An earlier rally in US equity futures fizzled and Treasuries steadied after days of sharp losses as Apple sunk to session lows, while traders awaited employment data for clues on the path for Federal Reserve interest rates. As of 7:45am ET S&P futures were fractionally in the red at 4,520 erasing a earlier gain of 0.3% and set to extend their biggest weekly decline since March; meanwhile Nasdaq futures were still in the green, up 0.2% thanks to Amazon.com surging 9% in premarket trading after revenue at the world’s largest e-commerce and cloud services company beat estimates. Europe’s Stoxx 600 index turned lower while Asian stocks rose, trimming their weekly decline, on pockets of good news in China and shreds of optimism that the spike in bond yields won’t last. The Bloomberg dollar index rose 0.1% while 10Y TSY yields added one basis point to trade at 4.19%.

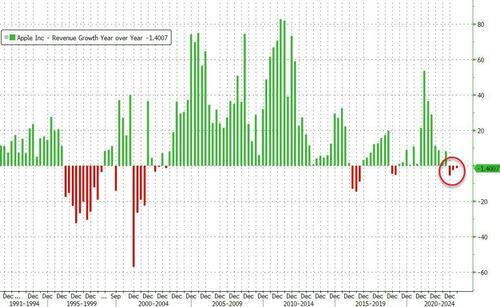

In premarket trading, Apple’s market value dropped 2%, sliding below the historic $3 trillion level after the world's biggest company posted a third straight quarter of declining sales, sparking worries over tepid demand for its handsets and other gadgets

On the other end, Amazon.com shares jumped as much as 9.1% as analysts hiked their price targets for the stock en masse after the e-commerce and cloud computing company reported second-quarter results that beat expectations and gave a positive forecast. Here are the other notable premarket movers:

The market has been largely frozen ahead of today's non-farm payrolls number (due at 830am) which is forecast to show the US added 200,000 jobs in July with crowd-soured whisper number higher at 222,000 (full preview here). While that would be the weakest print since the end of 2020, it’s still strong historically and a number exceeding that may fuel bets on more Fed hikes. A report Thursday underscored resilient US demand for workers and the mood in markets remains cautious. Here is a breakdown of payrolls forecasts by bank

“With NFP still to come, I shouldn’t think investors are too willing to jump in with both feet just yet,” said James Athey, investment director at Abrdn.

Investors indeed are biding their time until after the jobs report is out: the jolt from Fitch Ratings stripping the US of its triple-A credit ranking was compounded by news Wednesday that the government will boost quarterly debt sales to $103 billion, more than expected. Yields soared to the highest since November as traders fretted over the increased supply, wiping out the Treasury market’s gains for 2023.

Meanwhile, the recent tumult in markets is making investors wary. Bank of America’s clients are moving out of equities as the risk of an economic contraction remains high, strategist Michael Hartnett said. “Private clients are shifting back to ‘risk-off’ mode,” he wrote in a note, adding that a hard landing was still a risk for the second half amid the higher bond yields and tighter financial conditions.

Europe’s Stoxx 600 index rose 0.3% as it looks to snap a three-day losing streak as travel and leisure shares outperformed. European natural gas headed for the biggest weekly gain since June. Here are the most notable European movers:

Asian stocks rose, trimming their weekly decline, on pockets of good news in China and shreds of optimism that the spike in bond yields won’t last. The MSCI Asia Pacific Index advanced as much as 0.5%, before fading most of the gains with benchmarks in Hong Kong, China and Vietnam among the biggest gainers. The MSCI regional gauge is still headed for a more than 2% drop this week, its worst since late June, as the dollar strengthened and bond yields spiked globally as traders assess the outlook for the US economy.

The macro backdrop has become more favorable for Asian equities, according to Goldman Sachs. Investors should “use the potential soft late-summer seasonality to position for the typically strong 4Q,” as US economic data support soft-landing prospects and China’s Politburo meeting positively surprised, strategist Timothy Moe wrote in a note.

In FX, the Bloomberg Dollar Spot Index is up 0.1% amid position unwinds ahead of the US nonfarm payroll data. However, the measure is still set for a third weekly advance. The Aussie added as much as 0.6%, extending an exporter-driven gain after the central bank implied that rates may have to remain at elevated levels for longer. The Swiss franc is the worst performer among the G-10’s, falling 0.4% versus the greenback.

“Solid ADP likely raised market expectations for NFP already, which means that the USD is vulnerable to a sell-on- rally reaction tonight,” said Fiona Lim, senior currency analyst at Malayan Banking Berhad in Singapore. “We had seen a bout of strong US data for much of the past week that lifted the USD,” she added

In rates, 30-year bonds edged higher with yields down 2bps while two-year borrowing costs rise 4bps. 10Y Yields were flat at 4.18%. The treasury curve was flatter into early US session, paring a four-day steepening move for 2s10s and 5s30s spreads. 5s30s returns to negative after flipping positive for the first time since June 13 on Thursday. Front-end-led weakness follows similar bear-flattening in bunds and gilts during London morning. Bunds are lower, having extended declines after German factory orders saw their largest rise in three-years.

In commodities, crude futures advance with WTI rising 0.5% to trade near $82. Spot gold is little changed around $1,934.

Bitcoin is under marked pressure in relatively narrow ranges which remain above the USD 29k mark given overall price action is somewhat tentative pre-NFP.

Looking ahead to today, we have the US July jobs report, the UK July construction PMI, new car registrations, Italian June industrial production, German construction PMI for July as well as factory orders, French Q2 wages and June industrial production, the Eurozone June retail sales and the Canadian jobs report for July. We will hear from the BoE’s Pill, and earnings releases from Dominion Energy and LyondellBasell.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as most bourses in the region lacked firm direction after a lackluster handover from the US, while participants reflected on tech giant earnings and the latest PBoC support pledges. ASX 200 was rangebound as gains in the commodity-related sectors and financials were counterbalanced by weakness in defensives, while the RBA’s quarterly Statement of Monetary Policy provided little to shift the dial and reiterated that some further tightening may be required. Nikkei 225 swung between gains and losses as an early retreat beneath the 32,000 level was met with dip buying which then petered out. Hang Seng and Shanghai Comp were positive with gains led by the property sector after the latest policy support pledges by the PBoC which announced it is to rollout guidelines to support private firms and will expand debt financing tools, as well as implement differentiated housing credit policies.

Top Asian News

European bourses are modestly firmer, Euro Stoxx 50 +0.4%, in largely contained trade ahead of the US NFP report. Sectors are mixed with outperformance in Travel & Leisure amid strength in airliners and some gambling names, elsewhere Banking and Energy names are supported by yields and benchmarks respectively. Stateside, futures are a touch firmer and largely in-fitting with European peers, ES +0.3%; aside from NDP, participants are digesting the numerous after-hours results on Thursday including Amazon +8.8% and Apple -1.8%.

Top European News

FX

Fixed Income

Commodities

Geopolitics

DB's Jim Reid concludes the overnight wrap

Another weekend ahead of being home alone and trying to play as many rounds of golf as my body permits. The family are going camping today. My wife and I have an unwritten understanding that camping is very bad for my back and therefore I'm not going. However, I think we both know that I have little interest in camping and it's easier for a successful marriage to not have that conversation and just blame my back. My thoughts are that I haven't worked hard for 28 years to sleep in a muddy field when I have a nice mattress at home. So it's just Brontë and I and three rounds of golf.

The bond vigilantes have certainly camped out on the lawn of the US fixed income market this week as the sell-off entered its third consecutive day on Thursday (10yr UST +9.6bps) in the shadow of US Treasury credit quality jitters and confirmation of increased Treasury supply in the coming quarter. I've not heard anyone mention the comparison but there is a minor similarity to what happened with the UK last September and October. Back then an ambitious pro-growth UK budget by the new Prime Minister and Chancellor prompted sudden fears of heavy extra gilt supply, yields then surged and the LDI crises magnified it and we ended up with; UK asset managers having huge liquidity issues, BoE intervention, mass political top level resignations and a complete U-turn of a budget. Of course there are important differences, not least the Dollar has rallied slightly this week whereas Sterling slumped last year when the mini-crisis happened.

For the US the confusing thing is how much of the budget deficit increase of late is due to delayed tax receipts (due to winter storms) and how much is due to genuine stealth fiscal easing. It still feels like the former to me but that's not to say that the weak US fiscal situation isn't unparalleled in non-recessionary or non-crises times. Also there’s no denying that tax receipts are lower and interest costs higher at the moment so the increased issuance in the next few months is real. As such treasuries are making room for the extra supply. We’ll wait and see if it triggers any issues anywhere.

On a similar vein, back in March there were some who suggested that the straw that broke the camel's back in the SVB downfall was possibly the Powell hawkish testimony to Congress earlier that week. So can any of us say with any certainty that the last of the market shocks from higher rates are behind us? Feel free to email me if you are 100% sure they are.

The renewed rates sell-off got an extra push with US data releases on the day that pointed to further resilience of the US labour market and upward price pressure in the US economy. In this context, it's put a laser focus on the market's favourite random number generator, namely payrolls later today. Our economists expect +175k (vs +200k expected by consensus), with the unemployment rate to remain steady at 3.6%. You can read their full preview here.

As we go into this important day, after the bell last night, we had mixed results from tech giants Apple and Amazon, which in aggregate have driven NASDAQ futures +0.50% higher as I type. Amazon shares gained +8.7% in after-market trading as it delivered stronger Q2 net sales ($134.38bn vs $131.63bn est.) and issued stronger sales and income guidance for Q3. By contrast, Apple shares lost some ground after hours. While its Q2 results broadly met expectations, they represented a third straight quarter of falling sales with iPhone sales a touch below estimates. So Apple’s $3trn market capitalisation achieved in late June may be at risk today. The two companies represent nearly 20% of the NASDAQ’s value so a big event to get through. S&P 500 (+0.34%) futures are also higher.

Back to the main story of the week now. The eventful start to August in the US Treasury market spilled into Thursday as the US Treasury officially kickstarted their increase in issuance, boosting the size of their T-bill auctions. The size of the 3-month bill sale rose from $65 billion to $67 billion, and the 6-month to $60 billion from $58 billion. This added to the issuance story that has been driving the selloff in US rates in the past few sessions. US 10yr Treasuries gained +9.6bps to 4.18%, again hitting its highest level since the 15-year peak of 4.24% reached last November. The long end again led the sell off, with +11.6bps rise in 30yr yields. 30yr mortage rates hit their highest level since 2000.

By contrast, the 2yr yield was virtually unchanged on the day, leading to a bear steepening of the 2s10s curve by +9.7bps. Although the curve remains deeply inverted (-70.8bps), this is the least inverted since May. Our rates strategists’ preferred term premium measure has also moved to its highest level since 2015. See their note here for more. Higher term premium has been one of our favoured trades for a while but has been surprisingly slow to work.

Adding to the mix, US weekly jobless claims remained at the lower levels of recent weeks at 227k (vs 225k expected). We also had the US July ISM services index at 52.7 (vs 53.1 expected). However, it was the prices paid index that caught the attention after a solid increase to 56.8 (vs 54.1 expected), highlighting risks to the disinflation view. This marginally trimmed the size of expected rate cuts into 2024, as pricing for Fed fund futures in December 2024 gained +1.3bps.

In Europe we heard from ECB’s Panetta. A known dove, Panetta stressed the “persistence approach” whereby policy rates are to be kept at a restrictive level for an extended period over further tightening. This echoed ECB President Lagarde’s comments at Sintra earlier this year, at which she argued that persistent inflation requires a persistent restrictive monetary policy stance. Panetta also reiterated the ECB’s data dependence mode, highlighting that further adjustment may be necessary “should the inflation outlook materially deteriorate”. The speech followed downward revisions to the Eurozone PMI results for July. The composite index was revised from 48.9 to 48.6, with increased questions over domestic growth as services new business fell into contraction for the first time since December. Despite this backdrop, 10yr German bunds sold off by +7.1bps, more in line with the US trends than domestic themes.

The risk-off mood tempered in equity markets, as the S&P 500 fell by a more modest -0.25% on Thursday, but still seeing its third consecutive day of losses. The energy sector (+0.95%) outperformed off the back of an extension of the voluntary 1m b/d supply cut by Saudi Arabia through September, with additional extensions possible. WTI crude rallied +2.59% to $81.55/bbl and Brent gained +2.33% to $85.14/bbl. The risk-off sentiment likewise wound back for the technology sector with the NASDAQ seeing only a marginal decline of -0.10% before the Apple and Amazon results. European STOXX 600 earlier slipped -0.63%. European technology struggled, with semiconductors down -2.51% following disappointing earnings forecasts by German semiconductor darling Infineon (-9.33%). The German DAX thus underperformed, down -0.79%.

Over the channel in the UK, the BoE followed the Fed’s and ECB’s lead by hiking their policy rate by 25bps to 5.25% as expected by consensus. The MPC retained its data-dependent approach but demonstrated confidence that tight monetary policy is now weighing on economic activity, with the MPC stating that “the current monetary policy stance is restrictive” for the first time. The Committee also judged “that risks around the modal inflation forecast are skewed to the upside, albeit by less than in May.” Much like the ECB, the BoE played the higher for longer card, emphasising that policy needed to be restrictive for “sufficiently long” to ensure inflation returns to their 2% target rate. You can find our UK economist’s review of the meeting here.

Expectations for near-term BoE rate hikes were subsequently pared back, with the expected rate for the November meeting falling -10.3bps. That said, terminal pricing for early 2024 eased more marginally (-3bp yesterday). 2yr gilts continued their rally off the back of the meeting (-1.6bps), with a big steepening as 10yr yields (+6.7bps) rose in line with the global trend.

Asian equity markets are mostly higher as they approach the end of a volatile week. In terms of specific moves, Chinese stocks are seeing gains with the Hang Seng (+1.01%) leading the way followed by the CSI (+0.52%) and the Shanghai Composite (+0.48%) amid signs of support for private sectors from the People’s Bank of China (PBOC). Otherwise, the Nikkei (-0.09%) and the KOSPI (+0.04%) are showing a lack of direction with both trading in and out of negative territory this morning.

In central bank news, the Reserve Bank of Australia (RBA) trimmed the growth outlook of the country to 1% for this year from its earlier estimate of 1.25% as the ‘cost -of- living pressures’ coupled with a ‘rise in interest rates’ continue to weigh on demand. Still the central bank highlighted that inflation is moving in the right direction and sees consumer prices returning within the 2-3% target range at the end of 2025.

Looking ahead to today, we have the US July jobs report, the UK July construction PMI, new car registrations, Italian June industrial production, German construction PMI for July as well as factory orders, French Q2 wages and June industrial production, the Eurozone June retail sales and the Canadian jobs report for July. We will hear from the BoE’s Pill, and earnings releases from Dominion Energy and LyondellBasell.