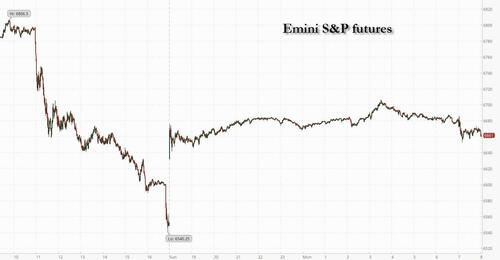

US markets closed last week with the largest one-day loss in six months, with Asian overnight futures pointed to a sharp downdraft on Monday. HSCEI and Hang Seng futures closed down 5% (limit down) on Friday night.

However, on Sunday Trump walked back some of his Friday comments, stating that “November 1 is an eternity” and expressing optimism that “they will be fine with China.” As a result, amid some fringe expectations of a "Black Monday" futures are solidly in the green as Trump strikes a reconciliatory tone in social media posts yesterday with futures pointing to a 50% retracement of Friday’s losses with Tech leading an ‘Everything Rally’ as the bond market is closed for the Columbus Day holiday and there are no expected data releases. As of 8:00am ET. S&P futures are 1.2% higher while Nasdaq futures gain 1.7% with Mag7 and Semis among the largest gainers pre-market. Cyclicals are seeing material outperformance to Defensives with rare earth plays seeing double-digit gains. In commodities, all 3 complexes are recovering with crude and precious metals the standouts as gold hits a new record high around $4080 and silver trades above $51.50 its highest level in decades amid a historic short squeeze in London. Cryptocurrencies bounced following the weekend’s selloff. French bonds held steady as President Emmanuel Macron unveiled a new cabinet to contain a growing political crisis. The dollar steadied and oil rose for the first time in three days.

In premarket trading, Mag 7 names are all green after Friday's rout (Nvidia +2.7%, Apple +1.4%, Microsoft +1.1%, Meta +1.4%, Tesla +1.7%, Amazon +1.3%, Alphabet +1.2%).

In corporate news, Morgan Stanley’s asset-management business is said to have asked to redeem some money it invested in a Jefferies fund with large exposure to the trade debt of First Brands. State Street and Marex Group are expanding their outsourced trading businesses.

Stock futures are bouncing back from Friday’s dramatic selloff after Trump signaled openness to a deal with China. Treasury futures slipped, with cash trading in US bonds suspended for Columbus Day. The dash for gold persisted as the metal neared $4,080 an ounce. In Europe, French bonds held steady as President Emmanuel Macron unveiled a new cabinet to contain a growing political crisis. Silver surged to its highest level in decades amid a historic short squeeze in London. Cryptocurrencies bounced following the weekend’s selloff. The dollar steadied and oil rose for the first time in three days.

“There is a belief emerging that this is mostly negotiating tactics on both sides,” wrote Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG. “The market will begin to price in a reasonable probability of a deal once the initial shock fades.”

Still, there’s plenty to keep traders tense, with Morgan Stanley's Mike Wilson said that a bear-case scenario could see the S&P 500 sink as much as 11% if trade tensions between the US and China aren’t resolved before a November deadline. Deutsche Bank strategists said overall equity positioning is moderately overweight but not stretched, and markets could follow a scenario from 2021 when stocks suffered a modest pull back before resuming a strong, steady rally.

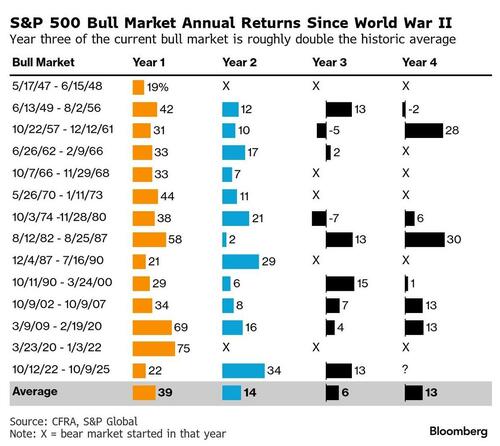

With the VIX remaining above the key 20 level, the next few days will be a test of whether investors continue the systematic dip buying seen in recent months. The current three-year bull market has seen the S&P 500 add about $28 trillion in market value, but history suggests gains need to broaden out to be maintained.

As well as US-China developments, investors will focus on earnings season this week which kicks off with the banks tomorrow. US financials kick things off tomorrow, while AI-related updates including TSMC and Samsung in Asia and ASML in Europe will be closely watched. Analysts tracked by Bloomberg Intelligence expect profit growth of 7.4% for US stocks in the third quarter.

A Citigroup index tracking US earnings revisions - the number of analysts upgrading versus downgrading estimates - turned flat for the first time since August, while RBC strategist Lori Calvasina said the rate of upward EPS estimate revisions has been fading. If last season’s strong sentiment around earnings can’t be maintained, stocks may face “a period of digestion,” Calvasina said. High valuations also leave little patience for companies that don’t meet the bar. The S&P 500 trades at 22 times P/E, a big premium to the rest of the world.

As JPMorgan, Goldman and Citigroup prepare to report third-quarter earnings on Tuesday, options on S&P 500 members imply an average 4.7% swing after results, data compiled by Bloomberg show. That’s near July’s level, when the expected move was the largest for an earnings-season kickoff since 2022, using JPMorgan’s release as the starting point.

“For earnings, the focus will remain on the richly-valued areas of the market,” said Geoff Yu, senior macro strategist at BNY. “We’ve seen a more defensive posture take hold and it’s a time for validation and confirmation.”

Outside of earnings, global policymakers and finance ministers gather this week in Washington for the IMF/World Bank fall meetings after a chorus of warnings that a stock bubble focused on AI might burst before long.

In Europe, the Stoxx 600 is up 0.4%, trimming part of Friday’s steep decline after President Donald Trump backpedaled on his tariff threats against China, signaling a willingness to negotiate. Mining, real estate and technology shares lead gains.

In FX, the Japanese yen is the weakest of the G-10 currencies, falling 0.6% against the greenback while the Swiss franc is not far behind. The Aussie dollar outperforms, rising 0.8%.

In rates, treasury futures came under early pressure from the reopen, partially unwinding a late bid seen in Friday’s session, after President Donald Trump’s administration signaled openness to a deal with China to quell the fresh trade tensions. Cash trading in Treasuries is closed for Columbus Day. In Europe, gilts lead a modest advance in European government bonds. French bonds held steady as President Emmanuel Macron unveiled a new cabinet to contain a growing political crisis

In commodities, spot gold rises over $50 to another record. WTI crude futures gain 2% to $60 a barrel.

There is nothing on the calendar due to the Columbus Day holiday.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week in the red as the region reacted to last Friday's Trump tariff threats and the subsequent Wall St sell-off, although US equity futures rebounded due to the softer tone from Trump over the weekend, while Japanese markets were shut for a holiday. ASX 200 was dragged lower by underperformance in tech, energy, telecoms and defensives, while gold miners are at the other end of the spectrum after prices rebounded back above the USD 4,000/oz level to touch fresh record highs. KOSPI retreated amid tech weakness, and with index heavyweight Samsung Electronics pressured after it was hit by a USD 445.5mln jury verdict for infringing wireless communication patents. Hang Seng and Shanghai Comp were pressured following the flare-up of US-China trade frictions on Friday after US President Trump threatened massive tariffs on China and announced to impose a 100% additional tariff on China from November 1st, before softening his tone over the weekend, while participants digested the latest Chinese trade data, which showed both exports and imports topped forecasts.

Top Asian News

European bourses (STOXX 600 +0.4%) opened firmer across the board to varying degrees and have traded sideways throughout the morning. Markets are currently cheering US President Trump's softer tone on China, after Friday's threat of 100% tariffs on the region. European sectors hold a strong positive bias. The cyclical sectors are all towards the top of the pile, with Tech and Consumer Products leading whilst Telecoms lag a touch.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopoltics: Ukraine

Geopoltics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It's hard to know where to start this morning with a continued US shutdown seemingly the least of our concerns these days. The plates currently spinning in markets are 1) the sudden resumption of trade hostilities between the US and China on Friday; 2) the reappointment of Lecornu as French Prime Minister late on Friday but with no obvious signs that he'll find life any easier than what promoted him to resign a week before; 3) the collapse of the governing coalition in Japan on Friday just a week after Takaichi was elected as LDP leader which will make radical policymaking more challenging and even threaten her nomination as PM; 4) The US intervening to prop up the Argentinian Peso ahead of domestic mid-term elections (President Milei is an ally of Trump) in less than 2 weeks; 5) the London Silver market seeing one of the biggest short squeezes in history; 6) a peace deal with Hamas and Israel which should see the remaining hostages released today after two years of captivity; 7) signs of weakness in US credit, after the First Brands collapse a couple of weeks back, and bubbling private credit fears, post a long period of being bullet proof; and 8) a large fall in Crypto late on Friday, including a $10,000 fall in bitcoin in just a few hours. There’s probably more but these are the main themes in global markets.

After Friday’s sell-off where the S&P 500 (-2.71%) fell the most since April 10th, just as US Treasuries were under their peak post Liberation Day stress, Asian markets are also seeing a weak session this morning. US futures are bouncing though on hopes that US and China can negotiate through their disagreements. Throughout the region, the Hang Seng Tech index (-4.54%) is at the forefront of losses, while the Hang Seng index is also sinking (-3.49%), primarily influenced by substantial declines in major Chinese internet and technology companies. In addition, the CSI (-1.76%) and the Shanghai Composite (-1.30%) are also lower. Elsewhere Japan is shut for a public holiday, while the KOSPI (-1.62%) and the S&P/ASX 200 (-0.99%) are also weak. S&P 500 (+1.22%) and NASDAQ (+1.65%) futures are rebounding strongly as the US leadership rhetoric over the weekend showed willingness to negotiate.

When Trump returned to power, I was convinced it would mark the beginning of a much weaker US-China relationship, with a real risk of significant decoupling. Yet, over the past few months, US trade tensions have often seemed more focused on traditional allies, while the relationship with China appeared to be improving, albeit after some aggressive tariff threats. But Friday’s developments were a reminder of the underlying tension that still exists.

I suspect the recent improvement was driven more by US fears of empty shelves if the punitive tariffs threatened post-Liberation Day were actually implemented. Perhaps the US needed time to adjust. Since then, the mood music has been notably more positive, and it’s still very possible, maybe even likely, that both sides are simply trying to strengthen their near-term negotiating positions. However, these tensions will probably be a recurring theme in the years ahead as both sides compete on the global stage for dominance.

China currently holds considerable leverage in the rare earths market and seems keen to use it to secure a better deal—particularly in the chip sector, where the US has imposed export controls. So, this battle is shaping up as rare earths versus AI chips.

Interestingly this morning's data show that China is diversifying their exports. While exports to the US decreased by -27.0% year-on-year in September, marking the sixth consecutive month of double-digit declines, growth in its global exports reached a six-month high of +8.3% (compared to +6.6% expected), significantly surpassing the +4.4% year-on-year increase recorded in August. Imports rose by +7.4% in September, exceeding the forecast of +1.8%, resulting in a surplus of $90.5 billion.

It’s worth remembering that Trump and Xi were expected to meet on the sidelines of the APEC 2025 summit in South Korea on October 31st–November 1st. Also note that the suspension of higher US tariffs on Chinese goods expires on November 10th. There’s still plenty of time for negotiations, and I suspect the market will begin to price in a reasonable probability of a deal once the initial shock fades. For what its worth, Polymarket has the probabilities of the two Presidents meeting by October 31st at 62% this morning, down from a peak of 88% last week but up from around 35% at the lows on Friday night. So there is a belief emerging that this is mostly negotiating tactics on both sides. Trump posted on social media yesterday “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A wants to help China, not hurt it!!!”. Meanwhile JD Vance also opened the door to negotiations yesterday. We will see.

Onto France, where the motto seems to be “if at first you don’t succeed, try, try again.” Whether this time will be any different is a moot point, but with Lecornu reappointed as PM late last week, they will be having another go at passing a budget and forming a government early this week. Polymarket currently shows a 30% probability that fresh elections will be called before the end of October, and a 63% chance by year-end. There’s also a 20% chance of elections being announced by this Friday.

In terms of key events this week, the US CPI won't happen as expected on Wednesday, but we now know it will be released on the 24th October. The special treatment during a shutdown is due to the fact that September’s CPI is a crucial input into the government’s calculation of the “cost of living adjustment” (COLA) that is applied each year to several categories of federal outlays. So it’s likely that this is a one-off data wise. The main highlights elsewhere start today with Columbus Day in the US, with bond markets closed but equity markets open. The Annual World Bank and IMF meetings also start today and run through into Saturday. They’ll be plenty to discuss. Tomorrow sees UK employment numbers, the German ZEW, Fed Chair Powell speaking, and the start of US earnings season (more below). Wednesday sees Chinese inflation, Eurozone Industrial Production, and the Fed Beige book and Thursday sees the US NAHB index. There are lots of Central Bankers speakers which you can see in the day-by-day calendar at the end as usual.

As briefly touched upon above, US banks will kick off the Q3 earnings season tomorrow with notable companies reporting including JPMorgan Chase, Goldman Sachs and Citigroup. Morgan Stanley and Bank of America will follow on Wednesday. In tech, the spotlight will be on semiconductor firms ASML (Wednesday) and TSMC (Thursday). Other earnings highlights this week include Samsung, Johnson & Johnson and Blackrock.

Recapping last week now and all was relatively quiet until the US/China trade tensions flared up late on Friday. The S&P 500 ended the week down -2.43% (-2.71% Friday) with Tech stocks underperforming significantly on Friday, as the NASDAQ was down -3.56% (-2.53% on the week), and the Magnificent 7 down -3.68% (-2.69% on the week). This was despite news that OpenAI had agreed to purchase tens of billions of dollars of chips from AMD, which sent its shares up +30.5% last week (-7.7% Friday). It was the worst week for the NASDAQ since mid-April, and the worst since mid-May for the S&P 500. The VIX index of volatility rose to 21.7pts (+5.2pts Friday, +5.0pts on the week), which was the highest level since late-June.

European indices were closed before the final leg of Friday’s sell-off, so they did out-perform. France led losses though with a weekly decline of -2.05% (-1.54% Friday). Franco-German 10-year spreads closed the week +2.4bp wider (+1.3bps Friday) at 83.4bps. The Stoxx 600 was down -1.10% (-1.25% Friday), the FTSE 100 -0.67% (-0.86% Friday), and the DAX -0.56% (-1.50% Friday).

In fixed income, US treasury yields saw a significant rally on Friday with 2yr yields ending the week -7.4bps lower (-9.1bps Friday) at 3.50%, 10yr yields were down -8.7bps ( -10.6bps Friday) to 4.03%, and 30yr Treasuries were down -9.3bps (-10.3bps Friday) to 4.62%. 10yr bund yields rallied -5.4bps (-5.9bps Friday) on the week and BTPs were down -5.0bps (-4.7bps Friday).

Credit markets also saw their biggest wobble since Liberation Day. USD IG spreads were 6bps wider on the week (+4bps Friday), while USD HY spreads were +36bps wider on the week (+22bps Friday). That is the largest weekly backup for both markets since the first week of April, when the initial tariffs were announced. This also comes as there have been growing fears of stress in private credit markets and Business Development Companies, whose stock prices fell sharply even prior to Friday’s selloff. EUR credit markets were not immune to this stress as EUR IG spreads were +4bps wider on the week (+3bps Friday) and EUR HY spreads gapped +37bps wider (+15bps Friday).

In commodities, gold continued its climb to break through $4,000/oz last week and finished the week up +3.38% (+1.03% Friday) at $4,018/oz. Brent crude declined -2.79% (-3.82% Friday) to $62.73/bbl, as the first phase of the Israel-Hamas truce began on Friday day, with thousands of Palestinians already moving back north and the Israeli army leaving the enclave.