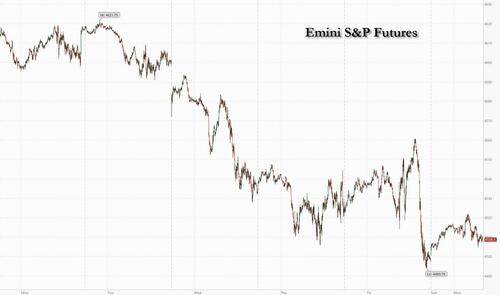

A selloff in treasuries and global government bonds returned with a vengeance on Monday as the threat of further rate hikes unsettled traders. With 10Y TSY yields jumping as much as 9bps from 4.03% to 4.12% overnight, the yield on 30-year German bonds surged nine basis points to 2.72%, the highest since early 2014. However, unlike Friday when stocks tumbled as yields spiked to a fresh 2023 high, on Monday US equity futures rose modestly - at least for now - alongside yields in subdued, listless trading, signaling a rebound from Friday’s rout. At 7:45am ET, S&P futures higher by about 0.2% although European stocks were in the red, following softer-than-expected German June industrial production data, and Asia was mixed. The dollar was a little stronger against G10 currencies while oil and iron ore prices are lower, despite a Ukraine drone attack on a Russian oil tanker, the first of many.

As JPM's trading desk notes this morning, expect a return of hawkish Fedspeak this week though CPI remains the key data point, in an otherwise light macro data week; tied to that, JPM's chief economist Michael Feroli hiked his 23Q3 GDP estimate from +0.5% to +2.5% while removing his recession call. Meanwhile, as we reach the tail-end of earnings, we may see some inter-sector rotations as investors consider an improving economy.

In premarket trading, Yellow Corp. fell as much as 45% in premarket trading on Monday, after the trucking firm filed for bankruptcy and said it will remain shuttered. Wayfair gained 2.5% after UBS upgrades its rating to buy from neutral, writing that the market may be surprised by the scope for profit upside at the online retailer. Some other notable movers:

Over the weekend, Fed Governor Michelle Bowman said that the US central bank may need to raise rates further in order to fully restore price stability. According to Bloomberg, "Investors also considered mixed signals from Friday’s US jobs, which showed wages above forecast even as payrolls growth moderated", even though on Friday the only thing they considered was the dovish consequences of another drop in the monthly payrolls.

“We don’t think central banks will get the rise in unemployment rate and sustained moderation in wage growth in the coming year that they hope to see,” ADA Economics Ltd. Chief Economist Raffaella Tenconi said in an interview with Bloomberg TV.

The most important data point this week will be US CPI reading on Thursday, which is expected to show moderate price growth. The index is projected to rise 0.2% in July for a second month after excluding food and energy costs, marking the smallest back-to-back gains in 2 1/2 years.

European stocks retreated as a index of German industrial output fell to a six-month low, underscoring weakness in the economy. European stocks struggle with the Stoxx 600 down 0.4%, although in very light volumes with trading of Euro Stoxx 50 stocks about 40% less than the 30-day average. Here are the most notable European movers:

Earlier in the session, Asian stocks were mixed with a cautious start to the week, weighed down by concerns about higher US interest rates and a widening anti-graft crackdown on the pharmaceutical sector in China. The MSCI Asia Pacific Index fell as much as 0.3%, with Chinese pharmaceutical stocks among the biggest losers. Benchmarks in Taiwan, Singapore, India and Vietnam gained.

“It is too early to say whether the pharma crackdown will weigh on the markets. However, it is possible that it could lead to increased uncertainty and volatility in the short term,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. Investors are also assessing the mixed US jobs report.

In FX, the Bloomberg Dollar Spot Index is up 0.1% as markets weighed the economic outlook for the US and hawkish commentary from Federal Reserve Governor Michelle Bowman. The Swedish krona is the weakest, followed by the Swiss franc. USD/JPY rose 0.4% snapping three days of losses as the yield differential continues to weigh on the Japanese currency. EUR/USD slides 0.3% as German industrial production data slumped to a six-month low.

In rates, Treasuries were cheaper across the curve after yields tanked on Friday, following similar losses in long-end European rates, where German 30-year yields rise to highest since January 2014. Treasury yields cheaper by 6bp to 7bp across the curve with 10- year yields sitting around 4.11%, paring much of Friday’s sharp rally. The US Treasury curve bear flattened after weekend comments from the Fed’s Bowman, who said that more rate hikes are likely needed, appear to weigh on Treasuries; two-year yields are up 8bps. Gilts lag behind by around 1bp in the sector while bunds marginally outperform — German 2-year yields remain richer by almost 4bps on the day, rallying after the Bundesbank said it would stop paying interest on domestic government deposits, while 10-year borrowing costs rise 2bps. Dollar IG issuance slate contains three deals already; syndicate desks are projecting around $30 billion in new bond sales this week. Treasury auctions resume Tuesday with $42bn 3-year note sale, followed by $38bn 10-year Wednesday and $23b 30-year bond sale Thursday.

In commodities, crude futures decline, with WTI falling 0.7% to trade near $82.30. Wheat futures rise 2.5% after Ukrainian drone attacks on a Russian naval vessel and oil tanker. Spot gold falls 0.3%.

It's a quiet calendar today, with earnings season dying down while the only event on the economic calendar is consumer credit at 3pm ET.

Market Snapshot

S&P 500 futures up 0.3% to 4,513.50

Brent Futures down 0.4% to $85.91/bbl

Gold spot down 0.4% to $1,934.67

U.S. Dollar Index up 0.27% to 102.29

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks began the week mostly negative following on from last Friday's late retreat on Wall St as Apple shares extended on their losses post-earnings and as the regional bourses reacted to the weaker NFP and firmer-than-expected US hourly earnings. ASX 200 was marginally lower amid weakness in healthcare, financials and tech heading into a busy week of earnings including Australia's largest lender CBA which is set to report on Wednesday. Nikkei 225 initially suffered from early selling after it gapped beneath the 32,000 level at the open but then staged a recovery and returned to above the aforementioned key psychological level. Hang Seng and Shanghai Comp conformed to the subdued mood with mixed fortunes in Chinese developers clouding over the gains in energy and with participants cautious heading into upcoming key releases including the trade data on Tuesday followed by inflation figures on Wednesday. Chinese FX Reserves (Monthly) (Jul 2023) 3.204Trl vs. Exp. 3.2Trl (Prev. 3.193Trl).

Top Asian News

European bourses are under modest pressure with the overall tone relatively indecisive with a summer feel to markets, Euro Stoxx 50 -0.3%. Sectors are mixed but with the breadth relatively narrow and individual stock specifics somewhat limited. Stateside, futures are in the green and feature some slight outperformance in the NQ after marked pressure last week; ES +0.3%, NQ +0.4%.

Top European News

FX

Fixed Income

Crude

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

We had two US payrolls and two inflation releases to get through before the next FOMC in September and although the first of these on Friday was a mixed affair, it did trigger a big rally across the US rate curve with 2yr and 10yrs -11.7bps and -14.1bps tighter, respectively, on the day even if yields were still higher at the long-end on the week. We'll review the main payroll highlights below but with that out the way we move on to the next big one, namely US CPI on Thursday. PPI follows fast behind on Friday alongside the University of Michigan consumer survey which contains the all-important inflation expectations series. In Europe, the focus will be on GDP numbers in the UK (Friday), industrial production in Germany (today), the ECB's Consumer Expectations Survey (tomorrow) and China CPI/PPI (Wednesday). Corporate earnings wind down quite sharply with 33 S&P 500 and 55 Stoxx 600 companies reporting this week.

Before we preview CPI, its worth reviewing what our economics team thought about payrolls given the huge rates move, albeit in context of a week where rates went up a lot earlier in the week. The gains in both headline (+187k vs. +185k last) and private (+172k vs. +128k last) payrolls were pretty much in line with our forecast of +175k on both. As our economists' highlight in their weekly preview here, as has been the case recently, most of the job gains came from private education and health services as well as leisure and hospitality, which together grew by +117k. Some of the leading indicator industries showed job losses, namely manufacturing (-2k), transportation and warehousing (-8k), and temporary help services (-22k). Temp help data only goes back a few decades but declines have been a good lead indicator in the past. There was also some talk of this being the sixth successive month where we've had downward revisions to the prior month, something that has happened in the past around labour market turning points.

There was also a one-tenth decline in average weekly hours. This, combined with the moderating pace of job growth, has aggregate hours worked unchanged over the last six months. While average hourly earnings (AHEs) surprised again to the upside (+0.4% vs. +0.4%, a tenth high than expected), the year-over-year growth rate of our economists' nominal wage income proxy (private payrolls times average weekly hours times average hourly earnings) declined from 6.3% to 5.7%, much closer to the average of 4.6% that prevailed from 2015 to 2019. However, the unemployment rate fell back down a tenth to 3.5% while the U-6 underemployment rate unwound its two-tenths rise in June, falling to 6.7%. Wage growth is also not trending towards the 3% that Chair Powell cited as being consistent with their inflation target. Indeed, year-over-year growth in AHEs seems to have stalled out around 4.3-4.4%, where it has hovered since the beginning of the year. Short-term trends also show some signs of re-acceleration, with the three-month annualised change at 4.8%. For more see our economists' labour market chartbook: "July Jobs: Same song, different verse?".

In conclusion there was no real conclusion from the report. There was something for everyone. Unless there's a sudden shock though, any path to a hard landing is likely to be via signs of a soft landing first but the bulls will say that's where it will stop. You pays your money and you takes your choice.

So next stop is US CPI on Thursday. One thing to bear in mind for inflation over the next few months is the +15.8% gain in the WTI crude price last month. Gasoline prices are rising fast too. Too early perhaps to make much inroads yet but a complication if prices stay elevated. In fact, for now, with seasonally adjusted gas prices down a bit from June, our economists expect a slightly weaker headline (+0.17% forecast vs. +0.18% previously) reading relative to core (+0.21% vs. +0.16%). This would equate to 4.8% YoY for core (though it is very close to rounding down to 4.7%), however, shorter-term trends should show significant improvement. The three-month annualised rate should fall by about 80bps to 3.3%, while the six-month annualised rate should fall by 40bps to 4.2%, both the lowest in over two years.

With regards to the ever-important core services excluding rent and medical services sector, last month's data showed significant progress. This category posted the second-lowest monthly print in the last 21 months (unch.), though much of this weakness was due to a sharp -8.1% drop in airfares. Our economists explain that this decline brings airfares back to pre-pandemic levels, so is that normality returning or was last month an anomaly. We will see.

Staying with inflation, China CPI and PPI numbers on Wednesday are interesting as the country sits on the brink of consumer price deflation with the latest readings printing 0.0% for the CPI and -5.4% for the PPI YoY. Current median estimates on Bloomberg point to a -0.5% YoY CPI and -4.0% YoY PPI reading.

Asian equity markets are largely trading lower at the start of the week but US futures are rebounding. As I check my screens, Chinese stocks are leading losses with the CSI (-0.77%) the biggest underperformer followed by the Shanghai Composite (-0.60%) and the Hang Seng (-0.28%) as markets grow a bit impatient over the lack of major stimulus steps from Beijing. Elsewhere, the KOSPI (-0.22%) is also in the red while the Nikkei (-0.02%) is paring earlier losses. Outside of Asia, S&P 500 (+0.40%) and NASDAQ 100 (+0.57%) futures are higher, after coming off their worst week since March. Meanwhile, yields on 2yr and 10yr USTs are +4.4bps and +2.4bps higher, respectively, reversing some of Friday’s declines as we go to print.

Looking back on last week now, and even with a volatile rates week, expectations for the next Fed meeting in September didn’t change much, falling by -1.0bps on Friday and -1.5bps on the week.

All the fun and games was at the longer end. US 10yr Treasury yields fell back -14.1bps on Friday, but still ended the week +8.4bps higher after the earlier sell-off following the US credit rating downgrade by Fitch and higher refunding announced by the US Treasury. The 2yr yield likewise fell -11.6bps on Friday but was down by -11.2bps on the week. A twist steepening thus remained the main story, with the 2s10s curve +19.6bps steeper on the week at -73.7bps (but -2.9bps on Friday). The 30yr yield was up +19.0bps on the week despite a -9.0bp rally on Friday. Over in Europe, the moves were similar in direction if smaller in magnitude, with 10yr bunds selling off by +6.8bps on the week despite Friday’s rally (-4.2bps).

In equity markets, a sell-off in the US session left the S&P 500 down for the fourth day in a row on Friday (-0.53%), leaving it with a -2.27% weekly decline, the sharpest since the SVB crisis in early March. Tech likewise struggled last week as the NASDAQ fell back -2.85% on the week (-0.36% on Friday). The index was weighed down by Apple, which fell by -4.80% on Friday, although this was largely offset by Amazon’s strong +8.27% gain, after the two mega caps reported results the previous evening. European equities saw a similarly underwhelming week, with the STOXX 600 down -2.44% despite gaining on Friday (+0.29%).

Lastly, in commodities, oil continued its upward march last week, propelled upwards by Saudi Arabia’s fresh announcement of voluntary cuts earlier in the week to reach its sixth consecutive week of gains. WTI crude gained +2.78% week-on-week (and +1.56% on Friday) to $82.82/bbl. Brent crude rose +1.47% (and +1.29% on Friday) to $86.24/bbl. Rising US yields and the overall risk-off sentiment weighed on the industrial metals market, as the Bloomberg index of industrial metals fell -1.25% week-on-week (and -0.41% on Friday).