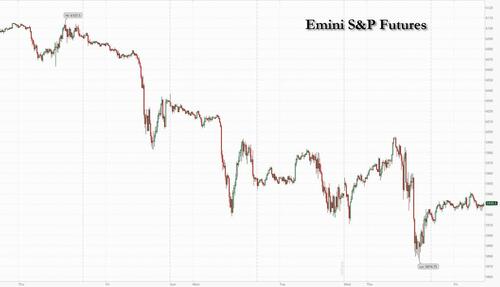

US equity futures posted modest gains suggesting stocks may finally halt a five-day losing streak, the longest since April, although we have seen early strength quickly turn to selling so it is unclear if today's modest bounce will last. As of 8:00am, S&P 500 contracts rose a modest 0.2%, fading stronger gains earlier, while the Nasdaq 100 rose 0.3%. European stocks dropped while Asian equities rebounded to erase Thursday’s losses, boosted by gains in the region’s technology companies even as Mainland China shares sank again as Chinese yields plunged to a new record low. And speaking of yields, the 10Y TSY yield ticked lower, dipping 2 bps to 4.54% while the dollar slipped from the two-year high it set Thursday. The US economic data calendar includes December ISM manufacturing at 10am. Fed speakers scheduled for the session include Barkin (11am).

In premarket trading, Tesla rebounding partially from Thursday’s slump prompted by disappointing vehicle sales numbers. US Still plunged more than 9% after reports that President Joe Biden has decided to block Nippon Steel’s purchase of the company. Here are some other notable premarket movers:

Overnight, Bloomberg reported that Biden has decided to block the sale of US Steel to Nippon Steel, ending a $14.1 billion deal that has faced months of vocal opposition and raising questions over the future of a US industrial giant. The news sent the stock sliding by double digits. The president had indicated his opposition to the proposed acquisition, arguing US Steel should remain American owned and operated, though the White House has never said outright that he would block the deal.

Separately, investors will be watching the US House Speaker vote Friday to see if Mike Johnson will retain his position. Republican squabbling over his reelection could bode ill for Trump’s agenda, according to Tom Essaye, founder of the Sevens report.

It’s been a volatile start to the year for stocks, with the S&P 500 index posting intraday gains in the previous two sessions, only to close lower. US manufacturing data due later will give investors clues on the health of the economy while they look ahead to Trump’s inauguration 17 days away to reduce uncertainty over future US policy.

“We really need to see more of that clarity on January 20th for markets to have greater conviction,” said Laura Cooper, global investment strategist at Nuveen. “But I think US exceptionalism will continue to be the dominant theme at least in the first half of the year, regardless of what some of those policies that come through are.”

In Europe, the Stoxx 600 fell 0.3% while French stocks underperform their regional peers. Autos, consumer products and miners are the biggest laggards on growing concerns about Chinese demand. Stellantis NV fell as much as 3.8% as some EV models that had previously received US tax credits for electric vehicles were excluded under tougher rules. Here are some other notable European movers:

Earlier in the session, Asian equities rebounded to erase Thursday’s losses, boosted by gains in the region’s technology companies. Mainland China shares sank extending their worst start to the year since 2016. The MSCI Asia Pacific excluding Japan index rose as much as 0.8%, the most since Dec. 23, with TSMC, Xiaomi and SK Hynix contributing the most. South Korean shares led the gains in the region after five days of selling. Benchmarks also gained in Hong Kong, Taiwan and Australia, while India’s fell. China’s stocks were mixed after a selloff on Thursday that saw mainland equities register their worst start to the year since 2016. China’s CSI 300 slumped 1.2%, while the Hang Seng Index rose 0.7%. The weakness was more prominent in the country’s small-caps stock after the CSI 2000 index marked its worst day in more than a week. The yuan fell to breach the psychological milestone of 7.3 per dollar for the first time since late 2023. The nation’s 10-year government bond yield slipped below 1.6% for the first time ever.

“There’s been many false dawns in China in recent months and it looks as though it’s unraveling again,” said Kenneth Broux, a strategist at Societe Generale. “We’ve seen three big days of selling which is not really conducive to sentiment.”

In FX, the Bloomberg Dollar Spot Index fell 0.2% from the two-year high it set Thursday, while the Swiss franc tops the G-10 FX leader board, rising 0.3% against the greenback. The onshore yuan weakened past 7.3 per dollar, a level that China had been defending since late last year.

In rates, Treasuries edged up, with US 10-year yields falling 2 bps to 4.54%. German government bonds underperform, more notably at the short-end of the curve with German two-year borrowing costs up 3 bps. Gilts advance.

In commodities, oil prices dipped with WTI falling 0.5% to $72.80 after a four-day rally. European natural gas prices are also in the red. Spot gold is steady near $2,656/oz on track for its biggest weekly gain since November. Bitcoin dropped for the first time in four days, trading below $97K.

Looking at today's calendar, US economic data calendar includes December ISM manufacturing at 10am. Fed speakers scheduled for the session include Barkin (11am).

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with most major indices higher although the gains were capped amid the holiday closure in Japan and after the negative handover from the US where the dollar strengthened and Tesla deliveries disappointed. ASX 200 was underpinned with energy and gold miners leading the advances after recent gains in underlying commodity prices. KOSPI outperformed despite reports of a standoff between a military unit and South Korean investigative authorities attempting to arrest impeached President Yoon, while acting President Choi ordered to deploy market stabilising measures swiftly and boldly if volatility heightens. Hang Seng and Shanghai Comp traded mixed despite falling yields amid a report the PBoC is said to plan a policy overhaul as pressure mounts on the economy and would likely cut interest rates from the current level of 1.5% at an appropriate time. Nonetheless, some support was seen for Hong Kong tech stocks after an NDRC official said they will sharply increase funding from ultra-long treasury bonds this year to support "two new" programmes and will broaden the consumer trade-in initiative to include smartphones, while the mainland failed to benefit amid the ongoing US-China trade-related frictions.

Top Asian News

European bourses opened modestly mixed, but quickly succumbed to some selling pressure to display a negative picture in Europe thus far. European sectors opened mixed, but now hold a slight negative bias. A broker upgrade for UBS has helped to prop up Financial Services; Consumer Products once again is towards the foot of the sector list, with Luxury names doing much of the dragging. US equity futures are modestly firmer, with modest outperformance in the NQ after trading lower in the prior session. Phone shipments within China -5.1% Y/Y at 29.61mln handsets in November (vs +1.8% Y/Y to 29.67mln units in October), according to CAICT; shipments of foreign branded phones including Apple (AAPL) iPhone within China -47.4% Y/Y at 3.04mln handsets in November (vs -44.3% Y/Y in October), according to Reuters calculations based on CAICT data.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets got 2025 off to a gloomy start yesterday, with the S&P 500 (-0.22%) extending its post-Christmas losses as various headlines added to the downbeat tone. The latest decline is now the 5th consecutive move lower for the S&P, making it the longest run of declines for the index since April. But as we mentioned yesterday, the first trading day has been a very poor guide to the rest of the year in recent times, so we shouldn’t extrapolate things too far. Indeed, both of the last two years saw the S&P 500 lose ground on the first day, before going on to rise more than +20% over the year as a whole.

Several factors helped to extend the selloff over the last 24 hours. First up, we had a lot of negative headlines out of Europe, as concerns mounted about the energy situation after the expiry of the transit deal between Russia and Ukraine. That meant European natural gas futures closed above €50/MWh for the first time since October 2023, and the end of the transit deal has also coincided with some very cold temperatures in northern Europe right now. So the fear is that higher gas prices are going to add to inflationary pressures, whilst gas storage has been falling faster than usual this year as well.

That backdrop saw the euro (-0.88%) close at its weakest level against the US Dollar since November 2022, ending the session at $1.0265. This continues the declining trend that’s been evident since late-September, as the prospect of US tariffs and a more hawkish Fed have put the currency under pressure. In the meantime, sterling saw even bigger losses, falling by -1.09% to $1.2380, which is its weakest closing level since April. And with inflationary pressures mounting, including from a weaker currency, sovereign bonds struggled across much of Europe, with yields on 10yr bunds (+1.2bps), OATs (+3.8bps) and gilts (+3.1bps) all moving higher. In fact, for another sign of the risk-off tone yesterday, the Franco-German 10yr spread moved up to 85.6bps, which is the widest it’s been since December 2, the day that the National Rally announced they’d back a motion of no confidence in Michel Barnier’s government.

That downbeat European narrative got a further push yesterday from the final manufacturing PMIs for December, which saw modest downward revisions compared to the flash prints. For example, the Euro Area manufacturing PMI came down a tenth to 45.1, and the UK reading came down three-tenths to 47.0. And in the UK’s case, that also leaves the manufacturing PMI at an 11-month low.

To be fair, the European equity performance was pretty good in the circumstances, with the STOXX 600 (+0.60%) and all the other major indices advancing. That was driven by an outperformance from energy stocks given the upward moves for energy commodities, and Brent crude oil ended the session up+1.73% at $75.93/bbl, marking its 4th consecutive move higher. That trend has continued this morning too, with Brent crude prices up another +0.28% to $76.14/bbl. But for US equities there was a much more negative story, with the S&P 500 (-0.22%) posting a 5th consecutive loss, driven by even deeper losses for the Magnificent 7 (-0.69%). In fact, Tesla (-6.08%) was the worst performer in the entire S&P 500 after they reported that their annual vehicle sales had fallen for the first time since 2011. The NASDAQ (-0.16%) and the Dow Jones (-0.36%) lost ground as well, with the small-cap Russell 2000 (+0.07%) outperforming as it posted a modest gain.

Whilst there were several negative headlines yesterday, a more positive story were some upside surprises in the US data. For instance, the weekly initial jobless claims fell to their lowest since April over the week ending December 28, coming in at just 211k (vs. 221k expected). That pushed the 4-week moving average down to 223.25k, and the continuing claims for the previous week also fell to their lowest since September, at 1.844m (vs. 1.890m expected). Separately, we had the final manufacturing PMI for December, which was revised up from the flash reading to 49.4 (vs. flash 48.3). So that was all coming in on the upside.

But even with those upside data surprises, it meant investors dialled back their expectations for rate cuts from the Fed over the next few months, so that meant risk assets lost a bit of support. Moreover, given the latest moves in energy prices, investors moved to raise their near-term inflation expectations, with the US 1yr inflation swap up +4.9bps yesterday to 2.57%. And after the jobless claims numbers were out, the 2yr Treasury yield (-0.2bps) moved off its intraday low of 4.20%, paring back that decline to end the session at 4.24%. It was a similar story for the 10yr yield (-1.0bps) too, which came off its intraday low of 4.51% to close at 4.56%.

Overnight, there have been some signs of a recovery, with advances for South Korea’s KOSPI (+1.78%) and Australia’s S&P/ASX 200 (+0.60%). And looking forward, US equity futures are also positive, with those on the S&P 500 up +0.14%. However, Chinese equities have continued to lose ground, with both the CSI 300 (-0.25%) and the Shanghai Comp (-0.69%) extending their 2025 losses. That comes as China’s 10yr government bond yield has fallen below 1.6% intraday for the first time ever this morning, whilst the FT reported comments from the People’s Bank of China that they would likely cut interest rates “at an appropriate time” this year. The article said that the PBoC would prioritise “the role of interest rate adjustments”, moving away from “quantitative objectives” for loan growth. Otherwise, Japanese markets remain closed for a holiday.

Looking forward, one thing to look out for today will be the start of the new session of Congress in the United States, including the vote to elect the Speaker of the House of Representatives. The incumbent Speaker Mike Johnson is trying to stay in post and has the endorsement of Donald Trump, but the Republicans have a very tight majority in the House, with a 220-215 margin over the Democrats. A few Republicans haven’t committed to voting for Johnson for Speaker, and two years ago it took 15 ballots over multiple days before Kevin McCarthy was elected. From a market standpoint, this will be an interesting test as to the unity of the new Republican majority as they seek to enact Trump’s second term agenda, as it’s a much tighter margin than they had after the 2016 election, when the Republicans began with a 241-194 majority in the House.

To the day ahead now, and data releases include the US ISM manufacturing print for December, German unemployment for December, and UK mortgage approvals for November. From central banks, we’ll hear from the Fed’s Barkin and the ECB’s Lane.