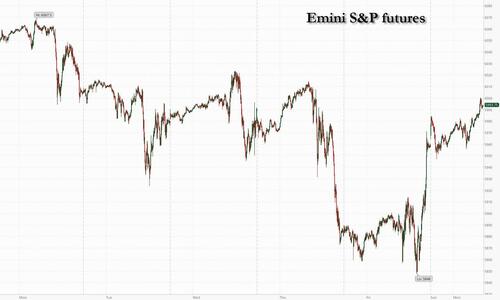

Futures are higher with both tech and small caps outperforming as investors look for Canada/Mexico tariffs to be adjusted lower or delayed again based on Trump comments of the border being closed (Fox News) and Hegseth comments warning of military action without compliance. As of 8:00am ET, S&P futures are up 0.5% and Nasdaq futures rise 0.8% in what appears to be a powerful short squeeze after the second biggest shorting spree by hedge funds in the past five years. Pre-market Mag7 is mixed with AAPL/NVDA lower but Semis and Cyclicals higher. Defense firms surged again in Europe with leaders fast-tracking their spending plans, while bond yields jumped as markets brace for a new debt-funded spending spree. Asian stocks also rose, although China’s benchmark CSI 300 Index erased gains of as much as 1% to end the day little changed. Treasuries dip, with the US administration on the verge of slapping new tariffs on Canada and Mexico while doubling a levy on China. US 10-year yields climb 4 bps to 4.25%. The Bloomberg Dollar Spot Index falls 0.3%. Commodities are mixed with precious/softs leading and oil flat. The macro data focus today is on ISM-Mfg, Construction spending, and vehicle sales. JPM followed other banks to cut its Q1 2025 GDP estimate from 2.25% to 1.5%.

In premarket trading, cryptocurrency-exposed stocks rally as Bitcoin recoups some of its recent losses after President Donald Trump once again talked up his plan for a strategic crypto reserve (MicroStrategy +13%, Coinbase +9.2%, Riot Platforms +9.9%, MARA Holdings +11%, Bit Digital +9.8%, CleanSpark +11%, Hut 8 +12%). Bitcoin traded around $92,000, paring some of its weekend gains but up about 20% from its Friday lows. Chipotle shares gain 2.4% after the restaurant operator was upgraded to overweight from equal-weight at Morgan Stanley as stock’s weakness presents an opportunity to buy into an “excellent tech play.”

“How much more cautious can the market get?” Katrina Dudley, senior investment strategist at Franklin Templeton, said on Bloomberg TV. “If you look at that fear and greed index, we are right in the red zone that flashes and says: caution.”

Defense stocks lead gains in Europe as a concerted push by regional leaders to demonstrate broad support for Ukraine fueled bets on a wave of military spending. The Stoxx 600 was up 0.5% while the euro climbs 0.7%. Defense stocks soared: BAE Systems Plc soared 13%, Rheinmetall AG gained 10% and Saab AB gained 9%. Tech shares also rose, while utilities and real estate sectors fall. Bonds in Germany and France fell on expectations for increased debt issuance. Germany’s next government is exploring options for large-scale investments in defense and infrastructure spending which could amount to hundreds of billions of euros, according to Reuters. Here are some of the biggest movers on Monday:

Earlier in the session, Asian stocks also rose with Indonesia’s stock gauge leading gains in the region after JPMorgan upgraded the nation’s banks. The MSCI Asia Pacific Index advanced as much as 0.8%, with China’s Tencent and Alibaba among the biggest contributors ahead of the nation’s annual national parliament meeting. The Jakarta Stock Price Index surged by the most in almost five years. Shares gained in Japan as they tracked their US peers higher. Investors will be watching the Two Sessions for Beijing’s plan to counter risk from US tariffs after Trump threatened to add an additional 10% levy from Tuesday. Any effort to boost technological advancements will also be crucial to sustain the artificial intelligence-led rally in Hong Kong. The tariffs “would deliver a negative signal to the market that the trade conflict between China and the US is going to escalate,” said Jason Chan, a senior investment strategist at Bank of East Asia. “It may hurt the near-term market sentiment and trigger an ongoing technical correction toward Chinese equities, especially for those AI thematic stocks with rich valuations.”

In FX, Bloomberg Dollar Spot Index falls 0.3%. EUR/USD rose as much as 0.9% to 1.047 on the prospect of more EU defense spending; Hedge funds cut bearish euro wagers for a second straight week, according to the latest CFTC data; the Polish zloty and Hungarian forint led gains among emerging-market currencies.USD/SEK fell as much as 1% to 10.67 as the Swedish krona led Group-of-10 gains against the dollar; Strategists at Societe Generale say the large size of the nation’s defense sector as a proportion of GDP is buoying the currency.

In rates, treasuries are cheaper as US trading gets under way, following bigger losses in core European rates, where German curve steepens on prospect of increased supply tied to support for Ukraine and improved security measures for the continent. US yields are 3bp-4bp higher across maturities with curve spreads steeper but within 1bp of Friday’s closing levels; 10-year is around 4.25% with bunds and gilts in the sector lagging by an additional 5bp and 1bp. Bunds fall, led by longer-dated maturities, as any increase in defense spending will likely be funded by higher debt issuance, which in turn means QE is just around the corner. German 30-year yields rise 7 bps to 2.77%. German two-year borrowing costs climb 3 bps and rose to session highs after euro-area headline and core February CPI topped estimates and contributed to the selloff during London morning.

In commodities, spot gold rises $13 to around $2,870/oz. WTI falls 0.5% to $69.40 a barrel.

Bitcoin is on a firmer footing and sits comfortably above $92K, as sentiment in the complex is lifted following Trump's recent announcement. Trump is to host the first White House cryptocurrency summit on March 7th. Trump also commented that the executive order on digital assets directed a strategic reserve that included XRP, Sol and ADA. Trump also stated that BTC and ETH, as other valuable cryptocurrencies, will be at the heart of the reserve, as well as commented that he loves Bitcoin and Ethereum.

US economic data calendar includes February S&P Global US manufacturing PMI (9:45am), January construction spending and February ISM manufacturing (10am). Fed speaker slate includes Musalem at 12:35pm; later this week, Chair Powell is slated to speak on the economic outlook Friday

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new trading month mostly higher in a rebound from Friday's Asian session sell-off and despite geopolitical uncertainty from the fallout of the Trump-Zelensky heated exchange in the Oval Office, while participants digested better-than-expected Chinese PMI data from over the weekend. ASX 200 traded higher with gains led by strength in the tech, real estate, telecoms, miners and materials sectors, while quarterly Australian company gross profits growth smashed forecasts. Nikkei 225 recovered some of Friday’s substantial losses despite the lack of fresh drivers and ongoing tariff uncertainty. Hang Seng and Shanghai Comp were underpinned following the better-than-expected official Chinese Manufacturing PMI data over the weekend which showed a surprise return to expansion territory, while Caixin Manufacturing PMI also topped forecasts. However, the gains in the mainland were contained as the tariff threat lingered with US Commerce Secretary Lutnick noting that China tariffs are set unless they end fentanyl trafficking into the US and with China reportedly studying relevant countermeasures in response to the US March 4th tariff threat.

Top Asian News

European bourses (STOXX 600 +0.3%) are mixed vs opening modestly firmer across the board; a significant sell-off was seen soon after the cash open, but with little fundamental driver at the time. As it stands, indices have rebounded from worst levels and look to be approaching the earlier highs. The complex was initially little reactive to slightly hotter-than-expected EZ HICP but then retreated from best levels thereafter. European sectors are mixed vs opening with a strong positive bias. Industrials take the top spot and is by far the clear outperformer, as Defence names prop up the industry. The likes of Rheinmetall (+8%), BAE Systems (+13%) and Rolls Royce (+5%) all gain for the reasons listed in the next bullets. Firstly, sentiment regarding a Ukraine-Russia peace deal has been hit after the recent bust-up between US President Trump and Ukrainian President Zelensky at the Oval Office on Friday. Secondly, French President Macron's proposed to raise the EU's defence spending to 3.5% of GDP. And finally, Germany is reportedly considering defence-specific funds in the formation of a new government.

Top European News

NOTABLE US HEADLINES

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

A belated welcome to March, and as it’s the first business day of the month, Henry has published our monthly/YTD performance review here. Interestingly most assets in our sample made steady gains, despite the threat of US tariffs and the huge transatlantic tensions around the war in Ukraine. In a rare move in recent times, the US equity market (-1.3%) underperformed (especially European markets), and the Magnificent 7 (-8.7%) posted its worst month since December 2022, which in turn dragged down US equities more broadly.

As we kick off a new month, this week’s highlight will again revolve around the US President as tariffs on Canada, Mexico and China come into force tomorrow barring any last minute negotiations. US commerce secretary Lutnick said on Fox yesterday that they will be implemented but that the level is still being decided. That could signal some room for the 25% on Canada and Mexico to be lower. On top of that Mr Trump is set to address a joint session of Congress outlining his agenda tomorrow, his first such speech since his inauguration last month. The fall out from an extraordinary televised row on Friday in the Oval Office between Trump and JD Vance on one hand and Zelenskiy on the other will also be a big talking point. Yesterday we had a large number of NATO countries’ leaders convene in London for an emergency (another!) summit on Ukraine. This was planned before Friday’s argument in the White House but it took on added importance after the clash. There was a lot of solidarity for Ukraine after the meeting but a lot still hinges on the US's involvement.

In Germany things are moving fast after the election and speculation has increased over special funds for defence and infrastructure being established while the existing parliament sits rather than wait for the new one where centrist policies won't have the two-thirds majority to reform the debt break on their own. Reuters reported yesterday that economists advising the talks have suggested the need for a EU400bn fund for defence and a EU400-500bn one for infrastructure. If this actually occurs before the new coalition is formed it will be a real positive "shock and awe" for Germany and Europe. Let's see what we hear on this in the coming days. Things continue to move at pace in Europe and after we paraphrased Lenin's famous "There are decades where nothing happens; and there are weeks where decades happen" quote two weeks ago, after the Munich Security Conference, the phrasing might need to be updated from weeks to days!

In terms of the data, the main focus will be on the US jobs report (Friday) and ISM indices in the US (today and Wednesday). Powell has a keynote economic speech on Friday to look forward to. In Europe, the ECB will likely cut rates a further 25bps on Thursday, the same day as a special EU summit on defence and Ukraine is set to take place. It’s getting hard to keep up with all these summits and emergency meetings. MNI sources yesterday suggested that we will hear about a EU100bn common funding for defence at this meeting which is a mere drop in the ocean as to what Europe will likely need to spend on defence in the next several years.

In China we see the annual session of 14th NPC starting on Wednesday where the government is expected to outline its plans for 2025 including targets for the fiscal deficit and government bond issuance. In Japan, the release of the annual shunto wage hike demands by labour unions on Thursday is a key event. As earnings season winds down after 485 of the S&P 500 and 310 of the Stoxx 600 have now reported, maybe keep an eye out for Broadcom's results on Thursday which is the next cab off the ranks in terms of the Mag-7 or a firm member of the BATMMAAN group of stocks. Their market cap briefly went above Tesla last week and is only just behind now.

Going through a couple of the main events this week in a little more detail now and all roads point to the tariff deadline tomorrow and payrolls on Friday. Our economists have previously published here that 25% tariffs on Canada and Mexico, If sustained, would likely create a 0.4-0.7ppts drag on 2025’s US GDP and boost core PCE by 0.3-0.7ppts. It is possible that the revenues from the tariffs allow for larger US tax cuts which may help reduce the growth impact but we’re also starting to see some of the trade uncertainty hit confidence so there are a lot of moving parts. Overall, it’s hard to see China tariffs being negotiated lower but there’s still a chance that those on Mexico and Canada are lower than 25% as hinted by Lutnick yesterday. We will see today.

With regards to payrolls, our economists expect headline (160k forecast vs. 143k previously) and private (150k vs. 111k) payroll gains to rebound from weather-related and potential seasonal-factor related drags in the prior month. However there is a drag factored in from the start of federal government layoffs even if March may see a larger impact. DB think the unemployment rate will tick up a tenth to 4.1%. Today’s manufacturing ISM (DB at 51.8 vs. 50.9 last month) and Wednesday’s services ISM (DB at 52.1 vs. 52.8) will have employment components that along with Wednesday’s ADP report may sharpen the street’s forecasts as the week progresses.

Asian equity markets are mostly rebounding at the start of the month tracking Friday’s strong finish on Wall Street. As I check my screens, the Nikkei (+1.67%) is outperforming with the Hang Seng (+1.12%), and the Shanghai Composite (+0.27%) also edging higher on strong Chinese factory activity data (more below). Additionally, hopes of a fresh fiscal stimulus from China after the policy meeting this week, offsetting the looming tariffs, is supporting risk sentiment. Elsewhere, the S&P/ASX 200 (+0.84%) is also higher. Markets in South Korea are closed for a public holiday. S&P 500 (+0.15%) and NASDAQ 100 (+0.14%) futures are higher and yields on 10yr USTs are +2.5bps, settling at 4.233% as I type.

Over the weekend, Chinese manufacturing activity grew more than expected in February, indicating a strong start to 2025 led by bouncebacks in new orders. China's official manufacturing PMI rebounded to 50.2 in February, up from 49.1 in January (v/s 49.9 expected). The non-manufacturing PMI saw a smaller uptick in February, to 50.4 from 50.2, in line with consensus forecasts. The index has been at, or above, the 50 threshold for 26 months now. At the same time, the Caixin's manufacturing PMI also rebounded to 50.8 in February (v/s +50.4 expected) from 50.1, a three-month high, benefiting from an uptick in both output and new orders.

In the crypto world, US President Donald Trump in a social media post over the weekend has revealed the names of five cryptocurrencies that he says he'd like to be included in a new strategic reserve to establish the US as the Crypto Capital of the World thus sending their values skyrocketing and partly reversing a recent slump. Following the announcement, the price of the two major digital currencies (Bitcoin and Ether) rose more than 9% and 13% on Sunday respectively. So one to watch.

Looking back at last week, there was a clear risk-off move across global markets as investors faced up to the threat of more US tariffs again. That was exacerbated by some weak US data, including a decline in the Conference Board’s consumer confidence reading, as well as Nvidia’s results, which showed the smallest revenue beat in two years. By the end of the week, that meant the S&P 500 was down -0.98%, even as it recovered by +1.58% on Friday thanks to a late month-end rally with all the gains for the day occurring in the last 90 minutes. The big tech stocks were the main driver of that in both directions, with the Magnificent 7 falling -4.73% in its worst weekly performance since September despite a +2.04% rebound on Friday. Over in Europe, there was a much stronger performance however, and the STOXX 600 posted a 10th consecutive weekly gain, with a +0.60% advance (+0.01% Friday).

On Friday, we also got the latest PCE inflation data for January, which is the Fed’s target measure. That was broadly as expected, with headline PCE at +0.33% on the month, and core PCE at +0.28%. However, it meant both headline and core PCE were still lingering above the Fed’s 2% target on an annual basis, at +2.5% and +2.6% respectively. The other important release was the merchandise trade deficit, which unexpectedly surged more than +25% to $153.3bn in January (vs. $116.6bn expected). The surge likely reflects companies seeking to import goods before tariffs come into place, with gold shipments one potential factor. The release caused a big hit to Q1 GDP estimates with the Atlanta Fed’s GDPNow estimate plummeting to show an annualised contraction of -1.5%, though traditional nowcast models may need to be heavily discounted given the nature of the trade distortions.

For sovereign bonds, the risk-off tone pushed yields lower around the world, with the 10yr Treasury yield falling -22.3bps last week (-5.2bps Friday) to 4.21%. That’s the 7th consecutive weekly decline for the 10yr yield, which is the first time that’s happened since June 2019. Meanwhile in Europe, yields on 10yr bunds fell -6.4bps (-0.8bps Friday) to 2.40%. And over in Japan, the 10yr yield fell -5.2bps (-2.3bps Friday) to end a run of 7 consecutive weekly increases.

Finally, the risk-off move last week hit several other asset classes. Commodities fell back across the board, with Brent crude oil prices down -1.68% on the week to $73.18/bbl. Bitcoin saw a significant decline, closing at a 3-month low on Friday of $84,212 before the weekend rally. And credit spreads widened too, with US HY widening +4bps to 275bps, whilst Euro HY was up +3bps to 284bps