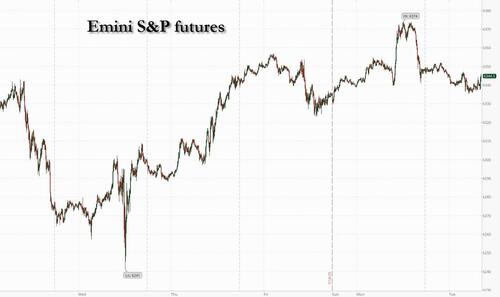

US equity futures are trading flat, erasing an earlier loss following record highs in both the S&P and Nasdaq while the small cap Russell 2000 sits 8.5% below its ATH. As of 8:00am ET, S&P futures are unchanged while Nasdaq futures are down 0.1% as investors brace for corporate news on how tariffs are filtering through to their earnings. In pre-market trading Mag7 names are mixed with AAPL, GOOG, and META higher and NVDA pulling semis lower. Cyclicals are weaker with Industrials outperforming. Treasuries and the dollar steadied before an 830am speech from Fed Chair Jerome Powell in which he is not expected to discuss monetary policy. Powell has faced relentless criticism from the Trump administration, mostly over decisions to hold interest rates steady so far in 2025. The yield curve is seeing a slight twist steeper with 10s and 30s +1bp; USD is modestly lower after yesterday seeing its largest daily decline since June 12. Commodities are weaker with Energy/precious lower, base metals higher, and Ags mixed. Today’s macro data focus is on regional Fed activity indicators.

In premarket trading, Mag7 stocks are mixed (Alphabet +0.4%, Meta +0.3%, Apple +0.2%, Amazon +0.09%, Microsoft is little changed, Tesla -0.2%, Nvidia -0.6%). Here are some other notable premarket movers:

In earnings, NXP Semiconductors gave a less bullish third-quarter forecast than some investors had anticipated, while Steel Dynamics second-quarter adjusted EPS missed.

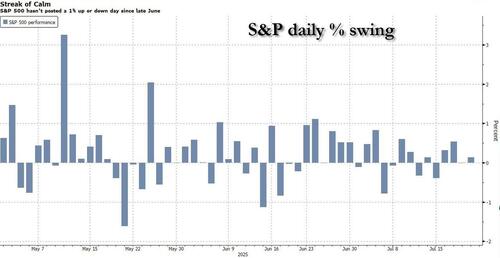

A record-breaking stock rally has powered on in the face of growing uncertainty over trade negotiations ahead of the Aug 1 tariff deadline. But with valuations stretched, the strong second-quarter earnings season is failing to illicit much of a reaction from investors so far, as they wait for more concrete information on the tariff fallout.

“Of course we see beats, but that won’t tell us a huge amount about where we are going forward,” JP Morgan Asset Management Global Market Strategist Hugh Gimber told Bloomberg TV. “That’s where we are spending our energy on this earnings season, trying to gauge where the hit from tariffs will come through.”

After hitting a series of all-time highs, the S&P 500 is trading around 22 times expected 12-month profits. The S&P 500 hasn’t posted a 1% up or down day since late June. Reports from megacaps Tesla Inc. and Alphabet Inc. are due Wednesday.

Wall Street giants such as Invesco, Fidelity and JPMorgan Asset Management are leaning harder into the rally in risk assets. The high-octane wager is that while Trump is threatening to disrupt the economic order anew, he will step back from the brink.

The 50 global companies with the highest US sales exposure are now expected to post average earnings growth of 10% this year, down nearly 400 basis points from estimates at the start of the year, according to BI strategists. The 50 firms with the least US exposure have seen upward estimate revisions. Elsewhere, Goldman Sachs traders said chip stocks are the most crowded pocket of tech, if not the market, on AI enthusiasm.

On the trade front, President Donald Trump may issue more unilateral tariff letters before the tariff deadline, White House Press Secretary Karoline Leavitt said. More trade deals may also be reached before the deadline, she added. Philippine President Ferdinand Marcos Jr. will be the latest foreign leader eager to make a deal before the deadline when he visits Trump in the Oval Office later Tuesday. A team of US officials will visit India in the second half of August to hold talks on a bilateral trade deal, the Financial Express reported Tuesday.

Firms such as Invesco Ltd., Fidelity International Ltd. and JPMorgan Asset Management are leaning harder into the rally in risk assets. The high-octane wager is that while Trump is threatening to disrupt the economic order anew, he will step back from the brink.

European stocks are in the red amid a mixed batch of earnings as investors await the results of trade negotiations between Brussels and Washington. The Stoxx 600 is down 0.5%. Chemical and tech shares are lagging, while utilities and miners are gaining. Among individual stocks, Akzo Nobel falls after cutting its profit forecast for the year. Here are the biggest movers:

A key Asian stock benchmark erased a gain and dipped, weighed down by losses in South Korean and Taiwanese chipmaker shares. The MSCI Asia Pacific Index fell as much as 0.5%, set for its first decline in four sessions. Taiwan Semiconductor Manufacturing and Samsung Electronics were the biggest drags. Lenders in Australia weighed down the index further ahead of the earnings season. South Korean stocks retreated from near an all-time high ahead of this week’s tariff talks with the US and upcoming earnings releases. Japanese shares had a volatile session as investors weighed policy implications from the ruling Liberal Democratic Party’s historic setback in Sunday’s elections. Prime Minister Shigeru Ishiba’s plan to remain in his role alleviated some worry of a sudden upheaval, though uncertainty has risen over the stability of his government. Among other nations hoping for positive trade talks, Malaysia is said to be seeking a milder US tariff rate of 20%, while Philippine President Ferdinand Marcos Jr. plans to meet with President Donald Trump later Tuesday. Elsewhere, Thailand is set to name its new central bank chief on Tuesday, ending a months-long search.

In FX, the dollar kicked off the day stronger but has seen that fade. The Bloomberg Dollar Spot Index is now down for the day after having yesterday seeing its largest daily decline since June 12. The New Zealand dollar is the worst G-10 performer after seeing first quarterly decline in exports for two years, and the yen continues its wild gyrations as markets are in denial over the coming fiscal easing tsunami that will send the currency tumbling.

In rates, Treasuries are under slight pressure as US trading day begins, after Monday’s rally sent yields across tenors to lowest levels in more than a week. 10- to 30-year yields are higher by 1bp-2bp with shorter-maturity tenors little changed; the 10-year near 4.39% is back above the 200-day moving average level it dipped below Monday and hasn’t closed below since July 2. Potential catalysts are in short supply as the US economic calendar is light and Fed policymakers are in self-imposed external communications blackout ahead of their July 29-30 meeting, however Chair Powell is slated to give welcoming remarks at a regulatory conference in Washington at 8:30am, and Governor Michelle Bowman, the Fed’s vice chair for supervision, is slated to appear on CNBC at 7:30am. UK bonds are falling after the country’s budget deficit hit the highest since April 2021. The yield on 10-year gilt bonds is up four basis points, lagging comparable Treasuries and bunds, where their respective yields are each up by a basis points.

Oil is falling, with tariff worries and supply concerns the culprits. Brent futures down 1.1% and below $69/barrel. Gold weaker, down around $8 to about $3,388/oz.

In commodities, oil fell for a third session, and gold slipped. Iron ore headed toward the highest in nearly five months as traders eyed China’s prospective supply-side reforms for the steel industry and plans for a massive dam project

The US economic data calendar includes July Philadelphia Fed non-manufacturing activity (8:30am) and July Richmond Fed manufacturing index and business conditions (10am). Fed officials are in external communications blackout ahead of their July 30 rate decision, anticipated to be no change in the fed funds target range of 4.25%-4.5%

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after failing to sustain the early upward momentum seen at the open following the fresh record intraday highs on Wall St and with two-way price action seen in Japan following the ruling coalition's upper house election loss. ASX 200 was rangebound as strength in the mining, materials, resources and healthcare sectors offset the losses in financials, energy and industrials, while the RBA Minutes from the July meeting provided very little to shift the dial but continued to signal future cuts ahead. Nikkei 225 initially surged to above the 40,000 level as participants returned from the long weekend, but then wiped out its gains and then some, as participants second-guessed the ramifications of the ruling coalition's upper house election setback. Hang Seng and Shanghai Comp kept afloat in rangebound trade amid a lack of major fresh catalysts and after the Hong Kong benchmark breached the 25,000 level.

Top Asian News

European bourses (STOXX 600 -0.4%) opened mostly lower and sentiment continued to deteriorate as the session progressed. Downside, which followed a mixed APAC session, where indices failed to sustain early upward momentum. European sectors hold a slight negative bias, with only a handful of industries managing to stay afloat. Utilities takes the top spot, joined closely by Basic Resources and then Travel & Leisure to complete the top three. Chemicals sits at the foot of the pile, with two of the top 10 industry constituents reporting today; Givaudan reported weak sales and Akzo Nobel missed across its headline figures, alongside a cut to its FY Adj. EBITDA view.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

If you see any evidence of me working harder this week it's because I was told last night how much it would cost to redecorate the house.There are people in the house who think that after 6 plus years post a complete renovation and having lived in it with three grubby kids, it is in desperate need of some fresh licks of paint. There are others (ok me) who disagree. I think we all know which argument will come out on top.

60/40 portfolios have generally come out on top over the last 24 hours with both equities and bonds continuing to rally even if the high-water mark for equities seemed to be the European close last night. The S&P 500 (+0.14%) crept up to a fresh record helped by the slew of good earnings reports but drifted around half a percent off its highs around the time Europe closed. The bigger move has been in sovereign bonds, with a large global rally that saw 10yr BTPs (-10.1bps) and OATs (-10.4bps) lead the way. 10yr bund yields (-8.3bps) posted their biggest daily decline since January (same for BTPs), and 10yr USTs (-3.9bps) also rallied. So this all helped to ease some fears about fiscal policy, as well as concerns about tighter financial conditions that had accompanied the recent rise in long-end bond yields. Overnight Japanese yields have re-opened after the election and holiday with 10yr yields -4bps lower but 30yr yields a couple of basis points higher. The ultra long end has marched to its own beat in recent weeks.

That small US equity rally was powered by the ongoing strength in big tech stocks, with the Magnificent 7 (+0.70%) posting a 9th consecutive advance for the first time since 2023. That left the index just half a percent beneath its all-time high from December, whilst the NASDAQ (+0.38%) hit an all-time of its own. We see Tesla and Alphabet report after the close tomorrow. As mentioned at the top, the equity rally did lose some steam later in the session, with almost two thirds of the S&P 500 constituents lower on the day, while the small cap Russell 2000 fell by -0.40%.

Another factor supporting bonds and equities in recent days has been a growing confidence that Fed Chair Powell was unlikely to be fired after the peak fears last week. However there were comments from Treasury Secretary Bessent yesterday that “we need to examine the entire Federal Reserve institution and whether they have been successful.” But they weren’t seen as particularly aggressive, and the 30yr Treasury yield came down -4.3bps to 4.94%, some way beneath the 5.07% intraday peak it reached last week. That was echoed across the yield curve, with 2yr yields down -0.9bps to 3.86%, and the 10yr yield as discussed at the top down -3.9bps to 4.38%. The flattening in the yield curve was the mirror image of the large steepening as Powell’s position came into focus last week. However, that decline in long-end yields also took out some support for the dollar, with the dollar index (-0.64%) seeing its biggest daily decline since mid-June after having rallied the previous two weeks.

Over in Europe, the picture was initially very different, as worries over the fate of the EU-US trade deal weighed on investors’ minds ahead of the August 1 deadline. Officials are expected to continue negotiating this week, and Bessent said on CNBC yesterday that things “don’t have to get ugly with the Europeans.” But the lack of concrete progress has continued to give investors pause. That meant the major indices were down for most of the session, although several managed to pare back their losses as the positive mood from US earnings spread more widely. So the STOXX 600, which had been down -0.41% intraday, recovered to close only -0.08% lower, and there were gains for the FTSE 100 (+0.23%) and the DAX (+0.08%) as well.

Japanese stocks opened significantly higher this morning (up around a percent) but have subsequently slipped with the Nikkei now -0.38% lower as focus shifts to the August 1st trade deadline and how the ruling coalition will deal with being three seats short of a majority.

Elsewhere in Asia the Hang Seng and Shanghai Composite are both up around a quarter of a percent but with the KOSPI (-1.58%) sliding after a strong start. It seems that August 1st is starting to focus investor minds in Korea as well. The S&P/ASX 200 (-0.17%) is slightly lower alongside S&P 500 (-0.05%) and NASDAQ 100 (-0.14%) futures.

Finally on geopolitics, Iran’s Tasnim news agency reported that Iran had agreed to hold talks with the UK, France and Germany over its nuclear program, expected to take place this Friday and separate to ongoing discussions on indirect talks with the US. And separately on Ukraine, Bloomberg reported that the US and Germany had agreed to send two Patriot systems to Kyiv. This follows last Friday’s announcement that the EU had approved “one of its strongest sanction packages” against Russia, including a lower oil price cap from $60 to $47.6/bbl. Brent crude fell as much as -1.23% intra-day on Monday but was a mere -0.10% lower at $69.21/bbl by the close. Those oil moves helped support the bond rally during European hours before its partial reversal later in the US session.

Now for the day ahead, we’ll get the US July Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index, UK June public finances and France’s retail sales. We’ll also get the ECB’s bank lending survey and RBA minutes of the July meeting. Central Bank speakers include Fed Chair Powell and BoE Governor Bailey. Finally, today’s earnings reports include SAP and Coca-Cola.