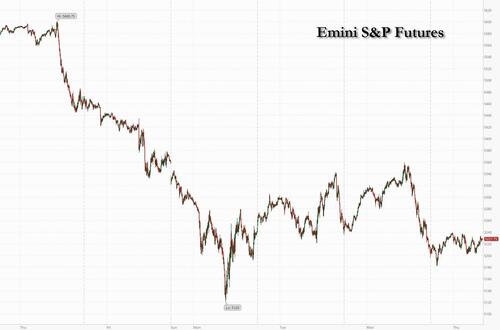

After three rollercoaster days of wild, brutal swings, futures are flat ahead of the Thursday open, erasing overnight losses if still below the all-important CTA threshold level of 5255 which trigger billions in sales by systematic funds. Asian and European stocks declined, prolonging the soaring volatility that has gripped global markets for days after the BOJ effectively steamrolled the carry trade last week when it unexpectedly hiked rates, only to U-turn just days later when the Nikkei suffered its biggest one day crash since Black Monday. As of 7:4am S&P futures were unchanged at 5,228 while Nasdaq futures were fractionally in the green, with Mag7 and semis providing support despite the continued selling by Supermicro. Treasuries yields are lower ahead of US jobless claims data, with US 10-year yields falling 2bps to 3.93% as European bonds also gain. Keep an eye on bonds as yesterday’s 10Y auction was weak but that could have been negatively impacted by elevated Credit issuance; today is the 30Y auction. The USD is weaker and commodities are lower across all 3 complexes as WTI dips below $75, but precious metals catch a bid. Today’s macro data focus is on jobless claims; a spike there preceded a weaker NFP that coincided with the carry unwind so the market may have heightened sensitivity to the print. Elsewhere, both Goldman and JPMorgan raised their recession odds, from 10% to 25% and from 25% to 35%, respectively.

In premarket trading, Warner Bros shares plunged after the parent of CNN and TNT posted a $9.1 billion charge write-down on the value of its traditional TV networks. Monster Beverage shares slid after the energy-drink maker missed second-quarter profit estimates. Here are all the notable premarket movers:

Markets have been extremely volatile since poor jobs data last week fueled worries that Federal Reserve policy is risking a deeper slowdown. Coupled with a rate hike by the BOJ, the carry trade has suffered a historic unwind which according to JPM is about 75% done. Thursday’s US jobless claims figures are in sharper focus than ever after last week’s flimsy payrolls numbers. Investors are also bracing for the US and Japanese central banks to potentially move interest rates in opposite directions in the coming months, putting further strain on the yen-funded carry trade.

This is a “consolidation period before any new trend, given how volatile the market has been,” said Kerry Goh, chief investment officer at Kamet Capital Partners Pte. “Investors probably will stay sidelined until new data appear. The next couple of days will be crucial — either calm returns, or we see a new bout of volatility emerge.”

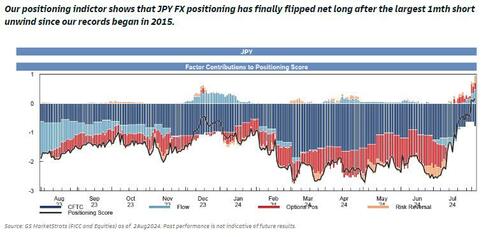

Meanwhile, as discussed last night, the divergence in US and Japanese central bank monetary policy is set to undermine the yen’s role as a cheap source of funding for financial assets. A Thursday summary of the minutes from last week’s Bank of Japan meeting showed that authorities didn’t see last months surprise rate hike as policy tightening. However, just days later, and following an epic Japanese stock rout, Deputy Governor Shinichi Uchida yesterday said the BOJ won’t raise interest rates when financial markets are unstable, a reassurance that helped buoy stocks and sent the yen lower.

Three-quarters of the carry trade has been unwound as the recent slump wiped out all positive year-to-date returns, according to strategists at JPMorgan while Goldman analysts believe that positioning in the yen is now net long, suggesting most of the carry trade has been unwound.

The carry strategy, which involves borrowing at low rates to fund purchases in higher-yielding assets elsewhere, has been wobbling for months. Carry trades were pummeled over the past week as global market volatility jumped amid fears of rapid Fed rate cuts and after the Bank of Japan’s larger than expected rate hike. The unspooling of the carry trade has further room to run, according to Quincy Krosby at LPL Financial. “A softer dollar, driven by the market’s perception that the Fed will soon initiate an easing cycle, should help support a stronger yen — a negative for the trade.”

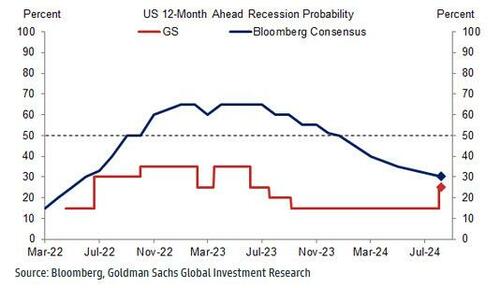

Elsewhere, debate about the path of the US economy continues. JPMorgan now sees a 35% chance that the US economy tips into a recession by the end of this year, up from 25% as of the start of last month. The bank’s new calculation for recession risks followed just hours after a similar step by Goldman, which now sees a 25% probability of a recession in the next year.

Other investors, however, argue that the data still point to a soft landing. “I’m not that worried for the US economy. Yes, unemployment is a concern but it’s not dramatic, it’s just a slowdown,” said Francois Rimeu, a strategist at La Francaise Asset Management in Paris. “I take the view that this was just a volatility episode like we’ve experienced in the past during the summer.”

Europe’s Stoxx 600 index reversed much of Wednesday’s advance, dragged lower by technology and mining shares. The is Estoxx 50 down 1%, tech and industrials underperforming. Siemens shares dropped after the manufacturer said it sees group revenue growth and returns in its key industrial unit at the lower end of forecasts. Zurich Insurance Group AG shares fell after the company reported a rise in losses atit property and casualty arm, driven in part by “higher catastrophe losses and weather events.” Allianz SE climbed after second-quarter profit rose on stronger earnings from its life-health insurance and asset management businesses. Deliveroo Plc rallied after reporting stronger customer orders and saying earnings for the year will be on the higher end of its forecast. Entain Plc soared after the UK gambling firm got an earnings boost from this summer’s European Football Championship.

Earlier in the session, Asian equities first rose but eventually dropped, halting a two-day rally, as Japanese shares reversed an early gain after a volatile trading session. The MSCI Asia Pacific Index fell as much as 0.9%, weighed by tech shares including TSMC, Samsung and Keyence. Japan’s Topix Index declined, as technology firms tracked their US peers lower. Exporters also took a hit after the yen strengthened against the dollar. Benchmarks retreated in Taiwan, South Korea and Australia. Chinese stocks in Hong Kong and the mainland were broadly steady amid the selloff in Asia, burnishing the markets’ appeal as a foil to the ongoing global volatility while investors seek value. Sentiment in the region remained fragile in one of the most tumultuous weeks for stocks in recent memory. The Asian gauge is headed for its fourth successive week of losses as investors reassess the outlook for the US economy and the nation’s interest rate trajectory.

In FX, the Bloomberg Dollar Spot Index falls 0.2%. The Swiss franc tops G-10 peers and the Japanese yen also rises in a haven bid. The Australian dollar climbs after more hawkish rhetoric from the RBA.

In rates, Treasuries hold small gains in early US trading. Yields are richer by 1bp-2bp across the curve with inverted 2s10s around -3.5bp after closing at YTD high -2.1bp Wednesday; new 10-year is around 3.93%, lagging bunds in the sector and outperforming gilts. Supply remains in focus as auction cycle concludes with $25b 30-year bond sale and at least a couple of corporate offerings are expected to follow Wednesday’s deluge of almost $32 billion. Yesterday's unexpectedly weak 10Y auction which tailed by 3.1bp, a notably poor result, as it drew the lowest yield in a year and spooked markets and precipitated a cross-asset selloff. The When Issued on the 30-year yield is at ~4.225% is ~17bp richer than last month’s, which tailed by 2.2bp

In commodities, oil steadied after its biggest advance in a week, with traders still glued to fluctuations in wider markets and tensions in the Middle East. Spot gold rises $13 to around $2,396/oz.

Bitcoin rises 3.7% after Ripple framed the recent SEC ruling as a win for the company.

Looking at today's calendar, US economic data slate includes weekly initial jobless claims (8:30am) and June wholesale inventories (10am). Scheduled Fed speakers include Barkin at 3pm

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after the weak handover from Wall St where the major indices fumbled early gains and finished in the red amid soft earnings and geopolitical risks. ASX 200 was dragged lower amid underperformance in the commodity-related stocks including BHP which is reportedly planning to sell Brazilian copper and gold assets it acquired in the takeover of Oz Minerals. Nikkei 225 slumped in early trade with losses of as much as 2.5% before briefly staging a full recovery. Hang Seng and Shanghai Comp. pared opening losses with the former making its way back towards the psychological 17,000 level, while the mainland also pared early losses but kept within a narrow range amid light catalysts.

Top Asian News

European bourses are lower across the board, Euro Stoxx 50 -1.2%, as the downbeat sentiment from Wall St. reverberated into APAC trade and continued. Macro newsflow light, earnings driving sectoral differences with Travel & Leisure underpinned by Entain numbers, Telecoms supported by Deutsche Telekom. Stateside, US futures are lower across the board but only modestly so with losses shallow than those seen in Europe, ES -0.4% & NQ -0.3%. Ahead, a handful of earnings due.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar