US equity futures are higher, European bourses are mixed and Asian market are red following the worst session of the year for US stocks, as the S&P tumbled 1.7% leaving it about 2% below its ATHs. As of 7:30am, S&P futures are up 0.5% and Nasdaq futures rise 0.4%, with Mag7 names mixed as Nvidia rises in early trading; the Russell outperforms while Fins/Banks are bid this morning pointing to a rebound in Value/Cyclicals. Bond yields are 1-2bps higher with a flat USD. Commodities are mostly lower with WTI still above $70/bbl and precious metals with a slight bid sending gold to a new all time high. Weekend trade news was muted with the German election and the war in Ukraine in focus. Today’s macro data focus is on regional activity indicators.

In premarket trading, Berkshire Hathaway shares were up in the premarket on solid results boosted by a strong jump in insurance underwriting. Apple shares slid after it said it plans to spend $500 billion domestically over the next four years to hire workers and build out AI capacity. Nvidia and Amazon are leading premarket gains among the Magnificent Seven stocks on Monday; NVDA is up as much as 1.5% in early trading, days before its earnings release. Here are some other notable premarket movers:

US stocks looked set to claw back ground after Friday’s sharp selloff, with Nvidia Corp. rising in early trading. German stocks gained after conservatives led by Friedrich Merz emerged as the winners in a weekend vote.

All eyes now turn to what may be the most important earnings release of the quarter when NVDA reports earnings on Wednesday: the result will be a key test of demand for US megacap stocks and the artificial intelligence frenzy that’s powered them. With recent advances in AI by China’s DeepSeek, Nvidia is under pressure to deliver blockbuster results to reassert its leadership.

“Markets are in wait-and-see mode until we see those bellwether AI earnings as that could be a key turning point,” Laura Cooper, head of global investment strategy at Nuveen, said in an interview.

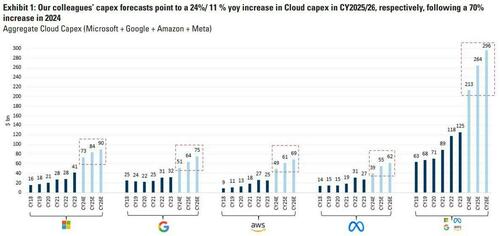

Meanwhile, doubts are starting to creep again that the exponential capex hockeystick forecast will fall well short. Last night we first reported that according to TD Cown, Microsoft has begun canceling leases for a substantial amount of datacenter capacity in the US, a move that may indicated the Mag7 giant is building more AI computing than it will need over the long term (see full report her). OpenAI’s biggest backer has voided leases totaling “a couple of hundred megawatts” of capacity, the US brokerage wrote Friday, citing channel checks or inquiries with supply chain providers. Microsoft has also stopped converting so-called statement of qualifications, which are agreements that usually lead to formal leases, TD Cowen said. That was a tactic rivals such as Meta Platforms employed previously, when it decided to cut back on capital spending, the brokerage wrote.

A potential pullback by Microsoft on spending and datacenter construction raises questions about whether the company — one of the frontrunners among Big Tech in AI — is growing cautious about the outlook for demand. If so, then much of the AI thesis - which is based on the chart below - will go down in flames.

But even without a Mag 7 wipeout, the S&P 500 Index is trailing international peers in 2025 after years of outperformance, as investors are put off by uncertainty from President Trump’s policies on tariffs and their potential to rekindle inflation. Friday’s tumble left the S&P 500 1.7% lower on the week. That said, top Wall Street strategists say the underperformance is unlikely to last long given the robust outlook for US economic growth.

“We’ve seen a lot of inflation fears, but now markets are shifting focus back to the potential growth effects of these US policies,” Nuveen’s Cooper said.

Europe's Stoxx 600 Index, and the euro, fluctuated as initial enthusiasm about Germany’s election gave way to concern the new government may lack a consensus to push through much-needed economic reforms, preventing bond yields from rising and keeping the bid in stocks in place. The DAX rises 0.9% after German conservative opposition leader Friedrich Merz said he’ll move quickly to form a new government after he won Sunday’s federal election. Mid-cap stocks outperform, with the MDAX up 2.8%. Merz emerged as the winner in Sunday’s election, but the results gave his Christian Democrat-led bloc just one clear path to power and they face intense pressure to move quickly to form a government and rally support for measures including potentially looser borrowing rules. “Centrist parties failed to retain a constitutional majority, complicating the prospects of decisive fiscal regime change,” said Apolline Menut, an economist at Carmignac. “Tricky political compromises would be required, as well as fiscal creativity.” Electrification stocks, including Siemens Energy AG, ABB Ltd and Schneider Electric SE, fell as concerns grew around data centers spending after the abovementioned report that Microsoft has begun canceling leases for a substantial amount of datacenter capacity. Here are some other notable movers:

Earlier in the session, Asian equities fell, weighed by Chinese technology shares after Trump stepped up curbs on the world’s second largest economy. The MSCI Asia Pacific ex-Japan Index slipped as much as 0.7%, with TSMC, Tencent and Alibaba among the biggest drags. Japanese markets were closed for a holiday. Sentiment was cautious after US stocks had their worst session so far in 2025 following weaker-than-expected economic data and a surge in consumers’ long-run inflation views. Sino-American tensions flared up again, as Trump moved to restrict Chinese investment in some strategic US industries, while also considering further restrictions on outbound investment to Beijing in sectors including semiconductors and artificial intelligence. A selloff in India continued on Monday even as Citigroup Inc. upgraded the country’s stocks to overweight from neutral, citing a “meaningful upside” amid less demanding valuations. In South Korea, the top financial regulator said the nation is on track to lift its ban on short selling across all stocks starting March 31. A complete resumption of short selling is necessary and any market impact is expected to be short-lived, a top official said at a regular briefing.

China’s top leaders are expected to convene next week at the annual legislative meeting to lay out the economic blueprint for this year. Investors are closely watching for any new stimulus measures. Equities in Hong Kong and mainland China slipped after fluctuating in early trading.

In FX, the EUR/USD rallied by as much as 0.7% to 1.0528, only to pare the advance and trade around 1.0470; the currency was supported after the Asia open on relief that Germany’s far right party didn’t show up much stronger than expected. The Bloomberg Dollar Spot Index falls as much as 0.4% to the lowest since December, before erasing losses. USD/JPY reverses losses to rise 0.3% to 149.66; it earlier fell to 148.85, lowest since Dec. 3

In rates, US Treasury curve bull-steepens modestly; Treasuries trade cheaper across the curve, unwinding a portion of Friday’s steep flight-to-quality gains. Front end leads losses with yields ~2bp higher on the day, ahead of $29b 2-year note auction at 1pm New York time. 10-year yield rises 1bp to 4.44% while two-year yield is 2bps higher at 4.22%; German counterpart more than 2bp higher; Treasury 2s10s curve is ~1bp flatter on the day. Longer-dated German yields are higher after conservative opposition leader Friedrich Merz said he’ll move quickly to form a new government after winning Sunday’s federal election. This week’s Treasury auction cycle begins with 2-year notes and includes $70b 5-year and $44b 7-year note sales Tuesday and Wednesday. WI 2-year yield near 4.21% is close to January’s 4.211% result, 0.1bp higher than its WI at the bidding deadline.

In commodities, oil prices advance, with WTI rising 0.1% to $70.50 a barrel. Spot gold climbs $7 to around $2,943/oz. Bitcoin is flat near $95,700.

Looking at today's calendar, we get the January Chicago Fed national activity index (8:30am) and February Dallas Fed manufacturing activity (10:30am). Fed speaker slate empty for Monday. Logan, Barr, Barkin, Bostic, Schmid, Bowman, Hammack, Harker and Goolsbee are scheduled to appear later this week.

Market Snapshot

Top Overnight News

German Election

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mixed after last Friday's sell-off on Wall St and amid holiday-quietened trade with Japanese markets closed for the Emperor's Birthday, while participants also reflected on the results from Sunday's German election. ASX 200 traded little changed as gains in financials and the defensives were counterbalanced by losses in tech and the commodity-related sectors, while there was also another deluge of earnings updates. KOSPI underperformed amid ongoing economic concerns and ahead of tomorrow's BoK rate decision. Hang Seng and Shanghai Comp were choppy but were ultimately pressured amid ongoing trade-related frictions, with the US said to be pushing Mexico towards tariffs on Chinese imports. Nonetheless, there were some encouraging reports with Chinese state-backed developers beginning to buy land at a premium again, while agricultural stocks were supported after China pledged to deepen rural reforms as part of efforts to revitalise the agricultural sector and bolster food security in the State Council's annual rural policy blueprint.

Top Asian News

European bourses (STOXX 600 +0.2%) opened modestly, and on either side of the unchanged mark (though the DAX 40 outperformed after the German election). At the cash open, some pressure was seen, which then exacerbated in the hour following. Thereafter, a considerable bounce was seen across the complex; as it stands, indices are mostly firmer. European sectors are mixed; initially opened with a narrow breadth, but performance is now varied. Utilities takes the top spot, lifted by renewable names after the German Election; Merz has previously favoured their use. Strength in German auto names have lifted the Autos sector. Basic Resources is the laggard thus far, with downside attributed to mostly lower metals prices.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Five years ago today, global markets first began to panic after a weekend that saw 11 Italian towns emerge from it in Covid lockdown. Five years later we had a mini panic on Friday as attention focused on a report earlier in the week about a new coronavirus discovery in bats, from the infamous Wuhan lab, with similar properties to Covid-19. Note there has been no reported transmission to humans as yet and as far as we know it's just been found in a lab. We're all probably paranoid and it's difficult to know what to do with that information but ahead of a weekend, and with memories of that fateful weekend five years ago, it was no surprise people wanted to lighten up with the S&P 500 (-1.71%) seeing its worst day of the year so far, extending declines after earlier stagflationary data that we'll discuss at the end. In overnight trading, US stock futures are back up with those on the S&P 500 (+0.49%) and NASDAQ 100 (+0.48%) higher.

Talking of five years, will the German election be seen as a pivotal moment when we look back on it in 2030? For financial markets the make-up of the Bundestag was probably as important as the overall results and the one line summary is that the centre-right and centre-left should have sufficient seats to form a grand coalition but overall the centrist parties are short of a two-thirds majority. This latter means that any future reforms of the debt break will be challenging and may require compromise and horse trading.

In terms of the details, the provisional results confirm a victory for the centre-right CDU/CSU (28.6%), followed by the far-right AfD (20.8%), centre-left SPD (16.4%) and Greens (11.6%). Of the smaller partis, the leftist Linke (8.8%) comfortably exceeded the 5% threshold, but the far-left BSW (4.97%) and liberal FDP (4.3%) fell short. BSW’s narrow failure to enter the Bundestag, which may take a few days to be definitively confirmed, has the important consequence of leaving the CDU/CSU and SPD combined with a projected 52% of the seats. That leaves the grand coalition as the most likely outcome, being the only option to avoid the need for three-party coalition given that mainstream parties have ruled out partnering with the AfD. Our Germany economists see the prospect of a two-party coalition led by a strong CDU/CSU as a positive for Germany's corporate sector, promising less policy gridlock and uncertainty than under the outgoing government. See their reaction here for more. Earlier in the night, CDU leader Merz said he wanted to form a coalition within the next two months.

While the outcome may reduce the risks of particularly fractious coalition talks, it still confirms an ongoing anti-establishment trend that has been visible both in Germany and Europe as a whole. The result marks the lowest ever vote share for the two major parties, even as the turnout (82.5%) was the highest since at least 1990. And it leaves the centrist parties short of a 2/3rds constitutional majority, with the CDU/CSU, SPD and Greens jointly at just under 66% of seats. That means any debt brake reform, including for defence spending, would require support from one of the fringe parties. This may not be impossible, but it would require significant political compromises.

After a nervy night, European assets gained traction as the likelihood of simple ‘grand coalition’ majority emerged. The euro is trading +0.58% higher this morning, touching a one-month high against the dollar, while DAX futures are up just over a percent and Euro Stoxx 50 futures are +0.46% higher. Meanwhile Bund futures are slightly down as I check my screens.

In terms of other events this week, Nvidia's earnings on Wednesday could be the biggest mover of markets. Interestingly of the 62 analysts who cover the stock on Bloomberg, 56 have a buy rating with only one sell. DB are currently one of only 5 with a hold rating. Outside of that inflation takes centre stage with US core PCE, German, French and Italian flash CPI, as well as Tokyo CPI all out on Friday with Spain's equivalent coming out on Thursday. In terms of the rest of the main global releases, the German Ifo survey today will be less relevant given the election but later we have the Dallas and Chicago Fed manufacturing surveys. Tomorrow sees the US Conference Board consumer confidence release which will be interesting after Friday's weak UoM equivalent. Wednesday sees US new home sales and Australian inflation. Thursday sees US durable goods and the ECB account of their January meeting and Friday sees US personal income and spending data and the ECB consumer expectations survey. There are also lots of central bank speakers through the week, including at the G20 central bankers and finance minister meeting in Cape Town on Wednesday and Thursday. You can see the main ones detailed in the day-by-day calendar at the end as usual, along with key earnings releases and all the other data.

Digging into the main US data this week now. According to our economists, Friday's personal income (+0.3% forecast vs +0.4% previously) and consumption (+0.2% vs. +0.7%) will likely be softer due to the LA wildfires and poor weather with the all-important core PCE deflator (+0.27% vs. +0.16%) higher but not as extreme as CPI due to softer subcomponents in the subsequent PPI. This would lower the YoY core PCE two tenths to 2.6%. In the US consumer confidence tomorrow, the jobs-plentiful / jobs hard-to-get series is important as a good proxy for the unemployment rate. For claims on Thursday our economists are looking to the DC area in particular given press reports of substantial federal government layoffs. Around 20% of the ~2.3mn federal government employees live in Washington DC, Maryland and Virginia. Our estimates are that there have been roughly 14k potential federal layoffs since the Trump Administration took office with another 12k pending the resolution of court cases. Clearly this is just within the first month.

Asian equity markets are mostly drifting lower at the start of the week following Friday’s significant losses on Wall Street. Across the region, the Hang Seng (-0.64%) with the Shanghai Composite (-0.26%) is also down. The KOSPI is -0.42% lower. Japanese markets are closed for a public holiday but Nikkei futures are around a percent lower. With this holiday there is no cash Treasuries trading in Asia.

Now recapping last week, which ended with a big risk-off move on Friday following more stagflationary US data alongside some scares around the reporting of the new coronavirus discovered by researchers at the Wuhan Institute of Virology. On the fifth anniversary of the first proper slump in markets associated with Covid that's the last thing the world wanted to hear. According to the journal that reported the story as long ago as last Friday the virus hasn't been detected in humans yet but this virus apparently enters cells using the same gateway as the Covid-19 virus. So that scared markets a bit and led to a spike in vaccine stocks like Moderna (+5.34% on Friday) just around the time Europe closed for the day.

However, the earlier data started the softness. First were the February flash PMIs, which saw the headline services reading (49.7 vs 53.0 expected) slump into contractionary territory for the first time in 13 months. At the same time, the PMI manufacturing input prices soared to their highest since October 2022 (+6.1pts to 63.5). Then 15 minutes later, the final University of Michigan consumer survey showed 5-10 year median inflation expectations spiking to a post-1995 high of 3.5% (up from 3.3% in the flash release), even as headline consumer sentiment slumped to a 15-month low. So that added to concerns over the US consumer that had emerged with a weak January retail sales print the previous Friday and Walmart’s disappointing results on Thursday morning. As ever we note that for long-term inflation expectations, the results are extreme along party lines with Democrat supporters expect 4.2% and Republicans 1.5%.

Nevertheless the overall backdrop weighed on risk assets, with the S&P 500 (-1.71%) posting its worst day of 2025 so far, leaving it -1.66% lower on the week. Most affected were small caps, with the Russell 2000 slumping -2.94% on Friday (-3.71% on the week), as well as tech stocks, with the Mag-7 down -2.51% (-3.52% on the week). Both indices fell into negative territory YTD. By contrast, in Europe equity markets closed before the worst of the US slump with the Stoxx 600 (+0.52% Friday) just about posting a ninth consecutive weekly gain (+0.26%).

Other risk assets also suffered on Friday, with US high yield credit spreads seeing their biggest daily spike YTD (+10bps to 271bps). And in the commodity space, Brent crude saw its largest decline since October (-2.97%), leaving it -0.71% down on the week to $74.21/bbl. However, gold advanced +1.86% on week to $2,936/oz despite a marginal retreat on Friday (-0.10%) from Thursday’s all-time high.

Bonds rallied amid Friday’s risk-off environment, with 10yr Treasury yields falling -7.4bps to 4.43% and posting a sixth consecutive weekly decline (-4.5bps). Over in Europe, 10yr bund yields also fell -6.4bps on Friday, but were still +3.7bs higher on the week to 2.47% after an earlier rise amid increased expectations of higher European defence spending.