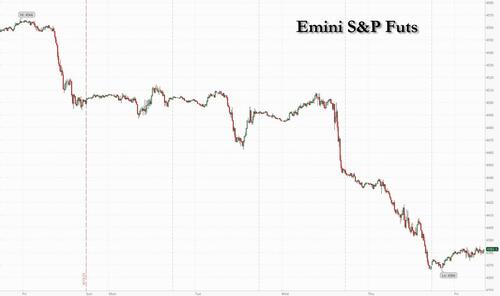

US equity futures rebounded from a furious three-day selloff at the end of a bruising week for investors which sent markets to the lowest level in over a month as investors are forced to accept the idea of higher-for-longer interest rates (at least until the Fed once again breaks something, which it will). As of 7:45am ET, S&P 500 added 0.3%, a modest rebound after the index fell the most since March on Thursday; the tech-heavy Nasdaq 100 climbed 0.5%.European stocks pared their losses while Asian markets closed week well in the green, except for Japan where not even continued BOJ dovishness and a collapsing yen is enough to support risk. Treasury yields retreated across the curve, after 10-year rates briefly climbed above 4.5% in early trading in Asia. The Bloomberg Dollar Spot Index was little changed, with the Japanese yen and British pound leading declines among Group-of-10 currencies. Brent crude climbed 0.5% to $93.80 after a three-day drop. Gold and Bitcoin rose.

In premarket trading, megacap tech stocks rose, set to rebound slightly after Thursday’s losses as US 10-year yields dipped slightly from highest since 2007. Apple, Amazon.com, Alphabet, Meta Platforms, Tesla, Nvidia were all in the green. Activision Blizzard gained 1.8% as Microsoft’s $69 billion acquisition of the gaming company looked set to clear its final regulatory hurdle. Here are some other notable premarket movers:

Global central banks this week stressed that they remain vigilant about the risks of inflation and warned investors against premature expectations of rate cuts. The increasing possibility that monetary policy will lead to recession is prompting investors to dump stocks at the fastest pace since December, BofA's Michael Hartnett said, who noted that equity funds had outflows of $16.9 billion in the week through Sept. 20. Hartnett warned that persistently high rates could lead to a hard economic landing in 2024, and result in “pops and busts” in financial markets.

“What matters more than Fed hikes themselves is whether a recession occurs or not,” said Wolf von Rotberg, an equity strategist at Bank J Safra Sarasin Ltd. “It would be a remarkable accomplishment if it were avoided, yet that seems unlikely. If a recession were to happen, the equity market is not prepared for it.”

The latest evidence of resilience in the US labor market reinforced the case for the Fed’s stance of holding interest rates higher for longer. Applications for US unemployment benefits fell to the lowest level since January last week, figures out Thursday showed.

“The prospect of interest rates staying higher for longer has given investors a lingering headache and sentiment has worsened as the week progressed,” said Russ Mould, investment director at AJ Bell. “Many investors had hoped we would approach the end of 2023 with a clearer picture on when interest rates will start to be cut. That scenario has now been muddied by comments from the Fed that it is prepared to raise rates further if necessary and keep a restrictive policy until there are clear signs that inflation is moving back to target levels.”

Always an outlier, amid a hawkish barrage of central bank announcements, overnight the yen weakened after the Bank of Japan held interest rates, its 10-year yield target and forward guidance unchanged. The central bank reiterated its expectation that inflation is decelerating.

European stocks were lower, with the Stoxx 600 down 0.2% and almost all sectors in the red. Construction, retail and real estate are the worst performers. In individual moves in Europe, Adevinta ASA soared after the classifieds company said it received a takeover proposal from private equity investors including Blackstone Inc. and Permira. Meanwhile there were fresh signs of frailty in the euro-area economy Friday as figures showed private-sector activity in France and Germany continued to shrink in September. Here are the most notable European movers:

Earlier in the session, Asian stock retraced early declines and closed in the green. Chinese shares rallied, a move that likely reflects “short covering on expectations of more policy support measures over the weekend, just like the government’s moves in every weekend this month,” said Steven Leung, an executive director at Uob Kay Hian Hong Kong Limited.

In FX, the Japanese yen and British pound are rooted to the bottom of the G-10 rankings today. The yen added to its post-BOJ fall as Governor Ueda tempered expectations they were close to raising interest rates - USD/JPY rises 0.4% to trade near 148.20. Sterling slipped 0.4% after UK retail sales and composite PMI both fell short of estimates. The Bloomberg Dollar Spot Index rises 0.1%. EURUSD dropped 0.4% to 1.0615, lowest since March 17, after French manufacturing and services PMIs came in below estimates; currency pared losses after German PMI data came stronger-than-expected

In rates, 10-year yields fall 2bps to 4.47% after touching a new cycle high above 4.5% for the first time since 2007 during Asian trading hours. The US session includes the first Fed speakers since Wednesday’s policy decision. Yields are lower by 1bp-2bp with curve spreads little changed on the day; in 10-year sector bunds trade cheaper by ~2.5bp vs Treasuries while gilts keep pace. Futures block trade of 5-year contracts at 6:35am New York time appeared consistent with a seller. Dollar IG issuance slate empty so far and expected to be muted; weekly volume stands at around $16b, in line with estimates for $15b to $20b. US economic data slate includes September S&P manufacturing and services PMIs at 9:45am.

In commodities, oil rose, in part supported by news that Russia would ban exports of diesel-type fuel and gasoline; crude futures advanced, with WTI rising 1% to trade near $90.50. European natural gas prices fell as Chevron and labor unions in Australia agreed to end strikes at major export plants that roiled the market for more than a month. Spot gold adds 0.3%.

At 8:50 a.m., Federal Reserve Governor Lisa Cook will give a keynote address at a National Bureau of Economic Research event. At 9:45 a.m., we’ll get the latest reading on S&P Global’s manufacturing and services gauges. San Francisco Fed Mary Daly will speak in a fireside chat at 1 p.m., and Minneapolis Fed President Neel Kashkari will appear in a separate event at the same time.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid a higher yield environment and after this week’s central bank frenzy culminated with a lack of surprises from the BoJ. ASX 200 was dragged lower with real estate and tech among the worst performers after the Australian 10yr yield touched its highest level since 2014, while the flash PMI data was mixed and showed a deeper contraction in manufacturing. Nikkei 225 was pressured following the mostly firmer-than-expected Japanese CPI data but then pared some of the losses following the lack of hawkish surprises from the BoJ. Hang Seng and Shanghai Comp shrugged off early jitters amid supportive measures including Beijing’s draft rules to promote a high level of opening up and encourage foreign investments, while China's market regulator also issued measures to promote the private economy.

Top Asian News

European bourses are mostly lower, but have trimmed the losses seen at the cash open. The main macro story for the region thus far has been the flash PMI prints for September. Sectors in Europe are mostly lower with the exception of Basic Resources which is in marginally positive territory thanks to underlying metals prices. On the downside, the Construction & Materials sector lags. US futures are trading slightly firmer following the biggest US stock drop since March, in yesterday's session.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Markets experienced another big sell-off yesterday, with longer-dated yields hitting new highs for the cycle across several countries. In fact, the US 10yr Treasury yield has surpassed the 4.5% mark in trading overnight, which is the first time that’s happened since 2007. And the moves haven’t just been confined to Treasuries, since Bloomberg’s global aggregate bond index closed at its lowest level of 2023 so far yesterday. Meanwhile for equities, the losses gathered pace towards the end of the session, and the S&P 500 (-1.64%) experienced its worst day since March.

In large part, those moves have been driven by the prospect that central banks are likely to keep policy rates in restrictive territory for longer than previously thought. That was prompted initially by the Fed’s hawkish dot plot on Wednesday. But the sell-off then got fresh momentum yesterday from theUS weekly jobless claims, which came in at their lowest since January at 201k. That pushed the 4-week moving average to its lowest level since March, offering further evidence that this strength doesn’t just look like a blip.

That backdrop led to an intense bond sell-off, since the strong labour market data suggested that any rate cuts were still some way off. By the close yesterday, the 10yr Treasury yield (+8.7bps) was at a post-2007 high of 4.494%, and it remains there overnight after coming down slightly from the 4.5% mark. At the same time, the 10yr real yield (+6.6bps) also hit a post-2009 high of 2.11%. Yesterday’s rise was even stronger at the long-end, with the 30yr yield seeing its sharpest rise since April, up +12.8bps to 4.57%. That said, front-end yields actually fell on the day, with the 2yr yield ending the day -3.1bps lower at 5.15%. As a result, the 2s10s slope saw its most significant steepening since the March banking stress (to -65.4bps), and overnight it’s steepened a bit further to -63.9bps. Over in Europe it was much the same story, with yields on 10yr bunds (+3.5bps) hitting their highest intraday level since 2011 at one point, although they then pared back those gains somewhat to close at 2.73%.

This rise in nominal and real yields meant that equities continued to struggle, and the S&P 500 (-1.64%) seeing its worst day since March and closing at its lowest level in nearly 3 months. It also means that we’ve now had a 5% sell-off in the index since its recent peak at end-July, which is the first time since the SVB sell-off in March that we’ve experienced a decline of that magnitude. At the same time, the VIX index of volatility rose for a 5th consecutive day, up a further +2.4pts to 17.5pts, which is its highest level in a month. The NASDAQ saw an even sharper loss (-1.82%). Meanwhile, the small-cap Russell 2000 (-1.56%) is now in technical correction territory, having shed more than -10% since its peak in end-July. And over in Europe there were losses across the continent, with the STOXX 600 down -1.37%.

Overnight in Asia, the main story is that the Bank of Japan has left policy unchanged at their latest meeting, in line with expectations. We’ll have to see what Governor Ueda says in the press conference, but so far the Japanese Yen has weakened -0.30% against the dollar overnight, since the ongoing stimulus has put further pressure on the Yen. Ahead of the decision, the latest CPI numbers for August were also stronger than expected, with headline CPI at +3.2% (vs. +3.0% expected). Following the decision, Japanese equities have pared back some of their earlier losses, but the Nikkei is still down -0.38%. But outside of Japan the picture has been more mixed, with losses for the KOSPI (-0.41%), but gains for the Hang Seng (+1.21%), the CSI 300 (+1.03%) and the Shanghai Comp (+0.77%). Looking forward, there’s also been a stabilisation in US equity futures, with those on the S&P 500 up +0.17% overnight .

The other important news overnight has been from the September flash PMIs. In Japan, they’ve weakened relative to August, with the composite PMI down to 51.8, which is its lowest level since February. But in Australia, there’s been a recovery in the composite PMI, which has risen to a 3-month high of 50.2. So all eyes will be on the US and European numbers later to see the direction of travel as we come to the end of Q3.

Elsewhere yesterday, t he Bank of England kept their policy rate on hold at 5.25%, which ended a run of 14 successive hikes. It was a narrow 5-4 vote among the committee, with 4 of the members preferring a 25bp hike, and their statement still signalled the potential for more hikes. For instance, it said that “Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.” The other important development came with regards to quantitative tightening, where they voted to reduce the gilt portfolio by £100bn over the year from October, taking the total down to £658bn .

For markets, the decision to leave rates unchanged came as something of a surprise, since swaps had been pricing in a 63% likelihood of a hike immediately prior to the decision. As a result, sterling fell against both the US dollar (-0.37%) and the Euro (-0.39%). However, gilt yields followed a pattern similar to the rest of Europe, with a noticeable steepening amidst rises in both the 2yr (+2.5bps) and the 10yr yield (+9.0bps). Looking forward, our UK economist thinks it’s more likely than not that rates have peaked. See his full recap here.

Central banks were in the spotlight elsewhere yesterday, with decisions in several other European countries. In Sweden, the Riksbank raised their policy rate to 4%, in line with expectations. Likewise in Norway, the Norges Bank hiked by 25bps to 4.25%, and Governor Bache said “There will likely be one additional policy rate hike, most probably in December”. However, in Switzerland, the SNB left rates unchanged at 1.75%, contrary to the consensus of economists who expected a 25bp hike. As a result, the Swiss Franc was the worst-performing G10 currency yesterday, weakening by -0.66% against the US Dollar .

Looking at yesterday’s other data, US existing home sales fell to an annualised rate of 4.04m in August (vs. 4.10m expected), leaving them at a 7-month low. Meanwhile, the Conference Board’s Leading Index fell by -0.4%, marking its 17th consecutive monthly decline.

To the day ahead now, and data highlights include the September flash PMIs from Europe and the US, along with UK retail sales for August. Central bank speakers include ECB Vice President de Guindos, along with the Fed’s Cook, Daly and Kashkari.