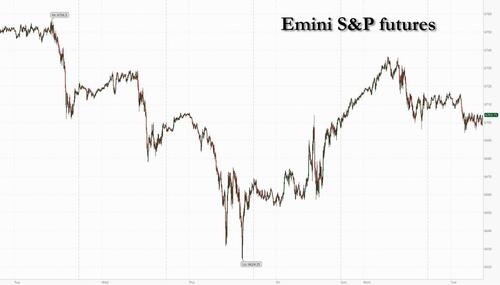

Futures are lower as we close out the quarter/month, ahead of what is a most likely (80% odds on Polymarket) government shutdown. As of 8:00am ET, S&P and Nasdaq futures are down 0.2% as sentiment sours after Monday’s optimism. Still, on the final trading day of the month, the S&P 500 is on track for its best September since 2010. Pre-market, Mag7 are all lower with Semis mixed; Defensives seeing outperformance relative to Cyclicals. Within commodities, virtually everything is lower ex-nat gas; gold/silver are down 86 and 196bps, respectively, on what looks like profit-taking / rebalancing with crude lower on potential increased OPEC+ supply. Bond yields are lower as the curve bull steepens; the USD is weaker, sitting ~1% above its 52-wk low. Gold fell toward $3,800 an ounce after touching a fresh all-time high earlier Tuesday just shy of $3900. After surging more than 10% this month on optimism over US interest rate cuts and haven demand, traders speculated that Chinese investors pared exposure ahead of the Golden Week holiday. Late on Monday, Trump set 10% tariffs on timber and 25% on kitchen cabinets as of Oct 14. Today’s macro data focus is JOLTS, Consumer Confidence, Housing Price Indices, and regional activity indicators. Expect headlines on the shutdown through the day, which most traders do not expect having a material impact on markets.

In premarket trading, Mag 7 stocks are mostly lower (Amazon -0.02%, Meta -0.1%, Nvidia +0.2%, Alphabet -0.1%, Microsoft -0.2%, Apple -0.3%, Tesla -0.7%).

In corporate news:

All eyes are on today's government shutdown. Vice President JD Vance said the US government is on track for a shutdown after President Donald Trump’s last-ditch meeting with congressional leaders ended without a deal. Many federal operations would pause if lawmakers fail to compromise before the fiscal year ends.

The Bureau of Labor Statistics — responsible for a number of gold-standard US economic releases — would cease operations and likely delay Friday’s payroll report in the event of a shutdown. “We advise investors to look past shutdown fears and focus on other market drivers,” wrote Mark Haefele, chief investment officer at UBS Global Wealth Management. “We continue to prefer quality fixed income, particularly those with medium-term maturities, which we believe offers a compelling combination of income and resilience.”

Tariffs are back in focus. Trump ordered 10% duties on imports of softwood timber and lumber as well as 25% levies on some wood furniture products. China’s state-run iron ore buyer told major steelmakers and traders to temporarily halt purchases of all new cargoes from Australian miner BHP, widening an earlier curb as a price dispute escalated, according to people familiar.

Elsewhere, traders are looking ahead to a series of US labor reports due this week to gauge the Fed’s next move, with the release of Friday’s key payrolls report in doubt amid a budget impasse in Congress. The uncertainty comes as the S&P 500 is headed for its best September in 15 years, fueled by looser policy, strong earnings and optimism over artificial intelligence.

“The main focus will be the US labor market, which should either confirm or challenge expectations of two more rate cuts in 2025,” said Susana Cruz, a strategist at Panmure Liberum. “If the shutdown delays the release, that could spark some anxiety.”

Fed Vice Chair Philip Jefferson warned Tuesday that the central bank faces a cooling labor market alongside rising inflation pressures, complicating the policy outlook. “I see the risks to employment as tilted to the downside and risks to inflation to the upside,” Jefferson said in remarks prepared for the fourth International Monetary Policy Conference hosted by the Bank of Finland. “It follows that both sides of our mandate are under pressure.”

The Fed’s Susan Collins and Austan Goolsbee are due to deliver speeches later on Tuesday. Investors will also look at August JOLTS data, which is expected to show weakening demand for labor. “The closer the headline is to estimates, the better, as a too-hot or too-cold print could weigh on already shaky markets amid the government shutdown worries,” said Tom Essaye at The Sevens Report.

The Stoxx 600 drops 0.2%,taking the shine off the best September performance since 2019, as Bloomberg News reported that China moved to ban all iron ore cargoes from BHP Group. The market was led lower by energy names as oil prices fall for a second day - WTI crude futures slip 0.9% to $62.90 a barrel. Here are some of the biggest movers on Tuesday:

Earlier in the session, Asian equities climbed to cap September with their longest monthly winning streak since early 2018, led by gains in Taiwan and Hong Kong stocks. The MSCI Asia Pacific Index rose 0.6% Tuesday, with Alibaba among the top contributors. The regional benchmark gained about 4% in September, recording its sixth consecutive monthly advance. Key benchmarks also traded higher in Japan, mainland China and Singapore. Investors have remained anchored in the region, chasing potential artificial intelligence winners and driving recent tech stock gains. Many are also scouring for China’s homegrown tech developers, amid hopes for an economic revival driven by increased consumption. Hong Kong’s benchmark, up 7% for September, has posted its best month since February, while the key onshore index also climbed for a fifth straight month. The Hong Kong market will be closed Wednesday while mainland bourses will be shut through Oct. 8 for Golden Week holidays.

In FX, yen is leading gains against the dollar for a second day, rising 0.5% and taking USD/JPY below 148 after a weak JGB auction pushed Japanese two-year yields to the highest since 2008. The Aussie dollar is still outperforming after a hawkish hold by the RBA.

In rates, treasuries inch higher, pushing US 10-year yields lower by 1 bp to 4.13%. Bunds ticked lower when German state CPI data showed accelerations across the country’s biggest regions.

In commodities, gold also added to Monday’s surge before swiftly erasing gains and now sits ~$30 lower on the day.

Looking at today's calendar, data due today include job openings for August and consumer confidence for September. Bloomberg Economist Anna Wong expects to see an improvement in confidence given the continued strength in spending through August. Still, she says sentiment measures have been diverging, with the U Michigan survey reflecting growing concerns about higher inflation and potential labor market weakness. US economic data slate includes July FHFA house price index, S&O Cotality house prices (9am), September MNI Chicago PMI (9:45am), August JOLTS job openings, September consumer confidence (10am) and Dallas Fed services activity (10:30am). Fed speaker slate includes Collins (9am), Goolsbee (1:30pm, 3:30pm) and Logan (7:10pm)

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded flat/mixed following a mostly but modestly firmer handover from Wall Street, with focus on the looming US government shutdown and the possibility of delayed NFP data as a result. Meanwhile, the White House announcement of further tariff details overnight capped upside in sentiment. ASX 200 gave up initial mild gains to trade flat as strength across gold miners just about offset hefty losses in energy and a subdued performance in financials, with little move seen in the index after the RBA policy announcement, in which the central bank left rates unchanged as expected in a unanimous decision but struck a hawkish tone, noting inflation risks and that the decline in underlying inflation has slowed. Nikkei 225 narrowly underperformed at the start and briefly fell back under the 45,000 mark with losses led by energy names, while some hawkish undertones from the BoJ Summary of Opinions likely weighed, with some members arguing it may be time to consider another adjustment after more than six months since the last hike, while others cautioned against surprising markets or moving prematurely given uncertainty around the US outlook. Hang Seng and Shanghai Comp varied, the former gave up earlier upside and the latter held onto mild gains with newsflow light ahead of the weeklong break, whilst Chinese PMIs showed manufacturing beat expectations, but services declined from the prior month in both the NBS and RatingDog (formerly Caixin) releases. Furthermore, China’s Securities Journal suggested experts believe the PBoC may flexibly use a variety of monetary policy tools in the future to maintain ample liquidity. KOSPI was subdued with US-South Korean trade talks seemingly at a standstill, with the South Korean national security adviser suggesting it is tough to strike an FX swap deal with the US.

Top Asian News

European bourses lower across the board, Euro Stoxx 50 -0.3%; broader market narrative is dictated by the looming US government shutdown. Sectors are mostly lower after a mixed start to the session, just Financial Services & Media remain in the green. Energy hit by ongoing crude softness. Gambling names impacted by late-night comments from Chancellor Reeves. Mining sector underpinned by initial XAU strength.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

This time tomorrow the US government looks set to be in shutdown unless we have a last-minute deal today. To remind and extend on what we mentioned yesterday, the longest was the 35 days that straddled year end 2018. The median length historically is only 2-3 days, often over weekends, and only a handful have lasted more than a couple of weeks (1978, 1995-96, 2013, 2018-19). Last night’s talks with Democratic leadership at the White House ended with no signs of a deal and with no further talks currently scheduled. Comments by Vice President Vance and reports following the meeting did suggest that the White House was open to bipartisan negotiations over expiring health subsidies which have been a key Democratic demand, but that such talks should take place in the “context of an open government”. In turn, Democratic leaders said they would not accept such uncertain pledges. The Polymarket probability for a shutdown before tomorrow is now 79% and 85% by year-end.

In terms of the impact of a shutdown, Brett Ryan has written "Everything you didn't want to know..." about it here. It was confirmed by the BLS yesterday that they would suspend operations and not release economic data during a government shutdown. So, no payrolls this Friday if it goes ahead. Indeed, a similar scenario happened back in October 2013, when the jobs report didn’t come out until the 22nd of the month. Moreover, the BLS also publish the monthly CPI data, which is due out on October 15. So, depending how long any shutdown drags on for, it’s even possible that the Fed might not have contemporaneous data going into their next meeting on October 28-29. Given the median shutdown lasts 2-3 days that's a stretch for now but worth bearing in mind.

A global bond rally (10yr USTs -3.6bps) was the main market story yesterday, helped by WTI crude oil (-3.45%) seeing its largest single day decline since June. Equities posted small advances overall, with the S&P 500 (+0.26%) closing less than half a percent from last week’s record high. There were several factors behind the moves, but a key driver was that sharp decline in oil prices after signals that the OPEC+ group may raise production again at their meeting next week. This helped reignite hopes of deeper rate cuts and drove a decent day for most asset classes, as US IG credit spreads (-1bps) fell back to within 1bp of their post-1998 lows while gold prices (+1.96%) again hit a new record of $3,834/oz. Overnight, gold prices are an additional +0.83% higher on further shutdown talk.

Drilling in, US Treasuries rallied across the curve, with the 2yr yield (-2.2bps) falling back to 3.62%, whilst the 10yr and 30yr yield declined by -3.6bps and -4.5bps to 4.14% and 4.70%, respectively. Markets also priced in a slightly more dovish rate path, with the amount of cuts priced by June 2026 up +1.9bps on the day to 81bps. The moves were helped by the latest decline in oil prices, which helped to counteract inflation fears from Trump’s latest tariff announcements. He said he’d impose “a 100% Tariff on any and all movies that are made outside of the United States”, as well as “substantial Tariffs on any Country that does not make its furniture in the United States.” And last night, Trump’s order confirmed 10% tariffs on lumber, as well as 25% levies on kitchen cabinets, vanities and upholstered furniture. Whilst the moves likely won’t have a big impact on inflation on their own, it’s feeding the concern that the tariffs are far from over, particularly given there are still outstanding reviews into sectors like semiconductors and critical minerals.

As all this was going on, US equities put in a decent performance, led by more cyclical sectors. Tech stocks outperformed with the NASDAQ (+0.48%) and the Magnificent 7 (+0.37%) outpacing the S&P 500 (+0.26%). But it was a broad-based advance overall with the equal-weighted S&P up by +0.32%. Construction materials (+1.24%) were one of the best performing subsectors as pending home sales for August rose +4.0% to their highest in five months, in a sign that the move lower in rates is helping housing activity recover from anemic levels.

European markets followed a similar pattern yesterday, with bonds and equities both advancing. As in the US, sentiment was boosted by the fall in oil prices, which helped to dampen fears about inflationary pressures. So yields on 10yr bunds (-3.8bps), OATs (-3.7bps) and BTPs (-4.8bps) all moved lower. And the start of the flash CPI prints were also in line with expectations, with Spanish inflation at +3.0% in September. So there wasn’t much cause for alarm there either, although we’ll get a broader picture today as the German, French and Italian prints come out. Then on the equity side, the STOXX 600 (+0.18%) moved up to a two-week high, and the FTSE 100 (+0.16%) reached a five-week high.

In geopolitical news, Trump and Israel’s Prime Minister Netanyahu said they had agreed a 20-point plan aimed at ending the war in Gaza. Several countries in the region, including Saudia Arabia, UAE and Turkiye issued a statement welcoming the proposals. However, it is rather uncertain whether Hamas will accept the plan, with one of its conditions being that Hamas would have no future role in running Gaza. Still, regional assets gained on the news, with the Israeli shekel (+1.76% against the dollar) being the best performing major currency on the day.

Asian equity markets are fairly quiet this morning after mixed business activity reports from China. As I check my screens, the Shanghai Composite (+0.37%) and the CSI (+0.11%) are slightly higher. The KOSPI (+0.04%), Nikkei (-0.05%), Hang Seng (-0.02%) and the S&P/ASX 200 (-0.05%) are pretty flat along with US equity futures. The RBA have just left rates unanimously unchanged as expected. At first glance the statement is very slightly hawkish with several mentions of upside inflation risk but we'll wait for the presser for more.

Coming back to China, official manufacturing activity contracted for the sixth consecutive month in September, while the service sector also experienced a decline. However, a separate private PMI survey indicated that both manufacturing and services activities expanded significantly more than anticipated in September. The official manufacturing PMI printed at 49.8 in September, which was marginally above the expected figure of 49.6, compared to the previous month's reading of 49.4. It was the highest since March. The non-manufacturing PMI, encompassing services and construction, decreased to 50.0 from 50.3 in August (50.2 expected). Conversely, the RatingDog services PMI recorded a value of 52.9 for September, exceeding expectations of 52.3 but slightly lower than the previous month's print of 53.0. Elsewhere the BoJ summary of opinions out this morning leans a touch hawkish with no real pushback against the need for rate hikes going forward.

To the day ahead now, and US data releases include the Conference Board’s consumer confidence for September, and the JOLTS report of job openings for August. Over in Europe, there’s the September flash CPI prints from Germany, France and Italy, as well as German unemployment for September. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Cipollone and Nagel, Fed Vice Chair Jefferson, the Fed’s Colins, Goolsbee and Logan, and the BoE’s Lombardelli, Mann and Breeden.