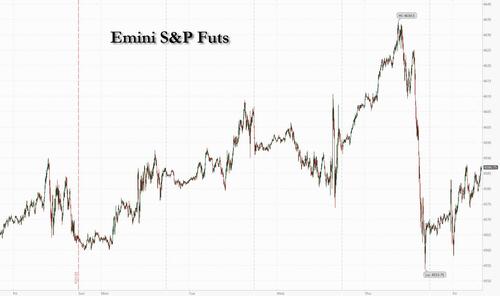

US equity futures reversed an earlier loss and traded at session highs even as bonds around the world fell, briefly sending the 10Y Treasury to 4.04% and JGBs to 0.57%, well above the previous 0.5% cap and the highest since 2014, after the Bank of Japan - the only major central bank not to have begun reversing ultra-easy monetary policy - surprised investors by tweaking its control of market rates, in a market test to how far it can go without explicitly starting normalization. But in the end, the tweak ended up being less hawkish than some feared and as a result, futures are now reversing much of yesterday's sharpo losses.

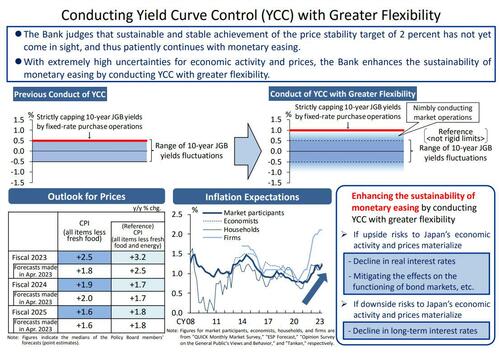

Having previously capped bond yields at 0.5% in a bid to stoke borrowing and its economy, the central bank said today it now regarded that level as a reference point rather than a rigid limit, and instead of intervening to keep rates capped at 0.5% it would only do so firmly at 1.0%, while deciding whether and where to intervene in the 0.5% to 1.0% band (the BOJ graphic explaining the change is below).

The BOJ pledged to show more flexibility over its yield curve control policy, though governor Kazuo Ueda insisted the bank was still far from the point where it could raise rates, and by then global deflation will have returned anyway.

In stock markets, the busiest week in the earnings calendar was drawing to a close, with sentiment supported by forecast-beating results and conviction that interest rates in the US and euro zone are near their peak. As of 7:30am ET, S&P futures traded 0.5% higher, reversing some of yesterday dump which was sparked, ironically, by a planted story in the Nikkei previewing the BOJ's action, which however turned out to be less hawkish than expected, and thus the equity market overreacted on Thursday, and rebounded today as 10Y yields traded down to 3.96% after rising as high as 4.04%

In premarket trading, Enphase Energy shares plunged 15% after the solar-equipment manufacturer reported second-quarter revenue that missed estimates. Analysts found the results to be disappointing, and noted that the third-quarter revenue outlook also failed to meet expectations. On the other end, First Solar shares jumped as much as 9% after the solar technology company results beat estimates and announced plans for a new manufacturing facility in the US, which analysts took as a sign of confidence in demand. Brokers also highlighted strong bookings and average selling prices. Here are some other notable premarket mover:

Ford shares drop 2% after the automaker said it now expects to see losses from electric vehicles hit $4.5 billion this year. While Ford’s other segments performed well, Morgan Stanley sees major changes to the EV strategy possibly being necessary.

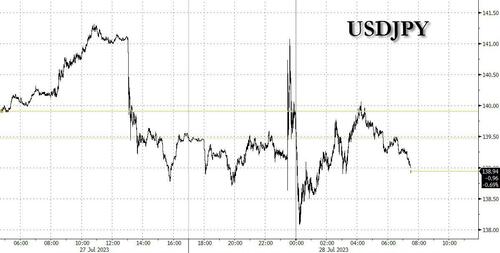

The BOJ move also sparked speculation it marked the first step towards the end of extraordinary stimulus after the recent surge in inflation. It also triggered big swings in the yen, sending it as much as 1% lower and higher at one point against the dollar, before trading largely unchanged compared to the pre-BOJ announcement. Despite the rollercoaster move, the yen was still headed for its best month since March, with gains of almost 3.5%.

“The BOJ decision is an invitation to short dollar-yen,” said Kenneth Broux, currency strategist at Societe Generale SA. “Higher Japanese yields reduce the spread versus US Treasuries and German bunds.” He added however that dollar downside could be limited, given Thursday’s strong US data that could imply further Fed tightening; furthermore sticky rate differentials mean that those who are stuck in a short USDJPY will suffer brutal bleeding thanks to the 5.50% difference between the BOJ and the Fed, a difference which will remain for a long time.

Markets elsewhere reacted to the possibility that higher yields at home will persuade Japanese investors, who own sizable amounts of US, European and Australian bonds, to reduce overseas debt holdings. As noted above, US Treasury yields rocked as high as 4.04% - first after a Nikkei news report that Japan was poised to tweak its yield-curve control policy, and then after the BOJ indeed tweaked it - but then yields dipped back down to 3.96% after markets digested the announcement realizing that it is not as hawkish as some had feared.

Elsewhere, the German 10Y Bund increased as much as 5 basis points, and Australia’s climbed 20 basis points at one point.

"This is a big week as it signals we are pretty much at the end of hiking cycles globally,” said Peter Kinsella, head of currency strategy at asset manager Union Bancaire Privee UBP SA. The “BOJ is effectively saying the top of the yield range is now 1% so that implies 50 basis points in potential steepening. So it’s slow gradual normalization, but yes, it’s normalization BOJ style,” he added.

European stocks are in the red with technology leading declines while banks rise. While the Stoxx 600 is down 0.3%, European bourses were still set for their third straight weekly gain. Here are the most notable European movers:

Earlier in the session, Asia’s equity benchmark held steady as a rally in Chinese stocks was offset by losses in Japan, where the central bank jolted markets by loosening its grip on bond yields. The MSCI Asia Pacific Index was little changed on Friday, but headed for a 2% weekly gain as Chinese shares extended this week’s rally on emerging signs that Beijing is acting on its policy pledges. Meanwhile, the Nikkei 225 slid as much as 2.6%, the worst performance in Asia, on concern the Bank of Japan’s adjustment paves the way for a stronger currency, potentially hurting exporters, however the Nikkei eventually rallied sharply, closing down just 0.4% led by Japan's lenders who rallied on optimism their profitability will improve.

Regional stocks have climbed this week on hopes of stimulus measures in China following the Politburo meeting. A gauge of the nation’s equities listed in Hong Kong jumped as much as 1.7% on Friday after regulators were said to have signaled additional support for the technology sector and on speculation that authorities may lower stamp duties to bolster trading. Tencent and Meituan were among the top positive contributors in the MSCI Asia gauge, while Japan’s Sony and Toyota Motor were among the biggest drags.

Asia’s stock benchmark climbed for a fourth straight day on Thursday after the US central bank raised interest rates to a 22-year high and said further tightening would be data dependent. The gauge is approaching this year’s high seen in January though its gain of 9% so far in 2023 compares poorly with the S&P 500 Index’s 18% advance. Optimism over earnings, gains in China and rising speculation that the Federal Reserve is nearing the end of its policy tightening have boosted sentiment toward Asia’s emerging-market equities in recent weeks.

The MSCI Asia gauge is on track for a second straight month of gains, with its 3.7% rally in July set to be the best since January. An index of Southeast Asian stocks has jumped close to 6% this month, heading for the best performance since November. “There is enormous potential for emerging-market equities to play catch up on emerging market debt in a world where the Fed stops tightening and the dollar weakens,” Christopher Wood, global head of equity strategy at Jefferies, wrote in a note.

Australia's ASX 200 was pressured amid weakness in the property sector and miners, with sentiment also not helped by the surprise contraction in Retail Sales

The record-breaking India stock market ended the week among the worst performing markets in the region as sentiment was hit by weaker-than-expected earnings from some index heavyweights. The S&P BSE Sensex fell 0.2% on Friday to 66,160.20 in Mumbai, while the NSE Nifty 50 Index was little changed at 19,646.05. The MSCI Asia Pacific Index was up 0.5% for the day. For the week, benchmark indexes lost 0.8% as compared to the regional benchmark’s 2.6% gains. Indian equities underperformed their peers in China, Hong Kong and Taiwan. The losses in the benchmarks during the week were limited by continued net buying of stocks by global funds, who look set to mark their fifth consecutive month of net purchases in July. Global funds have net bought over $19 billion since end of February. HDFC Bank contributed the most to the Sensex’s decline, decreasing 1.7%. Out of 31 shares in the Sensex index, 15 rose and 15 fell, while 1 was unchanged

In FX, the Bloomberg Dollar Spot Index slipped, while Treasury yields fell led by the short-end of the curve. USD/JPY fell more than 1% after the BOJ decision before gaining by a similar amount. It was down 0.1% at 139.30 at 10:30 a.m. London. Dollar sell-stops are building below 137.25, the July 14 low and buy stops above 142, according to Asia-based FX traders. European short-end bonds gained following dovish comments by ECB policymakers; Money markets ease ECB tightening wagers for a second day.

In rates, treasuries held gains in early US trading, led by the short end, steepening the curve. Curves are steeper globally led by UK and Japan, where 10-year yields jumped to highest level in nearly a decade after BOJ effectively adopted a higher target, a move previewed during US trading hours Thursday. US yields lower across the curve by as much as 5bp-6bp at short end with long end little changed; however 30-year earlier climbed to within 0.1bp of its July 10 YTD high 4.082%.

Yields remain higher on the week with the curve steeper, as focus began shifting from Fed policy stance — which Chair Powell this week said was evenhanded with respect to another interest-rate hike in September — to strong economic growth indicators and expectations that Treasury auction size increases will be announced next week for the August-to-October financing period. Also ahead next week, month-end Treasury index rebalancing is projected to extend its duration by 0.07 year, and first major economic indicators for July including ISM manufacturing and services gauges and employment report are slated.

In commodities, crude futures decline with WTi falling 0.3%. Spot gold adds 0.2%.

Bitcoin prices are relatively stable just above the USD 29,000 level.

To the day ahead now, and data releases from the US include the Q2 employment cost index, June’s PCE inflation, personal income and personal spending, and the final University of Michigan consumer sentiment index for July. Over in Europe, we’ll get the French and German CPI readings for July. Central bank speakers include the ECB’s Simkus. Finally, earnings releases include Exxon Mobil and Procter & Gamble.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with the region cautious as all attention was on the BoJ policy decision in which the central bank kept monetary policy settings unchanged but announced to guide YCC more flexibly with fixed rate operations for 10yr JGB to be conducted at 1.0% (prev. 50bps). ASX 200 was pressured amid weakness in the property sector and miners, with sentiment also not helped by the surprise contraction in Retail Sales. Nikkei 225 underperformed with yields higher and markets spooked by the latest BoJ developments. Hang Seng and Shanghai Comp shrugged off early weakness and gained after further calls and efforts for China to support the housing market and tech industry. US equity futures were rangebound overnight although slumped during US trade as markets faltered stateside following source reporting by the Nikkei on the BoJ. European equity futures are indicative of a lower open with the Euro Stoxx 50 -0.4% after the cash market closed up by 2.3% yesterday.

Top Asian News

European equities are a mixed bag as the dust settles on yesterday’s ECB announcement and the overnight BoJ release. The Stoxx 600 index is on track to close the week out with gains over just over 1% with discrepancies between regional bourses stemming from various heavyweight earnings releases. Equity sectors in Europe have a negative tilt with Tech, Real Estate and Travel & Leisure names lagging peers. US equity futures are trading on the front foot, as positivity seemingly returns following a sell-off in stocks yesterday, after a slew of hot data prints ahead of today's top-tier data.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It was originally another great day for the fictitious soft-landing ETF yesterday until markets started to break down around 6pm London time last night after a softish 7-year Treasury auction and more importantly, a report from Nikkei suggesting the BoJ would discuss tweaks to YCC at this morning's meeting, something they've followed through on as we'll see immediately below. This turned an +8bps sell-off in 10yr US yields into a +13.1bps one by the close and turned the S&P 500 from a +0.7% gain to a -0.64% loss, with the NASDAQ moving from c.+1.3% to -0.22% over the same 3 hour late session period. It all overshadowed a relatively dovish ECB meeting, within the context of the expected +25bps hike, afterwhich European yields moved notably lower for the day (e.g. 2yr bunds -5.1bps).

So the last international hold out on ultra low yields has turned with the BoJ tweaking it's YCC policy in the last couple of hours. In a slightly complicated message the BoJ kept their target for 10yr JGBs at 0% but effectively widened the band to +1% from 0.5% even if they've kept the original bands as reference points. It confused me a bit this early in the morning but they won't be able to defend 0.5% now absent a macro development that structurally lowers yields. 10yr JGBs have increased +12bps as we type to 0.56bps, their highest since 2014 and all other things being equal this should continue to creep up in the days and weeks to come and removes an anchor for global yields. It's going to be an interesting press conference just after we go to print.

Initially, the Japanese yen strangely fell on the news to 141 but now trades +0.6% higher at 138.6. Elsewhere the Nikkei (-2.24%) is sharply lower with the KOSPI (-0.26%) also trading in the red. Chinese stocks are bucking the trend with the CSI (+1.79%) leading gains followed by the Shanghai Composite (+1.38%) and the Hang Seng (+0.89%). US stock futures are edging slightly higher with those tied to the S&P 500 +0.18%. Meanwhile, yields on 10yr USTs (+3.01bps) are at 4.02% as we go to press.

Coming back to Japan, Tokyo’s consumer price index (CPI) rose +3.2% y/y in July (v/s +2.9% expected). This is the 14th consecutive month that the inflation rate in the capital came in above the BOJ’s 2% target. At the same time, core inflation (excluding fresh food) advanced +3.0% y/y in July, higher than Bloomberg estimates of +2.9% but lower than prior month’s reading of 3.2%. More surprising was the core-core inflation (excluding fresh food and energy) which climbed to +4.0% y/y in July (v/s +3.7% expected, +3.8% in June) and provided more justification for the move today. Elsewhere, Australia’s retail sales sharply declined by -0.8% m/m in June, recording its biggest decline this year, versus expectations of a flat outcome.

Before the 6pm London headline markets were riding high on optimism and shrugging off higher US yields. This all stemmed from another round of strong US data that added to investors’ optimism. At one point the Dow Jones was comfortably on track to record a 14th consecutive daily advance for the first time since the index’s creation in 1896. So a 1-in-a-127 year event. Blame the Nikkei article for that streak being over and only equally the record run.

Even before the late rate moves investors were growing increasingly sceptical about Fed rate cuts anytime soon, with the 2yr real yield (+6.3bps) hitting another post-GFC high of 3.058% with 2yr nominal yields up +7.7bps. The rate priced in for the December 2024 meeting rose by +15.3bps on the day to 4.23%. This moved US rates in the opposite direction to European yields (2yr bunds -5.1bps) after a slight dovish bias to the ECB meeting. All these moves will be put to the test today, or reinforced, by US core PCE, US ECI (important to see if labour costs can fall organicallly), alongside German and French CPI.

The main catalyst for the early move higher in US rates, and the earlier risk on yesterday, was a robust GDP print from the US, which showed growth accelerated in Q2 to an annualised pace of +2.4% (vs. +1.8% expected). The report also came with several positive details, including that core PCE inflation was only at +3.8% in Q2 (vs. +4.0% expected), which added to the recent theme of better-than-expected growth and softer-than-expected inflation. As well as the GDP release, the weekly jobless claims fell for a third week running to 221k over the week ending July 22 (vs. 235k expected), which is their lowest level since February. And the continuing claims print for the previous week came in at a post-January low of 1.69m (vs. 1.75m expected). So lots of good news all round from an economic standpoint maybe before the full impact of the monetary policy lag starts to bite.

So as discussed at the top equities faded into the close with tech stocks seeing the biggest beta to the move with the FANG+ index falling from c.+2.3% to -0.24% in the last 3 hours of trading. Meta (+4.40%) outperformed thanks to its strong Q2 results after the previous day’s close. This helped lift the communication services sector into the green for the day (+0.85%) while the rest of the top level S&P sectors declined, most notably real estate (-2.13%) and utilities (-1.73%). In Europe markets closed before the sell-off and neatly encapsulated the earlier bullish sentiment, with the STOXX 600 (+1.35%) hitting a 17-month high, whilst France’s CAC 40 (+2.05%) and Italy’s FTSE MIB (+2.13%) saw significant advances of their own.

Before all this excitement, the ECB delivered their own 25bp rate hike as expected, which took the deposit rate up to 3.75%. However, unlike recent meetings, there wasn’t a strong steer about what they’re going to do next, and President Lagarde said that “we have an open mind as to what the decisions will be in September and in subsequent meetings”. She avoided signalling a specific outcome, and said that if they did pause, then it “would not necessarily be for an extended period.” At the same time, the language in the statement was also softened, since it said that future decisions would ensure rates “will be set at sufficiently restrictive levels”. That’s a change from last time, when it said they “will be brought to levels sufficiently restrictive”. See our economists’ review here.

When it comes to the ECB’s next decision, we should start to get some more signals today, as the flash CPI releases from France, Spain and Germany are coming out ahead of the Euro Area-wide release on Monday. Obviously the data will go a long way to determining the likelihood of another move, but markets are still pricing in a 71.7% chance of another 25bp hike in September anyway. Nevertheless, sovereign bonds rallied yesterday after the decision, with yields on 10yr bunds (-1.0bps), OATs (-1.6bps) and BTPs (-3.0bps) all coming down. That divergence between Europe and the US also meant that the spread of 10yr Treasury yields over 10yr bunds reached its widest level of 2023 so far, at 153.4bps.

When it came to yesterday’s other data, in the US we had the preliminary durable goods orders for June, which showed strong growth of +4.7% (vs. +1.3% expected). Core capital goods orders were more subdued however, with just +0.2% growth (but better than the -0.1% expected). Elsewhere, pending home sales for June beat expectations with a +0.3% gain (vs. -0.5% expected), and the Kansas City Fed’s manufacturing index came in at -11 (vs. -10 expected).

To the day ahead now, and data releases from the US include the Q2 employment cost index, June’s PCE inflation, personal income and personal spending, and the final University of Michigan consumer sentiment index for July. Over in Europe, we’ll get the French and German CPI readings for July. Central bank speakers include the ECB’s Simkus. Finally, earnings releases include Exxon Mobil and Procter & Gamble.