US equity futures pointed to a strong end to the week, as a premarket surge in Broadcom powered gains across the entire chip and tech complex, even as European bourses dipped and Asian markets took it on the chin after the latest Chinese stimulus disappointment. As of 8:00am S&P500 futs gained 0.4%, and Nasdaq 100 futures rose 0.7%, with shares in Broadcom surging 15% after it predicted a 65% increase in sales of AI chips in the fiscal first qtr; if gains holds, the stock will hit a record high, inching closer to a $1 trillion market cap. Peers Marvell, Micron, Nvidia and Advanced Micro Devices also rose. US 10Y yields gained 3bps rising to 4.35%, highest since Nov. 25; the dollar reversed earlier gains with the euro bouncing after Macron named centrist Bayou as the new French PM. Crude oil futures rose to a weekly high. On tap today we have US Import/Export prices (8:30am ET), Eurozone + UK Industrial production, Japan Industrial production

In premarket trading, Broadcom surged 18% after the chip supplier for Apple Inc. and other big tech companies predicted a boom in demand for its artificial intelligence chips. Costco shares also rose in premarket trading after the retailer reported first-quarter earnings per share that came in ahead of consensus estimates. TD Cowen noted that newness, quality and value are resonating strongly with US consumers. Here are some other notable premarket movers:

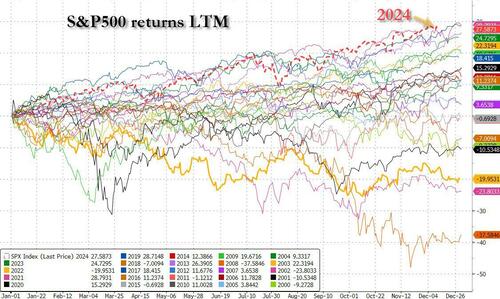

Stock markets are likely to extend their gains into next week, when the Fed is priced to deliver another quarter-point reduction. The S&P 500 has rallied 27% this year, and strategists polled by Bloomberg predict it will outpace European peers again in 2025. As of today, the S&P is on pace for the best full-year return this century.

"You have a US economy which is doing well and an incoming administration that is very pro-corporate — all that is in the price, but it doesn’t mean the rally can’t extend,” said Timothy Graf, head of EMEA macro strategy at State Street Global Markets.

Unlike the US where every day is a meltup, Europe’s Stoxx 600 index traded down 0.3% near session lows amid continued disappointment over the lack of concrete stimulus measures from China. Miners provided a drag, tracking iron ore futures lower after China’s Central Economic Work Conference seemed to underwhelm investors. Insurer Munich Re was a notable gainer after it forecast a net income boost next year. Here are the biggest movers Friday:

Earlier in the session, Asian shares fell led by losses in China after authorities again left investors waiting on the specifics of the fiscal stimulus even as their key policy meeting produced a vow to boost consumption. The MSCI Asia Pacific Index fell as much as 1.1%, the most in a month. Tencent, Meituan and Sony were among the biggest drags. Japanese gauges fell, while South Korean shares gained for a fourth day. Chinese stocks declined as traders parsed comments from the annual Central Economic Work Conference. Authorities vowed to raise China’s fiscal deficit target next year, and made “lifting consumption vigorously” and stimulating overall domestic demand their top priority. Retail sales data due next week will help shed light on the state of China’s economy. The week ahead is also packed with monetary policy decisions from the Federal Reserve as well as central banks in Japan, Indonesia, Thailand, Philippines and Taiwan.

“The market may have some hope that the CEWC would give more details on consumption stimulus and property inventory clearance packages, but it turned out a bit disappointing,” said Jason Chan, senior investment strategist at Bank of East Asia. “Investors may need to wait for more fiscal policy rollout in the first quarter, also the ‘Two Sessions’ held in March.”

A gauge of world stocks is headed for the worst week in nearly a month. “The newsflow has been underwhelming,” Beata Manthey, head of European equity strategy at Citigroup Inc., said of announcements from China. “The markets want numbers. We didn’t get the numbers.” However, Chinese 10-year government bond yields slid below 1.8% for the first time in history, as authorities vowed to cut policy rates and banks’ reserve ratios.

In FX, the dollar was steady against a basket of currencies, reversing earlier gains as the euro rebounded, but was still on track for a second straight week of gains. The pound weakened after Britain’s economy unexpectedly contracted for a second straight month in October. The euro strengthened after the ECB sounded less dovish on rates than some expected after its policy announcement Thursday and forcing traders to pared policy-easing bets for next year; it moved even higher after French PM Macron named centrist Bayrou as the new French PM. The yen is the weakest of the G-10 currencies, falling 0.5% against the greenback as traders bet that the Bank of Japan will keep interest rates unchanged next week, just as we warned.

In rates, treasuries are again cheaper across the curve, tracking bigger losses in European rates. The US yield curve steepening trend stalls following five straight increases in the 5s30s spread. US yields are 2bp-3bp cheaper across maturities with 10-year around 4.35%, highest since Nov. 25 outperforming German 10-year by ~2bp; major curve spreads are within 1bp of Thursday’s close. Bunds underperform their European peers, with German 10-year yields rising 3 bps to 2.23%. Gilts have been supported by soft GDP data from the UK while the surprise monthly economic contraction in October also weighs on the pound. IG issuance calendar empty so far. Gilts outperform after soft UK GDP data, which also weighed on the pound.

Graf of State Street expects more gains for the dollar, noting that the Fed’s easing cycle could prove shallow relative to Europe, where economic growth is weaker. Swap markets aren’t pricing a cut from the Bank of England at next week’s meeting, despite Friday’s weak data.

In commodities, oil prices advanced again, with WTI rising 0.8% to $70.60; Brent crude up 3.5% this week on the prospect for tighter US sanctions against Iran and Russia. Spot gold falls $12 to $2,668/oz.

US economic data calendar includes November import and export price indexes at 8:30am.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded lower across the board following a similar session on Wall Street after the hot US PPI, whilst sentiment in Asia-Pacific was somewhat hampered as participants digested the disappointing release from the Chinese Economic Work Conference. ASX 200 was pressured by the metals sectors, namely gold miners, after the recent slide in the yellow metal as the Buck ramped up. Nikkei 225 pulled back further under 40,000, failed to benefit from a softer JPY and largely overlooked higher-than-expected optimism among large Japanese manufacturers from the BoJ's Tankan Survey. Hang Seng and Shanghai Comp were both softer as traders digested the release from the Chinese Economic Work Conference, which overall seems like a disappointment as it offered little in terms of details whilst reaffirming the recent policy shift.

Top Asian News

European bourses began the European session on a modestly mixed footing, but soon after the cash open then lifted to session highs to display a positive picture in Europe. European sectors are mixed vs initially opening with a slight negative bias. Autos is towards the top of the pile, continuing to build on the gains seen in the prior session. Insurance follows closely behind, buoyed by gains in Swiss Re and Munich Re. Healthcare lags alongside losses in Basic Resources. US equity futures are entirely in the green, with clear outperformance in the tech-heavy NQ after Broadcom (+14%) shoots higher following a strong earnings report. Broadcom (AVGO) reported Q4 adj. EPS of 1.42 (exp. 1.39), and Q4 adj. net revenue of USD 14.05bln (exp. 14.1bln). Raised quarterly dividend +11% to 0.59/shr. Q4 semiconductor solutions revenue USD 8.23bln (exp. 8.05bln). Exec sees Q1 AI revenue growth of 65%, and expects momentum in AI connectivity to be as strong. +15% pre-market

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

We had the London FIC and Macro Research Xmas Party last night and I hope none of my colleagues will be offended if I say it was a relatively tame but pleasant affair and very different to the ones of my early years in banking. However, it wasn't without shock as after having known him for more than ten years I learnt for the first time that my colleague Luke represented Australia in his specialist discipline. I'll keep you guessing what that was in and reveal the answer at the end.

Markets have lost a little poise over the last 24 hours, as the combination of underwhelming data and comments from ECB President Lagarde led to a cross-asset sell-off. That was most evident among sovereign bonds, and there was disappointment that the ECB didn’t take an even more dovish tone, not least after Lagarde said that inflation risks were “two-sided”. On top of that, the US PPI inflation reading surprised on the upside, even if core and the components that feed directly into core PCE were a touch softer. However, the year-on-year rate rose above 3% again for the first time since early 2023. So that led to a bit more doubt about how fast any rate cuts would be next year (remember DB think none after next week), and the S&P 500 also ended the day -0.54% lower. Although the S&P 500 is only -0.64% beneath its record high, yesterday was the ninth day in a row that more constituents fell than rose in the index, the longest such run since 2001, a fairly stunning stat. So ex-tech, the market is losing some momentum even if the aggregate moves are still small.

Starting with the ECB, the headline decision was much as expected, with a 25bp cut that took the deposit rate down to 3%. Moreover, the statement had some dovish shifts, as it dropped the language about keeping rates “sufficiently restrictive” to get inflation back to target. That was supported by the latest economic forecasts, which saw growth and inflation both downgraded over the years ahead. For instance, they now see growth in 2025 at just 1.1%, down two-tenths from last quarter, whilst the 2026 number was also revised a tenth lower to 1.4%. Meanwhile on inflation, they now expect headline inflation to fall to 2.1% in 2025, down a tenth from before, before falling to 1.9% in 2026.

But in spite of those seemingly dovish elements, European sovereign bonds saw a heavy sell-off yesterday. Indeed, yields on 10yr bunds (+7.8bps), OATs (+9.8bps) and BTPs (+15.9bps) all moved sharply higher. That sell-off began as Lagarde’s Q&A comments did little to follow through on the dovish points in the statement or the forecasts, and avoided getting drawn on the size and speed of future cuts. So while the direction of travel towards lower rates is clear, these comments cast doubt on how aggressively the ECB would actually cut rates next year. That said, our European economists see the latest ECB signal as consistent with maximal optionality and continue to see the risk of larger 50bp cuts, although the bar for such a move at the next meeting in January feels high. Given their expectation of below-trend growth and below-target inflation, our economists maintain a baseline of a below-neutral 1.50% terminal rate by end-2025. See their full reaction piece here.

Whilst the ECB provided the main attention yesterday, there were a couple of US data prints that also disappointed investors. In particular, the PPI reading for November came in on the upside, which added to the sense that inflation was still lingering in a zone that would make it difficult to cut rates much further. For instance, the monthly headline PPI was running at +0.4% (vs. +0.2% expected), and the previous month’s reading was revised up a tenth to +0.3%. In turn, that pushed the year-on-year reading up to +3.0% (vs. +2.6% expected). However, the upside PPI surprise was in part due to one-offs (notably egg prices of all things), and with some respite from categories that feed into PCE inflation (which the Fed targets). These were on the weaker side alongside core PPI which printed at +0.1% MoM, below the +0.2% expected. So on paper, that still gives the Fed space to cut rates at next week’s meeting, even if the moves beyond that are in more doubt. In my opinion, there’s enough concern on inflation not to cut next week, but the Fed doesn’t like to provide big surprises to markets this close to the event, and with investors now pricing a 96% chance of a cut, the Fed would have to act astonishingly out of character to not do so.

The other release of potential concern were the weekly jobless claims, which saw initial claims at 242k over the week ending December 7 (vs. 220k expected), above every economist’s expectation on Bloomberg. Continuing claims for the previous week also surprised to the upside (1886k vs 1877k expected), though data may have been distorted by seasonal factors post-Thanksgiving. And while Treasuries initially rallied following the US data, the bond sell-off that has dominated so far this week resumed as the day wore on. By the close, 2yr (+3.9bps) and 10yr yields (+5.7bps) both posted a fourth consecutive increase to 4.19% and 4.33%, respectively. This leaves 10yr yields on course for their biggest weekly rise since early October (+17.5bps so far).

For equities it was also an underwhelming session yesterday. This was most visible in the US, where the S&P 500 was down -0.54%, and the small-cap Russell 2000 fell by a larger -1.38%. The tech megacaps also suffered from the downbeat mood, with the Magnificent 7 (-0.71%) reversing some of its +3.09% gain the previous day. As mentioned at the top, the number of decliners outpaced the advancers for a ninth consecutive session. Meanwhile in Europe, the losses were more marginal with the STOXX 600 down -0.14% and several indices posting modest gains, as the DAX (+0.13%) just about moved up to a new record.

Elsewhere in Europe, Swiss bonds outperformed after the Swiss National Bank delivered a 50bp rate cut yesterday. That came as something of a surprise, as both market pricing and the consensus of economists had leant towards a 25bp move as more likely. So there was a decent market reaction, which left the country’s 10yr yields down -0.7bps on the day, in contrast to the sizeable moves higher across the rest of Europe. In addition, the Swiss franc weakened by -0.37% against the US Dollar.

Overnight in Asia, equity markets are mostly sliding after the readout from China’s Central Economic Work Conference (CEWC) didn’t have much new policy details. That’s meant Chinese equities are underperforming, with the CSI 300 (-1.67%) and the Shanghai Comp (-1.36%) both losing ground, and the Hang Seng is also down -1.66%. Elsewhere, the Nikkei (-0.91%) is also trading noticeably lower, along with Australia’s S&P/ASX 200 (-0.41%). The one exception to this pattern is the KOSPI (+0.43%), and looking forward, US equity futures are pointing to a modest recovery, with those on the S&P 500 (+0.07%) and NASDAQ 100 (+0.28%) trading higher.

There was also a significant milestone in Chinese bond markets, as the 10yr government bond yield fell beneath 1.8% for the first time ever. That continues the downward momentum in Chinese yields over recent months, and the country’s 30yr yields are already trading beneath Japan’s 30yr yields.

In terms of data overnight, the Bank of Japan’s quarterly Tankan report showed that sentiment among the biggest Japanese manufacturers moved up to 14 in Q4, which was the highest reading since Q1 2022. However, the index for large non-manufacturers ticked down a point from last quarter to 33. In the meantime, the Japanese yen (-0.23%) is on track to weaken for a fifth consecutive session, and is currently trading at 152.97 against the dollar, its weakest since November 26.

To the day ahead now, and data releases include UK GDP for October and Euro Area industrial production for October. Meanwhile from central banks, we’ll hear from the ECB’s Villeroy, Holzmann and Centeno.