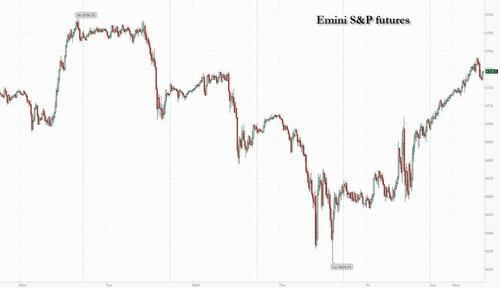

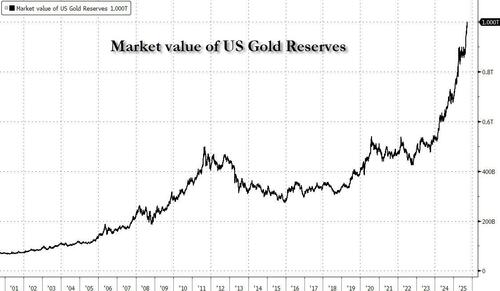

Last week's small market swoon is a distant memory with US equity futures up sharply on Monday, led by tech and small caps as the S&P looks to set a new ATH. As of 8:00am ET, S&P futures are up 0.5% (and off session highs) keeping the benchmark on track for its best September since at least 2013, even as the month is typically difficult for stocks. Mag7 / Semis are mostly higher premarket, and with Cyclicals leading Defensives after last week's stumble, the AI Theme looks resurgent again, helping sending European stocks broadly green. Most Asian equities advance as Chinese tech stocks resume rally. Hang Seng climbs for the first time in three sessions. Gold hit yet another record, topping $3,820 and pushing the market value of US gold reserves above $1 trillion, with a US government shutdown looming in 48 hours, while the dollar tumbles as clock ticks toward US shutdown deadline on Tuesday midnight. The yen strengthens below 149-handle and euro gains 0.2%. Yuan strengthens on industrial profits jump and a solid PBOC fixing. Treasury 10-year yield eases three basis points to 4.15%. WTI crude futures are offered around $65.30 on OPEC+ output hike expectations; commodities are weaker ex-Precious and Coffee which continue their bull runs. This is a heavy data week complicated by a potential government shutdown which could see labor market data delayed. The Fedspeech calendar is heavy with 12x speakers this week

In premarket trading, Mag 7 stocks are mostly higher (Amazon +1%, Alphabet +0.8%, Meta +0.6%, Nvidia (NVDA) +0.8%, Tesla (TSLA) +0.7%, Microsoft (MSFT) +0.3%, Apple (AAPL) -0.2%)

A busy week of data releases will culminate in Friday’s nonfarm payrolls report, as traders price in two Federal Reserve rate cuts by January to support the labor market. In the mix is the risk of a US government shutdown amid an impasse in Congress that could delay some releases.

Friday’s payrolls report is expected to show that the US economy added 50,000 jobs in September, in line with the average from the past three months. The jobless rate is projected to hold steady at 4.3%. Before then, Tuesday’s JOLTS report is expected to show a decline in job openings, while Wednesday’s data on company hiring is likely to confirm a further slowdown. Fed policymakers including Christopher Waller, Alberto Musalem and Raphael Bostic are due to speak Monday.

Global stocks are poised to extend their rally through year-end, driven by a resilient US economy, supportive valuations and a more dovish Fed stance, Goldman Sachs strategists said. A team led by Christian Mueller-Glissmann turned overweight on stocks over a three-month view, noting that the asset class often performs well during late-cycle slowdowns when policy support is in place.

“Good earnings growth, Fed easing without a recession and global fiscal policy easing will continue to support equities,” the team wrote in a note. “With anchored recession risk, we would buy dips in equities into year-end.”

The momentum in markets is “driven by a Goldilocks environment of optimistic growth prospects alongside expectations of a more dovish Fed,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “There might be some adverse effects if the shutdown were to prevail for a longer period, which is not our base case.”

European stocks followed their Asian counterparts higher with the Stoxx 600 climbing 0.4%. European stocks are set for their third straight quarter of gains as investors remain upbeat on the prospect of economic growth, AI advances and interest-rate cuts in the US. Miners and tech are outperforming while the energy and banking sectors are the biggest of the few decliners. Here are some of the biggest movers on Monday:

Earlier in the session, most Asian equities advance as Chinese tech stocks resume rally. Hang Seng climbs for the first time in three sessions. The ChiNext jumps almost 2% and CSI 300 nudges 0.5% higher. Japanese indexes buck the trend on ex-dividend stocks. The MSCI Asia Pacific Index climbed 0.5%, with Alibaba and Tencent among the biggest contributors. Shares also gained in China, Australia and Thailand. Japanese equities fell as ex-dividend stocks weighed on the nation’s benchmark indexes. China’s financial markets will be shut from Wednesday for the Golden Week holiday. Travel-related spending over the period along with recent stimulus measures for service industries may potentially revive sentiment toward consumer stocks.

Gold hit yet another record, topping $3,820 and pushing the market value of US gold reserves above $1 trillion, while the dollar tumbles as clock ticks toward US shutdown deadline.

In FX, the Bloomberg Dollar Spot Index falls 0.2% as govt shutdown fears emerge; the yen outperformed its G-10 peers, rising 0.6% against the greenback after Bank of Japan board member and noted dove Noguchi pointed to the rising need for an interest rate hike. Yuan strengthens on industrial profits jump and a solid PBOC fixing.

In rates, treasury 10-year yield eases two basis points to 4.16%. Aussie yields shed 4 bps across the curve. JGB futures remain better bid throughout the day. UK gilts held gains as Chancellor of the Exchequer Rachel Reeves addressed the Labour party conference.

In commodities, WTI crude futures are offered around $65.30 on OPEC+ output hike expectations. Bitcoin rises 1%.

Today's US economic data slate includes August pending home sales (10am New York time) and September Dallas Fed manufacturing activity (10:30am). Fed speaker slate includes Waller (7:30am), Hammack (8am), Musalem (1:30pm) and Bostic (6pm)

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mostly firmer following the positive Wall Street performance on Friday, albeit participants remain cautious ahead of a risk-packed week that culminates with Friday’s US jobs report. ASX 200 advanced, led by strength in gold miners and a rebound in healthcare, while traders looked ahead to tomorrow’s RBA decision in which Australia's Big 4 banks expect no change in rates. Nikkei 225 underperformed amid yen strength, with sentiment also weighed by the ex-dividend date for end-of-month payouts and risk trimming ahead of the BoJ Tankan Survey and the LDP leadership vote later in the week. Hang Seng and Shanghai Comp initially diverged, with Hong Kong buoyed by tech gains and foreign inflows. The Mainland swung between modest gains and losses heading into its weeklong break amid National Day and the Mid-Autumn Festival, whilst reports also suggested Chinese President Xi is reportedly planning to press US President Trump to formally state that the US opposes Taiwan’s independence, according to WSJ. KOSPI was lifted with tech spearheading the gains, whilst reports over the weekend suggested South Korea rejected a US request for USD 350bln in cash under a tariff-reduction deal. Nifty 50 traded with cautious gains after Friday's losses, and with traders looking ahead to the RBI policy announcement later this week.

Top Asian News

A firmer start to the week for European bourses, Euro Stoxx 50 +0.3%. Largely on a constructive footing, though the periphery is a touch softer. Incremental macro drivers so far a little light for the bloc. Sectors mostly in the green, Basic Resources leads given underlying benchmarks, Tech benefits in a bounce from Fridy's pressure. Banking names lag amid softness in yields, Energy hit alongside crude on reports around OPEC+. Healthcare supported by the White House will honour a 15% cap on pharmaceutical tariffs as part of trade deals with the EU and Japan, according to CNBC; though, a reported 100% level on the UK offsets. Stateside, futures firmer across the board, ES +0.5% & NQ +0.6%. Focus very much on the packed data agenda for the week as a whole, potential gov't shutdown which could impact that data and several Fed speakers.

Top European News

FX

Fixed Income

Commodities

Geopolitics:

NATO

RUSSIA-UKRAINE

ISRAEL-HAMAS

IRAN

OTHERS

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

It's fair to say that my nerves are shredded this morning. In addition, my sofa now has a big indentation in it after a weekend sat watching the Ryder Cup. Equally my marriage now has a big indentation in it after a weekend sat watching the Ryder Cup.

While the Europeans nearly snatched defeat from the jaws of certain victory, for more on how the world sees the outlook for all things US and European, this morning we've just published the results of our Q3 investor survey. You can see it here. The highlights are that bubble risk perception remains high in US tech but hasn’t increased that much in 2025 and is still just below levels seen in our surveys in 2021 when zero rates were the main valuation prop. The spread of responses to whether Powell stays on as a governor after his chair term ends in May suggests you haven't a clue (same here). Most think Treasury yields should fall and not rise as the Fed is cutting, and most think German stimulus is going to disappoint the initial expectations. Elsewhere, US inflation expectations are the highest since the end of 2022 and we check in on AI adoption at work. There's been a big increase in the last 12 months. See the pack here for lots more and many thanks for those who filled it in.

This week's big event might not actually happen, as payrolls Friday could be the first high profile victim of a potential government shutdown if Congress is unable to reach an agreement on a short-term funding resolution by midnight tomorrow night. Indeed, back in October 2013, the shutdown meant we didn’t get the September jobs report until the 22nd of the month. We'll preview both below, but the other main highlights this week are Waller, Bostic and Hammock speaking today; US consumer confidence, JOLTS, China PMIs, German, French and Italian CPI, the RBA meeting and the Fed Jefferson and Goolsbee speaking tomorrow; US manufacturing ISM, the ADP, Eurozone CPI, and the Fed's Logan speaking on Wednesday; US jobless claims and the Fed’s Logan speaking again on Thursday; and the US services ISM and the Fed’s Williams and Jefferson speaking on Friday. The full day-by-day calendar of events is at the end as usual.

In terms of the potential shutdown by midnight tomorrow, Brett Ryan in our US economist team has outlined "Everything you didn't want to know" about it for those that want to read more. Fears of a shutdown rose significantly last week, particularly after Trump cancelled a meeting planned with the Democratic leaders in the House and the Senate. But yesterday we heard that Trump will be meeting Democrat and Republican leaders today to try to broker a deal. So that helped the probability of a shutdown this year on Polymarket to fall from 84% yesterday to 72% this morning. Such an event could still be later in the year if a stop-gap is put in place this week but overall the probability of one occurring is deemed to be more likely than not before the end of the year. Remember that even though the Republicans have a majority in both chambers, they still need Democratic votes in the Senate, as there’s a 60-vote threshold to avoid the filibuster.

If there is a shutdown, all non-essential federal employees would be furloughed, which our economists estimate would cost the economy 0.2ppts per week on an annualised GDP basis. The longest shutdown was the 35 days straddling the end of 2018 and start of 2019. In 1996, we had one for 21 days and in 2013 one lasting 16 days. Others have lasted a few days or even only hours and before federal workers' alarm clocks went off.

If we don't see the shutdown and payrolls then get released, it’s a very important number given the recent negative revisions and real-time downtrend in new hiring, not to mention the Fed and market reaction function. In my opinion, we could be set for some notable volatility around these prints going forward as the breakeven payroll rate now seems to be around or under 50k per month. Given the naturally wide distribution of payroll numbers, this brings the prospect, and perhaps even the likelihood, of negative prints. These prints may not reflect the underlying trend but could lead to big moves. Given the breakeven rate has always been higher in our careers, we are not really conditioned to negative prints being within the margin of error, so reactions to such prints may be not be rational if and when they happen. Having said that, for this month our economists expect a rebound on the headline to +75k (consensus +50k) against +22k last month. For private payrolls they also expect +75k (consensus +60k) against +38k last month. The unemployment rate is expected to remain unchanged at 4.3%. So, the point above is more of an ongoing one over the coming months and quarters.

Tomorrow's JOLTS report is also important but only refers to August. So it’s always behind but is perhaps the more reliable indicator of the labour market. So far it has been fairly stable and indicative of a low hiring and low firing labour market. So stable, but with low numbers on both sides, and therefore it wouldn't take a big change in the direction either way to make a big difference. We also have ADP on Wednesday and then we think jobless claims on Thursday would likely be released in a shutdown as it’s compiled by states. This happened in the 2013 shutdown but we can't be 100% sure. Elsewhere for employment trends, the jobs hard/plentiful measure in tomorrow's consumer confidence, as well as the employment subcomponents in the two ISM readings this week will also be important for the current state of play in the US labour market.

The one other thing to say is that the start of Q4 on Wednesday brings the start of the multi-year German stimulus package. Given most of all of our careers have been soundtracked by German fiscal discipline, then we will all have to get used to a changing narrative. It's fair to say that investors have become more pessimistic over the summer as to the extent of the difference it will make (see our survey for more on this). However, some of this is just impatience and we think the momentum will really start to kick into gear very soon. There is some disappointment that more will be directed to consumption than the initial infrastructure and defense bias suggested, but it shouldn't change the near-term multiplier much, just the long-term potential growth rate. See our economists' mark to market of where we are with it here as the big momentous shift in spending in now just days away.

Staying in Europe, the focus will be on the flash CPIs for September starting with Spain and Belgium today. Prints for Germany, France and Italy will be released tomorrow and the Eurozone print will be out on Wednesday. Our European economists preview the releases here. They expect a 2.22% report for the Eurozone, with country-level forecasts including 2.34% for Germany, 1.12% for France and 1.67% for Italy. Finally, the September CPI report is also due for Switzerland on Thursday.

This morning, there’s generally been a positive tone across markets, building on Friday’s gains. There’s been a solid performance for the Hang Seng (+1.40%) and the KOSPI (+1.34%), whilst the CSI 300 (+0.47%) and the Shanghai Comp (+0.13%) have also advanced. Japanese equities have been the exception however, with the TOPIX (-1.45%) and the Nikkei (-0.68%) both struggling, in part because ex-dividend stocks are dragging the market lower. But otherwise, the global trend looks strong, with futures on the S&P 500 (+0.33%) and the German DAX (+0.40%) both pointing higher as well. And more broadly, gold prices (+1.20%) have hit another record overnight, currently trading at $3,805/oz, with this morning being the first time they’ve crossed the $3,800/oz mark on an intraday basis.

Recapping last week now, US markets lost a little momentum after investors grew more anxious about AI tech spending and the likely pace of Fed cuts, although a decent PCE print drove some renewed optimism on Friday. This left the S&P 500 down -0.31% (+0.59% Friday), and the NASDAQ -0.65% (+0.44% Friday). Remarkably, that was the biggest decline for the S&P in eight weeks, illustrating how strong the past couple of months have been for risk assets. The Mag-7 fell -0.71% (+0.81% Friday), led by Amazon (-5.05%) and Meta (-4.45%), while Nvidia ended the week +0.86% after announcing a $100bn deal with OpenAI for AI infrastructure, though the deal also sparked scepticism over potential circular financing. Tariffs were also in focus, as President Trump announced several new tariffs effective October 1st, most notably 100% on branded pharmaceuticals.

Meanwhile, Treasuries sold off last week after a string of mostly stronger US data. That included weekly initial jobless claims (at 218k vs. 233k expected) falling to their lowest level since July and an upward revision to the Q2 GDP data. On Friday, August core PCE inflation came in line with expectations at +0.2% (+0.23% unrounded) and with July revised down a tenth to +0.2%, even as real personal spending was stronger (+0.4% vs +0.2% expected). That left markets pricing 41bps of Fed cuts by year end, down -3.9bps over the week (but +1.4bps on Friday). That meant the 2yr yield moved up +7.1bps to 3.64% (-1.2bps Friday) and the 10yr yield rose +4.8bps to 4.18% (+0.5bps Friday).

Back in Europe, the STOXX 600 (+0.07% on the week, +0.78% Friday) remained stable, while the DAX (+0.42%, +0.87% Friday) and the CAC 40 (+0.22%, +0.97% Friday) moved higher as the Euro Area composite PMI reached a 16-month high of 51.2 (vs. 51.1 expected). European bonds saw muted moves with the 10yr bund yield down -0.1bps at 2.75% (-2.8bps Friday), though OAT (+1.5bps) and BTP (+4.8bps) yields moved higher on the week.

In the UK, despite the composite PMI falling to a 4-month low of 51.0 (vs. 53.0 expected) the FTSE 100 advanced +0.74% (+0.77% Friday). Meanwhile, gilts underperformed as investors’ fiscal concerns grew, particularly after Greater Manchester Mayor Andy Burnham, seen as a potential challenger for PM, called for £40bn of additional borrowing to build council houses. 2yr gilt yields were up +3.2bps (-0.3bps Friday), and 10yr yields were +3.1bps to 4.75% (-1.1bps Friday).

Elsewhere, gold advanced another +2.03% (+0.28% Friday) to $3,760/oz, ending the week just shy of Tuesday’s all-time high and now up more than +43% YTD. The move keeps gold prices on track for their strongest annual performance since 1979, when prices surged +127% after the Iranian Revolution. Brent crude also advanced +5.17% (+1.02% Friday) to $70.13/bbl, its highest level since July. That came as President Trump said that Ukraine could retake all the territory lost to Russia amid escalating rhetoric between the West and Moscow.