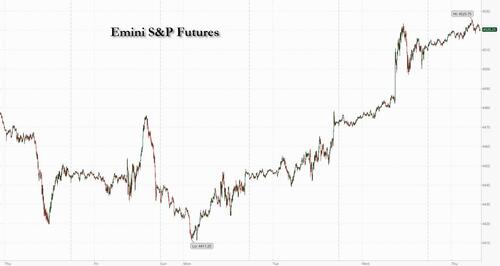

For the second day in a row, US equity futures are higher as part of a global risk-on move one which has sent spoos to fresh 52 weeks highs, and fast approaching the Jan 2022 all time high. Tech is again outperforming led by the "magnificent 7" megacaps following the unexpectedly soft CPI print which sparked expectations that after the July hike the Fed is done, and has accelerated the dollar tumble. As of 7:45am ET, S&P futures were 0.3% higher to 4,522 while Nasdaq futures rose 0.6%. Bond yields and the USD continue their move lower, with steepening in the belly of the curve. The DXY has made a 52-wk low today. The plunge in the dollar means that commodities are bid with strength across all 3 segments; keep an eye on Ags as India may move to restrict rice exports and the Black Sea Grain Initiative expires next week. Today’s macro data focus is on PPI, which will boost confidence that yesterday’s CPI print was not a fluke. Keep an eye on PPI in the future as China’s negative PPI and the lack of money supply growth may put accelerating downward pressure on input costs. Bank earnings kick off tomorrow.

In premarket trading, airline stocks rose after Delta Air Lines increased its adjusted earnings per share outlook for the year and reported stronger-than-expected second-quarter results; Delta shares jumped as much as 4.2% premarket. Walt Disney shares rose 1.3% in premarket trading after the entertainment company extended the contract of Chief Executive Officer Bob Iger for another two years. US-listed Chinese stocks also rose as Beijing urged Washington to immediately end unilateral sanctions on Chinese companies to help bilateral economic and trade cooperation. Alibaba (BABA) +1.4%, Baidu (BIDU) +2.5%, JD.com (JD) +2.8%, Bilibili (BILI) +3.0%. Here are some other notable premarket movers:

In case it wasn't clear yet, investors are piling back into equities as concerns over higher interest rates and a potential recession ease. Data Wednesday showed the US inflation rate slid to a two-year low, while today's PPI report is expected to show a decline from a year ago.

“The question now is whether the market continues to trade off the easing inflation narrative,” ING Bank NV strategists led by Antoine Bouvet wrote in a note. “There is an excuse to do so as today’s PPI report is also expected to be friendly.”

One driver for the surge in risk assets is a rout in the dollar; some top money managers said the dollar is poised for further losses as US exceptionalism wanes. Hedge funds turned net sellers of the dollar for the first time since March, according to data from the CFTC. “The recent USD underperformance reflects a qualitative shift in market comfort with being short USD as the terminal Fed policy rate looks increasingly capped,” Steven Englander, head of global G-10 FX research and North America strategy for Standard Chartered Bank, wrote in a note.

Back to stocks, European shares extended Wednesday’s rally, which saw the Stoxx 600 Index surge 1.5%. The European benchmark is in the midst of its longest rising streak since mid-April and has almost erased its second-half losses. Swatch Group AG, the maker of Omega and Longines watches, jumped more than 6% as China’s reopening fueled a rise in profits. Watches of Switzerland Group Plc, the biggest retailer of Rolex watches in the UK, soared 10%. US equity futures rose after solid gains on Wall Street. Here are some of the more notable European movers:

Earlier in the session, the MSCI Asia Pacific Index headed for the highest close in more than three weeks, with stocks in Hong Kong recording some of the biggest gains. Chinese Premier Li Qiang met with senior executives from firms including Alibaba Group Holding Ltd. and ByteDance Ltd., a sign that the government is ending its crackdown on the technology industry.

In FX, the Bloomberg Dollar Index fell 0.3%, taking losses this week to 1.8% and a fresh 52-week low after Wednesday’s CPI print gave momentum to the bearish greenback trend. NZD/USD and AUD/USD led gains, both climbing around 1%, while the British pound extended its rally to a sixth day, staying above the $1.30 level that it hit Thursday for the first time since April 2022, after data showed the UK economy shrank less than expected in May.

“A further decline in PPI and a rise in claims could see dollar losses extend,” wrote Chris Turner head of FX strategy at ING, who sees the selloff potentially marking the start of the dollar’s long-awaited cyclical decline. “DXY should press big psychological support at 100.00, the next target would be 99.00 on a breakout”

In rates, yields were broadly lower as investors unwound bets that the Fed would raise rates again following an expected hike this month; treasuries continued their bull-steepening streak as yields on the two-year slumped as much as 12 basis points to 4.63%, the lowest level in four weeks; as odds of another Federal Reserve hike after July are receding. The 5s30s spread is wider by ~5bp; 10-year around 3.82%, lower by 3bp on the day, with bunds and gilts outperforming by 6bp and 2bp in the sector. European bonds also rallied, led by Italy; traders are no long fully pricing another 50 basis points of hikes for the European Central Bank and erased bets on the Bank of England taking the key rate to 6.5%, seeing a peak of 6.25% instead. Germany’s 10-year yield dropped eight basis points to 2.49%. Yields are richer across the curve with front-end outperforming. The week’s auction cycle concludes with $18 billion 30-year reopening at 1pm New York time, which follows strong demand for 3- and 10- year sales that drew minimal market reaction. The WI 30-year yield at ~3.935% is ~3bp cheaper than last month’s, which stopped 1.1bp through. As investors globally continue to digest Wednesday’s benign US CPI data, Thursday brings PPI and 30-year bond auction, adding to steepening pressure on the curve.

In commodities, crude oil was steady even after the International Energy Agency said cut its forecast for demand growth. Iron ore rose as hopes increased that Beijing will deliver more economic aid for the beleaguered property sector and as investors shrugged off disappointing Chinese trade data.

Bitcoin is comfortably above the USD 30k mark but yet to make much traction above the USD 30.5k figure with catalysts light and price action broadly still a function of Wednesday's inflation update.

Looking to the day ahead now, and data releases include the US PPI reading for June, the weekly initial jobless claims, as well as UK GDP and Euro Area industrial production for May. From central banks, we’ll hear from the Fed’s Daly and Waller, whilst the ECB will be publishing the accounts of their June meeting. Lastly, earnings releases include PepsiCo and Delta Air Lines.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher as the region reacted to the softer-than-expected US inflation data which underpinned the global risk appetite, while weaker-than-expected Chinese trade data failed to dampen the spirit. ASX 200 was firmer with all sectors lifted by the constructive mood and as yields continued to decline. Nikkei 225 reclaimed the 32,000 level at the open after the US CPI data provided a rising tide for stocks. Hang Seng and Shanghai Comp were positive with outperformance in the Hong Kong benchmark due to tech strength after Chinese Premier Li met with several HK-listed tech giants, endorsed the platform economy and pledged more support for the sector, while gains in the mainland were somewhat capped alongside the latest Chinese trade data which missed forecasts. Credit Suisse upgrades Chinese equities to Overweight.

Top Asian News

European bourses are modestly firmer across the board in a continuation of the post US CPI trade, Euro Stoxx 50 +0.6%. Sectors are primarily in the green with Retail names outperforming after Fast Retailing while Homebuilders lag following Barratt Developments earnings commentary. Stateside, futures are also firmer ahead of IJC and Fed speak ES +0.3%; NQ +0.6% outperforms as yields continue to pullback. PepsiCo Inc (PEP) Q2 2023 (USD): Core EPS 2.09 (exp. 1.96), Revenue 22.32bln (exp. 21.73bln); raises annual revenue and profit forecasts after price hikes and steady demand. FY EPS view 7.47 (exp. 7.32). +3.1% in pre-market trade. US FTC investigating whether ChatGPT harms consumers, WaPo reports.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets have put in a very strong performance over the last 24 hours, thanks to a promising US CPI report that boosted hopes of a soft landing in the markets' eyes. There were several details that investors liked, but a key one was that it marked the first time in 29 months that the monthly core inflation print had been beneath 2% on an annualised basis. So the Fed would be very happy if we got some more reports like yesterday’s, and markets moved to price in more rate cuts for next year as a result. In turn, that led to a significant rally, with the S&P 500 (+0.74%) closing at a 15-month high, whilst yields on 10yr Treasuries came down -11.2bps to 3.86%.

What the financial world and the Fed will have to weigh up is whether the improvement in inflation is coming just in time or too late to change the direction of travel. Monetary policy operates with a lag and we still have several hundred basis points of hikes to fully work through the system. Ironically, if inflation is falling back to trend but the Fed takes some time to move to an easing bias, then policy will become more restrictive in real terms. However, it's fair to say that this print gives them the ability to move to an easing bias earlier. So you can see why markets would get excited.

When it came to the specifics of the CPI release, the main news was that inflation continued to soften, with monthly headline CPI at just +0.18% in June. That was beneath the consensus expectation for a +0.3% reading, and it took the year-on-year measure down to just +3.0%, which is the lowest it’s been since March 2021. On core CPI there was even better news, as the monthly print came in at +0.16%, which is the weakest since February 2021 before the current inflation spike really got going. Similarly, that took the year-on-year core CPI print down to +4.8%.

To be honest, it was difficult to find any negative spin from yesterday’s release. At worst, you could highlight the outsized contribution of airfares (-8.1%) to the core CPI slowdown and say some of the stickier factors were a bit stronger, but even those were still coming down from their levels over recent months. For instance, the Atlanta Fed breaks down the CPI into a sticky and flexible CPI series, and their sticky CPI print hit a 24-month low of +0.24% in June. On top of that, it was clear the declines were broad-based, as the Cleveland Fed’s trimmed mean that excludes the biggest outliers in either direction came in at +0.22%, which is the lowest since February 2021.

Although the CPI report was a downside surprise, it doesn’t look like it’d be enough to dissuade the Fed from hiking in a couple of weeks’ time. They’ve been consistent that they want to see a succession of lower numbers before they ease policy, particularly after summer 2021 when some weaker numbers led to false hope that inflation would prove transitory. This cautious message was supported by comments from Richmond Fed President Barkin, who said that backing off too soon would require the Fed to do even more. Market pricing has been reflective of that too, with expectations for a July hike unchanged yesterday at 89%. But even as a July hike looks almost-locked in, the CPI print led investors to lower the rate path further out. For example, terminal rate pricing for November came down by -4.8bps to 5.38%. And when it comes to next year, pricing for the December 2024 came down by -18.6bps on the day to 3.91%, and is down another -5.3bps overnight to 3.86%.

With investors pricing in more rate cuts, sovereign bonds rallied strongly across the world. The 10yr US Treasury yield was down -11.2bps to 3.86%, whilst the 2yr yield was down by an even larger -12.9bps to 4.75%. Bear in mind it was less than a week ago after the bumper ADP print that the 2yr yield went as high as 5.12%, so we’ve seen a pretty big turnaround since then. The rates rally was led by real yields, with 10yr real Treasury yield down -15.5bps on the day, its sharpest daily decline since March. Treasury yields have extended their decline overnight, with 2yr yields down another -4.4bps to 4.70%, whilst the 10yr yield has also fallen another -0.8bps to 3.85%. In Europe yesterday it was much the same story, with yields on 10yr gilts (-14.9bps), OATs (-11.6bps) and BTPs (-15.8bps) all plummeting.

The CPI report also led to some pretty seismic movements in FX markets, with the dollar index (-1.19%) posting its worst day in 8 months and falling to a 14-month low. That led to several milestones elsewhere, with the euro closing above $1.11 for the first time since March 2022 and this morning it’s up further to another 2023 high of $1.115. In the meantime, the pound surpassed the $1.30 mark for the first time since April 2022.

This backdrop was favourable for equities, and both the S&P 500 (+0.74%) and the NASDAQ (+1.15%) closed at 15-month highs. Over in Europe there were even larger advances, with the STOXX 600 (+1.51%) surging, and the DAX (+1.47%) posting its strongest daily performance since the financial turmoil in March.

Elsewhere yesterday, the Bank of Canada delivered a 25bp hike as expected, taking their overnight rate to a 22-year high of 5%. There were hawkish elements to the decision as well, as their latest Monetary Policy Report is now projecting a slower return to the 2% target relative to April, with a return to 2% in the middle of 2025. The statement said that the Governing Council “remains concerned that progress towards the 2% target could stall, jeopardizing the return to price stability.” Looking forward, overnight index swaps are currently pricing 7.9bps of hikes at the September meeting, so a roughly one-in-three likelihood of another 25bp hike.

Asian equity markets have followed up with further gains overnight, with a strong rally amidst the prospect of the Fed moving less aggressively. That’s led to major gains across the board, with the Hang Seng (+2.49%), the Nikkei (+1.67%), the CSI 300 (+1.12%), the Shanghai Composite (+0.86%) and the KOSPI (+0.82%) all advancing. US equity futures are similarly pointing to a positive start later, with those on the S&P 500 up +0.26%, whilst NASDAQ 100 futures are up +0.44%.

Lastly overnight, the Bank of Korea left its key interest rate unchanged at 3.5% as expected. That’s the 4th consecutive meeting that rates have been on hold now, but the statement said that the Board would “maintain a restrictive policy stance for a considerable time with an emphasis on ensuring price stability.”

To the day ahead now, and data releases include the US PPI reading for June, the weekly initial jobless claims, as well as UK GDP and Euro Area industrial production for May. From central banks, we’ll hear from the Fed’s Daly and Waller, whilst the ECB will be publishing the accounts of their June meeting. Lastly, earnings releases include PepsiCo and Delta Air Lines.