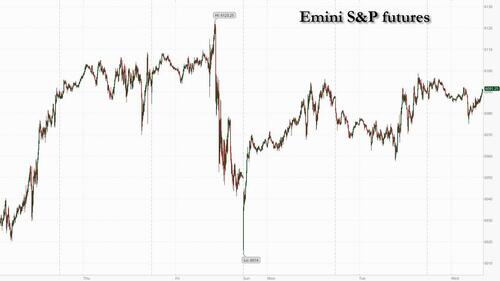

US equity futures are flat, with yields and the dollar modestly higher ahead of this morning's US CPI reports (full preview here). As of 8:00am ET, S&P futures are unchanged, while Nasdaq futures rise 0.2% with Mag 7 stocks mostly flat, except for a big swing in TSLA premarket which now trades trades +1% after sliding -2% earlier amid rising competition from BYD. European stocks are at a third consecutive record high, supported by positive earnings news. An index of Asian shares advanced. Treasury yields edged higher, with the 10-year adding a basis point to 4.55% as the US Dollar ticks higher; Powell’s testimony yesterday was largely in line with January FOMC and current market pricing (no urgency for the Fed to cut). Commodities are mostly lower; WTI -1.1%; Copper -0.9%. Today, the key macro focus will be CPI (our preview as well as JPM and Goldman's scenario analysis are here), with the market very much on edge: according to JPM, option markets anticipate a 1.2% swing in the S&P today, the biggest in over a year. Powell’s testimony at the House, CSCO earnings and any update from Trump on his reciprocal tariffs plan

In premarket trading, Super Micro Computer (SMCI) jumps 10% after giving an aggressive long-term revenue outlook and saying it “believes” it will meet a Nasdaq Inc. deadline to file audited financial results. Tesla is leading gains for the Magnificent Seven (GOOGL -0.1%, AMZN -0.2%, AAPL +0.06%, MSFT -0.1%, META +0.2%, NVDA +0.3% and TSLA +2.2%). Here are some other notable premarket movers:

The stakes for markets are high going into Wednesday’s consumer price index numbers. Economists expect core CPI excluding food and energy to rise 0.3% from the previous month in January, picking up from an increase of 0.2% in December. This corresponds to a year-over-year rate of 3.1%.

“We have to watch 10-year Treasury yields very carefully,” said Kenneth Broux, a strategist at Societe Generale in London. Hotter-than-expected inflation could easily push the yield to 4.60% “and the whole risk-on trade will be back on hold,” he said.

As noted last night, the trading desk at JPMorgan's Market Intelligence team estimates the S&P 500 will fall as much as 2% should the January consumer price index reading show an increase of 0.4% or more from the previous month.

“Expect the bond market to react violently as it shifts its view to Fed Funds not being restrictive and the most likely next action of the Fed to be a hike rather than a cut,” the team led by Andrew Tyler wrote in a note. “The move in bond yields would pull the USD higher, further pressuring stocks.”

The CPI figures are due shortly before the second half of a two-day testimony marathon for Fed Chair Jerome Powell, who yesterday told lawmakers the central bank is in no rush to adjust rates again.

“Until we get greater clarity on the medium-term inflation trends, bond yields are likely to remain sticky,” said Daniel Murray, Zurich-based chief executive officer of EFG Asset Management. “It is also clearly impacting equity investor sentiment, in particular in the US, where the combination of more hawkish rate expectations alongside tariff uncertainty has contributed to a rangebound market.”

Europe's Stoxx 600 rises for a third day, setting a new intraday record in the process, boosted by solid earnings. Food and beverage is the strongest sector, boosted by Heineken’s 13% rally - the most since 2008 - after the drinkmaker reported full-year results that were ahead of consensus and announced a €1.5 billion share buyback. ABN Amro Bank jumped more than 8% after its net interest income topped forecasts. Energy stocks provide a drag as they track a fall in oil. Here are Europe's biggest movers:

Earlier in the session, Asian stocks rose, led by gains in Chinese and Hong Kong shares on continued optimism about artificial intelligence, offsetting concerns over the Federal Reserve’s interest-rate policy. The MSCI Asia Pacific Index was up as much as 0.4%, with Alibaba and Tencent among the biggest boosts. An index of Chinese tech shares listed in Hong Kong advanced 2.7%, aided by a report that Alibaba is working with Apple on AI features. Investors are increasingly bullish on the outlook for Chinese equities as enthusiasm for DeepSeek and other AI developments spurs a fundamental rethink of the market’s attractiveness. For the broader region, sentiment was more downbeat Wednesday after Jerome Powell indicated the Fed is in no rush to cut interest rates, as economic data remains solid. Elsewhere, Indonesia’s key equity gauge rebounded after falling to a three-year low on Tuesday. Taiwanese shares underperformed the region.

In FX, the Bloomberg Dollar Spot Index is up 0.1%. The Japanese yen is the weakest of the G-10 currencies amid tariff concerns, falling 0.8% against the greenback and pushing USD/JPY to ~153.65. The Japanese government asked Trump on Wednesday to exempt the nation’s companies from his fresh tariffs. The Swiss franc outperforms with a 0.2% gain.

In rates, treasury yields are marginally cheaper across the curve with bunds and gilts lagging slightly as traders await January CPI data at 8:30am New York time and Powell’s testimony to House Financial Services panel at 10am. US 10-year yield is ~1bp higher on the day near 4.55% with bunds and gilts lagging by an additional 1.5bp and 1bp in the sector; curve spreads are narrowly mixed after steepening over past two sessions. Busy event slate also includes $42 billion 10-year note sale at 1pm, following strong demand for Tuesday’s 3-year note auction.

In commodities, Brent crude futures drop 1% to $76.30 a barrel. Spot gold falls $17 to around $2,880/oz.

US economic data calendar includes January CPI report (8:30am) and federal budget balance (2pm). Fed speaker slate includes Powell testimony to the US House Committee on Financial Services (10am), Bostic (12pm) and Waller (5:05pm).

Market Snapshot

Top Overnight News

Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with price action somewhat choppy following the similar performance stateside in the aftermath of Trump's recent tariff announcements and with US CPI data on the horizon. ASX 200 traded higher as strength in the top-weighted financial sector and the industrials atoned for the losses in tech, while participants digested key earnings releases including from Australia's largest bank and most valuable company, CBA. Nikkei 225 advanced on return from yesterday's holiday closure amid recent currency weakness but momentarily pared all of its gains amid rising yields and tariff-related uncertainty. Hang Seng and Shanghai Comp were varied with outperformance in Hong Kong led by strength in tech stocks including Alibaba after reports that Apple partnered with Alibaba to develop AI features for iPhone users in China, while SMIC benefitted after it posted stronger-than-expected revenue and guided revenue growth. Conversely, the mainland was contained with price action choppy amid ongoing trade frictions and the PBoC's liquidity effort.

Top Asian News

European bourses are generally modestly firmer, despite a mixed handover from the APAC session. European sectors hold a positive bias; Real Estate takes the top spot, propped up by post-earning strength in homebuilder Barratt Redrow (+5.6%). Heineken (+11.4%) jumped at the open after the co. beat on profit and announced a share buyback. Energy is the clear laggard, given the weakness in oil prices today.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I'm waking up in Paris this morning and will be waking up in a hospital in London later tonight after brief sedation post another back injection. I'm on last chance saloon before back fusion surgery that I'm trying to delay until the autumn. One of my discs in my lower back has slowly collapsed with no room for the nerve which is therefore consistently compressed. As such I've had constant sciatica for the last 3-4 years. I work on my core 4-5 days a week, have done countless physio sessions, numerous injections, and had a slightly simpler back operation 2 years ago. Nothing works. If anyone has experience of fusion surgery or any last-minute advice on how to avoid it I'd be interested to hear but I've tried most things non-surgical. Difficult to reallign a disc that's old and out of shape! The good news is that I've still managed to play to a 2.5 golf handicap in spite of the pain. The bad news is I'll be potentially off golf for 6 months when I have the op. I'm inspired by the fact that Tiger Woods won the Masters two years after fusion surgery! My equivalent will be the Worplesdon Golf Club Over 50s Cup in 2026!

Talking of 2026, markets have been getting slightly more concerned in recent days as to where inflation will be next year. We'll know a little more about the near term direction of travel today with US CPI out later. Ahead of that bonds have continued to sell off from their 2025 yield lows seen last week. There were a few catalysts yesterday but comments from Fed Chair Powell, who said that “we do not need to be in a hurry to adjust our policy stance” were a factor even if that's what we expected him to say. But on top of that, a fresh rise in energy prices and the prospect of retaliatory tariffs from the EU led to anxiety that inflation would keep lingering above target for some time. Indeed, the US 2yr inflation swap (+4.2bps) closed at its highest in nearly two years, at 2.796%.

This backdrop makes it an interesting day to get the US CPI print for January, which will offer the first big clue on inflation in 2025. Today’s report is getting a decent amount of attention, in part because last January’s report saw a strong upside surprise, so the fear is we could get another new year uptick that upsets market expectations for the Fed to still cut this year. That’s particularly the case because recent data has leant in a more hawkish direction, with the 3m annualised rate of CPI already running at +3.9% in December, whilst the 6m rate was at +3.0%.

In terms of what to expect, our US economists are looking for monthly headline CPI at +0.31%, which would keep the year-on-year rate at +2.9%. Then for core CPI, they’re looking for a monthly +0.28% print, with the year-on-year rate ticking down a tenth to +3.1%. The other key thing to look out for will be the annual revisions to the seasonal adjustment factors, which could affect the last 5 years of data. Last year the revisions didn’t change the picture much at all, but two years ago they showed that inflation wasn’t slowing as rapidly as we thought, so that shifted attitudes in a more hawkish direction. For more details, see our US economists’ full preview here and how to sign up for their immediate reaction webinar.

Ahead of that, the main story yesterday came from Fed Chair Powell, who was delivering his semiannual testimony before the Senate Banking Committee. As discussed above, his main comment was that the Fed didn’t need to be in a hurry, and he also said that if “the economy remains strong and inflation does not continue to move sustainably toward 2 percent, we can maintain policy restraint for longer.” Otherwise, there wasn’t too much in the way of headlines. Note that Powell speaks before the House Financial Services Commitee today in the second of his semi-annual double bill in Congress. Normally the second act doesn't get as many headlines but there's a chance today's CPI may solicit a slightly different tone or encourage different questions. All depends on where the release is relative to expectations.

While we wait for this, there was fresh news on the tariff front as the EU said that US tariffs on metals would “trigger firm and proportionate countermeasures.” The US tariffs don’t come into effect until March 12, so in theory that could offer time for a delay or a deal to be reached, as happened with Canada and Mexico last week. But for markets, the concern is this is going to lead to higher inflation on both sides of the Atlantic. And that sentiment was exacerbated by another rise in energy prices yesterday, with Brent crude oil (+1.17%) moving up for a 3rd day running to $76.76/bbl.

All that helped lead to a significant sovereign bond selloff yesterday, particularly in Europe. For instance, yields on 10yr bunds rose +6.8bps to 2.43%, which is their biggest daily increase of 2025 so far, albeit a good 22bps off the YTD highs in the first half of January. Similarly, yields on 10yr gilts (+5.1bps), OATs (+12.1bps) and BTPs (+8.0bps) all jumped higher as well. And in the US, Treasury yields rose across the curve, with the 2yr yield up +1.0bps to 4.28%, whilst the 10yr yield was up +3.9bps to 4.535% (4.545% in Asia). The steepening came amid strong demand for near-dated US government bonds, as the US Treasury’s $58 billion auction of 3-year notes saw a record low 10.2% primary dealer award.

Investors also dialled back the likelihood of Fed rate cuts, with the probability of a rate cut by June ticking down to 59%, from 63% the previous day. This comes amid another spate of Fed speakers preaching patience. New York Fed Reserve President Williams yesterday said he expects inflation will continue to move toward the bank’s stated 2% target, “but it’s important to note that the economic outlook remains highly uncertain, particularly around potential fiscal, trade, immigration and regulatory policies.” He still had a year-end inflation target of 2.5%, with the 2% goal arriving “in the coming years”. Cleveland Fed President Hammack, a non-voter this year who dissented the cut in December, said she would keep rates steady to study new government policies and wait for further evidence of lower price pressures.

For equities, there was a more robust performance over the last 24 hours, particularly in Europe. For instance, the STOXX 600 (+0.23%), the DAX (+0.58%) and the FTSE 100 (+0.11%) all moved up to record highs. That cements the DAX as the strongest-performing major index of 2025, having risen by +10.69% since the start of the year, and making it the strongest start to a year by this point since 2012. Meanwhile in the US, the S&P 500 (+0.03%) was basically flat, but it still remained less than 1% beneath its all-time high from January. Autos (-5.82%) were a major laggard yesterday primarily due to TSLA (-6.34%) underperforming as Chinese competitor BYD announced plans for self-driving technology to become standard in their cars. This latest slide means the automaker is down -31.5% from all-time highs reached in mid-December. Autos were also under pressure as reports circulated that Ford (down -0.32% yesterday, -6.97% YTD) CEO Jim Farley will be meeting with lawmakers in DC today in order to argue against the spectre of tariffs which are weighing on the industry.

Asian equity markets are mostly higher with the Hang Seng (+1.56%) leading gains in the region as Chinese tech, and EV stocks are surging amid AI hype. Meanwhile, the Nikkei (+0.18%) is edging higher after returning from a holiday with the KOSPI (+0.22%) and the S&P/ASX 200 (+0.51%) also up. Elsewhere, mainland Chinese stocks are bucking the regional trend with the CSI (-0.12%) and the Shanghai Composite (-0.01%) swinging between gains and losses. US futures are down around a tenth of a percent.

In stock specific news, Alibaba Group shares jumped more than 8%, hitting a four-month high on reports of a strategic partnership with Apple Inc to develop artificial intelligence (AI) features for iPhones in China. BYD Co. (+5.5%) has surged to a new record after the self-driving news we discussed above.

In FX, the Japanese yen (-0.76%) continues to lose ground for the third consecutive day trading at a 1-week low of 153.65 against the dollar due to reciprocal tariff uncertainty. Yen’s underperformance is in contrast from last week when the currency had strengthened for four straight sessions on rising bets that the BOJ will raise rates again this year. This morning, overnight index swaps (OIS) are suggesting a 77% chance of a BOJ rate hike by July and fully pricing in a rate hike by October.

There wasn’t much data yesterday, although in the US, the NFIB’s small business optimism index fell a bit more than expected in January. That was down to 102.8 (vs. 104.7 expected), moving off its 6-year high in December. Otherwise, the French unemployment rate was down to 7.3% in Q4 (vs. 7.5% expected).

To the day ahead now, and data releases include the US CPI print for January, and Italian industrial production for December. From central banks, Fed Chair Powell will be speaking before the House Financial Services Committee, and we’ll also hear from the Fed’s Bostic and Waller, the ECB’s Elderson and Nagel, and the BoE’s Greene.