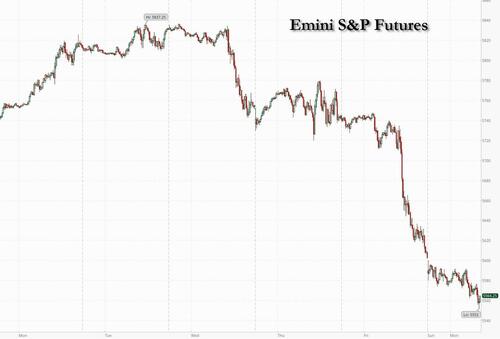

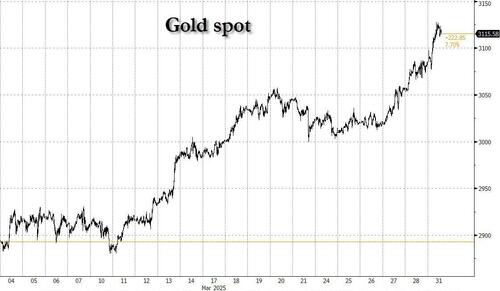

US equity futures and global markets tumbled on the last day of the worst quarter for US stocks in 23 years as the April 2 "liberation day" comes into sharp view. As of 8:00a, S&P futures are down 1.1% after Trump dented hopes he would limit the initial scope of levies set to be unveiled on Wednesday, telling reporters aboard Air Force One he plans to start with “all countries" leading to Goldman promptly slashing its S&P price target for the second time in weeks, now seeing the index dropping to 5300 in 3 months; Nasdaq futures tumbled 1.6% driven by heavy selling of the Mag 7 stocks (NVDA -3.2% and TSLA -4.1%). It wasn't just the US: Europe's Stoxx 600 slid 1.2% and Asian stocks suffered sharp losses, with the Japan’s Nikkei 225 index losing 4% and Taiwan’s stock index falling into a correction. Bond yields are 4-7bps lower; the USD was lower at first but has since rebounded . Commodities rise across the board: gold trading up 1.1% to a new record high of $3120, with base metals mostly higher, and Brent above $74. This week, all eyes are on April 1st (all studies related to trade policy will be completed) and April 2nd (reciprocal tariff announcement, sectorial tariffs such as pharma, semis and commodities, the resumption of 25% tariffs on USMCA-compliant goods). We will also receive ISMs and NFP this week.

In premarket trading, Tesla (TSLA) is leading losses among the Mag 7 ahead of President Trump’s deadline for a new set of sweeping global trade tariffs (Mag 7 movers: Tesla -6.0%, Nvidia -4.3%, Amazon -2.2%, Meta -2.5%, Microsoft -1.6%, Apple -0.8% and Alphabet -1.1%). Cryptocurrency-exposed stocks slip in premarket trading as Bitcoin slumps anew, with crypto traders flocking to the options market to hedge against further price declines. Canada Goose (GOOS) shares fall 5.3% in premarket trading on Monday as Barclays cuts the upscale parka retailer’s rating to underweight from equal-weight, citing challenging macro pressures. Here are the other notable premarket movers:

We had an eventful weekend with a slew of headlines from Washington: (i) a WSJ article suggested that the 20% tariff hike across-the-board is back on the table (here), along with Trump’s comments that he “couldn’t care less” if automakers raised prices due to new tariffs (CNBC); (ii) geopolitical tensions seem to rise with Russia (Trump said in an interview that he may put secondary tariffs on oil) and Iran (Iran rejected direct negotiation with the US; here). In addition, there was a concerning article on AI spending slowdown from The Information (here).

Trump also said he plans to start his reciprocal tariff push with “all countries,” tamping down speculation that he could limit the initial scope of levies set to be unveiled April 2. The president has said the tariffs will be “lenient,” but investors are on guard given the lack of specifics.

“It’s all about the tariff uncertainty,” Jefferies strategist Mohit Kumar said. “The negative scenario for the market would be that April 2 just marks the starting point of negotiation, and we have an extended period of negotiations where there is not much clarity on the tariff structure.”

Depending on the scale of what’s announced, Bloomberg Economics sees scope for a 4% hit to US GDP over a two- to three-year period, alongside a 2.5% increase in prices.

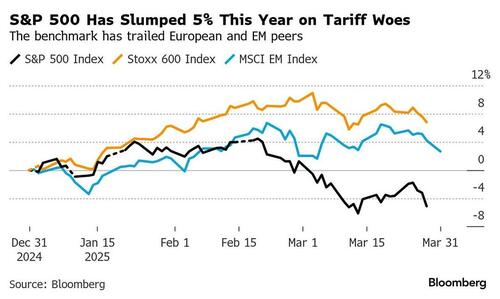

The risk that tariffs will hurt the global economy has propelled the S&P 500 to a 5.1% plunge in the first quarter, which would be the worst since 2022, and wiped about $5 trillion off the value of US equities since late February.

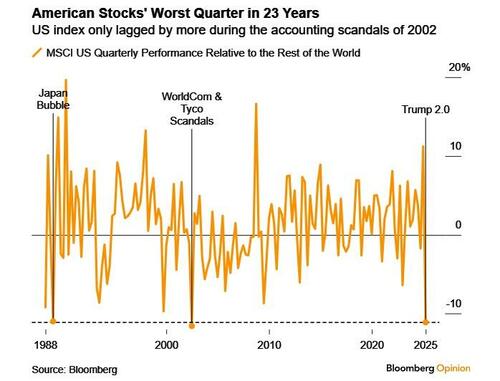

It gets worse: as Bloomberg's John Authers notes, we are on the verge of closing the worst quarter for US stocks relative to the rest of the world since 2002!

The S&P 500 and the Nasdaq are both set to test mid-March lows — with the S&P’s mid-March low of about 5,500 points flagged by RBC Capital Markets strategist Lori Calvasina as a key support level. The March correction has been accompanied by an elevated count of swing days: As of Friday the S&P 500 moved more than 1% on 12 trading days in March, the highest reading since 2022.

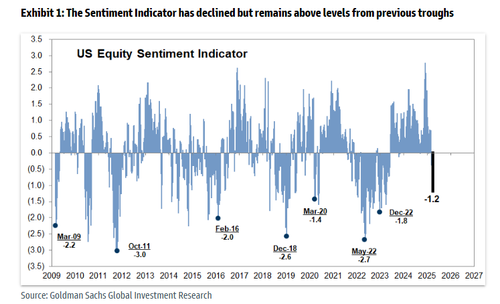

Goldman's US Equity Sentiment Indicator of investor positioning declined further this week to -1.2, the lowest reading since April 2023, but remains above levels typically reached at the trough of other major drawdowns during the past 15 years.

Meanwhile, as we first noted overnight, Goldman’s David Kostin cut his S&P 500 target for a second time this month. He expects the benchmark to end the year around 5,700 points versus his previous estimate of 6,200, citing a higher recession risk and tariff-related uncertainty.

Trump’s reciprocal tariff push is set to begin on April 2. In comments reported by NBC News, the US president also threatened curbs on “all oil coming out of Russia.” Speculation is also increasing that the trade war will spur more interest-rate cuts at the Fed and the ECB/ Ten-year Treasuries dropped six basis points to about 4.18% on Monday, while Bund yields fell three basis points.

Treasuries are on track to outperform stocks this quarter for the first time since the pandemic onset in March 2020. Jamie Niven, senior portfolio manager at Candriam, said 10-year US rates may slide below 4% as early as this week. “What’s changed is that markets are now starting to price the downside in risk assets as a recession risk and therefore Treasures rally,” he added.

European stocks follow their Asia counterparts lower ahead of Trump’s deadline for a new set of sweeping global trade tariffs. The Stoxx 600 falls 1.2% with mining and travel & leisure equities led declines, while telecommunications and utilities shares are the biggest outperformers. Here are the biggest movers Monday:

Earlier in the session, Asian stocks tumbled as traders braced for potential damage from tariffs threatened by US President Donald Trump that are set to be announced this week. The MSCI Asia Pacific Index fell 2.2%, putting it on track for its steepest loss in a month. Stock markets across Asia declined, with benchmarks in Japan and Taiwan sliding more than 4% to lead the selloff. Thai shares fell after trading reopened following an earthquake. Singapore, India, Indonesia and Malaysia were closed for holidays. The regional selloff came as investors turned their attention to a planned April 2 announcement of US reciprocal tariffs that Trump said will cover “all countries,” stoking concerns over a global trade war. Economic data Friday showing a plunge in US consumer sentiment and weak spending added to concerns. Chipmakers TSMC and Samsung Electronics were among the biggest drags on the MSCI regional gauge Monday, along with Chinese internet firms Tencent and Alibaba. Taiwan’s equity benchmark entered a technical correction, while Korean stocks slid as the nation resumed short-selling following a 17-month ban on the practice.

In rates, treasuries are richer by 5bp-6bp across maturities in early US session after gapping higher at the Asia open amid slumping equity markets globally. 10-year TSY yield near 4.19% is down ~6bp, outperforming bunds and gilts in the sector by 2.5bp and 1bp. As intermediate sectors led the move, 5s30s spread reached new multi-month wides above 67bp. Fed-dated OIS contracts price in additional easing this year, around 80bp vs 71bp at Friday’s close. Goldman Sachs projected the Fed will cut in July, September and November; its previous forecast was for two cuts this year and one in 2026. Morgan Stanley late Friday recommended being outright long 7-year Treasuries or TY futures to hedge risk-aversion. Treasury auctions resume next week with 3-, 10- and 30-year debt sales

In FX, the Bloomberg Dollar Spot Index is little changed. USD/JPY fell as much as 0.8% to 148.70, the lowest since March 21, before erasing almost all losses and trading at 149.4. “USD/JPY will take its cue from global equity markets this week,” Commonwealth Bank of Australia strategists including Kristina Clifton wrote in a note. “Risks are tilted to a sharp drop in global equities and a weaker USD/JPY.” The Euro also rose initially only to slide after inflation data in Germany missed expectations.

In commodities, spot gold climbs $35 to top a record $3,115 an ounce after it set another record. Bitcoin falls to around the $81,000 level. Oil prices advance with WTI up 0.5% at $69.70 a barrel having topped $70 at one stage as the market weighed Trump’s mixed remarks about the threat of fresh penalties on Russian crude.

Looking ahead, the US economic calendar includes March MNI Chicago PMI (9:45am, several minutes earlier for subscribers) and Dallas Fed manufacturing activity (10:30am). Fed speaker slate empty for Monday. Barkin, Kugler, Jefferson, Cook, Powell, Barr and Waller have events scheduled later this week.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Top Asian News

Top European News

Tariffs/Trade

UPDATES FROM THE US

UPDATES FROM OTHER NATIONS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured heading into month- and quarter-end amid tariff concerns as Trump's April 2nd Liberation Day drew closer, while geopolitical risks lingered after US President Trump voiced anger towards Russian President Putin for comments about Ukrainian President Zelensky and Trump also threatened to bomb Iran if a nuclear deal can't be reached. ASX 200 declined with all sectors in the red and underperformance in the mining, resources and materials sectors, while participants also await tomorrow's RBA rate decision where the central bank is widely expected to remain on hold and with the focus to turn to if there is any change to the cautious message regarding future rate cuts. Nikkei 225 suffered heavy losses and slipped beneath the 36,000 level amid the tariff concerns and with notable weakness seen in tech stocks, while the selling is also exacerbated heading into fiscal year-end and amid yen strength. Hang Seng and Shanghai Comp conformed to the downbeat risk tone after failing to sustain the early resilience seen in the mainland following encouraging Chinese PMI data and reports that China's Finance Ministry is to inject USD 69bln into four large Chinese banks, while there was also a slew of earnings releases including from most of the big 4 banks.

Top Asian News

European bourses began the week on the backfoot into month & quarter end, the looming April 2nd ‘Liberation Day’, and ongoing geopolitics; Euro Stoxx 50 -1.5%. Sectors in the region are broadly in the red, Basic Resources lag with Autos a close second. Basic Resources have failed to lift amid demand/growth concerns, despite gold prices surging to USD 3,100/oz for the first time. Chinese PMIs inched higher, though CapEco sees slower Chinese GDP growth in Q1.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Welcome to the last day of March ahead of the hotly anticipated "Liberation Day" on Wednesday. Asian equity markets are sinking as the fear of what it may contain continues to build. The Nikkei for example is -4.04% overnight as I type.

A couple of weeks ago, I referred to what I considered to be a rather insightful podcast featuring US Treasury Secretary Scott Bessent on the "All-In" podcast (link here). He outlined his ideologies and, in my view, committed the administration to potentially transformative policies. Shortly thereafter, US Commerce Secretary Howard Lutnick appeared on the same podcast and presented perhaps an even more radical perspective on the potential policy direction.

I think these are valuable podcasts to listen to and have helped convince me that this administration is serious about radical change. For those short on time, we uploaded the transcripts to Google NotebookLM and generated approximately 1,000-word summaries of each. This served as a useful test case for AI and hopefully provides informative summaries.

Also this morning we've published the next publication in our new Deutsche Bank Research Institute looking at how Germany's shrinking auto industry could be the key for expanding the defence capacity. It contains lots of fascinating stats about the spare capacity in autos and what is likely to be needed in defence alongside policy recommendations.

Moving back to this week, outside of "liberation day" and 25% tariffs on imported autos commencing on Thursday, it's also a big week for macro with all roads leading to Friday's payrolls and a speech by Powell. Before that, the main highlights are: today's German CPI; tomorrow's US manufacturing ISM, US auto sales, US JOLTS, China's manufacturing PMI, Japan's Tankan, Eurozone CPI, the RBA rate decision, and a speech from Lagarde; Wednesday's ADP report; Thursday's US ISM services, China's services PMI, Eurozone PPI, and the ECB account of the March meeting; all before the big end to the week on Friday.

In terms of what to expect from "Liberation Day" on Wednesday, the bid-offer is huge. As our US economists laid out last week (see "A little reciprocity goes a long way") reciprocal tariffs could add roughly 4 (best case) to 14ppts (worst case) to the overall US tariff rate relative to its 2024 level of 2.5%. The hit to 2025 real US GDP growth could be as little as -25bps to as high as -120bps. For core PCE inflation, reciprocal tariffs could add anywhere from a couple of basis points to potentially 1.2ppts. Importantly, these impacts are additional to the risks to growth and inflation from previously announced tariff actions.

Our economists calculate that the trade actions taken to date (if they remain in place through year end) imply an overall US tariff rate of roughly 10.5%, which is the highest since WWII. The Trump Administration's auto tariffs (see "Auto tariffs rev up inflation, pump brakes on growth") could push the US tariff rate as high as another couple of percentage points higher depending on the implementation details. So the starting point before "liberation day" is 10.5-12.5%. As such by the end of this week we could be looking at a aggregate US tariff rate of (very roughly) between 15 and 25%.

Over the weekend, Mr Trump told NBC that he "couldn't care less" if automakers had to raise prices in the US as it would force Americans to buy US made cars. The 25% tariffs are due to come into force on Thursday. So its becoming ever clearer that this administration is serious about bringing massive change to economic policy. If and where their pain threshold is in terms of markets and the economy is the next most important question. The rhetoric from the administration at the moment seems to suggest its high but there is an extraordinary amount of uncertainty at the moment.

The pain isn't showing up in the hard data at the moment and in terms of US payrolls on Friday there's only likely to be a small impact, DB forecasts +150k for both headline and private against +151k and +140k respectively last time. Incorporated in that is a roughly 20k drag from federal layoffs which have been complicated by court actions against them. DB expect the unemployment rate to just round up to 4.2% from 4.1% last time. Before that it will be interesting to see if the US manufacturing ISM (Tuesday) and services (Thursday) show any sentiment hit.

Tomorrow sees two special congressional elections in Florida to fill the seats of Matt Gaetz and Michael Waltz in the US House of Representatives. These are Republican strongholds but some polling has suggested it could be close. The Republicans will still control the House regardless but only have the narrowest of majorities so these are important elections in terms of breathing space for their agenda.

In geopolitics, the focus will be on a meeting of NATO foreign ministers on April 3-4. Its the first time they've met since Trump's inauguration. So they'll have plenty to discuss

Staying on this theme, over the weekend, Trump suggested he was angry at Putin over his recent comments that Zelenskiy should be replaced as a price for peace negotiations. Mr Trump used slightly stronger language according to NBC. Trump said that if Russia was to blame for there being no peace deal he's prepared to put secondary sanctions on Russian oil.

Asian equity markets are facing intense selling pressure as March sees its final hours there. The Nikkei (-4.04%) is the biggest underperformer with the KOSPI (-2.94%), Hang Seng (-1.74%) and S&P/ASX 200 (-1.54%) all sharply lower. Elsewhere, mainland Chinese stocks are holding in a bit better with the CSI (-0.99%) and the Shanghai Composite (-0.97%) outperforming. S&P 500 (-0.65%) and NASDAQ 100 (-1.17%) futures are lower with Euro Stoxx futures (-0.66%). 10yr USTs are -4.4bps lower at 4.21% as I type.

Coming back to China, the official manufacturing activity expanded at its fastest pace in a year, coming in at 50.5 in March (v/s 50.4 expected), picking up slightly from 50.2. The increase was more apparent with the non-manufacturing PMI data, which grew 50.8 in March, (v/s 50.6 expected) and accelerating from the 50.4 seen the month before. This saw the Chinese composite PMI advance to 51.4 in March from 51.1 in February.

Elsewhere, Japan’s industrial production grew at the fastest clip in nearly a year, as factory output increased by +2.5% y/y in February (v/s +2.0% expected) following a -1.1% decline the previous month. Retail sales growth slowed significantly to +1.4% year-over-year in February, falling short of the anticipated +2.5% and considerably lower than January's revised +4.4% increase.

Recapping last week now, the announcement of US auto tariffs and the prospect of retaliation meant investors grew increasingly concerned about stagflation. The impact was clear across different asset classes, and the US 1yr inflation swap moved up +20.9bps over the week to a two-year high of 3.16%, reaching levels last seen when the Fed were still hiking rates. But although tariff fears played a key role, those inflation concerns got a further boost from a strong PCE inflation report, which is the measure the Fed officially targets. It showed core PCE was up +0.4% in February (vs. +0.3% expected), which pushed the year-on-year rate up to +2.8% (vs. +2.7% expected). Shortly after, the University of Michigan’s survey also showed long-term inflation expectations hitting a 32-year high, with 5-10 year expectations coming in at 4.1% on the final print, two-tenths above the preliminary reading. So all that meant investors became increasingly focused on inflation, and gold prices moved up +2.00% last week (+0.87% Friday) to a record high of $3,083/oz.

The downbeat newsflow meant equities lost ground across the world, and the S&P 500 gave up its initial gains at the start of the week to close -1.53% lower (-1.97% Friday). The Magnificent 7 posted a 6th consecutive weekly decline for the first time since May 2022, falling another -2.41% last week (-3.48% Friday) and leaving the index -20.5% below its December peak. European equities also slumped, with the STOXX 600 down -1.38% (-0.77% Friday). That just about extended the run of STOXX 600 outperforming the S&P 500 to 9 consecutive weeks, the longest such streak since 1999. Meanwhile in Japan, the Nikkei fell -1.48% (-1.80% Friday), cementing its position as one of the worst-performing major indices this year, with a -6.95% decline YTD.

US Treasuries had struggled for much of the week, but the risk-off move on Friday reversed those losses. A -11.6bps decline on Friday left 10yr Treasury yield unchanged on the week at 4.25%. Front-end real yields saw large declines, with the 2yr real yield falling -19.1bps to 0.64%, their lowest since August 2022 when the fed funds rate was 200bps lower than currently. Over in Europe bonds saw a late surge on Friday, with 10yr bund yields falling -4.6bps to 2.72% (-3.8bps over the week). This was helped by soft inflation readings from France and Spain, which saw flash CPI prints for March coming in beneath expectations, with France at +0.9% on the EU-harmonised measure, whilst Spain was at +2.2%. So that led to optimism that the Euro Area number on April 1 would be weaker than expected, which cemented the view that the ECB would cut rates again at their next meeting in April.

Finally, the one asset class that saw a decent performance was commodities last week. However, that further exacerbated the inflation concerns mentioned above, particularly with further tariffs in the pipeline as well. That included fresh gains for oil, with Brent crude up +1.80% (-0.69% Friday) to $73.46/bbl, whilst copper prices were up +0.45% in their 4th consecutive weekly gain having hit a new record high on Wednesday.