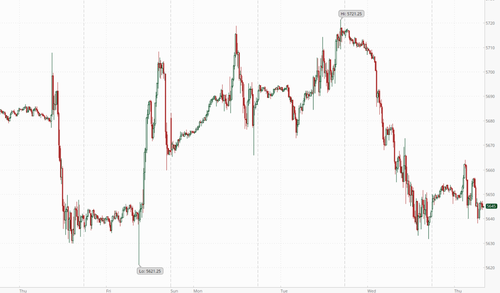

Futures are higher, rebounding from Wednesday's tech-fueled rout. At 7:40am, S&P futures are up 0.1% and off session highs, while Nasdaq futures rise 0.4% after concerns over tight US restrictions on chip sales to China drove its worst day since 2022; Semi stocks see some relief after Taiwan chip giant TSMC's earnings beat expectations: NVDA +2.7%, AMD +2.1%, AVGO +1.3%. Mag7 names are higher, too, with VRT +1.7% pointing to potential gains in second derivative AI plays. Major The Stoxx 600 index added 0.3% as most European markets trade higher ahead of the ECB at 8.15am ET, where the expectation is for rates to be held steady ahead of a potential Sept cut. China-exposed stocks are leading alongside macro recovery while AI/Semis remain under pressure despite positive TSMC earnings. Bond yields are higher 2-3bps with the belly underperforming; European bond yields are higher as many curves bear flatten. After tumbling to a 2-month low thanks to a surge in the yen driven by a reversal in the carry trade, the dollar was slightly higher as President Joe Biden faced intensified calls to bow out of the 2024 race. Commodity weakness continues with pockets of strength in precious metals and natgas (WTI is flat). Today’s macro data is focused on jobless claims and 3x Fed speakers.

In pre-market trading, US tech stocks were set to gain after Wednesday’s sharp selloff in the sector as a positive earnings update from Taiwan Semiconductor - the chipmaker for Apple and Nvidia - somewhat restored sentiment. Airline stocks lost ground after the earnings outlook for United Airlines fell short of estimates. Here are the other notable premarket movers:

One day after the worst rout for the Nasdaq since 2022, analysts said a relatively robust earnings season and expectations of interest-rate cuts from the Fed and other central banks are also supporting sentiment. Later in the day, streaming services giant Netflix will be the first major US tech company to report results — it’s expected to show continued growth in global subscriber numbers. Meanwhile, concerns around tech haven’t fully dissipated, and Amsterdam-listed chip giant ASML - among companies that could be hit by any tougher US measures - extended Wednesday’s 11% rout. That, alongside the prospect of trade tariffs under a potential Donald Trump presidency, continue to weigh on Europe’s Stoxx 600 index.

“I’m not surprised people are trying to buy the dip,” said Michael Brown, senior strategist at Pepperstone Group Ltd. “The fundamental bull case remains strong for equities — earnings and economic growth look resilient and the Fed should start cutting rates from September.”

Later in the day, a string of Fed rate-setters are due to speak, including San Francisco Fed chief Mary Daly and Governor Michelle Bowman. Initial jobless claims figures due later Thursday will give investors the latest snapshot of the state of the economy.

European stocks rose with the Stoxx 600 up 0.3% led by the tech sector as TSMC lifted its revenue outlook for 2024. Major markets were higher as markets prepare for the ECB at 8.15am ET, where the expectation is for rates to be held steady ahead of a potential Sept cut. Regional bond yields are higher as many curves bear flatten. China-exposed stocks are leading alongside macro recovery while AI/Semis remain under pressure despite positive TSM earnings. Value is leading, Cyclicals are lagging. UKX +0.9%, SX5E +0.2%, SXXP +0.4%, DAX +0.2%. On the earnings front, Volvo AB rose after it reported better-than-expected profits for the second quarter, though the update from telecom firm Nokia Oyj disappointed, knocking the stock as much as 10% lower. Here are the most notable European movers:

Earlier, Asia stocks slumped echoing the tech rout stateside. Nikkei 225 underperformed amid recent currency strength and as large tech stocks suffered similar fates to their US counterparts amid the threat of tighter restrictions to supply China, while Japanese trade data showed exports and imports missed estimates. Hang Seng and Shanghai Comp. were mixed and ultimately rangebound with sentiment sapped by ongoing protectionist concerns. Australia's ASX 200 was pressured by weakness in tech and telecoms but with downside cushioned after mixed jobs data which showed higher-than-expected employment change.

In FX, the dollar index traded near the lowest level in two months, while the yen was slightly weaker at around 156.32 per dollar, while the pound wasn’t able to stay above $1.30. The euro weakened slightly ahead of a European Central Bank meeting that’s expected to signal the next rate cut will come in September.

In rates, treasuries are cheaper by 2bp-3bp, following similar move in bunds ahead of European Central Bank policy decision at 8:15am New York time. While no change is expected, President Lagarde in subsequent press conference may signal another rate cut is likely in September. US session includes weekly jobless claims, 10-year TIPS auction and several Fed speakers. Treasury 10-year yields around 4.185% are cheaper by 2.5bp on the day, broadly in line with bunds; curve spreads are within a basis point of Wednesday’s close. French bonds hold losses while auctions saw decent demand.

In commodities, WTI pares gains to around $82.90. Spot gold rises roughly $7 to near $2,466/oz. Most base metals fall.

US economic data slate includes initial jobless claims, July Philadelphia Fed business outlook (8:30am), June leading index (10am) and May TIC flows (4pm). Fed members scheduled to speak include Goolsbee (10am), Logan (1:45pm), Daly (6:05pm) and Bowman (7:45pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the tech rout stateside owing to recent concerns of China tech curbs and tariff fears. ASX 200 was pressured by weakness in tech and telecoms but with downside cushioned after mixed jobs data which showed higher-than-expected employment change. Nikkei 225 underperformed amid recent currency strength and as large tech stocks suffered similar fates to their US counterparts amid the threat of tighter restrictions to supply China, while Japanese trade data showed exports and imports missed estimates. Hang Seng and Shanghai Comp. were mixed and ultimately rangebound with sentiment sapped by ongoing protectionist concerns.

Top Asian News

European bourses, Stoxx 600 (-0.1%) opened on a firmer footing, but at the cash open, contracts quickly dipped off best levels; weakness which was led by a renewed sell-off in the Tech sector. European sectors hold a slight positive bias; Autos take the top spot, lifted by post-earning strength in Volvo Car AB (+7.2%). Energy is also towards the top of the pile, given the upside in the crude complex; potentially also weighing on the Travel & Leisure sector, which underperforms. US Equity Futures (ES +0.3%, NQ +0.6%, RTY -0.2%) are mixed, with clear outperformance in the tech-heavy NQ, catching a bid following strong TSMC earnings; industry peers such as Nvidia (+2.5%), Micron (+1.7%) and AMD (+2%) all gain.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap