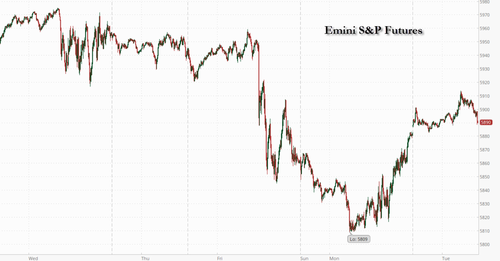

Global stocks and US futures jumped and the dollar slumped after a Bloomberg report that Trump’s incoming economic team is considering a gradual ramp-up in trade tariffs in a strategy that could avert a crippling spike in inflation and which JPM called "more scalpel than broad sword approach which the market seems to like." With bond yields flat and USD weaker, as of 7:30am S&P futures are 0.3% higher and Nasdaq 100 futures gained 0.6%, and on track to snap a two-day run of losses, as all Mag7 names advanced in premarket trading, with Nvidia and Tesla up more than 2%. European bourses were green across the board, and Asian markets also bounced while emerging markets emerged from their worst start to a year since 2016. In short, until and unless Trump denies the Bloomberg report, it appears to be a broad-based rally today, into PPI and tomorrow's CPI. Commodities are seeing some profit-taking today with Ags/Energy lower, but Metals still bid up. Today’s macro data focus includes NFIB Small Biz Optimism, PPI, Federal Budget Balance, and 2x Fedspeakers.

Similar to a WaPo report last week, Bloomberg News quoted "people familiar with the matter" as saying graduated tariff hikes of about 2% to 5% a month are under discussion, rather than aggressive one-time increases. “A slower and steadier tariff approach would perhaps remove a degree of upside inflation risk and a degree of downside growth risk, so everyone is getting cautiously optimistic again,” said Pepperstone strategist Michael Brown, who however correctly cautioned that Trump has previously dismissed any suggestions of a more moderate tariff strategy. “That’s perhaps why we are seeing some of the initial optimism fade a little bit,” he said.

The Bloomberg report knocked the dollar index lower after five straight days of gains, while global bond markets steadied after a sharp run-up in borrowing costs in recent days. However, an earlier drop in 10-year Treasury yields subsided, keeping borrowing costs near the October 2023 highs hit Monday after traders slashed bets on Federal Reserve interest-rate cuts.

The latest word on tariffs comes at a time when markets are increasingly fearful of an inflation resurgence that prevents central banks, especially the Fed, from cutting rates as much as expected earlier. According to a majority (but not all) market participants, Trump's policies, including mass deportations and higher trade levies, would lead to higher inflation. The flipside of course is that a trade war would lead to a global economic slowdown which would lead to rapid rate cuts, something which apparently nobody is considering. Inflation fears make this week’s US inflation data all the more crucial, especially if it signals the disinflation trajectory had already stalled at the end of last year. Producer inflation is due later Tuesday, followed by a CPI report on Wednesday, and December retail sales numbers that could confirm robust holiday-season spending.

Focus is also turning to the US corporate earnings season, with banks including Citigroup Inc., JPMorgan and Goldman reporting on Wednesday. Fourth-quarter earnings-per-share on the S&P 500 is expected to climb 7.3% from the year-earlier period, according to Bloomberg. Despite the solid growth, recent losses on the S&P 500 have wiped out its 2025 gains, with sentiment also hurt by the prospect of sweeping new limits on the sale of advanced AI chips by Nvidia.

“There’s been a swing back from the exuberance of the Trump election,” said Raphael Thuin, head of capital market strategies at Tikehau Capital in Paris. “The market is hoping for the upcoming earnings season to provide some reassurance.”

According to multiple reports, Chinese officials weighing an option that involves Elon Musk acquiring the US operations of TikTok if the company fails to fend off a ban. In other news, Donald Trump and Joe Biden both said they are optimistic a ceasefire between Israel and Hamas could be agreed within days, pausing the devastating war in Gaza.

In Europe, the Stoxx 600 index gained 0.5%, led by auto, technology and bank stocks. French stocks outperformed, receiving an additional boost from the possibility of a political agreement that could prevent a government collapse. Among individual stocks, oil stock BP falls after the company flags broad weakness across its business. Ocado soars on a strong retail update and chocolatier Lindt gains on firm margins. Here are some of the biggest movers on Tuesday:

Earlier, Asian markets rebounded with Chinese equities leading gains as news that US President-elect Donald Trump’s team is considering taking a gradual approach to raising tariffs buoyed sentiment. The MSCI China Index snapped a six-day losing streak, climbing more than 2.7%, its best return in a month, as the nation’s top securities regulator said it will work on building a mechanism to stabilize the market. More broadly, the MSCI Asia Pacific Index rose as much as 0.6%, with Tencent and Meituan among the top contributors to its advance. Equities in India also rebounded following a selloff in the previous session. Still, the Asian benchmark’s advance was held back by losses in Japanese chip-related companies after new US restrictions on semiconductor exports fueled caution toward the sector. Japanese shares closed at their lowest level since November 2024.

In rates, treasuries are steady ahead of US producer price data, with 10-year yields steady at 4.78% while 5s30s spread is steeper by ~1.3bp. Gilts gapped higher at the open before reversing gains with UK 10-year borrowing costs now unchanged at 4.88%. The French-German 10-year yield spread narrowed slightly after the Socialist party head said they may be nearing an agreement with the government. US session includes December PPI data, and another heavy slate of investment-grade corporate bond offerings is expected.

In FX, the yen is the weakest of the G-10 currencies, falling 0.3% against the greenback. The pound isn’t far behind with a 0.2% drop. The Bloomberg Dollar Spot Index saw choppy price action after Bloomberg report that Trump’s economic team is discussing a gradual approach to tariffs, increasing by 2%-5% per month, to boost negotiating leverage and avoid inflation

In commodities, WTI falls 0.7% to $78.30 as traders monitor the prospect of a cease-fire deal between Israel and Hamas. Spot gold is steady near $2,666/oz. Bitcoin rises above $96,000.

Looking at today's calendar, US economic data calendar includes December PPI (8:30am) and federal budget balance (2pm). Fed speaker slate includes Schmid (10am) and Williams (3:05pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the similar performance stateside where price action was choppy as most indices attempted to nurse post-NFP losses although the Nasdaq remained pressured on tech weakness, while Japanese stocks were heavily pressured on return from the long weekend. ASX 200 gained with outperformance in the commodity-related sectors but with the upside capped after weak consumer confidence data. Nikkei 225 slumped as it took its first opportunity to react to the post-NFP higher yield environment and last week's source reports of the BoJ mulling a rate decision for its meeting next week, while comments from BoJ Deputy Governor Himino also suggested the upcoming meeting is live. Hang Seng and Shanghai Comp outperformed despite the recent announcement by US and allies of new controls on AI chips, with participants awaiting the PBoC and FX regulator's looming briefing on financial support for the economy, while there was also a report that the Trump team is studying gradual month-by-month tariff hikes of 2%-5%.

Top Asian News

European bourses began the morning on a strong footing, Euro Stoxx 50 +1.0%, and continued to gradually edge higher as the morning progressed; indices generally reside just off session highs. Positivity today stems from Bloomberg reports that the Trump team is looking at gradual tariff hikes month-by-month of 2-5%. European sectors hold a strong positive bias, with only a few industries residing in negative territory. Autos takes the top spot, closely followed by Technology; the pair benefiting from reports of a “gradual” Trump tariff hike. Retail is underperforming today, pressured by post-earning results from JD Sports, which cut FY25 guidance; although, Ocado’s update was much more positive, but unable to prop up the sector. Energy is also on the backfoot today. BP (BP/ LN) Q4 Trading Statement (USD): Q4 impairment 1.0-2.0bln; oil trading result is expected to be weak; now expects other businesses & corporate underlying annual charge to be around 0.6bln (vs prev. view of 0.3-0.4bln) amid FX rates. Upstream production in Q4 is expected to be lower Q/Q, with production lower in oil production & operations and in gas & low carbon energy. UK CMA is to investigate Alphabet's (GOOGL) Google search services, to be completed within nine-months.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Russia-Ukraine

Geopolitics: Other

US Event calendar

DB's Jim Reid concludes the overnight wrap

The global bond selloff and tariff policies of the incoming Trump administration have again been the key market themes over the last 24 hours. Yields reached new highs yesterday, with 10yr Treasury yields up another +2.0bps to 4.78%, their highest since October 2023, while here in the UK 30yr yields again reached post-1998 highs. The market focus shifted towards trade yesterday evening, with a Bloomberg report suggesting that Trump’s economic team were discussing a “gradual approach” to tariff increases. This is driving a risk-on mood overnight even if you could read the story as being hawkish (see below). Before the story broke, US equities had already managed to shrug off the pressure from rates as the S&P 500 closed +0.16% higher, reversing a near -1% initial decline that saw the index trade below its pre-election day levels intra-day.

Starting with the tariff story, Bloomberg reported that Trump’s team are discussing slowly ramping up tariffs month by month to boost negotiating leverage. An increase in tariffs by 2% to 5% per month using authority under the International Emergency Economic Powers Act (IEEPA) is one reported option, with the plans still in the early stage. A lasting rise in tariffs at such a pace would be hardly trivial and the IEEPA route can arguably be used more quickly than the trade instruments used during Trump’s first term, so it is not obvious that this scenario would be all that sanguine. However the market has latched on the gradual and incremental element rather than the potential build up of tariffs and the potential end game. The dollar index has moved -0.35% lower overnight, while S&P and NASDAQ equity futures are trading +0.25% and +0.40% higher. Chinese equities are strongly outperforming overnight.

Treasury yields are trading around -1.8bps lower in Asia this morning, after a similar modest decline in the final 20 minutes of the US session yesterday as Bloomberg’s tariff story came out. But prior to this, bonds had lost yet more ground, which was in part an ongoing reaction to Friday’s US jobs report, but also reflected new concerns about persistent inflation. One driver was a fresh rise in oil prices as markets continued to digest Friday’s new sanctions against Russian oil, with Brent crude (+1.57% to $81.01/bbl) closing at its highest since August. Another was the NY Fed consumer survey, which saw median 3yr inflation expectations rise from 2.6% to 3.0%. So it felt like the newsflow was all moving in the same inflationary direction, which helped push 10yr breakevens up +2.1bps to 2.47%, their highest since October 2023. At the same time, long end real yields inched up, and the 30yr real yield (+0.3bps) hit a post-2008 high yesterday of 2.59%, so we’re in territory we haven’t seen for a very long time now.

The bond market mini-meltdown and inflation concerns have magnified the focus on tomorrow’s CPI report, as another upside surprise would further cement doubts that the Fed will be cutting rates anytime soon. We’ll start to get a better idea about the inflation picture today, as the PPI report is coming out a day before the CPI numbers this month. In terms of what to expect, our US economists are looking for headline PPI to come in at +0.4% in December, the same pace as in November. But the main focus will be on several components that feed into the PCE measure of inflation that the Fed officially target, which are health care services, airfares and portfolio management. So those will be the categories in focus when it comes to how the Fed might be thinking about future rate cuts.

Even though US Treasuries have been the primary focus given their importance as a global benchmark, the UK has seen some of the most severe losses, and yesterday saw those continue across multiple asset classes. In particular, the 10yr gilt yield (+4.7bps) was up to another post-2008 high of 4.88%, and the 30yr yield (+3.1bps) was at a post-1998 high of 5.43%. In both cases, that’s the 6th consecutive day they’ve moved higher, and the rise in yields means the government is at increasing risk of breaching its fiscal rules without fresh tax rises or spending cuts. There wasn’t much respite for the pound sterling either, which was down another -0.27% against the US Dollar to $1.2174. And it’s clear that investors remain bearish in the near term, as one-week risk reversals for sterling against the dollar show that sentiment hasn’t been this bearish since November 2022, in the aftermath of Liz Truss’ premiership. The next focal point will be the UK CPI report tomorrow morning.

The rest of Europe had a similar experience, with yields on 10yr bunds (+1.9bps), OATs (+3.1bps) and BTPs (+5.4bps) all moving to their highest levels in months. And the euro continued to lose ground yesterday, weakening -0.25% to $1.0218, its lowest level since November 2022. Sentiment wasn’t helped by a fresh rise in natural gas futures yesterday, which ticked back up by +6.72%, reversing the bulk of last week’s decline. In part, that was a reaction to the latest US sanctions on Russia, but the moves also come amidst cold winter temperatures, and European gas storage is currently at a 3-year low for this time of year.

Turning to equities, and as discussed at the top, the S&P 500 (+0.16%) recovered into the close after being weak most of the session. The recovery came thanks to a broad-based advance that saw three quarters of the S&P constituents move higher on the day, with energy (+2.25%), materials (+2.22%) and banks (+1.31%) leading the way. This outweighed losses for the Magnificent 7 (-0.40%), which lost ground for a 4th consecutive session, led by a -1.97% decline for Nvidia after the White House announced new restrictions on exports of AI chips. So some reversal of the trend we’d seen since the US election that has seen the Mag-7 up +13.44% post the vote, while the equal weighted S&P (-2.22%) and the Russell 2000 (-2.94%) are both lower.

Despite yesterday’s turnaround, the major US equity indices all remain down YTD, including the S&P 500 (-0.77%), NASDAQ (-1.15%) and Russell 2000 (-1.60%). To be fair though, several recent years have been considerably worse than 2025 so far. For instance in 2022, the S&P 500 was already down -2.25% by January 13th, and in 2016 it was down by a sizeable -7.52%. So it’s not a particularly big loss by the standards of the last decade. Recent Januarys have tended to be weaker than the long-term seasonal norms without having as much influence on full year returns as the January effect has done in the past. Indeed, over the last two decades the S&P 500 has lost ground in 10 out of 20 Januarys, more than any other month.

By contrast, in Europe the STOXX 600 (-0.55%) lost ground yesterday, closing before the late US rally, but it remains in positive territory for 2025 still, with a +0.21% YTD performance.

Asian equity markets are mostly trading higher with the CSI (+2.15%) and the Shanghai Composite (+2.05%) marching ahead followed by the Hang Seng (+1.76%). The KOSPI (+0.38%) and the S&P/ASX 200 (+0.48%) are also seeing gains. On the other side of the ledger, the Nikkei (-1.86%) is sliding after returning from a holiday.

In central banks news, BOJ’s Deputy Governor Ryozo Himino signalled the possibility of an interest rate hike next week. He stated that the board will be debating whether to raise interest rates while adding that there are risks both at home and abroad that require attention. Meanwhile, the global government bond sell-off has spread to Japan after their day off yesterday with yields on the 40yr JGB’s hitting 2.755%, its highest level since its inception in 2007 while the 20yr yield touched its highest level since May 2011. The 10yr JGB yield is +5.1bps higher trading at 1.24%, also its highest since May 2011.

To the day ahead now, and data releases from the US include PPI inflation for December, along with the NFIB’s small business optimism index for December. Meanwhile in Europe, there’s Italy’s industrial production for November. Otherwise, central bank speakers include the ECB’s Lane and Holzmann, the Fed’s Schmid and Williams, and the BoE’s Breeden.