US equity futures rise as Trump leaves the door open for more discussions despite the 14 tariff letters sent yesterday and the extension of the deadline to Aug 1 which is "not 100% firm." As of 8:15am ET, S&P futures rise 0.1% and Nasdaq futures gain 0.2% after US markets retreated on Monday from ATH on the back of increased tariffs on countries if deals are not reached (Japan/South Korea’s 25% were standouts). Pre-market, Mag7 names are all higher, while industrials are leading cyclicals with financials mixed. 10Y TSY yields are higher by 3bps to 4.41% as the curve bear steepens and the USD is higher after erasing an earlier loss. Commodities are generally weaker although Brent crude has once again rebounded from session lows to trade just shy of $70/bbl. The macro data focus today is on Small Biz Optimism (prints in line with expectations), 1-year Inflation Expectations, and an update on Consumer Credit.

In premarket trading, Magnificent Seven stocks are all higher (Tesla +1%, Nvidia +0.7%, Meta +0.5%, Amazon +0.3%, Alphabet +0.4%, Microsoft is little changed, Apple +0.06%).

For stock markets, TACO Tuesday’s calm reflected traders’ belief in a familiar pattern of US President Donald Trump escalating his trade war only to later de-escalate. In the latest round, Trump said he was still open to negotiations and postponed duties of 25% or more on a list for trading partners until at least Aug. 1.

“Equity markets are focused on the positive news,” said Wolf von Rotberg, equity strategist at Bank J. Safra Sarasin. “Europe is working toward securing a framework agreement with the US and the July 9th deadline was pushed out by another month. The market has learned to focus on the facts more than following the talk.”

Ongoing talks with the European Union are likely to draw particular attention. The bloc is seeking to finalize a preliminary agreement this week that would lock in a 10% tariff rate beyond Aug. 1 while a permanent deal is hammered out.

The prospect of a better-than-expected trade deal helped boost the euro. The common currency rose as much as 0.5%, extending gains for the year as traders reacted to a Politico report that said the US offered a deal that would keep the 10% baseline tariffs, with exemptions for sensitive sectors.

“The fact that higher tariffs have become the default if no deal is reached does introduce a layer of risk that markets will have to price in,” said Daniela Sabin Hathorn, senior market analyst at Capital.com. “The dollar could struggle as this would have a negative impact on the growth outlook in the US.”

So far, the US economy has held up under the threat of a spiraling global trade war. Hiring is healthy, while the S&P 500 hit an all-time high last week. Still, some investors remain cautious that persistent policy uncertainty, along with concerns over rising levels of government debt and geopolitical headwinds, could eventually catch up with markets.

“Investors betting on the TACO trade might gradually face some disappointment,” said Raphael Thuin, head of capital markets strategies at Tikehau Capital in Paris. “There’s a real possibility that tariffs are here to stay beyond Trump’s mandate as a permanent fiscal tool to fund growing deficits."

European stocks are in a narrow range, with Stoxx 600 fluctuating between gains and losses as European Union negotiators rushed to conclude a preliminary trade deal with the US to avoid a spike in tariffs, with miners, financial services and travel stocks outperforming, while real estate shares lag. Drinkmakers gain on tariff news, while renewables drop as the Trump administration targets tax breaks. Germany’s DAX marginally outperforms. Here are the most notable European movers:

Earlier in the session, stocks in Asia advanced as investors shrugged off US President Donald Trump’s tariff announcements and focused on room for further negotiations. The MSCI Asia Pacific Index gained 0.4%, with SK Hynix and Hitachi providing the biggest lift while BHP Group and Nintendo weighed on performance. South Korea and Japan both advanced on cautious hopes that the countries can reach trade deals ahead of Trump’s newly-extended tariff deadline. Trump earlier sent letters to Tokyo and Seoul, threatening levies of 25% beginning Aug. 1. Elsewhere in the region, Hong Kong shares rose, helped by a rebound in e-commerce giants Meituan and Alibaba. Their shares had been falling recently due to concerns over an intensifying price war in the food delivery business.

In FX, we initially saw broad dollar weakness after President Trump suggested he’s open to more negotiations on tariffs beyond an August 1 deadline, but that weakness has since reversed and the dollar is trading near yesterday's highs. Aussie dollar tops G-10 peers after the RBA surprise. The yen underperforms.

In rates, bonds sell off across Europe and the US, taking their cue from jitters in Japan over the country’s political situation and associated fiscal risks. Japanese 30-year bond yields rose as much as 13 basis points. Australian bonds also slump after the RBA unexpectedly kept interest rates unchanged. That fed into weakness in the long-end across Europe. 30-year bund yields hit the highest level since March, benchmark 10-year yields up by around five basis points across countries. A flurry of supply is also weighing. 10-year Treasury yields up three basis points to 4.415%, at session highs with German and UK counterparts cheaper by an additional 2bp. Treasury auction cycle begins with $58 billion 3-year new issue at 1pm New York time, followed by $39 billion 10-year and $22 billion 30-year reopenings Wednesday and Thursday. WI 3-year yield near 3.875% is about 10bp richer than last month’s, which tailed by 0.4bp.

In commodities, gold is down by $12 to around $3,324/oz. Oil prices lower, Brent drops 0.7% to just over $69/barrel.

Looking at today's calendar, US economic data slate includes June NY Fed 1-year inflation expectations (11am) and May consumer credit (3pm). The Fed speaker slate blank, with minutes of June FOMC meeting are to be released at 2pm tomorrow.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly traded with cautious gains as participants digested the latest trade-related developments including US President Trump's tariff letters to 14 countries so far including Japan, South Korea, South Africa, and Thailand with tariff rates ranging between 25%-40% and warnings against retaliation, although he also signed an Executive Order to delay the tariff deadline to August 1st. ASX 200 was indecisive as strength in tech and gold producers offset the losses in defensives, while an improvement in NAB Business Confidence was met with little fanfare as participants awaited the RBA rate decision which ultimately disappointed as the central bank defied the broad consensus for the first back-to-back cut since the pandemic, and instead decided to pause on rates through a 6-3 majority vote. Nikkei 225 recouped initial losses as recent currency weakness helped investors shrug off the tariff-related news with Japan facing a 25% tariff which is slightly higher than the 24% rate announced on Liberation Day. Hang Seng and Shanghai Comp were underpinned with the PBoC to support more onshore investors to invest in offshore bonds, while it will also expand the Bond Connect to include Chinese brokers, funds, wealth managers and insurers.

Top Asian News

European bourses opened higher, welcoming Trump's confirmation that the new tariff deadline is August 1st and as Monday's letters did not have any narrative-shifting surprises. Since, benchmarks have come off best and are either side of the unchanged mark, Euro Stoxx 50 U/C. Sectors in-fitting with the above and as such are now mixed. Basic Resources lead amid gains in Glencore (+2.5%) after an upgrade by and favourable commentary from JPMorgan. Retail at the other end, hit by the tariff letters on Asian manufacturing nations which are a key destination for European names such as Pandora (-1.1%).

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

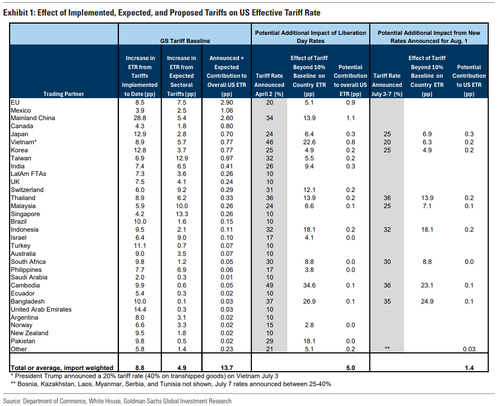

A quiet day where we were all waiting for tariff news sprung into life just after Europe closed yesterday as the first major tariff news of the week broke. In a series of posts on social media, President Trump announced new tariff rates on several trading partners. He started off by announcing 25% tariff rates against Japan and South Korea, effective August 1st. This was followed by “trade letters” to a further twelve countries including South Africa (30% rate), Malaysia (25%), and Indonesia (32%). President Trump also said that “any goods transshipped to evade a higher tariff will be subject to that higher tariff,” while noting that these would be separate from the sectoral tariffs. The headline rates for most countries announced yesterday were around the same levels as the Liberation Day tariffs, but President Trump also said that if countries were to raise their tariffs in response, then “whatever number” they choose will be added onto the 25% charged by the US.

White House Press Secretary Leavitt announced that more letters will be arriving throughout the week. After sending the posts, the President signed an executive order that effectively delays the new tariff rates until August 1, prolonging the current 10% tariff rate and giving nations more time to meet the trade demands from the White House. The President continued to signal he was open to deals, saying the August 1st deadline was “not 100% firm” and that they could “maybe adjust a little bit, depending.” Overnight, Politico reported that while a US-EU trade deal had not been finalised, the US had offered the EU a 10% tariff rate with caveats. Given the higher rates seen earlier in the day for other trading partners, the EUR has rallied (+0.32%) overnight and is back to levels before the letters started rolling out yesterday.

Stocks fell in response to the tariff news, although the S&P 500, which closed -0.79%, was already -0.6% just before the announcement in anticipation of the noon Washington timeline that had been given over the weekend with regards to letters being sent out. The index was down -1.25% at the lows of the day, before rebounding as investors priced in the possibility of trade deals getting over the line for larger trading partners before putative tariffs kick in.

Within US equity markets, the Magnificent 7 (-1.03%) underperformed while following a similar pattern to the broad index, although the index was also weighed down by Tesla (-6.79%), which saw the biggest decline in the entire S&P after Musk announced the formation of the “America Party” over the weekend. Small caps, which have less margin to absorb tariff costs, underperformed by even more as the Russell 2000 fell by -1.55%. Meanwhile, US Treasuries also struggled, with the 10yr yield up +3.4bps to 4.379%, whilst the 30yr yield (+5.4bps) rose to 4.92%. In turn, that helped to support the US Dollar index (+0.31%), which has stabilised around a 3-year low in the last week.

President Trump posted late on Sunday that any country aligning with the “Anti-American policies” of the BRICS would face an added 10% tariff, and this didn’t help the likes of Brazil’s IBOVESPA (-1.26%). The 10 member states met in Rio Janeiro over the weekend, where they condemned US and Israeli strikes on Iran, as well as the US unilateral tariffs. So, yet another tariff threat that adds to the uncertainty.

In the meantime, one ongoing theme was the continued pressure on the Fed from the administration. That came as Peter Navarro wrote in a Substack post that Chair Powell’s policy was causing American households “acute financial pain” and that if Powell “will not voluntarily adjust course, the board must act decisively to prevent further economic harm.” We’ll get the June FOMC meeting minutes release tomorrow, so that should offer more details on how officials are thinking about rate cuts. At face value, the latest tariff letters, and the fact that the deadlines seem to be pushing towards August 1st, thus prolonging uncertainty, means a September Fed cut will become more difficult unless there is strong evidence of a deteriorating economy.

Over in Europe, equities had put in a more positive performance, but closed before the stream of tariff headlines came through. Sentiment was also boosted, however, by hopes of a trade deal, with EU spokespeople earlier confirming to Bloomberg that they were close to a trade agreement with the US, after a “good exchange” between Von Der Leyen and President Trump. So that meant the STOXX 600 (+0.44%) and the DAX (+1.20%) both advanced. European futures are only lower by around a couple of tenths this morning. Away from the EU, the FTSE 100 (-0.19%) lagged behind yesterday. European sovereign bonds traded more in line with US Treasuries, with yields on 10yr bunds (+3.6bps), OATs (+4.2bps) and BTPs (+4.7bps) all moving higher. We also found out German industrial production rose +1.2% in May (vs. -0.2% expected), which was relatively stronger than the French and Spanish numbers last week.

Asian equity markets are higher this morning shrugging off the threats of increased US trade tariffs as President Trump left the door open for additional trade negotiations. Across the region, the KOSPI (+1.46%) is leading gains while the Hang Seng (+0.86%), the CSI (+0.74%), the Shanghai Composite (+0.58%) and the Nikkei (+0.28%) are also higher. The S&P/ASX 200 (-0.19%) is trading lower but has hardly had time to react to a surprise 6-3 decision, just before we go to print, to hold rates rather than cut them as widely expected. The RBA's statement pointed to an "uncertain outlook" as the reason for holding rates. The Australian dollar reacted sharply, jumping to 0.6539 against the dollar, while policy-sensitive 3-year government bond yields have climbed 14bps, 10 of which have come in the last few minutes after the decision. Governor Michele Bullock's upcoming press briefing is now the focus of market attention. Elsewhere US equity futures are flat to up a tenth of a percent.

On geopolitics, yesterday Iran announced that Israel had tried to assassinate its President during last month’s attacks, and that US strikes has severely damaged its nuclear infrastructure and equipment. In an interview with Tucker Carlson on Monday, Iran’s President Masoud Pezeshhkian said that the US could resolve its differences with Iran through dialogue and talks, but said it was difficult to trust the US and asked how they could be sure Israel wouldn’t be given permission to attack again. Amidst the newsflow, WTI rose +1.39% to $67.9/bbl and Brent crude was up +1.87% to $69.58/bbl even with the surprise oil production increases announced by OPEC+ over the weekend. It's back down around half a percent this morning.

To the day ahead now, we’ll have the US June NFIB small business optimism, the NY Fed’s inflation expectations, and Germany’s trade balance for May. Central bank speakers include the ECB’s Nagel.