US stock futures, European bourses and Asian markets all rose, while the 10-year Treasury yield traded near a three-week low and the USD eeked out its first gain of the week as traders reacted to a modest improvement in China's mfg PMI and looked ahead to Thursday's PCE data and Friday’s jobs report. At 7:45am ET, S&P futures rose 0.25% to 4,535 while Nasdaq 100 futures reversed earlier losses. Europe’s Stoxx 600 benchmark stayed in the green, buoyed by record profits at UBS as a result of its emergency takeover of Credit Suisse. Commodities are stronger led by oil and metals with natgas and wheat the biggest laggards. Today’s macro data focus includes jobless claims, income/spending and the PCE Deflator. Chicago PMI, expected to rise to 44.2, may point to a stabilization in mfg. Tomorrow we cap off the week with NFP.

In premarket trading, the retail rout continued with Dollar General plunging more than 13% after the company cut its 2024 net sales and profit forecast; Chewy also fell 5.3% as analysts say the pet products company’s customer growth disappointed in the second quarter amid macro uncertainties. Evercore ISI downgraded its rating. Okta jumped 11% after it reported second-quarter results that beat expectations and raised full-year forecast. Analysts highlight improvement in margins and the company’s sales strategy. Here are some other notable premarket movers:

Sentiment was modestly boosted after China’s NBS PMIs showed that Manufacturing came in at 49.7 (up from 49.3 in Jul and ahead of the Street’s 49.2 forecast) and Manufacturing new orders back in expansion mode for the first time in 5 months; on the other hand, Non-Manufacturing ticked down to 51 (down from 51.5 in Jul and below the Street’s 51.2 forecast).

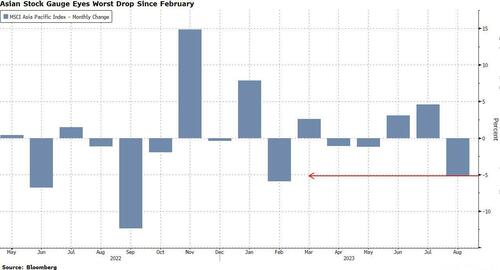

The S&P 500 was headed for the worst month since February, while the Nasdaq 100 is set for the largest decline this year. Asian and global stocks are also on pace for the biggest monthly losses since February.

Traders are closing out the month with economic data and China’s bruised markets center stage. Thursday’s mixed moves come after stocks and bonds pared their August losses in the past week. US jobless numbers picked up slightly to 235,000 according to economists polled by Bloomberg ahead of initial claims data due Thursday. Friday’s non-farm payrolls are seen at 170,000 in August versus 187,000 in July, while hourly wage growth is predicted to slow slightly. Weaker-than-expected economic numbers supported predictions for the Fed to ease back on interest-rate hikes on Wednesday.

“The big market catalyst we’re looking for in September is the Fed meeting,” Hugh Gimber, global market strategist at JPMorgan Asset Management, said by phone. “Tomorrow’s payrolls data will be hugely relevant for that meeting. Without a slowdown in wages, a soft landing is impossible.”

European stocks were higher with the Stoxx 600 rising 0.4%. The financial services, retail and real estate sectors are leading gains. The euro dropped 0.5% versus the dollar as euro-zone inflation stopped slowing in August, according to data on Thursday. That presents European Central Bank officials with a quandary as they weigh the possibility of tighter policy against signs of flagging growth. Here are the biggest European movers:

Earlier in the session, Asian stocks were mixed, heading for their worst monthly drop since February, as the rally in Chinese equities faltered amid worries about growth and the property crisis in Asia’s largest economy.

The MSCI Asia Pacific Index erased earlier gains of as much as 0.4% to trade little changed. Benchmarks in Japan and Singapore rose, while those in South Korea, Taiwan and Australia were lower. Equities in mainland China were set to extended their losses for another session after factory output contracted again, with the onshore stock benchmark poised for its biggest monthly decline since October. Gauges in Hong Kong fluctuated.

After suffering most of August on China’s growth concerns, the main Asian stock benchmark was on course for about a 5% drop this month, even after the recent recovery in Chinese stock markets helped narrow the loss. Equities rebounded earlier this week on the mainland following Beijing’s latest steps to shore up investor confidence in capital markets on Sunday but the rally lost steam after mid-week.

Asian stocks have been driven by “a combination of what’s happening in the US macro cycle and what’s happening in the Chinese macro cycle,” as well as the “ongoing AI bubble,” Mixo Das, Asia equity strategist at JPMorgan Securities, said in an interview with Bloomberg TV.

In FX, the Bloomberg Dollar Spot Index rose to session highs and after falling as much as 0.2% earlier. The yen rose the most among the Group-of-10 currencies. The greenback is likely to be “somewhat” volatile over the data release as PCE is the Fed’s preferred inflation measure, said Richard Grace, a senior currency analyst at InTouch Capital Markets Pte. “The market appears to still trying to work out the recent pattern of stronger-than-expected US economic data for a number of weeks, and now a pattern of weaker-than-expected US economic data for a number of days”

The euro fell as traders bet the ECB will hold off on raising rates next month, even as recent data shows inflation is still running above target. The repricing in ECB rates comes after policymaker Isabel Schnabel highlighted the mounting risks to growth and said she can’t say how long rates will remain in restrictive territory. “If the weakness we have seen so far is not enough to bring inflation down, the economy needs to weaken even more,” said Athanasios Vamvakidis, head of G-10 FX strategy at Bank of America. “That’s the main concern for the euro.” AUD/USD rose 0.2% to 0.6488, paring an earlier rise of as much as 0.5%.

In rates, treasuries held small gains in early US trading, paced by UK and euro-zone bond markets, with yields mostly inside Wednesday’s ranges. TSY yields are lower across the curve by 1bp-3bp; Wednesday’s ranges included lowest levels in more than two weeks for all benchmarks except the 30-year. Month-end index rebalancing at 4pm will extend its duration by an estimated 0.12 year as Treasuries issued during the month are added. Bunds are higher while the euro has extended declines as traders seem to focus on the slowdown in euro-area core inflation rather than the headline rate which held steady. Market pricing now suggests a less than 30% chance the ECB raises rates in September, down from ~40% before the data. German 10-year yields are down 5bps at 2.49% while two-year yields drops 9bps. The US economic calendar includes weekly jobless claims and July personal income and spending at 8:30am New York time and August MNI Chicago PMI at 9:45am. Focal points of US session include personal income and spending data that includes PCE deflator, Fed’s preferred inflation gauge, and month-end index rebalancing.

In commodities, Brent crude oil advanced for a third day with WTI rising 0.5% to trade around $82. Spot gold rises 0.1%.

Bitcoin was under modest pressure holding around the USD 27k mark within fairly narrow ranges above the figure. Pressure which eminates from the firmer USD in European trade.

Looking to the day ahead now, and data releases include the Euro Area flash CPI print for August, as well as the unemployment rate for July. In the US we’ve got the weekly initial jobless claims, PCE inflation for July, and the MNI Chicago PMI for August. From central banks, we’ll hear from the Fed’s Bostic and Collins, ECB Vice President de Guindos and the ECB’s Schnabel, and the BoE’S Pill. We’ll also get the ECB’s accounts of their June meeting. Finally, earnings releases include Lululemon, Dollar General and Broadcom.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mostly negatively following a marginally positive handover from Wall Street, which saw an equity bid underpinned by dovish US economic data. ASX 200 was flat on either side of 7,300 as the gains in the Telecoms and Financial sectors were offset by losses in Energy and Consumer Staples. Nikkei 225 saw mild gains although the machinery sectors were in the red following the dire Japanese industrial output data, with a Japanese government official highlighting a decline in demand both domestically and abroad, with output falling in several areas including production machinery. Hang Seng and Shanghai Comp varied at the open but later succumbed to losses, whilst Baidu soared 4.6% after winning Chinese approval for its AI model. The Mainland was more cautious from the start following mixed PMI data which saw Manufacturing topping expectations but remaining in contraction.

Top Asian News

European bourses are modestly firmer, Euro Stoxx 50 +0.1%, having trimmed initial upside throughout a session of significant Central Bank updates. Downside which has occurred despite a dovish-shift to pricing for the ECB post-HICP & Schnabel; within Europe, Real Estate leads the sectors while Banking names lag as both areas of the economy take impetus from yield action. Though, the Banking pressure is offset somewhat by marked upside in UBS +4.5% post-earnings; SAP modestly firmer after CRM earnings, CRM +5.5% in pre-market. Stateside, futures are mixed around the unchanged mark with some slight underperformance in the NQ -0.1% ahead of key data and despite the broader European-driven yield action.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets had plenty to chew on yesterday, as the latest round of data offered support to both sides of the hard vs soft landing debate. We again had some underwhelming US releases which suggested that growth and inflation were slowing further which could be used to support either side of the debate. However for yesterday the soft landing argument continued to win out with yields on 10yr Treasuries (-0.7bps) inching down to a 3-week low of 4.11% and the S&P 500 (+0.38%) hitting a 3-week high. But in Europe, markets saw a clear underperformance thanks to resilient inflation numbers from Germany and Spain, which added to speculation that the ECB might deliver a 10th consecutive rate hike next month.

With the conflicting releases, all eyes are now on tomorrow’s US jobs report to see if that can shift the narrative one way or the other. Our US economists are expecting nonfarm payrolls to slow down further to 150k, and yesterday we had some further evidence of a softening labour market from the ADP’s report of private payrolls. That showed growth of +177k in August (vs. +195k expected), which is the smallest gain since March. On top of that, there was a continued slowdown in pay growth, with the rate among job-changers down to +9.5% year-on-year, which is the slowest since June 2021, whilst the rate among job-stayers fell to the slowest since September 2021, at +5.9%.

That ADP report came just before the second estimate of Q2 GDP growth, which indicated that the economy was a bit weaker than previously thought. For instance, overall growth came in at an annualised rate of +2.1%, which was down from the initial estimate of +2.4%. And more promisingly for the Fed, both PCE and core PCE for Q2 were each revised down a tenth, with the latest estimate putting them at +2.5% and +3.7% respectively.

These indications of a slowing economy led to a fresh rally among US markets. The main reason for that is because expectations of another rate hike from the Fed have continued to come down, and now stand beneath 50% for the first time since last week. So bad news on the economy is still being treated as good news (for now), since optimism about fewer rate hikes is outweighing the prospects of slower growth. In turn, that led to a rally among US Treasuries, although one that lost steam during the day with yields on 2yr Treasuries (-1.0bps) and 10yr Treasuries (-0.7bps) down only a little by the close. The 2yr yield had traded as much as -6bps lower shortly after the US data in the morning. As discussed, equities put in another decent performance as well, with the S&P 500 (+0.38%), advancing for a 4th consecutive session. On a sectoral basis, it was tech stocks that led the advance once again, and the NASDAQ (+0.54%) hit a 4-week high.

Over in Europe it was a rather different story, since the latest data suggested that inflation was proving more resilient than expected. In particular, the German flash CPI print for August only fell back to +6.4% on the EU-harmonised measure (vs. +6.3% expected). At the same time, Spanish inflation ticked up three-tenths to +2.4%, whilst Irish inflation was also up three-tenths to +4.9%. That sets the stage for the Euro-Area wide print this morning, which is out at 10am London time. Following yesterday’s prints, our European economists see both the headline and core inflation prints coming in at between +5.3% and +5.4%. This would represent a near stable headline reading (+5.3% prev.) and a slight easing in core (+5.5% prev.).

Those CPI numbers led to growing expectations that the ECB might proceed with another hike at their next decision in two weeks’ time. Indeed, market pricing is now suggesting a 55% chance of a 25bp hike at the September meeting, so back up to its level prior to the underwhelming flash PMI data last week. It also led to a significant underperformance among European sovereign bonds, with yields on 10yr bunds (+3.4bps), OATs (+3.7bps) and BTPs (+4.4bps) all moving higher on the day, whilst the STOXX 600 fell -0.15%. The big concern now is that the European outlook is looking increasingly stagflationary, with inflation remaining stubborn whilst there’s few signs of growth either. On the topic of European inflation, our economists yesterday published the results of their latest dbDIG consumer survey, which has shown an uptick in inflation expectations during July and August. See their note here.

Overnight in Asia, several equity markets have lost ground this morning, which follows the release of the official PMIs from China. They showed that manufacturing contracted for a fifth consecutive month, with a 49.7 reading but it was higher than the 49.2 reading expected by the consensus, and above the 49.3 reading in June. However, the non-manufacturing PMI fell a bit more than expected to 51.0 (vs. 51.2 expected).

Against that backdrop, most of the major indices have struggled this morning, with declines for the CSI 300 (-0.54%), the Shanghai Comp (-0.53%), the KOSPI (-0.36%) and the Hang Seng (-0.26%). The main exception is in Japan, where the Nikkei (+0.80%) and other indices including the TOPIX (+0.79%) have seen a decent advance this morning. That comes amidst better-than-expected retail sales data overnight, which grew by +2.1% in July (vs. +0.8% expected). That said, industrial production fell by -2.0% (vs. -1.4% expected).

Looking at yesterday’s other data, there were further signs of resilience in the US housing market, as pending home sales unexpectedly grew by +0.9% in July (vs. -1.0% expected). That said, the July data was before the most recent rise in mortgage rates into August, and separate data from the MBA yesterday showed that the 30yr average fixed rate remained at 7.31% in the week ending August 25.

To the day ahead now, and data releases include the Euro Area flash CPI print for August, as well as the unemployment rate for July. In the US we’ve got the weekly initial jobless claims, PCE inflation for July, and the MNI Chicago PMI for August. From central banks, we’ll hear from the Fed’s Bostic and Collins, ECB Vice President de Guindos and the ECB’s Schnabel, and the BoE’S Pill. We’ll also get the ECB’s accounts of their June meeting. Finally, earnings releases include Lululemon, Dollar General and Broadcom.