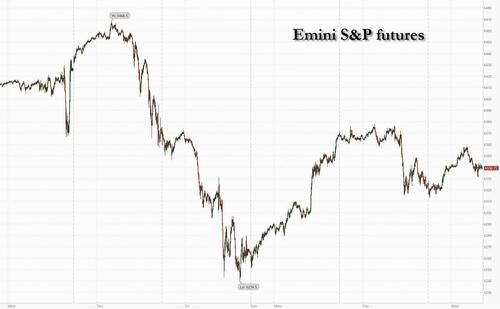

US futures rebound from yesterday's modest drop as the market shakes off stagflationary concerns raised by NFP/ISM, although spoos trade well off their early session gains. As of 8:00am ET, S&P 500 futures and Nasdaq 100 futures were 0.2% higher. In premarket trading, McDonald’s and Shopify jumped after earnings beats; Mag7 names are mostly higher while Semis are dragged with downbeat AMD/SMCI earnings (see below). DIS/UBER highlight pre-mkt earnings releases; the former is lower on disappointing TV revenues, while the latter is flat despite solid results. Energy, Industrials, Healthcare and Utilities are stronger, too. Yields are bear steepening and the USD is flat for the second day. The Swiss President arrived in DC yesterday to meet with Trump, even as the US president preps new sanctions against Russia’s shadow tanker fleet unless Putin agrees to a cease-fire by Friday; WTI did not react to this news. Witkoff to meet with Russian officials today. Macro data releases are light with only mortgage apps but keep an eye on 10Y bond auction today at 1pm. EPS still a top priority for investors with another slew today.

In premarket trading, Mag 7 stocks are mixed (Microsoft +0.7%, Amazon +0.7%, Meta +0.5%, Apple +0.4%, Alphabet +0.1%, Tesla -0.1%, Nvidia -0.8%); Uber and Disney dropped after reporting results that disappointed some investors. Super Micro Computer plunged more than 17% after cutting its annual sales forecasts, while AMD slumped after the company was unable to give a clear outlook for resuming sales in China. Some more details:

In other corporate news, Cathay Pacific said it would place a $8.1 billion order for 14 Boeing 777-9 jets in its first deal with the US planemaker in 12 years. The NFL is said to be putting together a few games for a new media package that it could sell to potential streaming partners, following news it will sell most of its media businesses to Disney in exchange for a 10% stake in ESPN. Miner Glencore has scrapped plans to move its primary listing to New York.

While earnings have mostly beat sharply trimmed estimates so far this season, investors are worried about the impact of tariffs and a slowing economy. The Services ISM data on Tuesday showed another stagflationary deterioration: sticky price pressures alongside deteriorating labor indicators, further complicating the Federal Reserve’s policy challenges after last week’s weak jobs numbers.

“Earnings are important, but at the headline level for markets, the most important thing is the macro,” said Jon Bell, a portfolio manager at Newton Investment Management. “I don’t think there’s any real expectation that uncertainty will go down. Every time we think we’ve got certainty about tariff levels, something else changes.”

Meanwhile, Trump ramped up his tariff blitz, saying he’ll impose increased levies on countries buying energy from Russia (including China) while his envoy Steve Witkoff is in Moscow, and slap duties on semiconductor and pharmaceutical imports soon. Trump is scheduled to make an announcement at 4:30pm today in the Oval Office. As a reminder, yesterday Trump said he was “very close to a deal” with China to extend the trade truce and he would likely meet with Xi by the end of the year if a deal is made.

Still, markets seem fairly indifferent to tariff news at this point, and are more excited about tech again — especially after Bloomberg reported that OpenAI is in early talks about a potential share sale at a whopping valuation of about $500 billion. The rush back into the AI theme has resulted in an extreme divergence between TMT’s market cap share — now at a post-2000 peak — and its earnings share of the S&P 500, according to BI strategists Gina Martin Adams and Michael Casper. The combination of soaring capital spending on AI, plus heavy tariff-related uncertainty weighing on non-AI components of the index has led to “renewed bubble risk,” they said. Bloomberg macro strategist Cameron Crise, meanwhile, is “surprised at just how vigorous the appetite to buy the equity dip has been.”

Meanwhile, Swiss President Karin Keller-Sutter arrived in Washington to make a last-minute bid for a deal to lower the 39% tariff imposed last week by Trump.

In Europe, the Stoxx 600 is little changed having reversed an earlier gain of as much as 0.4% as losses in healthcare shares weigh on the broader market. Novartis, Roche and Novo Nordisk are making the largest negative points contribution to the index as Washington readies tariffs on pharmaceutical imports. The SMI falls 0.8%. Here are the biggest movers Wednesday:

In other European news, UK Construction PMI was weaker and German factory orders unexpectedly declined for a second month in June, when the results of a European-US trade deal were still far from clear. the data came after outgoing Governing Council member Robert Holzmann said the European Central Bank shouldn’t lower borrowing costs again.

Earlier in the session, Asian stocks advanced, on track for a third day of gains, as optimism in Japan helped offset gloom in the technology sector. The MSCI Asia Pacific Index rose as much as 0.4%. Tencent and Alibaba were among the biggest boosts. Toyota shares gained as much as 2.7% ahead of its quarterly earnings report. Key gauges climbed in Thailand, Vietnam and Australia. Indian stocks edged lower after the central bank maintained the benchmark interest rate.

In rates, treasuries hold small losses in early US session, with long-end yields cheaper by around 3bp and the curve steeper, ahead of the 10-year new-issue auction at 1pm and Thursday’s 30-year. US yields are 1bp-3bp higher across tenors with 2s10s and 5s30s spreads steeper by 1bp-2bp. 10-year near 4.234% is about 2.5bp cheaper, with German’s similar and UK’s outperforming slightly. Bunds see similar price action following German factory orders data and auctions of debt maturing in 2038 and 2042. Sentiment continues to be influenced by shifting US trade policy, and President Trump said he’d impose increased tariffs on countries buying energy from Russia.

In FX, the Bloomberg Dollar Spot Index is little changed. The kiwi dollar tops the G-10 FX pile, rising 0.3% against the greenback after the New Zealand unemployment rate rose less than forecast.

In commodities, WTI crude futures rise 1.5% after a four-day loss. Spot gold slips $17 to $3362.

Looking at the day ahead, we have UK construction PMI, Germany’s June factory orders, July construction PMI, France Q2 private sector payrolls, Italy June industrial production, and Eurozone retail sales. We’ll also hear the Fed’s Cook and Collins speak. Earnings out today include Novo Nordisk, McDonald’s, Walt Disney, Uber, Shopify, AppLovin, DoorDash, and Glencore. We’ll also get the US 10-year notes auction ($42bn).

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed following the subdued handover from Wall St, where the attention was on the various comments from US President Trump and with sentiment dampened amid disappointing ISM Services data. ASX 200 gained at the open with strength in the materials, mining and resources sectors spearheading the advance in the index to a fresh record high. Nikkei 225 pared its opening losses and gradually extended higher amid gains in the heavy industry stocks, while softer-than-expected labour cost data and negative real cash earnings supports the case for the BoJ to continue to refrain from resuming its policy normalisation. Hang Seng and Shanghai Comp were varied in rangebound trade with little fresh drivers and after the PBoC reiterated China's support pledges including to strengthen macroeconomic policy orientation and optimise the environment for policy implementation.

Top Asian News

European bourses (STOXX 600 +0.2%) opened modestly firmer across the board and have traded at elevated levels throughout the morning. Though, the European benchmarks and US futures have been gradually fading from best into the arrival of US participants. European sectors hold a strong positive bias, with only really two clear underperformers today. Healthcare sits right at the foot of the pile, dragged down by post-earning losses in Novo Nordisk (-1%). The Danish Ozempic-maker initially opened higher after its Q2 metrics, but then gradually dipped into the red. Most headline metrics were weaker than expected, but Wegovy sales marginally beat expectations. Real Estate leads, lifted after Vonovia (+5%) posted strong H1 metrics and lifted guidance.

Top European news

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

The market focus on US macro uncertainty continued over the past 24 hours. A notable miss in the July ISM services data weighed on the S&P 500 (-0.49%), while 2yr Treasury yields (+4.9bps) reversed some of the sharp decline they’d seen since Friday’s weak payrolls print, in part as the ISM details showed signs of heightened price pressures. We also saw a flurry of trade headlines as Trump signaled tariffs on semiconductors and pharma within the next week, as well as an imminent threat of additional tariffs on India.

Starting with that US data, the July services ISM fell to 50.1 from 50.8 in June, disappointing expectations for a rebound to 51.5. The ISM details were also worrisome, as the employment component fell further into contraction (46.4 vs 47.2 previously), while prices paid (69.9 vs 66.5 exp.) rose to their highest since October 2022. So that raised renewed concerns that tariffs were pushing the US economy in a more stagflationary direction, complicating the Fed’s job in the process. To be fair, the data was not all bad, with the S&P Global services PMI instead revised up to a 7-month high of 55.7 (vs. 55.2 flash). The services ISM and PMI have trended in opposite directions in the past few months. The gap likely reflects tariff worries weighing more heavily on the larger, multi-national corporates that are represented more in the ISM versus smaller, more domestic-oriented PMI respondents.

Those stagflationary signs were enough to spook US equities, leaving the S&P 500 (-0.49%) and the NASDAQ Composite (-0.65%) lower on the day, though the small cap Russell 2000 gained (+0.60%). Tech stocks struggled despite Palantir’s (+7.85%) continued rise after reporting strong earnings the previous evening, with the Mag-7 down -0.59% and the Philadelphia Semiconductor index slumping by -1.12%. After the US close, we saw chipmaker AMD’s upbeat sales projections overshadowed by uncertainty over its ability to export to China, while Super Micro Computer’s shares plunged after-hours after it lowered its fiscal-year revenue forecast.

The decline in chips stocks came as Trump said in an interview with CNBC that tariffs on semiconductors and pharma would be revealed “within the next week or so.” While impending pharma tariffs have been well flagged, the timing of tariffs on chips has been uncertain with a Section 232 investigation under way since April. Trump also said that pharma tariffs will be phased in incrementally, saying that within the next year and a half, the tariff rate will go to “150%” and then “250%,” saying “we want pharmaceuticals made in our country.”

During the interview, Trump also escalated his threats to impose higher tariffs against India for purchasing Russian oil, saying he would “very substantially” raise tariffs on India within “the next 24 hours”. Later in day, he suggested the US may also place secondary tariffs on other importers of Russian energy, though he claimed he “never said a percentage” that such tariffs would be set at. So maintaining ambiguity after previously floating 100% tariffs. The FT reported that the US is also considering additional sanctions on Russia’s so called “shadow fleet". Trump’s earlier 10-day deadline for Russia to agree a ceasefire ends on Friday and his envoy Steve Witkoff is visiting Moscow today. India’s government has pushed back against the US criticism and the Indian rupee has underperformed so far this week, down -0.32% against the dollar since Friday. By contrast, oil prices fell for a fourth consecutive session yesterday, with Brent crude down -1.63%, though they are up half a percent this morning.

In other tariff news, Trump claimed that the EU would face 35% tariffs if the bloc does not follow through on its promise to invest in the US. Under the 15% tariff deal struck last week, the EU had promised $600bn of investment into the US and $750bn of US energy purchases by 2028, though the EU readout implied softer commitments than claimed by the White House. It seems like another lifetime when the center of the trade war was between the US and China, but in a mollifying development Trump said yesterday that trade talks with China were “very close to a deal” on an extension of the current trade truce and that he has “a very good relationship” with President Xi, with the two set to meet “before the end of this year.” We also heard that Swiss President Karin Keller-Sutter has travelled to Washington for talks to try and lower the 39% tariffs that will go into effect along with the other new country rates on August 7. She is due to meet Treasury Secretary Rubio this morning.

Turning to the Fed, Trump said last night that he would make the decision on filling Governor Kugler’s vacancy on the Fed Board “before the end of the week”, though adding it was not yet decided if this would be a permanent replacement or only until Kugler’s term ends in January. A permanent replacement would be seen as a potential choice for Fed Chair, given that Kugler’s seat is the main way for the White House to bring in an external candidate if Powell were to stay on the board after his term as Chair expires next May. Earlier yesterday the President confirmed that he was considering four candidates for Fed Chair, including Kevin Hassett and Kevin Warsh, and that Treasury Secretary Scott Bessent was not in the running as he “wants to stay in the Treasury.”

Fed funds futures on Tuesday slightly reversed increased expectations of rate cuts, with the amount of easing priced by December down -4.4.bps to 58bps. But that’s a full cut more than the 33bps priced prior to Friday’s payrolls and a 25bp cut is still 90% priced by the September meeting. Treasuries saw a sizeable flattening, with 2yr yields +4.9bps higher at 3.72%, 10yr up a modest +1.8bps and 30yr yields declining -1.1bps. Treasury markets showed some caution ahead of this week’s busy auction calendar, which began with $58bn of 3-year notes issued yesterday +0.7bps above the pre-sale yield. It will continue with 10yr and 30yr auctions today and tomorrow.

In Europe, equities put on a positive performance after decent PMI data there, although they lost momentum later on. The euro area July composite PMI came in at 50.9, a touch below 51.0 flash but up from 50.6 in June. The services PMI details saw Spain (55.1 vs 52.5 exp.) surprise to the upside and Germany revised up (50.6 vs 50.1 flash), while France (48.5 vs 49.7 flash) lagged. The country differences were reflected in the equity reaction, with Germany’s DAX (+0.37%) and Spain’s IBEX (+0.15%) advancing, but France’s CAC (-0.14%) falling back. The STOXX 600 was up +0.15%. European bonds held steady, with yields on 10 yr OATs (+0.1bps), bunds (-0.1bps) and BTPs (-0.1bps) little changed, while gilts (+0.7bps) saw a modest sell off after the stronger composite PMI there (51.5 vs 51.0 flash).

Overnight in Asia, Japan’s monthly wage data saw nominal wages grow by a slower-than-expected +2.5% in June (+3.1% exp.), though this still marked the fastest growth since February. Scheduled full-time pay (+2.3% vs. +2.5% exp.) saw a more modest miss, while real earnings (-1.3% vs -0.7% exp.) remained negative for a sixth consecutive month. Meanwhile, Japan's Taro Kono, who is seen as a potential candidate for Prime Minister, said that it is necessary for the BoJ to raise rates, highlighting the inflationary pressures and saying that "the yen is too cheap". 10yr JGB yields (+1.7bps) and the Japanese yen (+0.20%) are slightly higher this morning, with the Nikkei (+0.63%) also gaining.

Other Asian equity markets are little changed, with the Hang Seng (+0.18%), CSI 300 (+0.18%) and Shanghai Composite (+0.27%) all slightly higher, while Korea’s KOSPI is lower (-0.19%). S&P 500 futures are up +0.24%, with NASDAQ (+0.14%) slightly lagging after the softer AMD and Super Micro results.

Finally, this morning the Reserve Bank of India left its key rate on hold at 5.50%. This was in line with most economists' expectations, though increased risks from the US trade headwinds had seen a sizeable minority calling for a cut. Earlier in the morning, India’s composite PMI was revised up from 60.7 to 61.1 in the final July reading, reaching its highest level since April 2024.

In terms of the day ahead, we have UK construction PMI, Germany’s June factory orders, July construction PMI, France Q2 private sector payrolls, Italy June industrial production, and Eurozone retail sales. We’ll also hear the Fed’s Cook and Collins speak. Earnings out today include Novo Nordisk, McDonald’s, Walt Disney, Uber, Shopify, AppLovin, DoorDash, and Glencore. We’ll also get the US 10-year notes auction ($42bn).