As we enter the most hectic two-week period of the year, futures are stronger following the S&P's first weekly loss in 7 weeks; both Tech and Small-Caps are outperforming with the yield curve bear steepening and USD flat reversing an earlier spike as a splunge in the yen also reversed following a shock outcome to Japan's election this weekend which saw the ruling LDP lose its parliamentary coalition majority for the first time since 2009. A sense of relief swept through markets after Israel’s retaliatory strikes against Iran was just as performative as back in April, and avoided oil and nuclear facilities, with crude tumbling 5%. As of 8:00am ET, S&P futures were up 0.5%, but well off session highs; Nasdaq futures gained 0.6% with Mag 7 and semi stocks higher premarket. Oil/Energy commodities plunge, WTI down 6%, as the latest Israeli attack was another "straight to DVD" production and avoided energy facilities in Iran. Base metals have a bid but the balance of the commodity complex is lower. It's an extremely busy week, with payrolls on Friday and over 40% of the S&P reporting earnings, but today’s macro calendar is light with only Dallas Fed calendar but keep any eye on Japanese politics and any potential read-through for the US yield curve and Credit demand.

In premarket trading, airlines, whose fuel costs are linked to oil prices, were among the biggest gainers while energy stocks fell. Exxon Mobil (XOM) declined 2%, falling with other energy stocks amid a drop in Brent crude. Occidental Petroleum (OXY) -2%, Schlumberger (SLB ) -2% and others were also down big. United Airlines (UAL) gained 2%, climbing with other airline stocks which are getting a boost as a drop in Brent crude prices signaled a potential impact on jet fuel costs. Boeing declined after launching $19 billion share sale to address liquidity needs. Here are some other notable premarket movers:

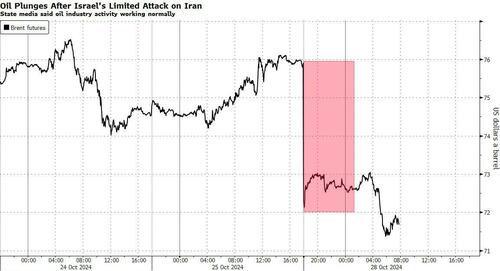

Oil slumped more than 6%, while gold also retreated after Israeli jets struck military targets across Iran on Saturday, delivering on a vow to retaliate for a missile barrage at the start of the month, but the attack was far more muted than most had expected. Israel’s shekel strengthened the most among about 150 currencies tracked by Bloomberg.

Iran said its oil industry was operating normally following Israel’s attacks on military targets. That eased geo-political tensions as markets prepare for a week packed with key economic data and corporate earnings. Among those are results for five of the “Magnificent Seven” big-tech behemoths, as well as eurozone and US economic-growth prints and a monthly payrolls report. And then comes the presidential election on Nov. 5, with markets increasingly pricing in a stocks-boosting victory for Donald Trump and the Republicans.

“Four factors are driving US equities higher right now: better macro data, solid third-quarter earnings, rising expectations of a Republican sweep and lower risk of an escalation in the Middle East,” said Wolf von Rotberg, an equity strategist at Bank J. Safra Sarasin. The Magnificent Seven earnings “are likely to provide another lift to S&P 500 earnings growth,” he said.

For the US bond market, already stung by the worst selloff in six months, the coming days will be crucial, as they feature the Treasury Department’s announcement on Wednesday on the scale of its debt sales. The 10-year Treasury yield rose about two basis points, while a gauge of the dollar was steady.

In Europe, the Stoxx Europe 600 erased an early gain, as heavy losses in oil-related shares offset gains in construction and media stocks which were the best performers. Energy majors Shell Plc, TotalEnergies SE and BP Plc weighed on the gauge. Royal Philips NV dropped 18% after the Dutch medical-technology firm cut its sales outlook. Porsche AG shares fell after the German carmaker reported earnings that fell short of analysts’ expectations. Here are some of the biggest movers on Monday:

Earlier in the session, Asian stocks edged higher, as gains in Japan offset losses in some other markets in the region. The MSCI Asia Pacific Index rose as much as 0.3%, snapping a five-day drop, with Japanese exporters including Toyota Motor among the biggest boosts to the index after the yen extended losses. Political risk put pressure on the currency as investors mulled the implications of the failure by Japan’s ruling coalition to win a majority in parliament. Stocks swung between gains and losses in mainland China after profits at industrial firms declined at a faster pace in September compared with a month earlier. Investors will also be watching for earnings from Chinese banks for clues on the impact of Beijing’s stimulus measures. Shares in Hong Kong traded higher.

“Despite the political noise, yen weakness, more spending and structural corporate reforms in Japan may keep Japanese equities attractive, especially amid potential supply chain shifts and Japan’s role as a stable regional player,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore.

In FX, the Bloomberg Dollar Spot Index is little changed, drifting slightly lower as traders awaited key data including non-farm payrolls later this week. The yen underperformed all other Group-of-10 currencies after Japan’s ruling coalition failed to win a majority in parliament for the first time since 2009, setting the country up for a period of instability. USD/JPY rose as much as 1% to 153.88, the highest since July, as a gamble by Prime Minister Shigeru Ishiba to call an early election backfired. Dollar buy stops above the Oct. 23 high of 153.19 were triggered, some of which were momentum-related, according to an Asia-based FX trader. However, since its earlier gap lower, the yen pared declines and at last check the USD/JPY was up 0.2% at 152.60, down more than 100 pips from session highs. “Uncertainty around whether Ishiba can continue as Prime Minister and also the formation of the next government in Japan will likely keep some weakening pressure in JPY in the near-term,” MUFG analyst Michael Wan writes in note.

In rates,longer-dated Treasuries remain slightly cheaper on the day, with yields in retreat following an opening gap higher as oil slumps. 10-year yields rose 2bps to 4.26%, after rising as high as 4.29% earlier; Longer-dated yields are cheaper by 1bp-2bp with shorter maturities little changed, steepening 2s10s and 5s30s spreads by ~1bp; UK and German 10-year yields are now slightly lower with bunds and gilts in the sector outperforming by 2.5bp and 3bp on the day. US session includes auctions of 2- and 5-year notes, while Fed officials are in self-imposed quiet period ahead of Nov. 7 policy announcement. The final Treasury auction cycle of the August-to-October financing quarter begins with $69b 2-year note at 11:30am New York time, followed by $70b 5-year note at 1pm. Cycle concludes Tuesday with $44b 7-year notes

In commodities, oil prices gapped lower at the open and slid further during the European morning session, aiding a rebound in European government bonds. Brent was about 6% lower after the much-awaited Israeli attack on Iran steered clear of oil infrastructure

Looking at today's US economic data calendar we only have the October Dallas Fed manufacturing activity at 10:30am; ahead this week are JOLTS job openings, consumer confidence, ADP employment change, PCE price indexes and jobs report. Tech giants slated to report quarterly results this week include Google, Meta, Microsoft, Apple and Amazon

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as markets digested key events over the weekend including Israel's strike on Iran which was aimed at military targets and not petroleum or nuclear facilities, while the election in Japan saw the ruling coalition lose its majority. ASX 200 traded indecisively as gains in tech and the mining sectors offset the weakness in real estate, utilities and energy. Nikkei 225 quickly shrugged off the initial post-election jitters and surged on the back of a weaker currency and prospects that the political uncertainty could delay the resumption of the BoJ's rate normalisation. Hang Seng and Shanghai Comp swung between gains and losses but ultimately eked mild gains after the PBoC announced it is to utilise outright reverse repo operations today, which will be conducted on a monthly basis and is a new policy tool aimed at managing liquidity.

Top Asian News

European bourses, Stoxx 600 (+0.4%) are almost entirely in the green (ex-AEX), with traders garnering optimism following the relatively moderate Israeli attack on Iran, which saw the former avoid hitting energy/nuclear facilities; indices have slipped off best levels in recent trade. European sectors hold a strong positive bias; Construction & Materials takes the top spot with Chemicals in second and Media in third. Energy is by far the clear underperformer, hampered by losses in the crude complex, following the aforementioned geopolitical updates. US Equity Futures (ES +0.4%, NQ +0.5%, RTY +0.4%) are entirely in the green, continuing the price action seen in Europe, which have ultimately benefited from the moderate Israeli attacks on Iran over the weekend.

Top European News

Japanese Election

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Peter SIdorov concludes the overnight wrap

For markets, the positive mood that dominated so far this autumn saw a mini-scare last week, as the S&P 500 fell for the first time in six weeks, while the bond sell-off continued apace. There’ll be plenty to test the market nerves with this week's bumper set of data releases, including US payrolls on Friday, and earnings reports, with five of the Magnificent 7 reporting. Meanwhile, the tight US election campaign will enter its final stretch.

One market fear that has eased over the weekend is escalation risks in the Middle East. This comes as overnight into Saturday Israel carried out retaliatory strikes against Iran, but with these targeting military facilities and avoiding oil or nuclear installations. The targeted scope of the attack and the absence of an immediate retaliation signal have seen markets price out some of the geopolitical risk premium. Brent crude is down around -4.5% lower to below $73/bbl in Asia trading, reversing last week’s 4% rise. Gold is down -0.60% from Friday’s record high, while US equity futures are posting decent gains with those on S&P 500 and NASDAQ +0.50% and +0.65% higher, respectively.

Meanwhile, Treasuries are extending their recent decline. 10yr yields are +3.2bps higher to 4.27% as I type, their highest level since July, having now risen by 65bps from their September lows. This rise has come amid both rising term premia, partly driven by concerns about US fiscal deficits, and growing skepticism that the Fed will deliver rapid rate cuts given solid US data. Indeed, Fed funds futures for end-25 are up to 3.53% this morning, having priced out three 25bps cuts over the past six weeks.

With the Fed now in the blackout period ahead of next Thursday’s meeting, the data will be doing the talking this week, with the marquee release being the October payrolls report on Friday. Our US economists foresee a sizeable slowing in headline (+100k forecast vs. 254k previously) and private (+75k vs. 223k) payrolls. However, this envisages a nearly -70k drag due to striking workers (mostly Boeing) and the weather impact of Hurricane Milton. The weather effect may also push up average hourly earnings (+0.6% vs. +0.4%). DB expects unemployment to tick up a tenth to 4.2% amid rising labour force participation, but the risk is that it remains at 4.1%. Given the likely noise in the payrolls, the market may pay extra attention to Tuesday’s JOLTS report for September. Given the strong September payrolls, the hiring rate may pick up from the historically low 3.3% in August. The last JOLTS print also saw the quits rate, one of the best leading indicators of wage growth, fall to 2.1%, its weakest since 2015 if one excludes the first few months of Covid. Other labour market data will include the Q3 Employment Cost Index reading (DBe: +0.9% vs. +0.9%), which is the Fed's preferred measure of wage growth.

In other US data, we will pay attention to the September personal income release on Thursday, which includes the Fed’s preferred core PCE inflation measure. DB expects core PCE inflation to rise by +0.29% (vs. +0.13% previously), its strongest since March. And Wednesday's advance Q3 real GDP is expected to show continued solid growth (DBe +2.7% vs. +3.0% previously). On the fiscal side, we have the US Treasury refunding announcement, with borrowing estimates on Monday and the refunding policy statement on Wednesday. Our rates strategists' preview can be found here.

Over in the euro area, the highlights will be the Q3 GDP print on Wednesday and the October flash inflation release on Thursday, with the latter preceded by the Spain and Germany CPI prints on Wednesday. Our European economists see headline euro area inflation rising from 1.7% to 1.9% but with core inflation slowing by a tenth to +2.6%, which would be its lowest level since January 2022. See our economists Inflation Chartbook here for more.

In the UK, the focus will be on the Autumn Budget on Wednesday. This will be the Labour Government's first budget in almost 15 years and our UK economist previews it here. Over in Asia, we will have the latest BOJ decision on Thursday, where a hold is widely expected (see our Japan economist’s preview here). And in China, the official PMIs on Thursday and the Caixin manufacturing PMI on Friday will be closely watched to gauge the effectiveness of the stimulus measures outlined by Beijing over the past month.

It will be a bumper week for earnings, with more than 40% of the S&P 500 by market cap expected to report. Following on the blockbuster earnings report from Tesla last week, five more of the Magnificent 7 are reporting this week, including Alphabet (Tuesday), Microsoft and Meta (Wednesday), Apple and Amazon (Thursday). See the rest of the week’s earnings and data releases in the day-by-day calendar at the end.

Last but certainly not least, the US election campaign will enter its final weekahead of the next Tuesday’s vote. Over 40 million early votes have already been cast and the latest polls continue to show a very tight race. The FiveThirtyEight average gives Harris a 1.5pp lead in national polls, but with a 0.6pp lead for former President Trump on average across the seven swing states, all of which see leads of less than 2pp for either candidate. The RealClearPolitics betting average now has former President Trump with a 61% likelihood of victory. That’s the highest it’s been since President Biden dropped out of the race in July, though it has largely stabilised in the past week.

Sticking with politics, a key event over the weekend was Japan’s Lower House election on Sunday, which saw the LDP-led ruling coalition lose its majority for the first time since 2009, getting 215 out of 465 seats. With the main opposition CDP well short of a majority on 148 seats, this leaves a highly uncertain political situation. See our Japan economist’s reaction note here for a discussion of the key points to watch on how this uncertainty will be resolved.

Following on the vote, the Japanese yen is -0.77% lower against the dollar this morning, sliding past the 153 level and touching its lowest level since July. In response, Japanese stocks are rallying this morning with the Nikkei 225 and the Topix trading +1.72% and +1.38% higher, respectively, while 10yr JGB yields are 1.5bps higher at 0.95% as I type. Other Asian markets are showing mixed moves. Chinese markets are mostly lagging behind with the Hang Seng (-0.24%) and the CSI (-0.21%) trading in the red, though the Shanghai Composite is up +0.17%. Elsewhere, the KOSPI (+0.79%) is also trading decently higher whilst the S&P/ASX 200 struggling to find direction in early trading with key inflation data due later this week.

Staying on Asia, data over the weekend showed that industrial profits in China fell -27.1% in September from a year earlier, marking the largest decline this year.

Recapping last week now, markets finally slipped back after a relentless run higher over the preceding weeks, with the S&P 500 ending a run of 6 consecutive weekly gains. By the end of the week, the index was down -0.96% (-0.03% Friday). The Magnificent 7 outperformed, rising by +3.49% over the week (+1.27% Friday) led by Tesla’s +21.97% gain. By contrast, the small cap Russell 2000 fell -2.99% (-0.49% Friday), marking its biggest weekly underperformance versus the Mag-7 since early July. Outside the US, equities mostly struggled, with Europe’s STOXX 600 falling -1.18% (-0.03% Friday), and Japan’s Nikkei down -2.74% (-0.60% Friday).

Sovereign bonds also lost ground last week, and US Treasuries fell back in particular. By the end of the week, the 10yr Treasury yield was up +15.7bps (+2.8bps Friday) to 4.24%, while the 2yr yield was up +15.8bps (+2.6bps Friday). Friday’s move higher was supported by the University of Michigan’s final consumer sentiment index for October, which saw its highest reading in 6 months (70.5 vs. 69.0 expected). European sovereign bonds also lost ground, with yields on 10yr bunds up +10.8bps last week, whilst those on 10yr OATs were up +14.7bps.