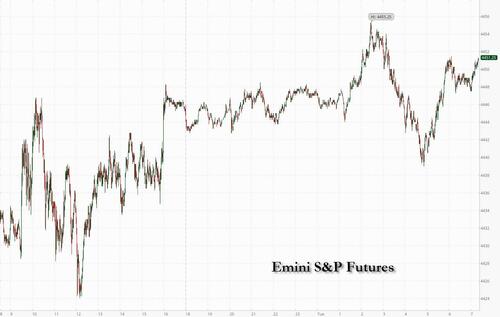

For the second day in a row, S&P futures are largely unchanged following a muted overnight session, reversing an earlier loss around the start of the European session and trading around session highs. In a reversal of yesterday's tech/small cap drubbing sparked by fears about the upcoming Nasdaq special rebalance (see here). As of 7:30am, S&P futures were up 0.2%, trading at 4,450, and building on Monday's modest gains with sentiment boosted after China signaled that more economic aid measures will come to support its ailing property market along with measures to boost business confidence; Nasdaq futures were also in the green as tech stocks see a lift while bond yields fall ahead of growing expectation that tomorrow's CPI will surprise dovishly (in large part on the back of yesterday's Manheim used car index collapse).

Treasury yields fell with the 10Y yield trading below 4% as USD weakness continued for a third day. NY Fed’s consumer survey shows inflation expectations continuing to decline; 1Y expectations are now 3.8%, the lowest reading since Apr 2021. The perceived probability of job loss moved up to 12.9%, highest since Nov 2021, which may feed into a reduced job quits rate. Meanwhile, Fedspeak remained hawkish, continuing the recent narrative with all of Monday's Fed speakers indicating they are looking for higher rates. As such rate hike expectations for July remain ~90%. With all eyes on Wednesday’s CPI print, we may see another quiet (from a news/catalyst perspective) session with activity mostly position squaring ahead of the CPI print. Yesterday saw another strong series of short covering, which in turn led to the third worst day of 2023 for hedge funds according to Goldman prime brokerage.

In premarket trading, Iovance Biotherapeutics shares fall 11% after the biotechnology company announced the pricing of an underwritten public offering of 20 million shares of its common stock at $7.50 per share, a nearly 15% discount to last close. JPMorgan gaines more than 1% after it was raised to buy from hold at Jefferies, which highlights the big US investment bank’s “stable” earnings outlook and better revenue diversity. Here are some other premarket movers:

“Last week’s surge in government bond yields put some pressure on equities – and highlights that companies will need to deliver on the market’s earnings expectations as the Q2 reporting season gets underway,” BlackRock Investment Institute analysts including Jean Boivin wrote in a note. “Resilient consumers have helped support earnings, but we see them exhausting the savings built up during the pandemic this year.”

While central bank officials in Europe and the US are increasingly suggesting they’ve reached a turning point in the battle against inflation, they’re also warning that higher rates for longer are needed to ensure price stability. That’s a mixed blessing for stock bulls who have had to endure a disappointing start to the second half after stellar gains in the first six months of the year. The approaching second-quarter earnings season will give them more food for thought: it kicks off in earnest on Friday, when JPMorgan, Citigroup and Wells Fargo all report their numbers.

“US equity markets have priced in a soft landing, or a more friendly recession, but actually the risk is for the recession to come in harder than expected,” Cecilia Chan, chief investment officer for APAC at HSBC Asset Management, said on Bloomberg TV. “For developed markets we expect a choppy-waters kind of scenario where it will be more difficult from now on, and we are more conscious of valuations that are on the expensive side.”

On Wednesday, the latest US CPI data will give further insight into outlook for prices and interest rates. Most Fed policymakers expect to increase rates by a further half percentage point by the end of the year, according to projections released after their June gathering. The ECB, meanwhile, is all but certain to raise rates by a quarter point on July 27. Policymakers are debating whether to raise borrowing costs again at their subsequent meeting in September.

In the UK, data showed that wage growth held at a level that BOE Governor Andrew Bailey said is fueling inflation. The data is crucial to shaping the central bank’s next decision on rates in August. The pound rose to the highest versus the dollar since April 2022.

In Europe, the Stoxx 600 index was on track for a third day of gains with construction, consumer and mining stocks leading gains after Governing Council member Francois Villeroy de Galhau said the European Central Bank is nearly finished hiking, but added that interest rates will stay at “high plateau” for some time. The UK’s benchmark fell as the latest wage data added pressure on the Bank of England to keep raising rates. Bonds rose, with the German 10-year yield falling five basis points to 2.59%. Here are the other notable European movers:

Earlier, a gauge of Asian equities climbed more than 1% and snapped a four-day losing streak, boosted by gains in semiconductor-related shares and China’s latest moves to support its flagging economy and property sector. The MSCI Asia Pacific Index climbed 1.2%, with Taiwan Semiconductor the biggest contributor after a better-than-expected sales report amid the boom in artificial intelligence. South Korea, Hong Kong, Taiwan and Australia were among the best-performing markets in the region, while Japanese stocks halted their longest losing run of the year as a result of a recent surge in the yen following months of carry-trade driven weakness.

Stock gauges in Hong Kong and mainland China extended gains from Monday as Chinese authorities signaled further policy support for the economy following minor steps to support the weak property market. The Hang Seng Index is still down 17% from a January high. “Valuations have been cheap but earnings revision seems to be bottoming out,” Rupal Agarwal, Asia quantitative strategist at Bernstein told Bloomberg Television explaining her constructive view on China. “Some of the policy-led support that the market could start receiving is also one of the key catalysts we are looking for,” she added. Japan's Nikkei 225 was the laggard and gave back most of its early gains with the upside capped by a firmer currency. ASX 200 traded higher with the index led by the tech and mining-related industries, while risk sentiment was also facilitated by an improvement in Westpac consumer confidence and NAB business surveys.

In FX, the Bloomberg Dollar Spot Index saw another day of broad-based weakening as the Japanese yen outperformed most major peers. USD/JPY fell as much as 0.63% as traders sold out of long dollar positions; NZD/USD slipped 0.4% and AUD/USD fell 0.1% after China’s economic stimulus signal did little to support the currencies.

“We do not expect big FX moves today, but DXY could continue drifting toward the 101.50 area,” wrote Chris Turner, head of fx strategy at ING, in a note. “The push factor of the Fed/US interest rate story versus the pull factor of overseas asset markets is slightly working against the dollar.”

In rates, treasuries advanced across the curve with yields on the two-year falling three basis points to 4.83% and yields on the 10-year down three basis points to 3.965%, outperforming bunds and gilts by 1bp and 2bp; euro bonds also saw broad.

Governing Council member Francois Villeroy de Galhau said the European Central Bank is nearly finished hiking, but interest rates will stay at “high plateau” for some time. Treasury’s $40 billion 3-year new-issue auction closes at 1pm New York time; $32 billion 10-year and $18 billion 30-year reopenings are Wednesday and Thursday. Gilts are higher after the UK unemployment rate unexpectedly rose in May although wages did top estimates. UK two-year yields are down 3bps at 5.34%. The pound is up 0.3%.

In commodities, crude futures advanced, with WTI gaining 0.2% to trade near $73.20. Spot gold adds 0.6%. Bitcoin falls 1.3%.

Looking To the day ahead, and data releases include UK employment and Italian industrial production for May, along with the German ZEW survey for July. In the US, there’s also the NFIB’s small business optimism index for June which came in stronger at 91.0 from 89.4 last month, above the 89.9 expectation. From central banks, we’ll hear from the ECB’s Villeroy. Finally, NATO leaders will be gathering for a summit in Vilnius.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive following the tailwinds from the US where cyclicals benefitted from encouraging inflation proxies ahead of this week's US CPI data, while participants also reflected on China's support efforts. ASX 200 traded higher with the index led by the tech and mining-related industries, while risk sentiment was also facilitated by an improvement in Westpac consumer confidence and NAB business surveys. Nikkei 225 was the laggard and gave back most of its early gains with the upside capped by a firmer currency. Hang Seng and Shanghai Comp conformed to the upbeat mood as developers benefitted after China extended two financial policies to support the stable and healthy development of the real estate market to the end of 2024.

Top Asian News

European bourses are firmer but off of best levels, Euro Stoxx 50 +0.4%, as sentiment has gradually deteriorated throughout the morning from initial APAC performance and as ZEW remains glum. Sectors are primarily in the green, though shy of best levels given the above; Autos lag with Volkswagen dragging after a Handelsblatt piece. Stateside, futures are directionally in-fitting but have been much closer to unchanged throughout the morning ahead of a relatively thin US agenda, ES +0.1%. German Cartel Office says, following the European Court Ruling, see scope for further actions against Big Tech names.. Reminder, On July 4th, the EU's Top Court said the German Antitrust Agency can asses privacy in its investigations.

Top European News

FX

Fixed Income

Commodities

Geopolitics

Asia Pacific

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets had started the week in a holding pattern, but a rates rally in the US emerged as the main theme on Monday that sent the 10yr Treasury yield back beneath 4% again. The decline in yields followed some dovish tones in usually second-tier US data, which comes ahead of tomorrow’s all-important US CPI print. For equities it was a slow moving day, but the major indices like the S&P 500 (+0.24%) and Europe’s STOXX 600 (+0.18%) did see muted gains ahead of the start of earnings season later this week.

Earlier in the day 10yr US Treasury yields briefly looked like they might move above the pre-SVB peak, reaching as high as 4.088% shortly before the US open. But yields closed materially lower in the end, with the 2yr down -8.8bps to 4.86% and the 10yr down -6.8bps to 3.99%. The latter was the sharpest daily fall since the first half of June, and overnight we’ve seen the 10yr move another basis point lower to 3.98%. The rally came as investors grew more confident that the Fed would cut rates in H1 2024 (with June 2024 Fed pricing down -11.0bps from Friday). However, investors only marginally dialled back their expectations for rate hikes this year, with no change in the 89% likelihood of a hike this month and with the terminal rate priced for November down just -1.0bps to 5.42%.

The US rates rally appeared most driven by the US Manheim used car price index release, which fell -4.2% month-on-month in June, marking the biggest monthly decline since April 2020. Manheim used car prices have now declined for three months in a row, adding to the array of indicators pointing to slowing goods price momentum. Another data point supporting the rally was the New York Fed’s latest Survey of Consumer Expectations. That showed 1yr inflation expectations falling back to +3.8% in June, which is their lowest level in over two years. Furthermore, the mean perceived probability of losing one’s job in the net year was up to 12.9%, the highest since November 2021. So that offered fresh signs that price pressures might be abating and the labour market softening. That said, the survey also saw 5-year inflation expectations rise to 3.0%, their highest since March 2022. So while there is increasing evidence of near-term disinflationary trends, questions remain as to whether inflation will persist at uncomfortably high levels in the medium-term.

The inflationary concern was reflected in hawkish comments from various Fed officials. That included Cleveland Fed President Mester, who said her view “is that the funds rate will need to move up somewhat further”, while San Francisco President Daly said “we’re likely to need a couple more rate hikes over the course of this year” and that the risks of doing too little to curb inflation outweighed the risks of doing too much. In the meantime, Atlanta Fed President Bostic had a more dovish tone, saying that “we can be patient” and that policy was “clearly in the restrictive territory”.

Elsewhere from the Fed, Vice Chair for Supervision Barr gave an important speech about his review on capital for large banks. Among others, the proposals outlined would stop relying on banks’ own estimates of their own risk, instead moving over to standardised approaches that apply the same requirements to each bank. He also said that stress tests “should evolve to better capture the range of salient risks that banks face.” Barr said that these changes “would increase capital requirements overall, but I want to emphasize that they would principally raise capital requirements for the largest, most complex banks.”

Back in Europe, the recent rates sell off held ground, and yields on 10yr bunds edged up +0.2bps to their highest level since SVB’s collapse, at 2.64%. Likewise in France, the 10yr yield (+0.7bps) inched up to a post-SVB high of 3.19%. The UK was the outlier once again, although this time gilts outperformed and the 10yr yield came down -1.2bps. We did hear from BoE Governor Bailey yesterday, where he acknowledged that the UK economy had “shown unexpected resilience” to external shocks, and said that “headline inflation is set to fall markedly over the remainder of the year.”

As mentioned at the start, Monday was a modestly positive day for equities. In the US, the S&P 500 was up +0.24%, and the NASDAQ up by +0.18%. European indices saw similar moves, with the STOXX 600 (+0.18%), the DAX (+0.45%), and the CAC 40 (+0.45%) all advancing. Across sectors, tech stocks underperformed in the US, with the FANG+ index of megacap tech stocks down -0.80%. On the other hand, cyclical and small-cap stocks were big outperformers, with the Russell 2000 up +1.64%.

This morning in Asia, equity markets have extended their overnight gains on Wall Street after China stepped up its support to the property sector. Yesterday saw a joint statement from the People’s Bank of China and National Financial Regulatory Administration, and some loans are set to be given a one-year repayment extension. Furthermore, there were signals of more policy support ahead, with the China Securities Journal newspaper saying that China was expected to “accelerate” the policy rollout to support the real estate market, and that measures to support business confidence may be introduced.

With more support being signalled, the Hang Seng (+1.53%) is leading gains across the region followed by the KOSPI (+1.36%), the CSI (+0.63%), the Shanghai Composite (+0.48%) and the Nikkei (+0.01%). In overnight trading, US stock futures are also pointing towards modest gains, with those on the S&P 500 (+0.04%) and NASDAQ 100 (+0.03%) just above flat. In the meantime, the Japanese Yen has continued to strengthen against the US Dollar, falling beneath 141 per dollar in its 4th consecutive move higher.

Elsewhere, there was important news in the Netherlands after Prime Minister Mark Rutte said he’d be leaving politics. That follows the collapse of his coalition government because of disagreements over migration, and came ahead of a vote of no confidence in parliament. Rutte has been PM since 2010, making him the second-longest serving EU leader after Hungary’s Viktor Orban. Rutte is expected to remain as caretaker PM until elections are held later this year.

To the day ahead, and data releases include UK employment and Italian industrial production for May, along with the German ZEW survey for July. In the US, there’s also the NFIB’s small business optimism index for June. From central banks, we’ll hear from the ECB’s Villeroy. Finally, NATO leaders will be gathering for a summit in Vilnius.