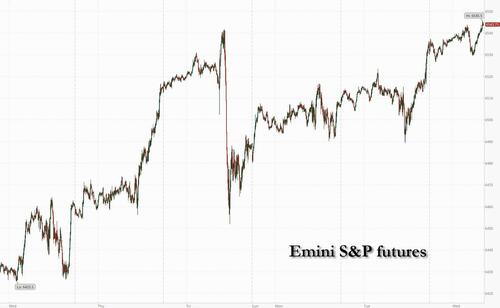

US stock futures are trading at another record high, with European and Asian also pushing higher after Oracle underpinned the strong sentiment in tech with blowout guidance sending its shares up by 30% in premarket trading, while the market awaits inflation data today and tomorrow. As of 8:15am, S&P futures are 0.3% higher with Nasdaq futures rising 0.4%...

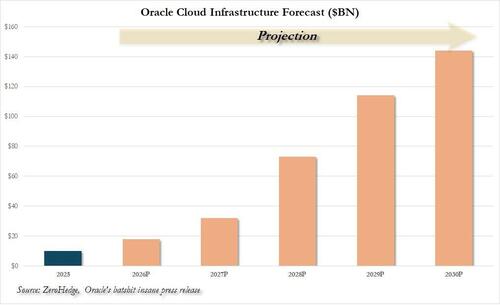

... with all eyes on ORCL as earnings missed across the board, but it was the ridiculous hockeystick guidance - with cloud infra guide going from $18bn in FY25 to $144bn in FY30 - that sent the stock +30% pre-mkt and fueled optimism that the AI infrastructure roll-out is speeding up. Chipmaker Nvidia Corp. and AI infrastructure firms also advanced (NVDA +1.9%, AVGO +2.3%). Large-cap Cyclicals poised to outperform Defensives.

Keep an eye on Poland / Russia as Poland invoked Article 4 of NATO (military defensive consult); for ref, Article 5 is the call to arms of all members, used only once by the US after Sept 11. Trump looks to implement secondary tariffs on India / Russia. The yield curve is twisting steeper with the 30Y yield +1bp and USD is flat. Cmdtys are mostly higher led by crude and precious. Today’s macro data focus is on PPI with CPI tomorrow. TSMC also said its August sales rose 34% to signal sustained, strong demand for AI tech.

With the latest leg of the stock rally driven by hopes that the Fed will rapidly lower rates, investors believe that sticky wholesale and consumer inflation will remain sufficiently contained and give officials room to shore up the jobs market.

The likelihood of lower financing costs is supporting rate-sensitive sectors such as tech, allowing markets to remain resilient against recurring risks ranging from geopolitical tensions to trade wars. Over the past day alone, the S&P 500 advanced despite escalating frictions in the Middle East and Eastern Europe alongside fresh US tariff threats targeting India and China.

“The prospect of far easier financial conditions remains supportive,” said Geoff Yu, FX and macro strategist for EMEA at BNY Mellon. “Barring any really large upside shocks in today and tomorrow’s PPI/CPI figures, it’s really a case of ‘as you were.’”

August’s producer price figures are due at 8:30 a.m. Eastern time, with the consumer inflation report following 24 hours later. Those reports, along with retail figures due Sept. 16, will be the last major data points before Fed Chair Jerome Powell announces next week’s rate decision.

Oracle is poised to add roughly $200 billion in market value if its early surge carries through Wednesday’s session. The company’s outlook underscores how AI developers must continue ramping up spending, with its customer OpenAI alone projecting that trillions of dollars will eventually be needed to build and operate infrastructure.

“I don’t know if their guidance is actually realistic but the market is buying it and buying it fully,” said David Kruk, head of trading at La Financiere de l’Echiquier. “Maybe the outlook has been overbought, it’s hard to tell.”

The renewed excitement over AI and strong corporate earnings are prompting Wall Street strategists to boost their forecasts for the S&P 500. Deutsche Bank’s Binky Chadha lifted his year-end target for the US benchmark to 7,000, signaling potential gains of more than 7% from current levels. Analysts at Barclays also raised their estimate, while Wells Fargo Securities forecasts an 11% increase by the close of next year.

Poland shot down drones that crossed into its territory during a Russian air strike on Ukraine. France has appointed Sebastien Lecornu as prime minister, the fifth in two years and starting on a day of mass protests in the country. French yields are unchanged, bund yields are edging lower and Treasuries are mixed.

In premarket trading, Mag 7 stocks are mixed, with Nvidia outperforming after Oracle’s report (Nvidia +2%, Tesla +0.4%, Alphabet +0.1%, Microsoft +0.7%, Meta -0.1%, Apple -0.4%, Amazon -0.5%).

In Europe, the Stoxx 600 rises 0.2% with retail and technology shares leading gains, while travel and chemicals stocks are the biggest laggards. Sentiment was boosted by jump for Spanish retailer Inditex which means Spain’s IBEX benchmark is outperforming. Novo Nordisk is rising after announcing 9,000 job cuts, though also cutting guidance. Here are the biggest movers Wednesday:

Earlier in the session, Asian stocks rose, on course for a fifth-straight day of gains, with the technology-dominated markets of South Korea and Taiwan leading the charge to close at record highs. The MSCI Asia Pacific Index jumped 1.1% to the highest level since February 2021, with TSMC, Softbank, Tencent and SK Hynix among the biggest boosts. An upbeat cloud-business outlook from Oracle Corp. provided the latest boost for tech sentiment. South Korea’s Kospi closed at a record high, buoyed further by optimism that a proposal to lower the threshold for capital-gains tax will be scrapped. Taiwan’s benchmark also closed at a new all-time high. Elsewhere, key equity gauges advanced more than 1% in Hong Kong and Singapore. Mainland China shares edged up but underperformed their regional peers, as sentiment softened after last week’s military parade and following the strong rally in August.

In FX, the Bloomberg Dollar Spot Index little changed, Norway’s krone is stronger, with euro and Canadian dollar weaker.

In rates, treasuries are mixed in early US trading with front-end yields slightly richer on the day and long-end underperforming, steepening the curve around the 10-year, which is little changed. Focal points of US session include August PPI data in the morning and 10-year note reopening in early afternoon. Front-end yields are 1bp-2bp richer on the day, long-end cheaper by similar amounts and the 10-year near 4.09%, widening 2s10s and 5s30s spreads steeper by 1bp-2bp.French bonds underperform slightly as Lecornu’s first day as prime minister was marked by mass protests against the government’s budget proposals; bunds trade broadly in line with Treasuries. In the US, Treasury auction cycle continues with $39 billion 10-year reopening at 1pm New York time and concludes Thursday with $22 billion 30-year sale. Demand was strong for Tuesday’s 3-year note auction, which stopped through by 0.7bp and produced a record low primary-dealer allotment

In commodities, brent futures are up 0.9% to $67/barrel while gold is up by about $19/oz to around $3,646/oz.

Looking at today's calendar, US economic data slate includes August PPI (8:30am) and July wholesale trade sales (10am)

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the mostly positive handover from Wall St, where the major indices shrugged off large downward job revisions and geopolitical escalation, to approach record levels. ASX 200 eked mild gains as outperformance in financials, tech and telecoms atoned for the losses in the mining and materials sectors. Nikkei 225 edged higher despite the recent hawkish source reports that the BoJ sees some chance of hiking this year, despite the political situation, with some officials even said to view that a hike could be appropriate as early as October. Hang Seng and Shanghai Comp gained with the Hong Kong benchmark led higher by strength in tech, while the mainland lagged after deflationary CPI data and with US President Trump said to have asked the EU to hit China and India with 100% tariffs to pressure Russian President Putin.

Top Asian News

European bourses opened mostly firmer across the board, but sentiment has slipped on comments from the Polish PM who asked to evoke Article 4. European sectors hold a strong positive bias, and with those industries in the red only marginally so. Retail is by far and away the clear outperformer today, boosted by post-earning strength in Zara-owner Inditex (+7.5%); the Co. reported fairly in line metrics but saw a strong start to Autumn sales, which has boosted sentiment.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Poland

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets faced a few more challenges yesterday, as investors grappled with heavy downward revisions to US payrolls, alongside a flareup of Middle East tensions after Israel carried out a strike in Qatar against Hamas’ leadership. That meant risk assets initially took a hit, whilst oil prices spiked higher as fears grew about some sort of escalation in the Middle East. However, the peak negative reaction was around London going home time with the S&P 500 (+0.27%) recovering to post a new record high. Still, bond yields closed near their intra-day highs as investors toned down Fed rate cut expectations ahead of the US PPI and CPI data today and tomorrow.

In terms of those different stories, the Middle East dominated market attention as Israel confirmed they’d made a strike in Qatar. That’s a significant development, because Qatar is a US ally and hasn’t been involved in the conflict, acting as a mediator in the negotiations between Israel and Hamas. Qatar called the strikes a “blatant violation” of international law, with Hamas claiming that its leadership had survived the strike. US President Trump posted that the strike was “a decision made by Prime Minister Netanyahu”, adding that it “does not advance Israel or America’s goals” and calling it an “unfortunate incident”.

The news of the strike led to an oil price spike as investors were reminded of what happened in June, back when Israel and Iran came into direct conflict and there were fears of a broader escalation across the Middle East. But this mostly reversed later on, with Brent crude ending the session up +0.56% at $66.39/bbl, having been as high as $67.38/bbl. The news also added initial upward pressure on gold, but this was -0.26% lower by the close as rates moved higher. Still, gold is up +38.2% so far this year. Oil is up a further +0.9% overnight after Trump last night said he'd back more tariffs on India and China to pressurise Russia, but only if the EU did the same.

The other big news yesterday came from the Bureau of Labor Statistics in the US, who announced some sizeable negative revisions to payrolls. The headline was that total payrolls were revised down by -911k in March 2025, meaning that the labour market was in a weaker state than we previously thought. To be fair, these numbers don’t cover the most recent jobs reports and only go up to March. But if you smooth that adjustment over the year, then it means that the payroll numbers over April 2024 to March 2025 were around 75k lower each month than we thought. So, depending on what the final numbers show in Q1 2026, it’s quite possible that we had a couple of negative payrolls prints in 2024 already with yesterday's revision implying -5k in August and -29k in October. So as it stands this cycle didn't ultimately reach the second longest payroll expansion in history we were previously led to believe. In fact, it's now in 5th place behind the runs that ended in 1979, 1990, 2007 and 2020.

Despite the negative revisions, markets were fairly unreactive to the release, given that the direction of travel was already expected to be negative. Moreover, the weaker numbers didn't ramp up expectations of a 50bp cut from the Fed either as 27bps of cuts are now priced for next week, -1.5bps on the day. So, things were fairly steady, and there’s even a positive interpretation which says that the downgrades to 2024 and early 2025 make the recent slowdown in payrolls a lot less obvious if you consider that the baseline should be around 75k lower each month. In a Fox Business interview yesterday, Treasury Secretary Bessent did say that the Fed should recalibrate policy given the revised data, having also posted earlier that Trump is “right to say the Fed is choking off growth with high rates”.

However, Treasuries struggled to sustain the sharp rally of the previous four sessions, focusing more on the geopolitical shock and the inflationary impact of higher oil prices ahead of today’s PPI data and tomorrow’s CPI print. So, yields saw a decent move higher across the curve, with the 2yr yield (+7.2bps) rising to 3.56%, whilst the 10yr yield (+4.7bps) rose to 4.09%. Indeed, investors dialled back the likelihood of rapid rate cuts over the months ahead, with the amount of cuts priced by the June 2026 meeting falling -9.8bps on the day to 117bps.

This backdrop created some cross-winds for equities but the S&P 500 (+0.27%) still reached a new all-time high as the Mag-7 (+0.83%) powered ahead to a new record of their own. Those tech gains came even as Apple (-1.48%) sank after its annual product launch. I've already ordered the new headphones, with the new iPhone and possibly the watch to follow! The breadth of the equity performance was also on the softer side, with 60% of the S&P 500 lower on the day and the small-cap Russell 2000 down -0.55%. Meanwhile in Europe, it was a pretty flat session, with the STOXX 600 up just +0.06%. S&P 500 (+0.23%) and NASDAQ 100 (+0.19%) futures are rising after Oracle delivered a strong cloud infrastructure outlook in its results last night.

Over in France, attention has continued to focus on the political situation, with President Macron wasting little time yesterday in naming Sebastien Lecornu as France’s new prime minister, just hours after Francois Bayrou officially resigned from the post. Lecornu is a long-time ally of Marcon, most recently serving as Defence Minister in the outgoing government. He will now have the task of trying to steer a budget through the National Assembly, which is still completely fractured between the political groups. There were no signs last night that this task will become easier, with the far-right and far-left maintaining calls for snap elections while the centre-left Socialists said that Macron “persists in a path in which no socialist will participate”.

Notably yesterday we even saw France’s 10yr yield briefly poke above Italy’s 10yr yield in trading, although it eventually settled just beneath. That was partly a technicality to be honest because France’s 10yr yield benchmark rolled from the May 2035 bond to the November 2035 bond, so that mechanically pushed the yield higher. But even so, it was still notable given that France has been considered the safer sovereign of the two for much of recent history, and you have to go back to 1999 for the last time that France’s 10yr yield closed above Italy’s. Nevertheless, aside from the bond roll, French assets actually outperformed yesterday, with the 10yr OAT yield down -0.9bps on the session, in contrast to a rise in yields for 10yr bunds (+1.7bps), BTPs (+0.6bps) and gilts (+1.7bps).

Staying on Europe, today we’ll hear from Commission President Ursula von der Leyen, who’s delivering her State of the Union address to the European Parliament. This is usually a high-level strategic agenda for the next 12 months, but it could also contain some new policy measures, with the 2023 speech announcing the anti-subsidy investigation into Chinese EVs and the commissioning of the Draghi report. Speaking of the Draghi report, yesterday was the one-year anniversary of its release, and our European economists have published a note looking at how progress is measuring up on EU competitiveness in light of the report (link here).

Asian equity markets are extending gains this morning with the KOSPI again leading the charge, up +1.57%, and eyeing a record close, with major chipmakers Samsung Electronics and SK Hynix also seeing significant increases of +1.40% and +5.03% respectively. Elsewhere, the Hang Seng (+1.19%) is also advancing, rising to a four-year high amid hopes that China will cut interest rates after consumer prices fell further (more details below). On the mainland, the CSI (+0.12%) and the Shanghai Composite (+0.17%) are also seeing small gains. Meanwhile, the Nikkei (+0.52%) continues to trade higher, hovering just below record highs reached in the previous session.

Returning to China, consumer prices fell more than anticipated in August, while deflation in wholesale prices continued, as calls intensified for Beijing to enhance measures to stimulate sluggish domestic demand and mitigate the decline in export growth. The CPI decreased by -0.4% y/y in August (compared to the -0.2% expected), primarily due to a high base effect and weaker-than-normal seasonal increases in food prices. The PPI dropped by -2.9% y/y in August, improving from July’s -3.6% decline. This narrowing marks the first improvement since March and indicates stronger industrial demand following government initiatives to support growth. Our Chinese economist has reviewed the inflation data here including a discussion on what was the first test of the new "anti-involution" movement, which started in July with a goal of curbing excess price competition.

To the day ahead now, and data releases include the US PPI reading for August, and Italy’s industrial production for July. In the political sphere, European Commission President Von der Leyen will deliver the State of the Union address to the European Parliament.