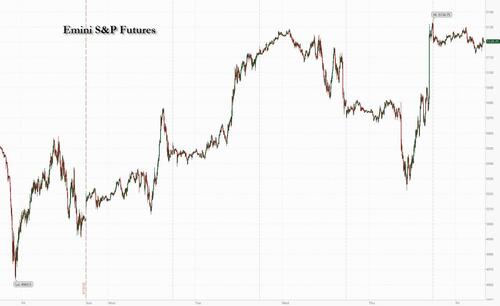

In a rollercoaster 48 hours to close the week, yesterday's early market slump (after the disappointing Meta guidance) has been fully reversed and stock futures are now pointing sharply higher after blockbuster earnings from Microsoft and Alphabet with attention now turning to the release of US personal consumption data - the Fed’s preferred measure of inflation, where a hotter-than-expected reading after Thursday’s weaker GDP figures may signal US rates will remain higher for longer. As of 7:40am, S&P futures are 0.7% higher while Nasdaq futures gain 1.1%. The positive sentiment carried into European trading, with tech stocks leading equity gains, with miners outperforming as copper hit $10,000 a ton for the first time in two years. Traders are also speculating as to whether Japan will intervene to support the Yen after the currency slid to a 34-year low before rebounding after the central bank kept rates on hold and Ueda said nothing to prop up the currency in what Deutsche Bank has called a policy of "benign neglect." Later in the day, attention will shift. Elsewhere, the USD is higher and bond yields are slightly lower. In commodities, oil and precious metals are higher; base metals and Ags are mixed. Today, key focus will be the March PCE release at 8.30am ET, where consensus expects headline PCE and core PCE to both rise +0.3% MoM.

In premarket trading, Google parent Alphabet surged as much as 12%, poised to add more than $230 billion to its market capitalization and exceed $2 trillion in valuation. Microsoft rose 4% after the software giant reported third-quarter results that beat expectations, a sign that AI is fueling growth and demand. The companies trounced Wall Street estimates with their latest quarterly results, fueled in part by demand for AI services. In other earnings-related moves, Exxon fell 1.2% after missing EPS but smashing revenue estimates, while Intel slumped more than 7% after providing weaker-than-anticipated guidance. Here are some other notable movers:

While earnings remain center stage, the focus Friday will also be on US data, with the Fed's preferred measure of inflation of particular interest. Treasury yields dipped following yesterday’s bond-market losses when stagflationary GDP data pushed back expectations for policy easing. A gauge of the dollar was steady.

“We have a precarious situation where the earnings of a few big companies are driving sentiment on the entire market,” said Justin Onuekwusi, chief investment officer St James Place Management. “We have seen a bit of volatility driven by earnings as well as rate decreases being priced out and that’s likely to continue.”

Almost 80% of S&P 500 firms that have reported so far have beaten analysts’ earnings estimates, according to JPMorgan strategists. Still, stock price reactions have been underwhelming, with better-than-expected results seeing below average upside, while those missing estimates are being penalized by more than usual, the strategists wrote. More than 50% of S&P 500 companies have yet to report.

A big highliight of the overnight session was the latest collapse in the Japanese yen which fell to a fresh cycle low near 157 versus the dollar after the Bank of Japan stood pat on interest rates and Governor Ueda did little to push back against recent weakness in the press conference. The yen’s slump to a record low versus the dollar has left traders on guard for any hints of intervention from Japan. The yen swung sharply from the day’s low to near its high amid jittery trading in the wake of the Bank of Japan’s decision to keep monetary policy unchanged.

“Should the yen fall further from here, like after the BOJ decision in September 2022, the possibility of intervention will increase,” said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking Corp. “It is not the level but it’s the speed that will trigger the action.”

European stocks rose along with US equity futures: the Stoxx 600 is up 0.6%, with technology and construction sectors leading gains, while chemicals and insurance subgroups are the biggest losers. Thyssenkrupp shares jumped after Czech billionaire Daniel Kretinsky’s EP Corporate Group agreed to buy a fifth of the German manufacturer’s troubled steel unit. Miners outperformed as copper hit $10,000 a ton for the first time in two years. Here are the biggest movers Friday:

Earlier in the session, Asian stocks rose, headed for their best week since November, as investors cheered upbeat earnings from technology firms and sentiment on China continued to improve. Japanese stocks rose as the Bank of Japan left interest rates unchanged. The MSCI Asia Pacific Index rose 0.8%, with TSMC and Tencent among the biggest boosts. The gauge extended its weekly gains to more than 3%. Stocks rose in mainland China and Hong Kong, with the Hang Seng China Enterprises Index poised for its best week since April 2015. Signs of an improving Chinese economy, better corporate earnings and Bejing’s support measures have spurred inflows from global funds.

In FX, the dollar was slightly lower, as all the action was in the Japanese yen which cratered to a fresh 34 year low near 157 versus the dollar after the Bank of Japan stood pat on interest rates and Governor Ueda did little to push back against recent weakness in the press conference. USD/JPY did swing sharply lower to sub-155 before swiftly rebounding in jittery trading amid heightened speculation that authorities may intervene in the market.

In rates, treasuries climbed, paring some of Thursday’s post-data drop. US yields are richer by up to 2bp across long-end of the curve with 5s30s spread around 8bp, tighter by around 1bp on the day; 10-year yields around 4.685%, down 1.5bp on the day with bunds outperforming by 1bp in the sector.

In commodities, oil prices advance, with WTI rising 0.4% to trade near $83.90 a barrel. Spot gold rises 0.7% to around $2,350/oz. Copper hit $10,000 a ton for the first time in two years.

Looking at today's calendar, the US session highlight is the March personal income/spending (8:30am); we algo get the April revised University of Michigan sentiment (10am) and April Kansas City Fed services activity (11am). Fed members are in self-imposed quiet period ahead of May 1 policy announcement

Market Snapshot

Top Overnight News

Earnings

A recap of overnight news courtesy of Newsquawk

APAC stocks were mostly higher as the region digested recent market themes including disappointing US data, strong big tech earnings and the BoJ policy announcement. ASX 200 underperformed after the prior day's losses caught up with the index on return from holiday. Nikkei 225 was initially choppy and briefly dipped into negative territory as participants braced for the BoJ policy announcement and whether the central bank flags a reduction in bond buying, but then surged as the central bank kept policy settings unchanged and refrained from any major hawkish surprises. Hang Seng and Shanghai Comp. were underpinned by strength in tech and property, while the constructive mood was also facilitated by a meeting between US Secretary of State Blinken and Chinese Foreign Minister Wang where it was stated that the US-China relationship has stabilised although negative factors are building.

Top Asian News

European bourses, Stoxx 600 (+0.5%) are entirely in the green, though trade has been contained at session highs, as participants await March's US PCE at 13:30 BST. European sectors are almost entirely in the green, with the exception of Chemicals, following poor IMCD (-9.1%) results. Tech tops the pile, with optimism lifted following strong large-cap Tech earnings in the US. US Equity Futures (ES +0.7%, NQ +0.9%, RTY +0.1%) are entirely in the green, with the NQ outperforming, benefitting from significant pre-market strength in both Google (+11.1%) and Microsoft (+3.6%), after reporting strong earnings after-market.

Top European News

BOJ

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It’s been a volatile 24 hours in markets, but in spite of a selloff yesterday, there’s increasing positivity this morning thanks to strong results from Microsoft and Alphabet after last night’s close. Both companies exceeded revenue and earnings expectations, with Alphabet seeing the larger beat on profitability, as their growth was boosted by demand for cloud computing and AI-related offerings. That’s seen Alphabet rise by over 11% in after-hours trading, while Microsoft is up more than -4%, having both been down in the main session yesterday. In turn, futures on the S&P 500 are currently up +0.81%, which is a significant turnaround from yesterday, as the index closed -0.46% lower, and that was only after recovering from initial losses that had pushed it down -1.60%.

That positivity has continued into Asian markets overnight, which comes as the Bank of Japan left their interest rates unchanged at their latest meeting. That’s seen the Japanese Yen weaken further, and it’s currently trading at 156.11 per dollar, which is its weakest level since 1990. Front-end government bond yields have also fallen overnight in Japan, with the 2yr yield down -0.7bps to 0.29%. And for equities, all the major indices have risen, including the Nikkei (+0.74%), the KOSPI (+1.10%), the Hang Seng (+1.98%), the CSI 300 (+1.03%) and the Shanghai Comp (+0.79%).

Before that overnight reversal, markets had struggled yesterday, as challenging data and poor earnings led to a notable selloff. That meant investors pushed back the timing of rate cuts yet again, and the 2yr Treasury yield (+7.1bps) closed at 4.998%, so almost at 5% for the first time since mid-November. That was mainly driven by the Q1 US GDP release, which had the unfortunate combination of a downside surprise on growth, and an upside surprise on inflation. As we found out in 2022, that stagflationary mix can potentially be a bad recipe for markets, so it wasn’t a surprise to see equities and bonds lose ground simultaneously even if equities have since been busy making up their initial losses.

In terms of the details, growth came in at an annualised rate of +1.6% (vs. +2.5% expected), which is the slowest growth since Q2 2022. But more alarmingly for markets, core PCE surprised on the upside, with an annualised rate of +3.7% in Q1 (vs. +3.4% expected). Headline PCE was also strong, at +3.4% in Q1, and core services ex housing (a measure Fed Chair Powell has cited in the past) was at +5.1%. So whichever way you crunch the numbers, this clearly isn’t the sort of inflation momentum where the Fed could be comfortable cutting rates. We’ll get the monthly US PCE numbers for March today within the spending report as well. If you’re looking for positives on growth, final private domestic sales came in at 3.1%, with the slowing in headline GDP growth coming from net exports, inventories and government spending. So domestic demand still holding up well. However you could argue that just ties in with the strong inflation component.

Unsurprisingly, that release meant markets dialled back the odds of rate cuts anytime soon. For instance, the chance of a rate cut by the July meeting fell from 50% the previous day to 34% afterwards. And for the year as a whole, futures are now pricing in just 34bps of cuts by the December meeting, down from 43bps the previous day and 67bps at the start of the month. So futures are now pricing the most hawkish profile we’ve seen to date in this hiking cycle, at least in terms of where rates are set to be by the end of 2024. Indeed for the first time, the first 25bp cut isn’t fully priced in until the December 2024 meeting.

With investors pricing out rate cuts, US Treasuries slumped and yields hit their highest levels of 2024 so far. In particular, the 2yr Treasury yield (+7.1bps) saw a closing value of 4.998%, having reached 5.02% intra-day. And similarly, the 10yr yield was up +6.2bps to 4.70%, although this morning it’s since come down -1.0bps to 4.69%. Bear in mind that just after Christmas, the 10yr yield hit an intraday low of 3.78%, so it’s moved up by almost 100bps from that point now. At the same time, there was a decent spike in real yields, with the 10yr real yield (+4.4bps) reaching a post-November high of 2.28%.

That trend was echoed in Europe, where investors lowered their expectations for ECB rate cuts this year, and now see just 68bps of cuts by December’s meeting, down -5.5bps on the day. As in the US, that meant 10yr yields hit new YTD highs, with those on 10yr bunds (+4.1bps) up to 2.63%, 10yr OATs (+3.7bps) up to 3.13%, and 10yr gilts (+2.8bps) up to 4.36%. For now at least, a June rate cut from the ECB is still seen as an 84% probability, but from Monday we’ll start to get the flash CPI prints for April, so it’ll be interesting to see if that changes anything.

For equities, this backdrop meant it was a tough day across the board even if the recovery was steady as the US session progressed. All the major indices fell, including the S&P 500 (-0.46%), the NASDAQ (-0.64%) and the Dow Jones (-0.98%). Rebounds by Nvidia (+3.71%) and Tesla (+4.97%) helped limit and reverse the earlier larger losses. But Meta (-10.56%) was the worst performer in the entire S&P 500 following its earnings release the previous day, meaning that the Magnificent 7 (-1.19%) underperformed despite the gains for Nvidia and Tesla. IBM (-8.25%) lost significant ground after its release the previous evening as well.

Over in Europe, the STOXX 600 (-0.64%) also saw a decent decline, although the FTSE 100 (+0.48%) was again an exception as it hit another record high, aided by a surge in Anglo American (+16.10%), which was the index’s best performer after BHP proposed a takeover. The proposed deal would bring together two of the world’s largest mining companies and create a clear number one globally. Our mining team think the deal rationale is about global scale and growth in copper, a structurally tight commodity which is key to future global electrification. Copper prices have risen by +17.6% so far this year, and overnight they’re trading at their highest level since April 2022. The mining team’s note (link here) runs through the deal terms and other talking points.

Looking at yesterday’s other data, the US weekly initial jobless claims fell to 207k in the week ending April 20 (vs. 215k expected), which is their lowest level in a couple of months. Otherwise, pending home sales grew by +3.4% in March (vs. +0.4% expected), reaching a 13-month high.

To the day ahead now, and data releases include US PCE inflation for March, along with personal income and personal spending. In addition, there the University of Michigan’s final consumer sentiment index for April, and in the Euro Area, we’ll get the M3 money supply for March. Finally, earnings releases include Exxon Mobil and Chevron.