US equity futures jumped, rapidly approaching all time highs, while oil and the dollar tumbled on hopes the worst is over in the middle east, even as traders parse rapidly-changing headlines on Iran where the fragile ceasefire with Iran announced by President Donald Trump was promptly violated by both sides, sparking several angry outbursts by Trump this morning, starting with this one...

... followed by this:

... and Trump even dropped the F-bomb in frustration.

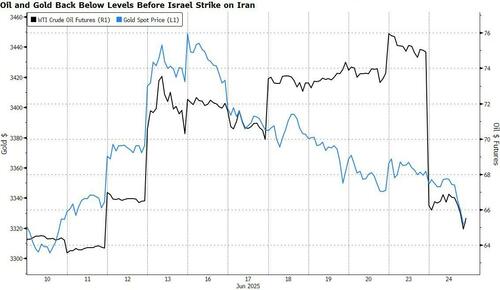

In any case, for now markets are giving the lack of a ceasefire the benefit of the doubt - after all Trump probably already printed hats commemorating the end of the "12 Day War", and as of 8:00am, S&P futures rose 0.8%, signaling a second day of gains, while Nasdaq 100 futures surged 1%, with all Mag7 stocks higher premarket led again by TSLA with semis and cyclicals ex-energy also higher. European stocks and Asian stocks also advanced. has plunged 15% from Monday’s intraday high, sliding an additional 5.6% on Tuesday as it fell below the level of June 12, the day before Israel began attacking Iran’s nuclear sites. The benchmark later pared some losses to trade above $69 a barrel after Israel reported a missile launch from Iran and instructed its military to respond; but for the most part oil has completely shrugged off reports that the ceasefire is obviously being violated. The dollar headed for its biggest drop since the outbreak of the conflict. The yield on 10-year Treasuries was little changed, as investors’ awaited the first day of Fed Chair Jerome Powell’s testimony before lawmakers on Tuesday (at 10am ET) which is adding fuel to the rally. The yield curve is twisting steeper as USD decline continues. Cmdtys are lower, dragged by Energy, but precious metals are under pressure. Today’s macro data focus is on housing prices, Consumer Confidence, and regional Fed activity indicators. Barring another escalation in the Middle East, focus will shift back to the Fed, with six speakers today including Powell.

In premarket trading,Mag7 stocks are all higher alongside index futures (Tesla +2.2%, Amazon +1.5%, Alphabet +1.2%, Apple +1.2%, Nvidia +0.9%, Meta +0.7%, Microsoft +0.6%). Tesla (TSLA) is outperforming fellow Magnificent 7 stocks in premarket trading on Tuesday, rising 2.2%, after launching its much-anticipated driverless taxi service to a handful of riders. Here are the other notable premarket movers:

In corporate news, Alphabet’s Google is set to face more scrutiny from the UK’s antitrust watchdog over its online search and advertising business. Starbucks said it’s not currently considering a full sale of its China business, disputing a report from Caixin Global that had sent the shares higher in late trading on Monday.

The rapid-fire sequence of events followed a turbulent stretch in financial markets, which have been roiled for nearly two weeks by fears of an escalating conflict. Volatility was particularly high in oil, as concerns over supply and shipping disruptions had pushed Brent crude to nearly $80 a barrel. However, the subsequent collapse in the price of Brent below $70 helped the narrative on inflation risk and, together with equity positioning that suggests investors are still on the sidelines, could create upside potential. Barring another escalation in the Middle East, focus will shift back to the Fed, with six speakers today including Powell.

“If the ceasefire holds – and there is no guarantee that it will - it will undoubtedly be greeted positively by markets as it will at the margin reduce uncertainty,” said Daniel Murray, chief executive officer of EFG Asset Management in Switzerland. Lower oil prices will reduce inflationary pressure and “also help support consumption trends and hence growth overall.”

The greenback slipped 0.4% against a basket of currencies as demand to hedge against higher oil prices receded.

“The US dollar was one of the key beneficiaries of the hostilities so it is now rolling over,” said Sean Callow, a senior analyst at InTouch Capital Markets. “Investors have been very keen to draw a line under the Israel-Iran conflict, choosing to leave aside any concerns over the path Iran might choose beyond the very short term.”

Elsewhere, Powell is due to testify before two committees in Washington this week amid ongoing pressure from Trump who said interest rates should be “at least two to three points lower.” Further geopolitical headlines might come from a two day NATO summit starting today in the Netherlands.

“We’re going to go back to the bigger picture, and that is to talk about tariffs and growth,” Mislav Matejka, head of global equity strategy at JPMorgan Chase & Co., told Bloomberg TV. “To believe that tariffs are fully digested and that inflation pickup will not happen whatsoever, i think that is premature.”

In Europe, the Stoxx 600 rose 1.4%, lifted by airline shares, as President Donald Trump said a ceasefire was in place between Iran and Israel, easing worries about a prolonged conflict. Energy and utility sectors are the only two in the red. Here are some of the biggest movers on Tuesday:

In FX, the Bloomberg Dollar Spot Index dropped 0.5% to a one-week low. The kiwi dollar is leading gains against the greenback, rising 1%.

In rates, treasuries mixed with the yield curve steeper in early US session. US front-end yields are more than 3bp lower on the day with long-end tenors little changed, leaving 2s10s and 5s30s spreads wider by 2bp-3bp, extending Monday’s move. 5s30s spread topped at 99.98bp, approaching year’s high 100.9bp, reached May 22. the 10-year is flat at 4.35%, outperforming bunds and gilts in the sector by 5bp and 1.5bp. European bond markets are broadly weaker on the day led by Germany, which announced plans to borrow about a fifth more than planned in the third quarter, spurring long-end-led selloff. Longer-dated bonds lead declines with German 30-year yields rising 10 bps to 3.06%. US 30-year borrowing costs also rise 2 bps to 4.90%. US shorter-dated yields fall. The Treasury auction cycle starts with $69 billion 2-year note sale at 1pm New York time and includes $70 billion 5-year Wednesday and $44 billion 7-year Thursday. WI 2-year yield near 3.82% is ~13.5bp richer thank last month’s, which stopped through by 1bp

In commodities, Brent crude futures fall over 3% to $69 a barrel after US President Donald Trump announced a ceasefire agreement between Israel and Iran had gone into effect. Oil prices pared losses briefly after Israel has accused Iran of breaching the ceasefire, while Tehran denied firing missiles at Israel after truce. Spot gold falls $49 to around $3,319/oz, and together with oil, was back below levels before the Israeli strike on Iran. Bitcoin rises 1.6% and above $105,000.

The US economic data slate includes June Philadelphia Fed non-manufacturing activity and 1Q current account balance (8:30am), April FHFA house price index and S&P CoreLogic home prices (9am), June Richmond Fed business conditions and consumer confidence (10am). Fed speakers include Hammack (9:15am), Powell (10am), Williams (12:30pm), Kashkari (1:45pm), Collins (2pm), Barr (4pm) and Schmid (8:15pm)

Market Snapshot

Top overnight news

Iran/Israel

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded firmer across the board with the region coat-tailing gains from Wall Street, which initially stemmed from Iran's "symbolic" strike on a US base in Qatar—de-escalatory in nature given the clear effort to minimise casualties and collateral damage. Sentiment was further boosted at the resumption of futures trading after US President Trump announced a ceasefire between Israel and Iran, although the Iranian Foreign Minister later clarified that there was no "agreement", but Iran would stop attacking if Israel also halts. ASX 200 was bolstered by most sectors, although energy producers and gold miners bore the brunt of the slide in oil and gold. Nikkei 225 gains and tested the 39k mark to the upside amid broader market optimism, although gains were somewhat capped by gradual JPY strength. Hang Seng and Shanghai Comp conformed to the broader tone across the market amid optimism surrounding the Israel-Iran ceasefire alongside the step-down in tensions with the US.

Top Asian News

European bourses (STOXX 600 +1.2%) opened entirely in the green and still trade at elevated levels, albeit have cooled a touch off peaks. Sentiment today has been boosted by US President Trump’s “complete and total ceasefire” announcement between Iran and Israel. Though this seems to have broken down only 4 hours after being in effect, with the IDF suggesting it had detected and intercepted fresh ballistic missiles from Iran. In response to this latest attack, the IDF Minister instructed the military to respond “forcefully” to Iran’s violation of the ceasefire. Iran has denied firing missiles at Israel after the ceasefire. Complex continues to remain buoyed. European sectors hold a strong positive bias, in-fitting with the positive risk-tone seen across markets. It comes as no surprise that Energy sits right at the foot of the pile, due to the latest slump in oil prices, following the latest ceasefire agreement. Travel & Leisure takes the top spot, lifted by lower oil prices and with airliners generally buoyed by the broader sentiment.

Top European News

FX

Fixed Income

Commodities

Geopolitics:

Iran's attack on US base in Qatar

Israel-Iran Ceasefire

Strikes since ceasefire announcement

After the ceasefire came into effect

Israel claims Iran has violated the ceasefire agreement

US Event Calendar

Central Banks (All Times ET):

DB's Jim Ried concludes the overnight wrap

Despite all the fears over the weekend, over the last 12 hours we've seen a pretty remarkable de-escalation of tensions in the Middle East. The best scorecard of this has been the price of oil which now trades just below $70/bbl, having opened at just over $80/bbl early yesterday morning in Asia. Brent crude (-7.18%) posted its biggest daily decline since 2022 and is subsequently trading another -2.56% lower this morning at $69.65/bbl, close to the levels before Israel’s strikes against Iran on June 13. Easing geopolitical concerns helped the S&P 500 rebound +0.96%, with futures another +0.55% higher overnight. Easing inflation fears supported bonds, with Treasuries also benefitting from more dovish Fedspeak, more on which later.

To recap developments, shortly after yesterday’s European market close, Iran launched missiles at a US air base in Qatar, but with the attack being well telegraphed and Qatar suspending air traffic shortly before. Markets soon rallied as it became apparent that Iran’s retaliation did not involve energy targets and was likely seeking to avoid any escalatory spiral with US, with reporting that Iran had warned Qatar ahead of the strikes. Later in the US afternoon, Trump posted that there were no casualties from Iran’s “very weak response” while also thanking Iran for “giving us early notice” of the strikes. This was followed by a surprise post by Trump at around 11pm London time last night claiming that Iran and Israel have agreed to a “Complete and Total CEASEFIRE (in approximately 6 hours from now, when Israel and Iran have wound down and completed their in progress, final missions!), for 12 hours, at which point the War will be considered, ENDED! Officially, Iran will start the CEASEFIRE and, upon the 12th Hour, Israel will start the CEASEFIRE and, upon the 24th Hour, an Official END to THE 12 DAY WAR will be saluted by the World."

As I write this around 6 hours after the post above, we are yet to hear formal confirmation on the ceasefire from Israel or Iran, with US media reporting that the ceasefire was brokered by Trump in direct conversation with Netanyahu". Iran’s foreign minister posted that Iran has “no intention to continue our response” if Israel stops its aggression but that “as of now, there is NO 'agreement' on any ceasefire or cessation of military operations”. So there are still outstanding questions, from whether a ceasefire will hold given that mutual strikes had continued overnight, to the future of what remains of Iran’s nuclear programme. But as things stand, the past 12 days look set to join the long list of geopolitical shocks that proved temporarily disruptive but had little lasting effect on markets.

Prior to those Middle East developments, the main new story of the day had been on the Fed, as rate cut speculation got further support after comments from Michelle Bowman, the Fed’s Vice Chair for Supervision. She commented how inflation had come in at or beneath expectations recently, and said “we should recognize that inflation appears to be on a sustained path toward 2 percent and that there will likely be only minimal impacts on overall core PCE inflation from changes to trade policy.” As such, she said that she’d support a rate cut as soon as the next meeting in late July, if “inflation pressures remain contained”. Those remarks meant futures dialled up the likelihood of a July rate cut, rising from 17% before the weekend to 23% by the close, while pricing of rate cut by September rose to 96%, its highest since mid-May. So that really heightens the importance of the next CPI report, as a 5th downside surprise in a row would really keep up the momentum for a rate cut. There has been talk about potential candidates for the Fed Chair role becoming more vocal around dovish thoughts if they believe in them given the President's very public view on what the Fed should do so this may be something to bear in mind in the weeks and months ahead. Powell's term ends in May 2026 but a replacement could be named very soon. Staying with all things Fed and rates related, today, we’ll see Fed Chair Powell appearing before the House Financial Services Committee, so it’ll be interesting to hear his thoughts too but this time the gap between this and last week's FOMC isn't large so new information may not be forthcoming.

With oil prices falling and markets pricing in more rate cuts, this proved good news for US Treasuries, with the 2yr yield down -4.5bps to 3.86% and the 10yr down -2.9bps to 4.35% and another -1.5bps lower overnight. That’s their lowest levels since May 7, before US and China announced a pause in the retaliatory tariffs. Rising rate cut expectations and easing geopolitical risks also drove a big turn around for the dollar, which had climbed by as much as three-quarters of a percent by European lunchtime, but ended the day -0.29% lower.

Another boost to markets yesterday came from the flash PMIs for June. They were broadly in line with expectations, but that cemented the narrative that the global economy was still holding up after Liberation Day, with no obvious signs of a deterioration, even with the 10% baseline tariffs that have been in place. That was echoed across the major economies, with the US composite PMI beating expectations at 52.8 (vs. 52.2 expected), whilst the Euro Area composite PMI held steady at 50.2 (vs. 50.4 expected). So both were still in expansionary territory, although France was an underperformer as its composite PMI fell back to 48.5 (vs. 49.3 expected), remaining in contractionary territory for a 10th consecutive month.

That backdrop proved supportive for US equities, though the impact of the data was dominated by volatility around the Middle East headlines. The S&P 500 had opened with a solid gain, reversed this as reports of imminent Iranian retaliation emerged, but then rallied to close around the day’s highs (+0.96%) to end a run of 3 consecutive declines. Tesla (+8.23%) was the strongest performer in the entire S&P after they launched their robotaxis over the weekend, which in turn helped the Magnificent 7 rise +1.58%. But the advance was pretty broad, with solid gains for the NASDAQ (+0.94%) and the small-cap Russell 2000 (+1.11%).

Over in Europe, markets didn’t perform quite as well. In large part that was as markets closed before the more sanguine news out of the Middle East and the big decline in oil played out, but also as European markets didn’t get as much of a benefit from the rate cut speculation centered on the Fed. So by the close, the STOXX 600 was down -0.28%, along with the DAX (-0.35%) and the CAC 40 (-0.69%). Moreover, the bond rally was also more subdued, with yields on 10yr bunds (-1.0bps), OATs (-1.4bps) and BTPs (-1.5bps) seeing smaller moves than Treasuries.

In Asia the mood is upbeat with the KOSPI (+2.78%) leading the gains led by a jump in index heavyweight Samsung Electronics. Elsewhere the Hang Seng (+1.93%), the CSI (+1.09%), the Shanghai Composite (+1.01%), the Nikkei (+1.07%) and the S&P/ASX 200 (+0.99%) are all experiencing major gains in early trade. S&P 500 (+0.55%) and NASDAQ 100 (+0.78%) futures are also higher.

Meanwhile, demand for Japan's 20-year bond auction was marginally below the average of the past year, despite the government's adjustments to its borrowing strategy. The bid-to-cover ratio came in at 3.11, stronger than from the last two auctions, but with many expecting a more positive outcome. The sale comes after the Finance Ministry yesterday approved a plan to reduce the volume of 20-, 30- and 40-year bonds sold in regular auctions by a total of ¥3.2 trillion ($22 billion) until the end of March 2026.

In response to the reduction in long-term funding, the ministry plans to enhance the issuance of shorter-term securities, which will include 2-year notes and six-month Treasury bills. These changes will be evident starting from the auctions next month.

To the day ahead now, and aside from Fed Chair Powell’s appearance before the House Financial Services Committee mentioned above, there will be attention on the annual NATO summit being held in the Hague today and tomorrow. This is expected to confirm a 5% of GDP spending target, including 3.5% on core defence spending, up from 2% before. Our European economists have previewed the summit and its fiscal implications here. Today Germany is also set to unveil its spending plan, with reporting yesterday that this will aim for an increase in core defence spending to 3.5% of GDP in 2029 and amount to a pretty speedy ramp up in spending already in 2025.

Other events today include central bank speak from the Fed’s Hamack, Williams, Kashkari, Collins, Barr and Schmid, ECB Vice President de Guindos, the ECB’s Kazimir and Lane, BoE Governor Bailey, and the BoE’s Greene, Ramsden, Pill and Breeden. Data releases include US Conference Board’s consumer confidence for June in the US, the Ifo’s business climate indicator for June in Germany, and Canada’s CPI for May. Finally, the NATO summit will begin.