Futures are higher led by tech as voting gets underway in a very tight presidential race between Donald Trump and Kamala Harris (full election day guide here). As of 8:00am S&P futures are up 0.1%, off session highs; Nasdaq futures are 0.3% higher with Mag7 names mostly higher as Semis also have a bid. DJT is +6% pre-mkt; BA is +2% after the company secured a labor deal ending an 8 week strike. Palantir surged 13% on record profit and high demand for its artificial intelligence software. The dollar was steady, while 10-year Treasury yields advanced four basis points to 4.32%. The commodity complex is stronger today led by Energy and Base Metals; brent trades aroun $75.50. The macro data focus is on ISM Services and the Election, although we may have to wait for the results: in 2016, Trump was declared winner early Weds but in 2020, Biden was declared winner on Sat.

In premarket trading, Boeing shares rose 1.9% after workers voted to accept a new labor contract and end a strike that’s crippled jetliner production for 53 days, clearing a major obstacle for the US planemaker to restore its operations and finances. Celanese shares plunged 16% after the chemical manufacturer’s fourth-quarter profit guidance disappoints following “severely constrained demand” in the third-quarter. Here are some other notable premarket movers:

Traders are taking a cautious approach after one of the most tumultuous and dramatic presidential campaigns in modern history. With polls suggesting a photo-finish result, the likelihood of a disputed result means that the vote count could eventually drag on for days or even weeks.

“What you can see across markets now is that no one is ready to take clear investment positions on the election,” said Alexandre Hezez, chief investment officer at Groupe Banque Richelieu in Paris. “The uncertainty is palpable across all asset classes. There’s such a massive gap between the program of the two candidates that caution is of the essence.”

Options data suggests stock traders are pricing in a 1.8% move in either direction for the S&P 500 on Wednesday, according to Citi. The swings will likely be most obvious in individual stocks and sectors, as has been the case so far this election season. “A tough count will increase uncertainty on the markets, a scenario that produces not many winners,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM.

Some hedge funds are favoring currency options that will gain from a weaker dollar should Harris win the presidency. Close polling in especially Iowa jolted leveraged funds to re-evaluate who will emerge victorious, with some unwinding bullish greenback bets on Monday.

There are additional catalysts likely to move the market this week. Election Day will quickly be followed by Thursday’s Federal Reserve’s decision and Jerome Powell’s press conference, where he’ll give details on the central bank’s interest-rate path. A big chunk of US firms are due to report earnings.

In Europe, the benchmark Stoxx 600 was little changed, with volumes tracking about two-thirds of the 20-day average. Miners and utilities the leading outperformers, while consumer products and chemicals stocks are the biggest laggards. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks climbed, buoyed by a jump in Chinese equities amid expectations for more stimulus and encouraging economic data. The MSCI Asia Pacific Index gained as much as 0.5%, with TSMC, Sony Group and Toyota Motor among the biggest contributors to the advance. Chinese gauges were the best performers in the region, with the onshore benchmark CSI 300 Index up as much as 2%, on track to cap its best day in more than two weeks. Sentiment in China was helped by a proposal to lift local governments’ debt ceiling to swap out their hidden debt. Signs that consumer demand may be on the mend also boosted the mood after a private survey showed China’s service activity expanded at the fastest pace since July. The rally is “more driven by the PMI,” though the debt proposal is good news and will boost the expectation of other measures, said Kenny Wen, head of investment strategy at KGI Asia Ltd. Stocks rebounded in Japan as markets reopened after a holiday. Investors are also on guard as the first day of extended trading hours at the Tokyo Stock Exchange has the potential to cause volatility toward the close.

Overnight, the RBA kept the Cash Rate unchanged at 4.35%, as expected, while it stated the board will continue to rely upon the data and evolving assessment of risks, as well as noted that inflation remains too high and is not expected to return sustainably to the midpoint of the target until 2026. RBA said policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range and the board is not ruling anything in or out. Furthermore, the SoMP stated that core inflation remains elevated with service inflation expected to decline only gradually and that policy in Australia is not as restrictive as in most peer countries, even after recent rate cuts abroad, while RBA lowered its GDP, household consumption, trimmed CPI and core inflation forecasts.

In FX, the Bloomberg Dollar Spot Index falls 0.1% even as 10Y US Treasury yield rose 4 basis points to 4.33%. “The unwinding of the Trump trade can only go so far given how close the race is,” Maybank analyst Saktiandi Supaat writes in a note. “The DXY index has found support around 103.60 while topside is seen at around 104.60. We see consolidation within this range until a winner is called” USD/JPY was up as much as 0.3% to 152.54 earlier after Democratic Party for the People leader Yuichiro Tamaki said Bank of Japan monetary policy should stay on hold a while longer. Chinese stocks rise after higher-than-expected PMI data in the world’s second largest economy, also promoting a move higher in the Aussie dollar, which outperformed G-10 currencies.

In rates, treasuries are weaker amid bigger declines for European bonds after UK 10-year bond sale drew weakest demand in almost a year, a sign of lingering investor anxiety over last week’s fiscally expansive budget. US yields are 3bps cheaper across a slightly steeper curve; 10-year around 4.33% is ~4bps higher with bunds and gilts underperforming by 1.5bp and 1bp in the sector. The Treasury’s $42 billion 10-year refunding auction follows soft demand for Monday’s 3-year note sale. US 10-year WI yield is around 4.31% ahead of the auction at 1pm New York time, about 24bp cheaper than last October’s, which tailed by 0.4bp

In commodities, oil prices advancd, with WTI rising 0.4% to $71.70 a barrel. Spot gold is steady around $2,738/oz.

To the day ahead now, and of course the main highlight will be the US election. On the data side, US releases include the ISM services for October and the trade balance for September. In Europe, there’s French industrial production for September and the final UK services and composite PMIs for October. From central banks, we’ll hear from the ECB’s Vujcic and Schnabel.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with most major indices in the green after further encouraging Chinese PMI data although some of the gains were capped as cautiousness lingered heading into the US Presidential Election coin toss. ASX 200 was dragged lower amid weakness across all sectors and underperformance in the top-weighted financial industry, while the RBA decision provided little surprise and the SoMP included a reduction in GDP and household consumption forecasts. Nikkei 225 rallied on return from the long weekend with some encouragement from earnings and strength in exporters. Hang Seng and Shanghai Comp benefitted following the better-than-expected Chinese Caixin Services PMI data, while Premier Li suggested a favourable outlook and optimism regarding economic prospects during his keynote speech at the CIIE.

Top Asian news

European bourses, Stoxx 600 (+0.2%) opened on a weaker footing, but sentiment did begin to improve into the European morning to display a more mixed picture across Europe. European sectors began the European session on a mixed footing, and with the breadth of the market fairly narrow; sentiment has since improved with sectors now holding a positive bias. Basic Resources leads whilst Energy lags. US Equity Futures (ES +0.1%, NQ +0.2%, RTY U/C) are mixed, with very modest outperformance in the NQ, attempting to pare back some of the losses seen in the prior session. Focus almost entirely on the US election.

Top European news

FX

RBA

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

To encourage readers to stay until the end of today’s EMR I will unveil my prediction for what might happen in today’s US election below the day ahead para. No early scrolling please.

As we reach one of the more important and consequential days we will have in our careers, according to the very latest polls it’s a statistical toss-up with 0.1pp separating the two candidates in the popular vote according to RealClearPolitics averages. As I showed in my CoTD yesterday this could easily be the tightest election on record on this measure with the 1880 and 1960 elections the only ones with a less than 0.5pp gap. Trump leads the battleground states by 0.8pp in the RealClearPolitics polling averages but the “best pollster in politics“ according to FiveThirtyEight threw a curveball over the weekend by suggesting that Iowa leans towards Harris by 3pp even though other recent polls in the State have Trump up by around 8pp.

Another thing to consider is that in 2016 and 2020, the polls underestimated Trump, so plenty have argued they might do so again. But then again, the pollsters have made strenuous efforts to correct for that, so lots have argued the reverse might be true this time around, and Trump’s margins were generally overestimated in the Republican primaries earlier this year. Given this, the major forecasting models are completely torn. For instance, FiveThirtyEight gives Trump a 52% chance of winning. That’s largely echoed in prediction and betting markets. Polymarket put Trump’s victory chances at 59% as we hit the last few hours before polls open. This did tick up a bit as yesterday went on, rising from a low of 54% over the weekend. Showing how important the battleground states are though, Polymarket have Harris at 72% to win the popular vote.

For those watching tonight, the excitement will kick off from 7pm ET/midnight London when polls close statewide across six states. Critically, that will include the battleground state of Georgia, which is a state that flipped from Trump to Biden in 2020, and had the closest margin of any state last time at 0.2pts. Then at 7:30pm ET, polls will close in North Carolina, which is another battleground state on the east coast. Bear in mind that both Georgia and North Carolina are basically must-wins for Trump on his path to 270 electoral votes. So if Harris were doing well in both of those, it would be difficult to see a winning path for Trump, unless he also managed to seriously outperform in the Midwest. Remember as well that polling errors are likely to be correlated across the country, so once the first battleground states come in, that should offer us a good clue about where the rest of the night might go.

At 8pm ET, we’ll then get another big round of polls closing, including in Pennsylvania. That’s the most important battleground state in many forecasts, as there’s a decent chance it’s the tipping point state that gives either candidate 270 electoral votes. So if there’s one state you’d want to know the result of, it’s Pennsylvania. Then at 9pm, polls will close in the other Midwestern battlegrounds of Wisconsin and Michigan, as well as Arizona. At this point, if Trump were running strongly in the midwestern trio of Wisconsin, Michigan and Pennsylvania, that would be a very good sign for his campaign, as those are the three states he took in 2016 that pushed him over the winning line.

Depending how close the race is, a winner might be coming into view at some point after this. So in 2012, the Associated Press called the race for Obama at 23:38 ET (04:48 London). In 2016, when things were a bit tighter, AP didn’t call the race until 02:29 ET (07:29 London). And then last time, there were lots of delays with mail-in ballots, and an AP declaration wasn’t made until 11:26 ET on the Saturday. But remember that in every example here, the eventual winner was apparent some time before they cleared the threshold of 270 electoral college votes, so if the major battlegrounds are going the same way, we may well have a good sense before one candidate crosses the winning line.

Whilst the presidential race is in focus, don’t forget that elections to the House of Representatives and the Senate are also happening, which will be crucial for the new President’s ability to enact their agenda. In the Senate, the Republicans are heavily favoured by forecasting models and prediction markets, as only a third of the seats are up for grabs, and most are currently held by the Democrats. So there’s more opportunity for the Republicans to gain seats, and they have plausible pick-up opportunities in West Virginia and Montana. In the current Congress, the Democrats have a 51-49 Senate majority, and the Vice President has the casting vote in the event of a tie, so the Republicans only need to gain one seat if Trump wins, and two if he doesn’t. As it stands, FiveThirtyEight’s forecast gives the Republicans a 92% chance of controlling the Senate.

Over in the House of Representatives it’s a similar toss-up as in the presidential race, with FiveThirtyEight’s model giving the Republicans a 49% chance of victory. In reality, given the correlation of polling errors, it’s likely to go the same way as the presidency. So if a divided government scenario does happen, the most likely permutation would be that the Republicans take control of the Senate, but the Democrats win the Presidency and the House. That would be important as the Senate doesn’t just have a role in passing legislation, but is also the chamber that approves cabinet appointments, Supreme Court justices, and Federal Reserve Governors. In modern times, every President since Bill Clinton has begun their presidency with both chambers of Congress in their party’s control, but there’s no guarantee of that, and last time the Democrats only narrowly ended up with the Senate thanks to the Georgia run-off elections in January.

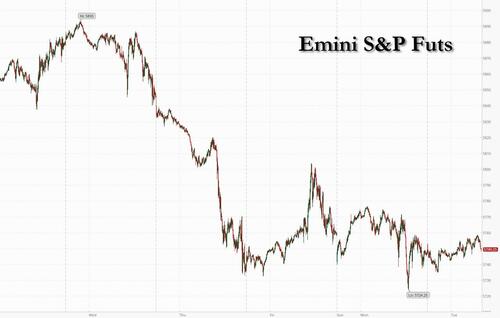

In terms of the market reaction, there’s been a clear unwinding of the Trump trade over the last 24 hours, which follows a few polls over the weekend that were more favourable to Kamala Harris. In particular, the 10yr Treasury yield fell -9.9bps to 4.29%. They did pull back slightly after trading -12bps lower at one point, but this is still the biggest daily decline since the bad jobs report in early August that kicked off the summer market turmoil. The logic for the Treasury rally is that under a divided government scenario, we’re less likely to see fiscal stimulus, so that’s better news for Treasuries, and with less fiscal stimulus we’re more likely to get rate cuts from the Fed. Clearly the next moves are going to depend on who wins the election and the outcomes in Congress, but for a trip down memory lane, Henry published a note yesterday (link here) running through how markets reacted after each election since 2000.

The unwinding of the Trump trade was reflected among several assets. The dollar index fell by -0.38%, after having fallen as much -0.7% intra-day, whilst the Mexican Peso strengthened +0.93%. And when it came to equities, there were gains among solar energy companies given the perception they’ll do better under a Democratic administration.

Equity moves were more moderate yesterday but showed some investor nervousness ahead of the election. The S&P 500 retreated by -0.28%, with Tesla (-2.47%) leading a -0.92% decline for the Mag-7. Energy stocks were the strongest outperformer in the S&P as oil prices bounced back after OPEC+ pushed back its planned December production increase by one month (Brent +2.71% to $75.08/bbl). Over in Europe it was a similar story of modest losses, with the STOXX 600 down -0.33%. Volatility remained pretty elevated, with the VIX index inching up +0.10pts to 21.98pts.

Here in the UK, it wasn’t noticed much given the US election backdrop, but the spread of 10yr gilt yields over bunds ticked up another +2.5bps yesterday to 207bps. That’s the widest they’ve been since October 2022, back when Liz Truss was still PM, and the 10yr gilt yield (+1.4bps) was also up to a one-year high of 4.46%. Elsewhere in Europe however, yields fell back, with those on 10yr bunds (-1.2bps), OATs (-2.4bps) and BTPs (-1.7bps) all falling.

Asian equity markets are generally on the rise this morning, driven by a series of positive developments from China that have boosted risk sentiment. The CSI (+1.99%), Shanghai Composite (+1.80%), and the Hang Seng (+1.24%) are leading the gains after the fastest expansion in China’s service activity since July. Further support came from the premier’s remarks highlighting the country’s significant policy flexibility. Following a public holiday, Japan’s Nikkei 225 (+1.27%) is also trading notably higher. Elsewhere, the KOSPI (-0.22%) and the S&P/ASX 200 (-0.32%) are seeing minor losses. US equity futures are fairly flat as we hit the big day and 10yr USTs are +1bps higher at 4.30% as we go to print.

Turning our attention back to China, the Caixin/S&P Global services PMI rose to 52 in October, up from 50.3 in September, indicating stronger demand following new stimulus measures from Beijing. However, this contrasts with the official PMI data released last week, which showed a slowdown in non-manufacturing activity in October. Elsewhere, Australia’s Judo Bank services PMI came in at 51.0 in October, higher than last month's figure of 50.5 as improvements in demand led to new business expanding at the fastest pace in almost two and a half years.

In monetary policy action the Reserve Bank of Australia (RBA) left its key interest rate unchanged at 4.35% for an eighth meeting in a row as it awaits more evidence inflation will soon return to its preferred target range. The press conference has just started as I type this.

To the day ahead now, and of course the main highlight will be the US election. On the data side, US releases include the ISM services for October and the trade balance for September. Meanwhile in Europe, there’s French industrial production for September and the final UK services and composite PMIs for October. From central banks, we’ll hear from the ECB’s Vujcic and Schnabel.

The prediction…….

….. I have absolutely no idea who is going to win. I have high conviction in this view.