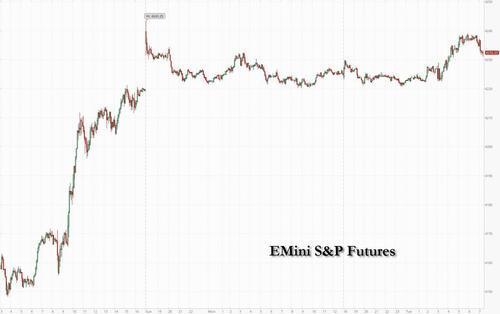

US stock futures levitated on Tuesday as euphoria over AI fueled a rally in chipmakers and tech stocks, while hopes that Congress will pass a debt accord to head off a default boosted risk sentiment, and sent the dollar and yields lower even as many warned that prospects of the debt ceiling deal - which we explained does not even cut real spending for one year - getting the necessary votes in Congress are "not that great right now." Contracts on the S&P 500 rose 0.6%, hitting a YTD high of 4238, while the Nasdaq was up 1.1%. Treasuries are continuing to rebound, with yields falling the most in the middle of the curve, as traders anticipate a deal over the debt ceiling. A measure of the dollar is weakening slightly, erasing earlier gains. Oil prices are dropping today while gold and bitcoin advance.

In premarket trading, Nvidia’s market value topped $1 trillion as it climbed more than 3% after CEO Jensen Huang unveiled several AI-related products and services. Other AI-related stocks also gained, including Advanced Micro Devices, Intel, Qualcomm and Meta Platforms; C3.ai rose +7%, while SoundHound AI bounce +5.9%.

Stocks linked to cryptocurrencies also rallied in premarket trading after Bitcoin climbed amid a boost to investor sentiment from a provisional deal on raising the US debt limit. Bit Digital +12%; Riot Platforms +6%. here are some other notable premarket movers:

Meanwhile, Treasury yields dropped across the curve as White House and Republican congressional leaders stepped up lobbying in support of a debt-ceiling deal. Yields on short-dated bills - the most at risk of a default extended declines from recent highs. A gauge of the dollar declined for a third day.

The clock is ticking as backers of the agreement have only a week to get it through Congress before a possible June 5 default - the so-called X Day. President Joe Biden has been personally calling lawmakers to support the bill, with a vote by the House likely Wednesday, before it goes to the Senate.

“Maybe the rally has a bit further to go but it’s more buy-on-rumor, sell-on-the-news,” said Cesar Perez Ruiz, chief investment officer of Pictet Wealth Management. “As from now, we will go back to looking at economy, inflation, plus the drain of liquidity as the Treasury General Account will need to be refilled.”

European stocks fluctuated, with the Stoxx 600 gaining 0.1%; technology, utilities and real estate are the best performing sectors. Nestle SA and Unilever Plc fell after both announced the appointment of new chief financial officers, underscoring a changing of the guard at consumer-goods companies as inflation pressures the industry. Euro-area government bonds got a boost from data showing inflation in Spain slowed more than expected in May.

Meanwhile, investors remain deeply pessimistic about China against a backdrop of disappointing economic data. The Hang Seng China Enterprises Index neared a bear market and the offshore yuan weakened past 7.1 per dollar for the first time since November. Oil declined amid concern about faltering demand. Other Asian markets were mixed and choppy:

In FX, the Bloomberg Dollar Spot Index is down 0.1%. The Japanese yen has been choppy as investors react to headlines related to a meeting of finance officials while the pound has emerged as the best performer among the G-10’s. The Turkish lira and South African Rand led declines in emerging market currencies on Tuesday while Nigeria’s dollar bonds rallied after President Bola Tinubu’s new road map on economic reforms.

In rates, cash treasuries rose on return from a long holiday weekend, with cash yields richer by 5bp to 7bp across the curve vs Friday’s close; US 10-year yields around 3.70%, richer by ~10bp vs Friday’s close amid hopes that debt ceiling turmoil has been resolved; belly of the curve outperforms slightly, dropping 2s5s30s fly by 3bp on the day; Germany and UK 10-year sectors lag by 3bp and 7.5bp vs Treasuries; bund futures rally after data showed Spanish inflation slowed more than expected in May. German 10-year yields are down 4bps while US 10-year borrowing costs drop 7bps.

In commodities, crude futures decline with WTI falling 1.8% to trade near $71.30. Spot gold is up 0.2% around $1,947. Bitcoin rises 0.6%.

Bitcoin is supported but remains capped by the USD 28k mark and has been in comparably narrow ranges vs broader market action.

Looking at today's econ calendar, we get the May Conference Board consumer confidence, Dallas Fed manufacturing activity, March Case Shiller/FHFA house price index, Q1 house price purchase index, Japan April job-to-applicant ratio, jobless rate, Italy April PPI, March industrial sales, Eurozone May services, industrial and economic confidence, April M3, Canada Q1 current account balance.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with price action mostly rangebound following the holiday closures in the US and the UK where cash markets have yet to react to the tentative debt ceiling agreement. ASX 200 was lacklustre amid losses in real estate and financials, while weak Building Approvals added to the glum mood. Nikkei 225 was choppy but remained above the 31,000 level after BoJ Governor Ueda reiterated a dovish message. Hang Seng and Shanghai Comp. were pressured as the Hang Seng China Enterprises Index entered bear market territory which added to the jitters from the already cautious mood heading into tomorrow’s PMI data.

Top Asian News

European bourses are mixed after a choppy morning, Euro Stoxx 50 +0.3%, with fresh fundamentals somewhat lacking but the region playing catchup and heading into month-end. Spain outperforms after the regions encouraging inflation metrics though political turmoil may return as PM Sanchez announces snap elections, IBEX 35 +0.6%. Stateside, futures are constructive but saw marked two-way action initially; this has since settled with NQ outperforming as NVDA +3.3% pre-market continues to gain following numerous AI-related updates and as it is on course for a USD 1tln cap. ES +0.5% and RTY +0.3% in-fitting with the above catchup play into month end and as the market takes stock of the debt ceiling deal; though, on this, there are still a number of deadlines in the near-term; newsquawk analysis above.

Top European News

Fx

Commodities

Geopolitics

US Event Calendar

Central Bank Spakers

• 13:00: Fed’s Barkin Speaks on Monetary Policy, Outlook

DB's Jim Reid concludes the overnight wrap

As both the UK and US were on holiday yesterday we'll do a quick guide to the week ahead this morning and also recap last week at the end as well as review a quiet start to the week and a debt ceiling deal that's starting to take shape. After watching the last ever episode of Succession last night, the shenanigans in Congress feel positively tame in comparison. I will miss my weekly glance into a family more dysfunctional than mine.

The latest on the debt ceiling is that a deal was hammered out between Biden and Republican House Speaker McCarthy over the weekend. It now has to clear both houses with the deadline tight ahead of June 5th, the very latest date that Treasury Secretary Janet Yellen has indicated the US can pay its bills. It seems the House will vote tomorrow with the Senate a bit later in the week. There's not much room for error but with moderates on both sides seemingly in line, then there can be a vocal minority on both sides against the deal and it still passes. We will see how lawmakers react as they come back from the holiday weekend. For now US stock futures are broadly positive with those tied to the S&P 500 (+0.20%) and NASDAQ 100 (+0.38%) grinding higher from Friday's close. Equities haven't really priced in much risk of failure over the last few weeks so the muted reaction to the positive news probably makes sense. The main reaction will be in the bills markets as liquidity builds as London opens. In Asia, yields on 10yr USTs (-4.1bps) have moved lower, trading at 3.758% as we go to press.

Asian equity markets are mostly lower this morning though with the Hang Seng (-0.77%) leading losses, reversing its opening gains while the Shanghai Composite (-0.71%), the CSI (-0.65%) and the Nikkei (-0.37%) are also weak. Elsewhere, the KOSPI (+0.75%) is bucking the regional trend after returning from a public holiday. In early morning data, Japan’s unemployment rate dropped for the first time in 3 months, easing slightly to 2.6% in April (v/s 2.7% expected) from March’s 2.8%.

In terms of the week ahead, all roads point to payrolls on Friday but with a few stop-offs and detours along the way. In particular we have the global PMIs/ISM on the first of the month (Thursday but with China tomorrow), European inflation (Germany, France and Italy on Thursday, Eurozone on Friday), and JOLTS data (Wednesday). The rest of the day-by-day calendar is at the end as usual. For the record our economists are expecting +200k on payrolls against a consensus of +190k and last month's +253k.

In thin markets yesterday, European equities traded relatively flat as the STOXX 600 edged -0.12% lower. The information technology sector relatively underperformed, falling by -0.57%. The semiconductor industry drove the losses (-0.70%) as the artificial intelligence excitement of last week eased a touch. Consumer discretionary and financials also underperformed, slipping -0.39% and -0.28% respectively.

News from the continent largely centred around the dissolution of parliament and surprise snap election called for by Spanish Prime Minister Pedro Sanchez after a series of losses for his party in local and regional elections on Sunday. The Spanish IBEX 35 fell notably in intraday trading before recovering to trade moderately down at -0.12%.

As more positive news on the debt ceiling came through, the ECB rate priced in by European overnight index swaps for December fell -2.1bps, and for the first time in five trading days, bringing the ECB’s implied rate for year-end to 3.762%. The rate priced in for October also fell back -3bps. European bonds rallied across the board. German 10yr bund yields fell -10.4bps to 2.43%, breaking a five-day streak of increases in their largest daily down move since the end of April. German 2yr yields slipped -6.2bps to 2.88% on Monday, likewise breaking five consecutive days of increases.

The European yield move reversed some of last week's price action. Although it seems a while ago now, there were some big moves last week that are now worth highlighting.

The week culminated in the US core PCE on Friday coming in above expectations, rising +0.4% month-on-month (vs +0.3% expected). In year-on-year terms this equated to an increase of 4.7% (vs 4.6% expected). Digging further into the details of the data release, consumption also beat estimates, at +0.8% (+0.5% expected) as did core durable goods shipments by +0.5% (vs +0.1% expected). Adding to this, core good orders significantly outperformed expectations, rising +1.4% (vs an expected -0.1%).

With inflation rising faster than expected and firmer data, markets increased bets that the Fed may hike further. The expected rate for the June meeting gained +11.5bps to 5.238% last week (and +2.3bp on Friday), pricing in a 61% chance for a 25bps hike. This being the highest expected rate since early March before the regional banking crisis. In fact, fed futures priced in a 95% chance of a hike by the July meeting. The rate for the December meeting rose a more dramatic +36.4bps in weekly terms (+4.0bps on Friday) to around 5%, its highest since the start of March.

Off the back of this, there was a weekly sell-off in sovereign bonds. US 10yr Treasury yields gained +12.6bps to 3.798% week-on-week (and -1.9bps on Friday), near their highest level since the first week of March. The interest-rate sensitive 2yr yield rose +2.9bps on Friday, and +29.6bps in weekly terms, its largest weekly increase since this time last year. 10yr bund yields mirrored US fixed income, gaining +11.0bps week-on-week (+1.6bps on Friday).

In equity markets, improving risk sentiment and hype around artificial intelligence saw major indices close up on the week, with the S&P 500 gaining +1.30% on Friday, and +0.32% week-on-week. The tech heavy NASDAQ strongly outperformed, rising +2.19% on Friday, with a tidy increase of +2.51% in weekly terms. The strong move on Friday followed an announcement from semiconductor firm Marvell Technology that they anticipated 2024 revenue to “at least double”. Shares for the firm gained +32.42% on Friday. This further added to the momentum of the artificial intelligence hype kickstarted by Nvidia’s strong earnings report on Wednesday, as Advanced Micro Devices and Nvidia, leaders in the discrete GPU chips market that are critical for large language models like ChatGPT, gained +5.55% and +2.54% on Friday and +20.04% and +24.57% week-on-week respectively.

The excitement translated to European equity markets, as ASML Holdings NV, a producer of advanced semiconductor manufacturing equipment, rose +6.01% week-on-week (and +4.52% on Friday). Overall, the STOXX 600 gained +1.15% on Friday but closed down -1.59% in weekly terms as negative risk sentiment weighed on markets earlier in the week.

Finally turning to commodity markets. With the positive news coming from the US, oil secured its second consecutive week of gains. Brent crude gained +1.81% to $76.95/bbl week-on-week (and +0.90% on Friday), and WTI crude climbed +1.57 % to $72.67/bbl (and +1.57% on Friday).