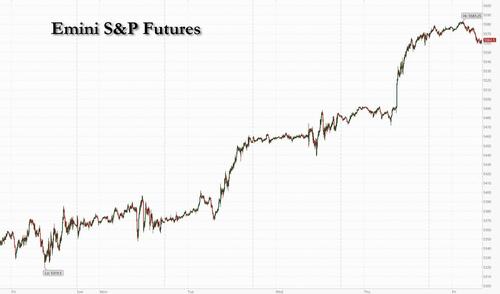

US equity futures erased earlier gains and were trading with modest losses as dollar, oil and yields all slumped entering the US session. As of 7:45am, S&P futures traded down 0.1% around 5,562 as consistent selling pressure emerged around the European open, even as Asian stocks had another solid session. Nasdaq futures were unchanged, with megacap tech mostly higher led by NVDA +56bp, and AMZN +60bp. Bond yields and USD are both lower; 2-, 5-, 10-yr yields are 2bp, 5bp, 10bp lower, pulled down by a sharp drop in oil as the Harris oil trading desk resumes shorting. Other commodities were mixed with base metals higher. Today, the key macro focus will be U of Mich Sentiment and housing data (Housing Starts and Building Permits).

In premarket trading, Applied Materials fell after the semiconductor capital-equipment company’s forecast disappointed bullish investors looking for a bigger payoff from artificial intelligence spending. Bayer AG jumped 10% following a significant win for the German company in long-running cancer litigation over its Roundup weedkiller. Here are the other premarket movers:

A flurry of data reversing the dismal post-payrolls hard-landing sentiment, and signaling that the American economy still has some has in the tank , has put US stocks on course for their strongest week of the year. The latest goalseeked readings, from inflation to jobless claims and retail sales, have reassured investors and supported hopes that the world’s biggest economy is heading for a “Goldilocks” scenario of contained price pressures accompanied by resilient growth (spoiler alert: it isn't, and the truth will be revealed on Nov 6 or thereabouts). As a result, the S&P 500 has rallied 3.7% this week, while the Nasdaq 100 is up more than 5%, the biggest gains for both indexes since November.

“There is little in the data flow now to really derail sentiment in the immediate near-term,” said Pepperstone Group strategist Chris Weston.

The powerful rebound means that stock markets around the world have erased last week’s losses, when traders were worried the Federal Reserve won’t cut interest rates fast enough to achieve a soft landing for the US economy. In Europe Friday, the Stoxx 600 Index added 0.3% as it headed for its best week since May. US equity futures were little changed.

The latest surge on Wall Street saw the S&P 500 notch its strongest six-day winning run since November 2022. Bank of America's Michael Hartnett said US stocks just recorded a seventh straight week of inflows, underscoring the sustained appetite for equities among investors. BofA said about $5.5 billion went into US equity funds in the week through Aug. 14.

US officials have been trying to use higher rates to ease inflation without causing the economy to contract. Fed Bank of St. Louis President Alberto Musalem said the time is nearing when it will be appropriate to cut rates. His Atlanta counterpart Raphael Bostic told the Financial Times he’s “open” to a reduction in September.

“A soft landing is no longer a hope. It’s becoming a reality,” said David Russell at TradeStation. “These numbers also suggest that recent market volatility wasn’t really a growth scare. It was just normal summer seasonality amplified by moves in the currency market.”

European stocks pared earlier gains of 0.5% to just 0.1% as they head for their best week since May amid evidence of economic resilience that’s supporting global equity markets. Auto and retail sub indexes were the best performers, rising 1.7% and 1.2%, respectively. Bayer shares rise as much as 10%, the most in five years, after a US appeals court concluded that federal regulations governing the Roundup weedkiller’s warning label supersede Pennsylvania laws. Here are the other most notable European movers:

Asian equities are higher following Thursday’s US rally. Nikkei jumps more than 3% and Kospi rises 1.8%. Taiex rallies as much as 2.2%. Hang Seng adds 1.7%; mainland China indexes eke out modest gains. Asia sported Friday’s strongest market gains as stocks in the region headed for their best weekly performance in over a year, led by Japan as a weaker yen boosts exporters’ earnings prospects. The currency is set for its sharpest weekly drop since June after sliding 1.3% against the dollar Thursday. It was trading around the 149 level, easing fears of a massive carry trade unwind.

In FX, the dollar slipped, on course for a third week of declines, the longest such losing streak in more than five months. The USD/JPY slipped as much as 0.1% to 148.00, while 10-year bond yield dropped 2bps to 3.8940% The yen “has tracked the swing in rates differentials overnight,” said Rob Carnell, head of research and chief economist for Asia Pacific at ING Bank

In rates, Treasury 10-year yield eased 5bps to trade near 3.86%. Australian 3-year yield remains about 6bps higher following the RBA Governor Bullock’s hawkish testimony; Aussie dollar 0.2% stronger. JGB futures sharply lower with Japan’s benchmark yield 5bps firmer. Treasury yields slumped across the curve, after surging Thursday as the resilient US economic data prompted traders to dial back bets for a jumbo September Fed rate cut, and as oil tumbled right on schedule ahead of Kamala Harris' big policy reveal later today. A 25 basis-point reduction remains fully priced, with more than 90 basis points of easing expected by the end of 2024.

In commodities, gold was on track for a weekly gain. Crude is lower in a paring to the prior day's gains. This morning's price action has been contained to within yesterday's range, although some downticks coincided with reports that Libya's Waha oil field is to return to full normal levels within the coming hours after production was reduced amid a fire. Brent is sliding as low as $79.

Looking at today's calendar, US data slate includes July housing starts/building permits, August New York Fed services business activity (8:30am) and University of Michigan sentiment (10am). Fed speakers scheduled for the session include Goolsbee (7am, 1:25pm and 4:15pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the rally on Wall St after a US data deluge soothed recent economic concerns. ASX 200 gained as the commodity-related sectors spearheaded the advances seen across all industries. Nikkei 225 outperformed and surged firmly above the 37,000 level following recent currency weakness. Hang Seng and Shanghai Comp. were positive with JD.com, MTR, Li Ning and Alibaba among the biggest gainers in Hong Kong post-earnings, while the mainland index continued to lag amid lingering economic concerns.

Top Asian News

European bourses, Stoxx 600 (+0.5%) are almost entirely in the green, in a continuation of the optimism seen following the strong US Retail Sales figure seen in the prior session. European sectors hold a positive tilt and with a cyclical bias; sectors such as Autos, Retail and Travel & Leisure are towards the top of the pile. Telecoms is towards the foot of the pile alongside Optimised Personal Care. US Equity Futures (ES +0.1%, NQ +0.2%, RTY +0.3%) are entirely in the green, continuing the Retail Sales induced strength; the RTY, once again, outperforms.

Top European News

FX

Fixed Income

Commodities

Middle East: Geopolitics

Middle East: Other

US Event Calendar

Central Bank speakers