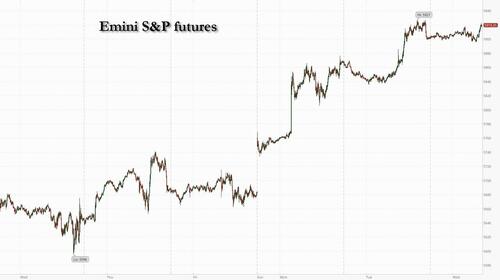

US equity futures are modestly in the green with tech/AI stocks leading and small caps lagging as equities may see some profit-taking given the relentless strength of the rally. Stocks has now erased their YTD losses, and the recovery pace of the past 6 weeks is the fastest since the 1980s. As of 8:00am ET, S&P futures are up 0.2%, near session highs after reversing earlier losses; Nasdaq futures gain 0.4% with chips higher on new deals being made by Trump in the Middle East regarding chips/AI infra build. Pre-mkt, NVDA/TSLA are higher with the rest of Mag7 mixed but Semis are higher though other Cyclicals are slightly weaker. AI theme is higher, too. The yield curve is twisting steeper as USD strength fizzles sparked by concerns Trump may turn to dollar strength next (following overnight Bloomberg report there was discussion between US and SKorea on dollar strength). Commodities are lower as Energy sells off, and gold is flat around $3220. The macro data focus is on mortgage applications (up 1.1%) and XHB is +5% over the last two days.

In premarket trading, magnificent seven stocks are mixed: Nvidia leads gainers as the semiconductor giant is on track to extend gains after a deal to supply chips to Saudi Arabian AI company Humain for a massive data center project (Nvidia +3%, Tesla +2%, Alphabet +0.6%, Meta +0.7%, Amazon +0.2%, Apple -0.3%, Microsoft -0.3%). Super Micro Computer (SMCI) rises 14%, set to extend Tuesday’s 16% rally, after Saudi Arabia-based data center company DataVolt signs a multi-year partnership agreement with the beleaguered US company. Here are some other notable premarket movers:

After the recent faceripping rally left the S&P 500 flat for the year, Wall Street strategists - who were skeptical stocks would rebound at all - are now skeptical about how much further stocks can run. Goldman Sachs strategist Peter Oppenheimer warned that equities remain vulnerable if deteriorating economic data reignites recession worries.

“Investors got very bearish in April, missed the market rebound and then were forced to chase it,” said Lilian Chovin, head of asset allocation at Coutts & Co. With focus shifting to the impact of tariffs, he’s using the rebound to take some profit and reduce his equities overweight.

After its recent rally, the dollar weakened 0.4% after Bloomberg reported that the US and South Korea discussed their currency policies in early May, fueling speculation President Donald Trump’s administration is open to a weaker greenback. The won jumped more than 1% and neighboring currencies, including the Japanese yen, also rose against the dollar.

Investors took news of the talks between South Korea and the US as reason to suspect foreign governments may accept strength in their exchange rates to smooth the way to trade deals with the US. Trump and other administration officials have argued weakness in Asian currencies versus the dollar have handed an unfair advantage for regional exporters over US rivals.

In Europe, the Stoxx 600 dipped 0.2% as stocks paused for breath after the rally spurred by trade optimism. Insurance, utility and telecoms stocks outperform, while autos and consumer products lag. Among individual stocks, Burberry surges after the luxury group’s fourth-quarter retail sales beat estimates and the company announced plans to cut almost a fifth of its workforce. Shares in tour operator TUI slide after summer bookings showed a negative inflection. Here are some of the more notable movers:

Earlier in the session, Asian stocks rose, on track for a fourth-straight session of gains, as Chinese tech firms climbed ahead of earnings announcements. The MSCI Asia Pacific Index advanced as much as 1.1%, with Tencent and Alibaba among the biggest boosts. Chipmakers TSMC and SK Hynix also drove gains, following US peers higher after news that Nvidia and Advanced Micro Devices will supply semiconductors for a large Saudi Arabian data-center project. Hong Kong, South Korea, Taiwan and Indonesia led gains in the region. Japanese stocks bucked the trend, with the benchmark Topix snapping a 13-day win streak, as worries about the nation’s continued lack of a tariff deal with the US and weak earnings from the auto sector drove profit-taking. Traders are looking to China’s tech earnings as another possible catalyst for stocks after this week’s US-China tariff cuts. The results could provide clues on whether the sector’s artificial intelligence-driven rally is back on track, which may offset lingering doubts over the potential for final deals between US and its trading partners.

In FX, the Bloomberg Dollar Spot Index is down 0.5% as the greenback falls across the board after Bloomberg reported the US and South Korea discussed their currency policies in early May and agreed to continue talks, according to a person familiar with the matter. The South Korean won rises 1.7%. The Japanese yen is the best performing G-10 currency with a 1.1% gain.

In rates, the 10-year Treasury yields are higher by 1basis point at 4.48%, reversing an earlier drop. US 2- to 10-year yields are 1bp-2bp cheaper on the day led by the 5-year, with long-end little changed, steepening 5s30s by about 1bp. UK gilts lag Treasuries slightly after an auction of 10-year debt.

In commodities, WTI drops 1% to $63 a barrel. Spot gold falls $20 to around $3,230/oz. Bitcoin falls over 1% toward $103,000.

The US economic data slate is blank; scheduled Fed speakers include Jefferson (9:10am) and Daly (5:40pm)

Market Snapshot

Top Overnight News

Tariffs/Trade

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed but with the region predominantly in the green following the momentum from the constructive performance on Wall St, where most major indices closed higher in the aftermath of the softer-than-expected US CPI data, although demand was contained overnight amid a lack of fresh major catalysts and as participants digested earnings releases. ASX 200 lacked firm direction as strength in energy and tech was counterbalanced by weakness in utilities and consumer stocks, while financials were rangebound despite Australia's largest bank CBA reporting an increase in profits. Nikkei 225 wiped out opening gains and briefly reverted to a sub-38,000 level with the list of worst performers in the index dominated by companies that had just reported earnings results. Hang Seng and Shanghai Comp gained amid strength in Chinese healthcare stocks and tech names leading the upside in Hong Kong ahead of Tencent and Alibaba earnings results scheduled for today and tomorrow, respectively, while the upside in the mainland was limited amid a lack of major fresh catalysts.

Top Asian News

European bourses (STOXX 600 -0.2%) opened modestly mixed and on either side of the unchanged mark; since, the risk tone has deteriorated to display a mostly negative picture in Europe. European sectors opened mixed and with no clear theme or bias, and with the breadth of the market fairly narrow. Real Estate takes the top spot, joined closely by Telecoms and then Utilities to complete the top three. Autos sit towards the foot of the pile, driven by post-earning weakness in Daimler Truck (-1.1%). US equity futures are flat/modestly lower, attempting to hold onto the gains seen yesterday, strength which was in-part spurred by the plethora of deals announced/reported on during the Saudi event. Barclays raises its 2025 year-end price target for STOXX 600 to 540 (prev. 490, currently 545.09). Barclays European Equity Strategy downgrades Consumer Staples to Underweight; upgrades Consumer Discretionary to Market Weight (prev. Underweight). Goldman Sachs lifts its Stoxx 600 target for the next 12-months to 570 (prev. 520).

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Banks (All Times ET):

DB's Jim Reid concludes the overnight wrap

It's been another 24 hours where the Trump administration continues to hog the headlines. With the President in the Middle East, various stories on AI supported a huge tech-led rally, which helped the S&P 500 (+0.72%) move back into positive territory for the year. That got a further boost thanks to a softer-than-expected CPI print (the third in a row), and it now means the index is now up +18.1% since the low on April 8. Indeed, the last time the index surged that fast in just over a month was back in April 2020, when markets were roaring back from the initial Covid slump. In the meantime, several other post-Liberation Day moves unwound further, with the VIX closing at 18.22pts, whilst US HY spreads (-6bps) fell to 299bps.

The Nasdaq (+1.61%) and the Mag-7 (+2.24%) led the gains yesterday, elevated by Nvidia’s +5.63% rise on the news they’d help build Saudi Arabia’s AI infrastructure, as part of an Economic Partnership that President Trump struck with Saudi Crown Prince Mohammed bin Salman yesterday. The White House framed the deal as a $600bn investment commitment from Saudi Arabia, while Trump and MBS touted a pledge of $1trn in commercial deals. The deal includes a $142bn defense agreement between the US and Saudi as well as tech firms like Google, Oracle and AMD pledging to invest $80bn in tech across both countries. So it was another win for tech stocks which helped push the S&P 500 +0.72% higher.

Trump’s visit is the first of a four-day trip to the Middle East, as the President seeks to form a series of financial deals with Qatar and the UAE. He's clearly in a mood to do deals so watch out for more on his trip. In fact, Bloomberg reported yesterday that the administration is weighing a deal that would allow the UAE to import 500k of Nvidia’s advanced chips annually, far exceeding limits for AI chip exports set under Biden. Meanwhile on trade, NEC Director Kevin Hassett suggested that Trump will announce the next trade deal upon his return to the US, and there were more than 20-25 deals on the table.

The ongoing rally was also helped by the US April CPI report, which came out weaker than predicted, with monthly headline and core CPI each up +0.2% (vs. +0.3% expected for both). From a market point of view, the main relief was also that tariffs weren’t showing up in a major way in consumer prices, even though April included the 10% universal baseline tariffs, and much higher tariffs on China. Admittedly, there were some categories likely showing tariff-related jumps, like an +8.8% monthly rise for audio equipment, but the broad impact was muted. And in turn, the year-on-year CPI rate fell to just +2.3%, which is the weakest since February 2021. Our US economists think the April data is still too early for the Liberation Day tariffs to show up in the aggregate numbers, and they don’t expect the effects to show up in consumer prices until June.

When it comes to the Fed, markets continued to dial back their expectations for cuts this year, but that was driven by the broader risk-on tone and lower recession fears, rather than the soft inflation print. So by the close, futures were only expecting 53bps of cuts by the December meeting, which was -3.2bps lower on the day, and the fewer cuts priced for this year since February. President Trump continued to call for lower rates, saying in a post that “THE FED must lower the RATE, like Europe and China have done.” Looking forward, our US economists will be watching tomorrow’s PPI data closely for categories that feed through into core PCE, the Fed’s preferred inflation gauge. They now see April core PCE tracking at +0.23% m/m, which would be consistent with the year-over-year rate remaining at 2.6%. See their full CPI reaction note here.

As investors dialled back their pricing of Fed cuts, that in turn helped to bring down front-end Treasury yields, with the 2yr yield falling -1.0bps on the day to 4.00%. By the close, the 10yr yield was also down -0.6bps to 4.47%, but the 30yr yield moved up +0.1bps to its highest closing level since January, at 4.91%. That’s still beneath the intraday peak above 5% just before the 90-day tariff extension, but still up from 4.68% at the end of April.

Back in Europe, markets posted moderate gains, with the STOXX 600 (+0.12%), DAX (+0.31%) and CAC (+0.30%) all moving higher. For the DAX it marked a new all-time high, with the index now up almost +19% YTD, so still well ahead of the S&P 500 which has only just turned positive for 2025 again. The gains came as Germany’s ZEW survey for May was stronger than expected, with the expectations component up to +25.2 (vs +11.3 expected) reaffirming a more bullish sentiment for the country’s economy. Against that backdrop, 10yr bund yields inched up +3.1bps to 2.68%, and sovereign spreads continued to tighten amidst the risk-on mood. For instance, the 10yr Italian spread over bunds tightened to just 102bps, the lowest since 2021.

Meanwhile in the UK, there were signs of an ongoing loosening in the labour market, with the unemployment rate ticking up a tenth to 4.5%, whilst wage growth in March softened to +5.5% year-on-year, the weakest since October. The news helped 2yr gilts to outperform yesterday, falling -2.0bps to 3.97%, unlike 2yr German yields which moved up +1.2bps.

In the commodity space, oil prices moved higher as Trump threatened to ramp up sanctions against Iranian oil if a nuclear deal weren’t reached, and Brent crude rose +2.57% to $66.63/bbl. The likes of gold (+0.43%) and copper (+2.25%) also advanced, in part helped a new decline in the dollar index (-0.77%), which retreated after posting its best day since Trump’s election win on Monday.

Overnight, markets have generally held on to their gains, with futures on the S&P 500 up +0.08%. Similarly in Asia, most of the major equity indices have moved higher as well, with a strong gain for the Hang Seng (+1.43%) and the KOSPI (+1.18%), alongside advances for the CSI 300 (+0.27%), the Shanghai Comp (+0.19%). The one exception to that has been Japanese equities however, with the Nikkei down -0.42%, whilst the TOPIX (-0.64%) has lost ground after advancing for 13 consecutive sessions. Otherwise this morning, data showed Japan’s PPI inflation coming in at +4.0% in April as expected, whilst Australia’s Q1 wage index was a bit stronger than anticipated, up +0.9% quarter-on-quarter (vs. +0.8% expected), and yields on 10yr Australian government bonds are up +4.1bps this morning.

To the day ahead now, data releases include Canada March building permits. For Central Bank speakers, expect Fed’s Waller, Jefferson and Daly speak, ECB’s Nagel and Holzmann speak, and BOE’s Breeden speak. Earning releases include Tencent, Cisco, Sony, and Coreweave.