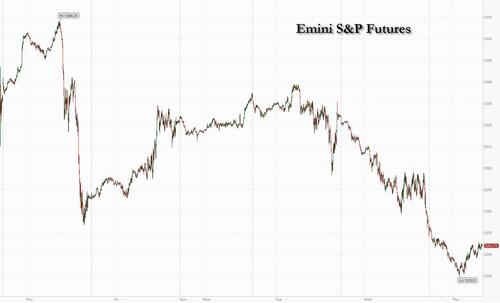

US equity futures are weaker despite lower bond yields, breaking away from this week’s narrative of Equity/Yields negative correlation, after Salesforce plunged 15% due to disappointing guidance. Small-caps are poised to outperform but have failed to hold gains this week. As of 7:45am, S&P futures are down 0.4%, pointing to a second day of declines but off the session's worst levels as Nasdaq futures drop 0.3% while Europe’s Stoxx 600 benchmark was led higher by telecom and banking stocks. Premarket, the Mag7 names are mostly lower, ex-AAPL, while NVDA is -0.8%, weighing on Semis, dragged lower by the read through from Salesforce. 10Y yields are down 2 basis points after jumping about 15 bps in the past two days. The US dollar is seeing its weakest start to the day for this week; commodities and bitcoin are weaker, too. Today’s macro data focus will be on Jobless Claims, Retail Inventories, Pending Home Sales, and revisions to the 24Q1 GDP print including the GDP Price Index and Core PCE Price Index. Tomorrow we receive the monthly PCE data which should be more market moving.

In premarket trading, Salesforce shares crashed 16% after the software maker said sales growth in the current quarter will stall to its slowest in history. The miss sparked concerns about the sector more broadly, and hit other software names: Oracle (ORCL) -2%, ServiceNow (NOW) -3%, MongoDB (MDB) -1%. Here are some of the biggest US movers before the opening bell:

Global equities are headed for their worst week since mid-April as US rate-cut expectations dwindle and tepid US auctions stir worries about funding the US deficit. The S&P 500 has advanced for 23 of the last 30 weeks, marking a joint record since 1989, but yesterday it fell -0.74%, and futures this morning are down again so it’s clear that the momentum is now more negative.

As DB's Henry Allen writes, "markets have had another rough 24 hours, with no sign of the negative momentum letting up overnight. The latest selloff has been driven by a range of factors, but bonds took a particular hit after a weak US Treasury auction yesterday, along with mounting concern about inflationary pressures, which sent European yields up to their highest levels in months."

BlackRock is sticking to the front end and the belly of the US Treasuries curve as optimism over US easing fades, according to Karim Chedid, the firm’s investment strategy head for EMEA.

“We see that as the area where you’re still getting the most bang for buck in terms of income for stability,” he said in an interview with Bloomberg Television. While the scorching rally in tech companies is underpinned by fundamentals and remains one of BlackRock’s “key sector overweights,” Chedid says he’s seeing growing inflows into European and Japanese equities.

The prospect of a rate cut from the European Central Bank at its June meeting is helping, as is “a bottoming out in the macro data in Europe, which investors are liking,” Chedid said. “Earnings have seen a significant upgrade in Europe over the past 12 months.”

And speaking of the coming ECB rate cut, European stocks are in the green after two days of losses, with telecommunication and bank shares leading gains. Major markets are all higher with Spain the notable outperformer. While some inflation prints have disappointed, the ECB remains on track to launch its easing cycle next week. Regional bonds are seeing a relief rally with Gilts curve the largest mover, seeing bull steepening. Banks among the biggest beneficiaries in EU while UK is seeing add’l support from Cyclicals. Here are the biggest movers Thursday:

Asian stocks extended declines into a third session, led by drops in Japanese and Korean equities, as higher US Treasury yields sapped the appeal of riskier assets. The MSCI Asia Pacific Index fell as much as 1.2% to touch its lowest level in three weeks, with TSMC, Samsung and Toyota among the biggest drags. The regional tumble comes after another weak sale of Treasuries reinforced concerns about the impact of higher yields. Japan’s key benchmarks retreated as the country’s long-term yields continued to rise. The yen briefly fell through a level that prompted the latest round of suspected action by Japan to prop up the currency. The Kospi dropped, dragged by losses in Samsung after the firm’s labor union said Wednesday it plans to carry out its first strike ever.

“Asian markets are clearly taking a cue from the US session marked by higher correlation and volatility,” said Homin Lee, a senior macro strategist at Lombard Odier. “We see signs that investors are still nervous about major policy innovations in Japan and China where the recent attempts to tackle the respective macro challenges - real estate in China and currency weakness in Japan - seem to have underwhelmed the markets and need to be ramped up even further,” Lee said.

In rates, treasuries pare some of their recent decline. US 10-year yields are down 2bps at 4.59%, having risen almost 15bps in the prior two sessions; they remain near the highest levels this year as optimism over US rate cuts fades. Gains were led by gilts as European bonds also recoup some of Wednesday’s losses. 2s10s and 5s30s curves remain notably steeper on the week.

In FX, the dollar erased earlier gains to fall modestly, paring Wednesday’s 0.5% advance; the Japanese yen rebounds after falling through a level that prompted the latest round of intervention by authorities. USD/JPY is down 0.5% near 156.88 after hitting a four-week high late Wednesday at 157.71. The Swiss franc is the strongest in G-10 FX, rising 0.7% against the greenback after SNB President Jordan warned a weaker currency is currently the most likely source of higher inflation and could be offset with FX sales. The rand extended losses and banking stocks fell as South Africa’s election vote count gathers pace. The ruling party looks set to fall well short of obtaining a parliamentary majority for the first time since it came to power.

In commodities, crude slipped as traders look to US stockpile data and an OPEC+ meeting on the weekend for more clarity on the supply and demand outlook. WTI traded near $79.10 while Brent was at $83.50. Spot gold falls $3 to around $2,335/oz.

Bitcoin is modestly firmer and holds around $68k, while Ethereum continues to lose ground.

Looking to the day ahead now, US economic data includes second estimate of 1Q GDP, initial jobless claims, April wholesale inventories, advance goods trade balance (8:30am) and pending home sales (10am). Fed officials’ scheduled speeches include Williams (12:05pm) and Logan (5pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were on the back foot amid spillover selling from Wall St owing to the further upside in yields. ASX 200 was pressured with underperformance in miners after recent declines in underlying commodity prices. Nikkei 225 slumped at the open and briefly fell beneath the 38,000 level but is well off worse levels. Hang Seng and Shanghai Comp conformed to the uninspiring mood in which the Hong Kong benchmark gradually weakened with notable losses in mining and property stocks, while the mainland was rangebound following another substantial liquidity injection by the PBoC and after the central bank also vowed several support efforts including promoting trade and investment facilitation.

Top Asian News

European bourses, Stoxx 600 (+0.2%) began the session on a mostly softer footing, continuing the price action seen in APAC trade overnight; however, sentiment improved as the morning progressed, with indices climbing modestly into the green. European sectors hold a positive bias; Tech is the clear laggard, with sentiment in the sector hit following weak guidance from Salesforce (-16% pre-market), which has weighed on peers such as SAP. Basic Resources is hampered by broader weakness in metals prices. US Equity Futures (ES -0.4%, NQ -0.4%, RTY +0.1%) are mixed, though have been edging higher in recent trade, in tandem with the broader pick-up in European stocks.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

Markets have had another rough 24 hours, with no sign of the negative momentum letting up overnight. The latest selloff has been driven by a range of factors, but bonds took a particular hit after a weak US Treasury auction yesterday, along with mounting concern about inflationary pressures, which sent European yields up to their highest levels in months. That followed on from a hawkish set of headlines the previous day, where stronger-than-expected data led investors to price in that rates would stay higher for longer. So it was a tough backdrop for markets across several asset classes, and there had already been a relentless run of gains in recent weeks that was always going to be tough to maintain. Indeed, the S&P 500 has advanced for 23 of the last 30 weeks, marking a joint record since 1989, but yesterday it fell -0.74%, and futures this morning are down -0.56%. So it’s clear that the momentum is now more negative, and Asian markets are also falling across the board as we go to press this morning.

This negative tone was set from the outset yesterday after the Australian CPI report was higher than expected. But that was compounded by the German flash CPI print for May, which was also a bit above consensus. So that helped to deepen the selloff, adding to concerns that rates were set to remain at higher levels for longer than anticipated. In terms of the details, German inflation came in at +2.8% on the EU-harmonised measure, which was a tenth above expectations, and an increase from the +2.4% print in April. That was partly down to base effects, but the main significance of the release was that it cast doubt on how aggressively the ECB would cut rates over the coming months. Indeed, the amount of ECB rate cuts priced by April 2025 came down by -8.0bps to 75bps, so markets are now pricing in a shallower easing cycle after the release. We’ll get more European inflation data over the next couple of days, including from Spain today, before we get the Euro Area-wide release tomorrow.

The stronger inflation prints affected sovereign bonds across the world, but the impact was particularly noticeable in Europe ahead of the ECB’s decision next week. For instance, the 10yr bund yield was up +9.8bps to a 6-month high of 2.69%. But that wasn’t just confined to Germany, as the 10yr yield in France (+10.2bps) was also up to a 6-month high of 3.17%, and the UK 10yr gilt yield (+11.9bps) hit a 6-month high of 4.40%. Meanwhile at the front-end of the curve, the German 2yr yield (+4.3bps) hit a 7-month high of 3.10%, moving closer to its March 2023 peak (just before the SVB turmoil) at 3.33%.

That pattern was repeated in other regions, and the 1 0yr Treasury yield ended the day up +6.2bps at 4.61%. In fact, over the last two weeks, the 10yr yield is now up +27.3bps, so there’s been a big turnaround since the rally that followed the US CPI print. At the same time, the 2yr yield (-0.4bps) closed at 4.97%, just below the 5% mark again, whilst the 2yr real yield moved as high as 2.70% intraday before ending up +1.7bps at 2.68%. This came as there was weak demand for US Treasuries for a second straight day. The US sold $44bn of 7-yr notes at 4.65%, which was higher than the pre-auction level of 4.637%, as concerns over funding the US deficit in a higher rate world continued to percolate. Additionally, Fed pricing suggested that higher rates were set to persist, and this morning futures are putting a 48.5% probability on a rate cut by the September meeting. There was also a modest support from the Richmond Fed’s manufacturing index, which rose to 0 in May (vs. -7 expected), which is the strongest it’s been in 7 months.

This rise in longer-dated yields proved bad news for global risk assets. For equities, it meant the S&P 500 fell -0.74%, which currently puts the index on track to end a run of 5 consecutive weekly gains. Moreover, that decline was cushioned by a stronger performance for the Magnificent 7 (-0.08%), which only fell modestly from its all-time high the previous sessio n. So if you look at the equal-weighted S&P 500 instead, that actually fell by a larger -1.17%. So this continues the theme from last year where the equity rally is a very narrow one, as the overall S&P 500 is up +10.42% year-to-date, but the equal-weighted version is only up +2.96%. Every industry group in the index was lower by the close, with energy stocks (-1.76%) as the main underperformer after oil prices fell back (Brent Crude -0.74%). Meanwhile in Europe, the losses were even larger, and the STOXX 600 fell -1.08%, alongside declines for the DAX (-1.10%), the CAC 40 (-1.52%) and the FTSE 100 (-0.86%).

Overnight in Asia, this weakness for risk assets has continued, with losses for the KOSPI (-1.41%), the Nikkei (-1.37%), the Hang Seng (-1.22%), the CSI 300 (-0.16%) and the Shanghai Comp (-0.12%). Futures are also pointing to losses in other regions, with those on the DAX down -0.38%, and those on the S&P 500 down -0.56%.

To the day ahead now, and data releases include the Euro Area unemployment rate for April, and in the US we’ll get the second estimate of Q1 GDP, along with the weekly initial jobless claims, the advance goods trade balance for April, and pending home sales for April. From central banks, we’ll hear from the Fed’s Williams and Logan, along with the ECB’s Makhlouf.