US futures rebounded from yesterday's late day rout even as European stocks slumped the most in almost two months and Asian markets tumbled the most in a month, tracking Thursday's broad market retreat as oil prices held near five-month highs above $90 and investors braced for today's jobs report where the whisper is of a hotter than expected print. As of 7:30am, S&P futures rose 0.3% after tumbling 1.4% yesterday; even with the modest gain the index is on track for its biggest weekly decline since mid-February. Europe's Stoxx 600 slid more than 1%, following the previous session’s sharp retreat on Wall Street and losses in Asia earlier on Friday. US and euro-area bond yields inched higher as fears of an escalation in the Middle Eastern conflict kept Brent crude futures near $91 a barrel, fanning inflation concerns. The USD is stronger, bitcoin has resumed selling, commodities are higher led by Energy products and base metals. From a macro perspective, NFP is the focus, survey is +214k survey vs. BBG whisper +230k; both are down from the +275k prior.

In premarket trading, Mag7 and Semis are higher pre-mkt; Samsung earnings may aid the move. Here are some other notable premarket movers:

According to JPM's market intel desk, yesterday’s sell-off had a number of reasons offered for the move: Middle East Escalation, Oil Price Spike, No Rate Cuts, etc; and since the moves appeared to be a flight to safety, the likely answer is all of the above. We have now seen the first week of the year where the SPX has lost at least 70bps twice and is the first time since the week of Oct 23, 2023 whose close that Friday market the bottom before this current rally.

“Clearly, geopolitical risks are rising and that is on everyone’s radar right now, hence some softness in equity markets and credit spreads,” said Luke Hickmore, a portfolio manager at Abrdn Investment Management Ltd. He added that he was also focused on the upcoming US employment report for March.

Oil’s 18% surge this year, alongside gains across other crucial commodities such as copper and palm oil, raised the prospect of higher-for longer inflation. Minneapolis Federal Reserve President Neel Kashkari on Thursday flagged the possibility that rate cuts may not be needed this year at all if progress on inflation stalls.

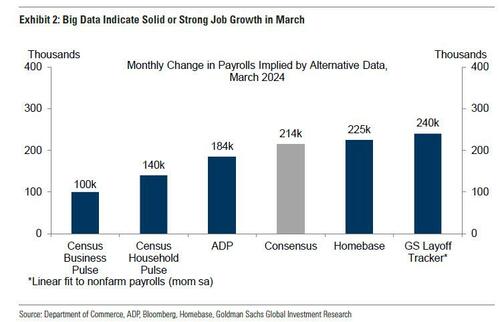

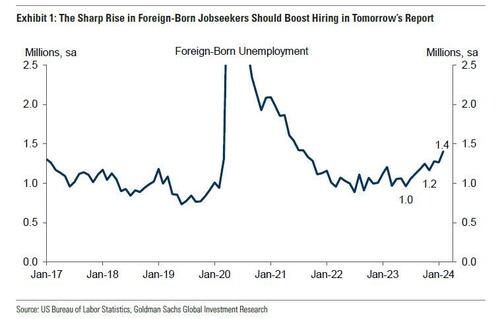

All eyes today will be on the March nonfarm payrolls report which are expected to show more than 200,000 new jobs (most of them going to illegal immigrants) added to the economy last month. A further sign of robust activity may lead the Fed to keep interest rates higher for longer. Currently, money markets are expecting fewer than three US rate cuts this year. As we discussed in our preview post, while most big data hints at a weaker than expected number...

... the relentless surge in illegal immigrants may lead to another 200K+ print.

That said, a number between 150K and 250K will likely lead to some market gains while outliers in either direction will be met with selling. Here is Goldman S&P’s reaction function for the NFP number.

European stocks fall with Financial Services leading the market lower as all sectors decline while energy stocks outperform as oil rises for a fourth day on escalating tensions in the Middle East, with concerns on jet-fuel costs weighing on travel stocks. Rising oil prices have forced a broad market retreat with bonds also slipping. FTSE 100 down 1% but outperforms peers, FTSE MIB lags with a 1.9% drop. Here are the most notable movers:

Earlier in the session, Asian stocks slumped by the most in nearly four weeks, driven by the selling of technology stocks, amid concerns over US monetary policy and signs of rising risks in the Middle East.The MSCI Asia Pacific Index fell as much as 1.2%, with Toyota, Tokyo Electron and Samsung among the biggest drags. Most markets declined, led by Japan after the yen strengthened. Energy stocks outperformed as oil climbed amid tensions between Israel and Iran. Hong Kong stocks dropped after a holiday, tracking losses across the region after Minneapolis Fed chief Neel Kashkari floated the possibility of no rate reductions this year. Markets were closed in mainland China and Taiwan.

In FX, the Bloomberg dollar spot index is steady. NOK outperformed G-10 FX while CHF underperforms; the yen stood out as it hit a two-week high as Bank of Japan Governor Kazuo Ueda stoked bets about an additional interest rate hike later in the year. The currency’s rise on Thursday pulled it back from levels that traders speculated would spark intervention.

In rates, Treasuries were slightly cheaper across the curve, partially unwinding the haven bid into Thursday’s US close after a flare-up of geopolitical tension between Israel and Iran. Treasury yields cheaper by 1b to 2bp across the curve, spreads within 1bp of Thursday’s close; 10-year around 4.33% is nearly 2bp higher on the day, underperforming bunds by 1.5bp while gilts lag, underperforming the rest of core Europe

In commodities, WTI trades within Thursday’s range at about $86. Brent rises to around $90. Spot gold falls roughly $4 to trade near $2,287/oz. Base metals are mixed; LME lead falls 0.6% while LME tin gains 0.5%.

Bitcoin a touch softer as markets await the NFP print and any fresh geopolitical developments to drive the macro narrative into the weekend.

Looking to the day ahead now, and the main highlight will be the US jobs report for March. Otherwise, data releases include German factory orders and French industrial production for February, along with the construction PMIs for March from the UK and Germany. From central banks, we’ll hear from the Fed’s Collins, Barkin, Logan and Bowman.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the losses in the US amid geopolitical concerns and hawkish-leaning Fed rhetoric. ASX 200 suffered amid weakness in tech and mining stocks, while data showed a monthly contraction in Australian exports. Nikkei 225 retreated beneath 39,000 with intraday losses of around 1,000 points amid currency strength. KOSPI was dragged lower with Samsung Electronics pressured following its preliminary Q1 results in which operating EPS topped forecasts but it missed on revenue.

Top Asian news

Equities lower across the board on catch-up play from the late selling seen on Wall Street given geopols/hawkish Fed rhetoric; Stoxx 600 -1.0%. Sectors in-fitting with defensives outperforming slightly given the tone and macro drivers. Stateside, futures are slightly firmer but action is more a consolidation than an uptick after the pressure seen late doors on Thursday, ES +0.3%.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Markets took a sharp risk-off turn in the US afternoon yesterday, continuing their tough start to Q2. The main catalyst were rising tensions in the Middle East, with Brent crude oil prices closing above $90/bbl for the first time since October, which in turn added to existing fears about inflation. Moreover, there were also some hawkish remarks from Fed officials, with Minneapolis Fed President Kashkari saying that if “we continue to see inflation move sideways, then that would make me question whether we needed to do those rate cuts at all.” So there was an open acknowledgement that rate cuts might not happen in a scenario with more persistent inflation, which the latest rise in oil prices won’t help with.

All that meant the S&P 500 fell by over 2% intraday, ending the session down -1.23%. That leaves the index on course for its worst weekly performance since October, having shed -2.04% since the start of the week. And it marks a big shift from its relentless run-up since the end of October. In fact, the S&P 500 is now -0.2% beneath its level 4 weeks earlier, which makes this the biggest 4-week decline for the index since 2024 began.

The equity selloff coincided with the sharp run-up in oil prices yesterday, which came amidst the news that Israel was preparing for a possible attack by Iran. This brought fears of a broader regional conflict back into the market’s view, leading oil prices to spike by almost 3% from the day’s lows. That took Brent crude up +1.45% to $90.65/bbl, while WTI (+1.36% to $86.59/bbl) extended its year-to-date gain above 20%. And overnight there’ve been further gains for oil, with Brent crude up +0.31% to $90.93/bbl.

This backdrop weighed heavily on equities, with the S&P 500 closing -1.23%, its biggest decline since mid-February, after being up +0.8% intraday. Notably, that also helped push the VIX index of volatility up to a 5-month high of 16.35pts. The decline was a broad one, with 23 of the 24 S&P 500 industry groups lower on the day, and tech stocks slightly underperformed, with the NASDAQ down -1.40%. The Magnificent 7 (-1.06%) saw diverse moves, with Nvidia (-3.44%) and Alphabet (-2.83%) posting large declines, whereas Tesla (+1.62%) and Meta (+0.82%) both advanced.

Treasuries benefited from the risk-off turn, with 10yr yields down -3.8bps to 4.31%, while 2yr yields fell by -2.5bps. Notably, this was fully driven by real yields, with breakevens higher on the day, as the 5yr inflation swap rose to its highest level in nearly 5 months (+2.9bps to 2.54%). Fed funds futures saw sizeable volatility, with pricing of a June cut moving from 63% earlier on to as high as 80%, before settling at 74% by the close. Earlier in the day, the jobless claims data further cemented expectations of a June cut, after initial claims rose to 221k over the week ending March 30 (vs. 214k expected), their highest level since January.

Looking forward, the next focal point will be the US jobs report for March today, which will offer fresh clues as to the likelihood of future rate cuts. In recent months, nonfarm payrolls have seen a noticeable improvement, and the 3m average gain was up to +265k in February, which is its fastest since June last year. So when you combine that with the upside inflation surprises over January and February, that’s seen investors push out the likely timing of rate cuts. In terms of what to expect today, our US economists are forecasting growth in nonfarm payrolls of +200k, with the unemployment rate ticking down a tenth to 3.8%. They see the risks to their payroll forecasts as roughly balanced, but when it comes to the Fed, they think that unless there are any substantial surprises, the inflation report next week will get more attention given the Fed’s focus on the inflation outlook. For more details, see their full preview along with how to register for their webinar (link here)

Yesterday also brought several Fed speakers before the jobs report. In aggregate, they did little in aggregate to move the needle on rate cut expectations. However, there was some hawkishness from Minneapolis Fed President Kashkari, who described the January and February inflation prints as “a little bit concerning”, and as mentioned at the top, he questioned whether rate cuts would need to happen at all if inflation did move sideways. Apart from Kashkari, Cleveland Fed President Mester said she wanted “to see a couple more months data” to discern if there was enough confidence in the inflation decline to begin lowering rates. Chicago Fed President Goolsbee suggested that the higher January and February inflation readings “should not knock us off the path back to target”, though he was watchful over the still elevated housing inflation. And Richmond Fed President Barkin said that “Given a strong labor market, we have time for the clouds to clear before beginning the process of toggling rates down ”, which was similar to Chair Powell’s comment the previous day.

This negative tone has continued in Asian markets overnight, where the Nikkei (-1.93%) and the KOSPI (-1.05%) have both experienced sharp losses. Otherwise, the Hang Seng (-0.71%) saw a smaller decline as it caught up after the previous day’s holiday, whilst markets in mainland China remain closed for a second day. Meanwhile, the Japanese Yen strengthened after comments from BoJ Governor Ueda that suggested another potential rate hike later this year. In particular, he said that the “possibility of achieving the BOJ’s long-awaited target will further increase as wage hikes are reflected in higher consumer prices from summer through autumn”. That supported a further rise in front-end government bond yields, with the 2yr Japanese yield up +2.1bps to 0.20%, its highest level since 2011.

Back in Europe, markets closed before the late run-up in oil prices, so yesterday’s session had been more cheerful for investors. Bonds experienced a sizeable rally, with yields on 10yr bunds (-3.4bps), OATs (-4.1bps) and BTPs (-10.9bps) all seeing a noticeable decline. And most European equity indices posted modest gains, with STOXX 600 up +0.16%. In part, sentiment was supported by the final services and composite PMIs for March. Those saw upward revisions compared to the flash PMIs, and the Euro Area composite PMI was up to 50.3 (vs. flash 49.9), marking its first time it’s been in expansionary territory in 10 months. A similar pattern of upward revisions was evident elsewhere, with the German composite PMI at 47.7 (vs. flash 47.4), whilst France’s was at 48.3 (vs. flash 47.7). The main exception to that pattern was in the UK, where the final composite PMI was down a tenth from the flash reading to 52.8.

Elsewhere in Europe, we saw the release of the accounts of the ECB’s March meeting, which were consistent with the ECB seeing June as the baseline for the first rate cut. The accounts noted that “While it was wise to await incoming data and evidence, the case for considering rate cuts was strengthening”, and pointed out that “the Governing Council would have significantly more data and information by the June meeting, especially on wage dynamics. By contrast, the new information available in time for the April meeting would be much more limited”. For more, see our European economists’ take on the accounts here.

To the day ahead now, and the main highlight will be the US jobs report for March. Otherwise, data releases include German factory orders and French industrial production for February, along with the construction PMIs for March from the UK and Germany. From central banks, we’ll hear from the Fed’s Collins, Barkin, Logan and Bowman.