US stock futures reversed a sharp two-day selloff as traders waited to see if Fed Chair Jerome Powell will continue to push back against the prospect of speedy interest-rate cuts during his testimony to the House Financial Services Committee. As of 8:00am, S&P futures rose 0.3%, while contracts on the Nasdaq 100 added 0.8% as tech names rebounded following Tuesday’s 1.7% drop for the Nasdaq Composite; all of the Mag7 names are higher pre-mkt with additional strength in aemis where AVGO/MRVL are up 2.6% and 3.3% pre-mkt (both report earnings tomorrow). According to JPM, "we appear to be set up for a relief rally but given recent dips being bought and markets higher over the next 2-3 sessions it begs the question of whether yesterday was the pullback." Bond yields are flat to up 1bp, and the dollar is being sold. The commodity complex is mixed with Energy higher, Metals lower, and Ags mixed. Bitcoin has staged a powerful rebound and recovered most of yesterday's post-all time high losses. Today’s macro data focus is on Powell’s speech at 10am (Day 1 of 2), ADP (which has not been predictive of NFP), JOLTS, and Beige Book.

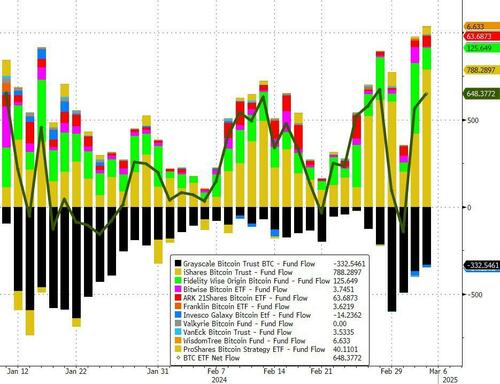

Also of note is that during yesterday's brutal selling across crypto after bitcoin hit a new all time high, investors were BTFD like crazy with blowout ETF inflows. And just like that, crypto is now a "safe asset."

In premarket trading, cybersecurity firm CrowdStrike soared after forecast-beating results, lifting in its wake peers Palo Alto Networks and Zscaler. Skincare companies’ shares dropped s after a report detailing how acne products from several brands are alleged to contain elevated levels of benzene, a chemical linked to cancer; Estee Lauder (EL US) -3.6%, Taro Pharmaceutical -3.5%. Cryptocurrency-linked stocks rally as Bitcoin rebounds from a temporary slump. In a volatile session on Tuesday, the cryptocurrency surged to a record for the first time in more than two years, before falling sharply. Among the crypto-linked moves, Cleanspark +6.3%, Cipher Mining +4.2%, Marathon Digital +5.7%, MicroStrategy +11%, Coinbase Global +5.6% and Riot Platforms +6.1%. Chinese e-commerce company JD.com Inc. soared in New York after it announced strong results and a $3 billion buyback. Here are the other notable premarket movers:

In yesterday's main event outside of markets, Donald Trump and Joe Biden sailed through the Super Tuesday round of primaries, edging closer to a general election rematch in November. There were no surprises there, nor was it a surprise when Nikki Haley announced she is dropping out of the presidential race. If anything, the question is why it took this long.

Attention now turns to Powell’s semiannual testimony before Congress, where he is widely expected to reiterate that the Fed does not see an urgent need for rate cuts, given robust economic data in recent months. A meeting of the European Central Bank is due Thursday, followed by monthly US payrolls data on Friday.

"The market is certainly not expecting a breakthrough from Powell, the ECB or Friday’s job data," said Francois Rimeu, a strategist at La Francaise Asset Management in Paris. Rimeu predicted this year’s equity gains will extend, with many investors fearful of missing out on the rally. The S&P 500 hasn’t suffered a drop of 2% or more in one day since February 2023, the longest run without such a pullback in six years. “I expect many investors late on the rally will buy the dips along the way,” he said.

European stocks are green and hovering near record levels with the Stoxx 600 up 0.3% as investors await Federal Reserve Chair Jerome Powell’s testimony on Wednesday and the European Central Bank’s meeting later in the week. Real estate and chemicals stocks outperform, while the health care and media sectors lag. Here are the most notable premarket movers:

Earlier in the session, Asian stocks gained as traders continued to digest China’s ambitious 5% growth target announced at a top official meeting, while Chinese tech shares rebounded ahead of key earnings releases. The MSCI Asia Pacific Index erased earlier losses to rise as much as 0.4%. Chinese tech giants such as Alibaba and Tencent were the biggest boosts to the regional gauge, while JD.com surged ahead of its fourth-quarter results. An index of Chinese shares listed in Hong Kong jumped more than 2%, while the onshore CSI 300 Index also edged higher. “Hong Kong’s rebound is led by tech and in particular JD.com. It looks to be related to expectations on its results due today,” said Marvin Chen, a Bloomberg Intelligence strategist. “There could be some short covering in JD.com as well.”

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The yen is up 0.2% but off its best levels having rallied on reports at least one BOJ policymaker will say it’s appropriate to end negative rates at the March meeting. The BOJ is also said to be getting more confident over the strength of wage growth. GBP/USD rises as much as 0.2% to 1.2731, in line with peers; Aussie climbs 0.3%, recovering from an early slip after data showed Australia’s economy slowed in the final three months of last year as elevated interest rates and rising living costs dragged on household spending. Kiwi dollar also recovers from weakness following Reserve Bank of New Zealand chief economist Paul Conway saying the central bank may be able to start cutting interest rates sooner than it currently expects to if the Fed begins easing later this year; Climbs 0.3% to 0.6104 amid broad dollar weakness. USD/JPY declined as much as 0.5% to 149.33 before paring the move.

In rates, treasuries were slightly cheaper across the curve in early US trading amid bigger losses across core European rates. 10-year yields around 4.16% are ~1bp cheaper on the day, bunds and gilts in the sector by an additional 2.5bp and 3.5bp; curve spreads are broadly within 1bp of Tuesday’s closing levels. Gilts underperformed ahead of the UK budget announcement where Chancellor Jeremy Hunt is expected to unveil personal tax cuts. JGBs were hit overnight following report on Mitsubishi UFJ Financial Group Inc.’s view that the BOJ will end negative rates in March. US session includes Fed Chair Powell’s congressional testimony before the House Financial Services Committee along with two peripheral labor-market reports.

In commodities, Oil prices advance, with WTI rising 1% to trade near $78.90. Spot gold is little changed around $2,127. Bitcoin jumps ~5%.

As noted above, Bitcoin climbs firmly above USD 66k after sinking below USD 60k in the prior session, after making ATHs.

US 10-year yields rise 1bps to 4.16%. European stocks are green and hovering near record levels with the Stoxx 600 up 0.3%. S&P futures rise 0.4% while Nasdaq 100 contracts add 0.8%. The Bloomberg Dollar Spot Index falls 0.1%. The yen is up 0.2% but off its best levels having rallied on reports at least one BOJ policymaker will say it’s appropriate to end negative rates at the March meeting. The BOJ is also said to be getting more confident over the strength of wage growth. Oil prices advance, with WTI rising 1% to trade near $78.90. Spot gold is little changed around $2,127. Bitcoin jumps ~5%.

Looking ahead, the US economic data calendar includes February ADP employment change (8:15am), January JOLTS job openings and wholesale inventories (10am). Fed speakers scheduled include Powell (10am New York time, though Fed sometimes releases text at 8:30am), Daly (12pm) and Kashkari (4:15pm); Fed releases Beige book at 2pm.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly choppy with early pressure following the tech-led declines stateside where Apple shares entered into a technical correction following a slump in China iPhone sales. ASX 200 traded rangebound as financials offset the losses in tech, while GDP data was somewhat inconclusive. Nikkei 225 gapped beneath the 40,000 level at the open before recovering the majority of losses. Hang Seng and Shanghai Comp. shrugged off early caution with outperformance in Hong Kong driven by tech and healthcare, while price action in the mainland was more reserved amid US-China frictions and some growth-related pessimism.

Top Asian News

European bourses, Stoxx600 (+0.3%) began the session on a mixed footing and trading on either side of the unchanged mark. As the morning progressed, indices moved into the green and currently trades near session highs. European sectors hold a positive tilt; Chemicals is propped up BASF (+2.5), after the Co. announced global price hikes for chemicals. Media is found at the foot of the pile, and Insurance is also found in the red, weighed on by Legal & General (-4.1%), post-earnings. US Equity Futures (ES +0.4%, NQ +0.7%, RTY +0.5%) are in the green, posting gains similar to that seen in Europe. There is some outperformance in the NQ, attempting to pare back some of the significant losses seen in the prior session. In terms of individual movers, CrowdStrike (+24.5%) is higher in the pre-market after beating on its results and raising guidance.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank speakers