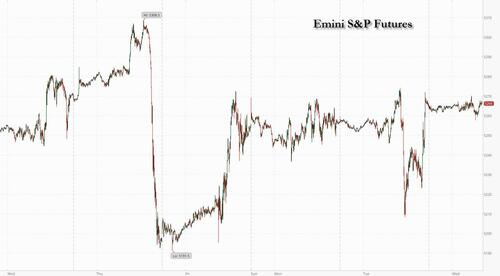

Futures are up small before the March CPI data was expected to show further moderation in price pressures following stronger readings at the start of the year, with Mag7 mixed and Semis lower, tracking bigger gains in Europe. Bond yields are uniformly 1bps lower, USD is off a touch, and commodities are mostly higher led by base metals and Ags. The CPI print is the clear focus today but keep an eye on the bond auctions (yesterday’s 3Y auction required a concession), 2x Fed speakers (Bowman, Goolsbee), and then the Fed Minutes this afternoon to look for any hints on policy including changes to QT.

In premarket trading, TSMC ADRs rose 0.5% after the Taiwanese chipmaker reported better-than-expected sales growth for the first quarter. The chip giant's quarterly revenue grew at its fastest pace in more than a year, shoring up expectations that a global boom in artificial intelligence development is fueling demand for high-end chips and servers. The main chipmaker to Nvidia Corp. and Apple Inc. reported a better-than-expected 16% rise in March-quarter sales to about NT$592.6 billion ($18.5 billion), versus the NT$579.5 billion average projection. Alphabet shares rose 0.7%, set to extend gains for a fourth consecutive session, as Google unveiled a host of updates to its artificial intelligence offerings at its annual cloud conference.

Here are some other notable premarket movers:

As discussed earlier, economists forecast that consumer prices rose 0.3% in March on a monthly basis, both overall and excluding food and energy costs. While that would mark a step down from the previous two months, it may not be enough for Federal Reserve officials looking for even lower readings, although both Goldman and JPM expect the final CPI prints to come in on the dovish side of expectations. A hot number could “put a question mark on whether the Fed will cut at all this summer and will it be a September time frame,” said Guy Miller, chief strategist at Zurich Insurance Co. This would mean a further delay and “markets are very vulnerable to that as we have seen significant multiple expansion in the past 12 months,” he said (our full CPI preview is here).

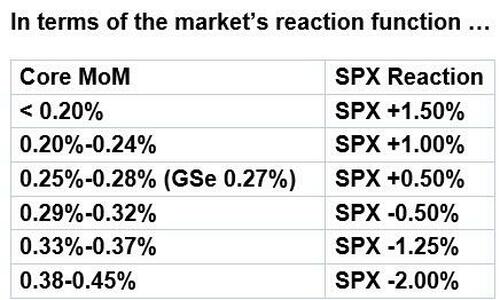

Wall Street traders predict stocks could move 2% either way on a surprise inflation number. Both JPMorgan Chase and Goldman Sachs trading desks see stocks falling some 2% if the consumer price index tops 0.4% in March on a monthly basis. However, both banks say they view any hit to the market as temporary. For those who missed our full preview (available here) here is the Goldman...

... and JPM reaction matrix (for core CPI MoM):

“This bull market continues irrespective of what happens with CPI,” said JPMorgan’s Market Intelligence traders led by Andrew Tyler (full note available here for pro subs). They point to a supportive backdrop, where the economy and corporate profits are growing and the Fed is on pause.

The straddle-implied move for today's move is 0.98%, up notably from last month's expectation of a 0.95% move and notably higher from the January's 0.70% move on CPI day; this is also the highest since November, but generally on the low side over the past two years.

Meanwhile, leading market strategists are optimistic that Corporate America can help fuel the next leg of the stock market rally by delivering another bumper earnings season. Even pricey technology stocks — the primary profit engine in the previous quarter — are again expected to be supported by solid results. While the S&P 500 Index is coming off its best first quarter in five years and trading near its all-time high, market experts are reluctant to bet against further gains.

“It’s way too early to apply the brakes on the US stock rally,” said Manish Kabra, head of US equity strategy at Societe Generale SA. “The momentum has been backed up by the earnings outlook, and I expect that to continue for at least one more quarter.”

Earnings for S&P 500 companies are expected to post a “healthy” 10% gain in the first quarter in headline numbers from a year ago, according to Deutsche Bank AG strategists. Earnings upgrades from analysts have outnumbered downgrades in the first quarter, according to a Citigroup Inc. index.

In Europe, the Stoxx 600 index was higher Wednesday, rebounding from the previous session’s losses, as surging sales at Taiwan Semiconductor Manufacturing Co. from the boom in global AI development boosted tech stocks. Miners advanced after gains in copper, iron ore and gold. Tesco Plc rose as it forecast higher retail profit and announced a share buyback. The gains come a day before an interest-rates announcement from the European Central Bank that’s widely expected to prepare markets for an initial cut in June as price pressures in the region ease. Here are the biggest European movers:

Earlier in the session, Asian stocks rose, as gains in Chinese technology shares helped counter declines in Japan, with a numbers of markets closed for holidays. The MSCI Asia Pacific Index rose as much as 0.4%, on track for its third day of gains. Alibaba, Tencent and Meituan were among the top contributors to the regional benchmark’s advance, and helped push a gauge of Hong Kong-listed tech shares 2.5% higher; meanwhile an index of Hong Kong-listed Chinese stocks gained for the third day and entered a technical bull market after advancing 20% from a January low. Stocks fell in Tokyo as investors assessed the risk of further interest-rate hikes this year in Japan.

TSMC’s quarterly revenue grew at its fastest pace in more than a year, shoring up expectations that a global boom in artificial intelligence development is fueling demand for high-end chips and servers. The main chipmaker to Nvidia Corp. and Apple Inc. reported a better-than-expected 16% rise in March-quarter sales to about NT$592.6 billion ($18.5 billion), versus the NT$579.5 billion average projection.

European stocks are on course for their best day in almost three weeks with technology names leading after a positive update from TSMC. The main chipmaker to Nvidia and Apple reported a better-than-expected 16% rise in March-quarter sales. The Stoxx 600 is up 0.6%, with retail, bank, auto and mining shares also outperforming.

In FX, the Bloomberg Dollar Spot Index falls 0.1% while the kiwi sits atop the G-10 FX pile, rising 0.2% versus the greenback after a hawkish hold from the RBNZ. The NZD/USD rose 0.2% to 0.6069, gaining for a third day. Leverage sellers sold the spot at Tuesday’s 0.6077 high immediately after the rate decision, according to an Asia-based FX trader “NZD can remain supported and AUD/NZD may remain under a little downward pressure over the very near-term,” said Peter Dragicevich, a strategist at Corpay Solutions. “However, a change in the RBNZ’s viewpoint and bias looks to be a matter of time based on the weakness across the NZ economy and moderating inflation pressures.”

In rates, treasuries edge higher ahead of US inflation data due later on Wednesday, with 10-year yields falling 1bps to 4.35%, slightly outperforming gilts in the sector; curve spreads are likewise little changed, with price action limited ahead of CPI and 10-year note auction. US session also includes 10-year note reopening at 1pm, following soft reception for Tuesday’s 3-year note auction, and 2pm release of minutes of March FOMC meeting. WI 10-year yield at around 4.36% is ~19.5bp cheaper than last month’s result, a 0.9bp tail. The market set-up into CPI data appears to have favored short positions, posing risk of a squeeze in the event of benign readings.

In commodities, oil prices advance, with WTI rising 0.2% to trade near $85.40. Oil was steady following back-to-back losses after an industry report pointed to a gain in US crude stockpiles, although simmering tensions in the Middle East are expected to cap losses. Iron ore was near a two-week high following a 10% surge fueled by bets that a recent slump was overdone. Copper extended its rally to $9,500 a ton amid supply risks and a brightening outlook for demand. Prices have risen more than 10% on the London Metal Exchange this year, making copper one of the best-performing industrial metals. Finally, gold held a record high as investors positioned for the inflation data.

In crypto, Hong Kong is likely to approve spot Bitcoin ETFs next week and some launches could happen in April, according to Reuters sources.

Looking at today's calendar, the US economic data slate includes March CPI (8:30am), February wholesale inventories (10am) and March monthly budget statement (2pm). Fed speakers scheduled for the session include Bowman (8:45am) and Goolsbee and Barkin in a panel discussion at 12:45pm. And from other central banks, there’s a policy decision from the Bank of Canada, and we’ll get the FOMC minutes from the March meeting.

Market Snapshot

Top Overnight news

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed with some lacking conviction ahead of looming risk events, while there were also holiday closures in South Korea, Singapore, Malaysia, Philippines, Indonesia & Middle East. ASX 200 was led higher by outperformance in the mining and defensive sectors. Nikkei 225 remained subdued but was off worst levels following mixed PPI data. Hang Seng and Shanghai Comp. were mixed with Hong Kong boosted by tech after China's Cyberspace Administration said several firms including China Mobile, Alibaba, Huawei and Tencent completed the filing of large model AI services registration. However, the mainland declined amid a lack of fresh drivers and with the EU wanting to talk with China about unfair competitive conditions and over-capacity during German Chancellor Scholz's visit.

Top Asian News

European bourses firmer across the board, Stoxx 600 +0.5%, with the region playing catchup to the late-doors rally on Wall St. SMI +0.2% is firmer but is the incremental laggard amid losses in Novartis, also resulted in contained performance for Healthcare more broadly. DAX 40 +0.8% supported by sales metrics from numerous auto names, with Infineon benefitting from broader tech strength while Aurubis is assisted by tin pricing. Stateside, futures are essentially unchanged but with a very mild upward bias into US CPI; ES +0.1%, NQ +0.1%

Top European News

FX

Fixed Income

Commodities

Geopolitics Middle East

Geopolitics: Other

US Event Calendar

Central bank speakers

DB's Jim Reid concludes the overnight wrap

US Treasuries posted a strong rally ahead of today’s US CPI release for March, with the 10yr yield (-5.8bps) seeing its biggest daily decline in over two weeks. That meant yields came off their highs for the year on Monday, and this morning we’ve seen a further -0.8bps decline to 4.35%. Meanwhile for equities, the S&P 500 saw a late rally to post a modest gain (+0.14%), with the index finding a more stable footing after last week’s decline. Nevertheless, the S&P 500 has now gone 7 consecutive sessions without a new record, which is the longest period without an all-time high since January, back when the S&P 500 surpassed its 2022 peak. So it makes a change from the pattern of very strong gains over recent months, with the index currently on a run of 5 consecutive monthly gains since November.

Looking ahead to today, the US CPI print will be heavily in focus after the last two prints came in strongly. They showed core CPI running at a monthly +0.4% in both January and February, which has led to concern that inflation could end up remaining sticky above target levels. For now at least, the Fed haven’t sounded too concerned, and Fed Chair Powell said last week that “it is too soon to say whether the recent readings represent more than just a bump.” But today’s print will be crucial, as if there is a third strong reading, it would be increasingly difficult to explain that as just a temporary blip. A related point was made yesterday by Atlanta Fed President Bostic, one of the more hawkish FOMC voices. He reiterated that he only expects one rate cut this year. And when asked if the Fed might not cut at all this year, he said that “I can’t take off the possibility that the rate cuts may even have to move further out.”

In terms of what to expect today, our US economists are looking for headline CPI to be at a monthly +0.27%, with the year-on-year measure picking up two-tenths to +3.4%. Then for core CPI, they’re forecasting a monthly +0.24%, with the year-on-year measure declining to +3.7%. You can read their full preview here, along with how to sign up for their webinar discussing the report.

Ahead of the report, there were some signs that investor concern was easing about inflation, at least compared to the rise in recent days. For instance, the US 2yr inflation swap reached a peak of nearly 2.56% early in yesterday’s session, its highest since October, but was down to 2.53% at the close. That also coincided with a fall in oil prices, with Brent Crude (-1.06%) falling back for a second day and closing beneath $90/bbl again. Moreover, investors dialled up the probability that the Fed would still cut rates, with the probability of a cut by June moving up to 60%, having been at 52% the previous day.

With the slightly better inflation news, sovereign bonds experienced a strong rally on both sides of the Atlantic. In the US, that meant the 2yr and the 10yr Treasury yield both moved off their year-to-date high from the previous day, with the 2yr yield (-4.6bps) down to 4.74%, whilst the 10yr yield (-5.8bps) fell to 4.36%. However, the downtrend in yields ran out of steam after a soft 3-year Treasury auction, which saw $58bn of notes issued 2bps above the pre-sale yield, the largest tail in over a year. Over in Europe there were similar moves, and yields on 10yr bunds (-6.4bps), OATs (-6.3bps) and BTPs (-7.5bps) all moved lower.

Equities had looked on course for a weak session yesterday, with the S&P 500 trading half a percent down in the final hour of trading, but a late rally left the index up +0.14% by the close. Rate-sensitive sectors outperformed, with utilities up +0.55%, while cyclical sectors underperformed, with financials (-0.50%) and industrials (-0.22%) seeing declines. Both the NASDAQ (+0.32%) and the small-cap Russell 2000 (+0.34%) posted moderate advances. Most members of the Magnificent 7 (+0.20%) posted gains, but its gain was limited by a -2.04% decline for Nvidia on news of a new AI accelerator chip announced by Intel (+0.92%). Meanwhile in Europe, there were large declines, with the STOXX 600 (-0.61%), the DAX (-1.32%) and the CAC 40 (-0.86%) all falling back. Indeed, for the Dax, this was the weakest session in over three months.

Overnight in Asia, there have been losses across several indices, including the Nikkei (-0.32%), the CSI 300 (-0.43%) and the Shanghai Comp (-0.34%), whilst markets in South Korea are closed for a holiday. The main exception to this pattern has been the Hang Seng (+1.88%), with the index currently on track for its highest closing level since November.

In other news overnight, Fitch Ratings revised their outlook on China to negative, while keeping the rating at A+. Separately in New Zealand, the central bank maintained the Official Cash Rate at 5.5%, and their statement said that “A restrictive monetary policy stance remains necessary to further reduce capacity pressures and inflation.” And over in Japan, the PPI data for March came in at +0.8% year-on-year, in line with expectations, up from an upwardly revised +0.7% in February. That came as BoJ Governor Ueda said that “We won’t consider changing monetary policy at all to directly respond to moves in foreign exchange”.

Looking back at yesterday’s data, the ECB Bank Lending Survey for Q1 showed a continued turn in the bank credit cycle. Pockets of weakness were still evident, including a deterioration in demand for corporate loans, probably reflecting the rise in rates since the start of the year. But with banks expecting further normalisation in Q2, the BLS points to an improving cyclical picture in the euro area. That said, whether this improvement materialises may well depend on whether expectations of upcoming ECB rate cuts prove accurate.

Finally in the US, the NFIB’s small business optimism index fell to an 11-year low of 88.5 in March (vs. 89.9 expected). There were also signs of weakness elsewhere in the release, as the number of firms saying they planned to increase employment fell to a net +11%, the lowest since May 2020.

To the day ahead now, and the main data highlight will be the US CPI release for March. Otherwise, there’s Italian retail sales for February. And from central banks, there’s a policy decision from the Bank of Canada, and we’ll get the FOMC minutes from the March meeting.