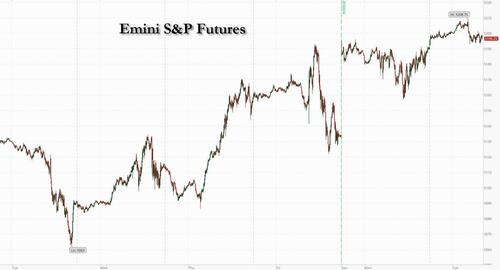

US equity futures rose with European and Asian market ahead of the closely watched February CPI data which could have an impact on the decision and messaging delivered by the Fed next week. As of 7:50am, S&P futures are up 0.2% while Nasdaq futures add 0.5% as TMT sees support from Semis (NVDA +1.9%) and the balance of Mag7 names are up 50bp – 95bps pre-market. Treasuries also edge higher, with US 10-year yields falling 1bps to 4.09%. Gilts outperform, boosted by soft UK wage data and solid auction demand. UK 10-year yields fall 7bps to 3.90%. European stocks rise 0.4%, led by gains in mining and bank shares. The yen is the weakest of the G-10 currencies, falling 0.4% versus the greenback after BOJ Governor Ueda noted pockets of weakness in consumption. The Bloomberg Dollar Spot Index is little changed. Oil prices climb, with WTI rising 0.6% to trade near $78.40. Spot gold falls 0.3%.

In premarket trading, Oracle shares rose 14% after the infrastructure-software company reported third-quarter results that beat expectations on key metrics. It also said that “demand for our Gen2 AI infrastructure substantially exceeds supply.”

US-listed Chinese stocks trade broadly higher in Tuesday’s premarket session as a rebound from a February low gathers steam. Here are some other notable premarket movers:

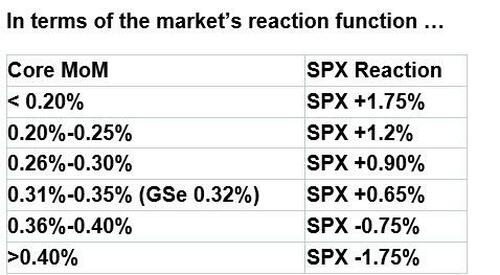

As discussed in our CPI preview (full note here), CPI is likely to accelerate, while the core gauge should slow slightly, according to Bloomberg Economics. A monthly rate of 0.3% or lower would be seen as a positive catalyst, according to Goldman.

“Today is another CPI day, we’ll have a lot of volatility around the data,” Claudia Panseri, UBS Global Wealth Management’s chief investment officer for France, said in an interview with Bloomberg TV. “What is important is the market has normalized expectations about interest rate cuts. We still expect inflation coming down, we still expect that the Fed cuts its rate in June."

“Ultimately, we don’t expect the February CPI report to provide clear enough evidence of disinflation to boost the Fed’s confidence to cut rates,” Bloomberg economists Anna Wong and Stuart Paul wrote in a note. “However, they could have enough confidence as soon as May.”

The options market is more concerned about a big S&P 500 move after the inflation report than it is about the Fed’s interest rate decision next week, according to Citigroup Inc. Traders are hedging for moves of 0.9% in either direction, the biggest implied shift ahead of a consumer price index report since April 2023.

Elsewhere, the yen weakened for the first time in six days after Bank of Japan Governor Kazuo Ueda pointed to some weakness in consumption of nondurable goods, while also signaling the central bank remains on track to end its negative-interest-rate policy. The BOJ makes it next policy decision on March 19. Japan’s 10-year bond yield climbed to the highest level in three months following a Jiji report that said the BOJ will end negative interest rates at next week’s meeting if wage data comes out strong.

European stocks rise 0.4%, led by gains in mining and bank shares. Banks and basic resources are the best-performing sectors, while utilities lag. Here are some notable premarket movers:

Earlier in the session, Asia-Pac stocks traded mixed following the tentative mood stateside and as participants await US CPI data.

In FX, the Bloomberg Dollar Spot Index is little changed; the yen is the weakest of the G-10 currencies, falling 0.4% versus the greenback after BOJ Governor Ueda noted pockets of weakness in consumption. Japanese OIS market is pricing about a 76% chance of a March rate hike. The yen had been stronger earlier in the session after Jiji reported that negative rates are seen ending if the first result of wage increases by businesses that the Japanese Trade Union Confederation, (Rengo), will provide on Friday “significantly” exceeds last year’s 3.8%. “We see the BOJ exiting the negative-interest-rate policy in April on the belief that the BOJ might want to digest more data,” strategists at Malayan Banking Bhd led by Saktiandi Supaat wrote in a research note.

In rates, treasuries edged higher, with US 10-year yields falling 1bps to 4.09%. Gilts outperform, boosted by soft UK wage data and solid auction demand. UK 10-year yields fall 7bps to 3.90%. gilts rallied after a rise in the UK unemployment rate and easing wage growth added to the view that the Bank of England may start cutting interest rates in coming months. Japan’s 10-year bond yield climbed to the highest level in three months following a Jiji report that said the BOJ will end negative interest rates at next week’s meeting if wage data comes out strong.

In commodities, oil edged higher as traders awaited OPEC’s monthly report and industry figures on US stockpiles. Gold eased from a record high.

Bitcoin held just above $72,000 after surpassing that level for the first time on Monday, with Ethereum also lower but remains above USD 4k.

Looking to the day ahead now, the main highlight will be the US CPI release for February. Other US releases include the NFIB’s small business optimism index for February, and the monthly budget statement for February. In the UK, there’s also the monthly labour market data. Central bank speakers include the ECB’s Holzmann and the BoE’s Mann. Lastly, there’s also a 10yr US Treasury auction.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the tentative mood stateside and as participants await US CPI data. ASX 200 notched slight gains but with upside capped by a lack of macro drivers and mixed business surveys. Nikkei 225 slipped at the open after firmer-than-expected PPI data and the ongoing hawkish BoJ-related speculation, but then clawed back the majority of the losses after BoJ Governor Ueda refrained from any major hawkish commentary. Hang Seng and Shanghai Comp. diverged with the former boosted by continued tech strength and as property developers showed resilience including Vanke despite being cut to junk by Moody's, while the mainland was pressured by lingering headwinds including US-China frictions and economic concerns.

Top Asian News

European bourses, Stoxx600 (+0.3%) began the session on a firm footing, though edged lower throughout the European morning as sentiment waned. The FTSE100 (+0.8%) outperforms, lifted by the weaker Pound and its exposure to Mining/Energy names. European sectors hold a strong positive tilt; Banks continue to advance ahead of an ECB meeting regarding European banking policies, whilst Utilities is found at the foot of the pile. US equity futures (ES +0.1%, NQ +0.4%, RTY +0.2%) are mixed, with slight outperformance in the NQ, with the Tech sector benefitting from strong Oracle (+13.3% pre-market) earnings.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Today the roadshow has moved onto Melbourne after a hectic day in Sydney yesterday. Walking between meetings in the hot sun has got me a bit worried I'm going to come back to the office with a tan next week with my team a bit confused as to how hard I was actually working. Actually my wife might be a bit confused too!

Markets have drifted into the shade a little to start the week as we await today’s all-important CPI print. The S&P 500 (-0.11%) fell back for the second session running with the Magnificent 7 (-1.12%) underperforming and the VIX (+0.50pts) up to its highest level (15.22) in nearly three weeks. The bigger story was renewed fears about inflation pushing 2yr Treasuries (+6.1bps) back up to 4.54%.

Those inflation concerns were heightened by the New York Fed’s latest Survey of Consumer Expectations, which showed medium- and long-term expectations rising again in February. In particular, the 5yr inflation expectation was up to a 6-month high of +2.9%, which was a reversal from the downward trend over the preceding months. Separately, there were also signs of a weaker labour market, as the mean probability of losing one’s job in the next year was up to 14.5%, which was the highest since April 2021. Moreover, the mean probability of finding a job in 3 months if one lost their job was down to 52.5%, again the lowest since April 2021.

That sets us up for another CPI day, which is getting more attention than usual after last month surprised on the upside. In terms of what to expect this time round, our US economists think headline CPI will come in at a monthly +0.41%, which would keep the year-on-year measure at +3.1%. Then for core, they’re expecting it to be at +0.30%, taking the year-on-year measure down two-tenths to +3.7%. If that’s realised, it would also be the 4th consecutive month that core CPI has come in at +0.3% or +0.4%, which is still a bit too fast for the Fed to be comfortable. Indeed, last month’s surprise saw investors push out the likely timing of rate cuts, and futures are increasingly looking towards June as the most likely date for a first cut. However, risk assets did not really suffer from last month’s surprise, and since that release came out the S&P 500 is around 2% higher, the Magnificent 7 c.+1.2%, Bitcoin c.+45%, and US HY spreads c.-4bps tighter.

With all that to look forward to, US Treasuries lost ground across the curve, with the 2yr yield (+6.2bps) up to 4.54%, whilst the 10yr yield (+2.3bps) rose to 4.10%. That was echoed in Europe as well, where yields on 10yr bunds (+3.6bps), OATs (+4.2bps) and BTPs (+4.6bps) all moved higher. That came as investors slightly dialled back the amount of rate cuts priced in, with the Fed now expected to deliver 91bps of rate cuts by the December meeting, down -4.3bps on the day.

For equities it was also a weaker session, with the S&P 500 (-0.11%) clawing back some of its initial losses but still down marginally on the day. That was mostly due to losses among the Magnificent 7 (-1.12%), and Nvidia (-2.00%) continued to lose ground after its -5.55% decline on Frida y. It also marked the first time since the very start of the year that the Magnificent 7 has fallen by more than -1% for two consecutive days. Notable underperformers also included Meta (-4.42%) and Boeing (-3.02%), with the latter extending its YTD decline to -26% amid news that the Department of Justice opened a criminal investigation into January’s mid-flight blowout incident. That said, the equal-weighted version of the S&P 500 did rise +0.14%, with materials (+1.13%) and energy (+1.00%) stocks outperforming. Meanwhile in Europe, there was a mixed performance, as the STOXX 600 fell -0.35%, but there were still gains for the FTSE 100 (+0.12%) and the IBEX 35 (+0.19%), alongside losses for the CAC 40 (-0.10%) and the DAX (-0.38%).

In Asia, equity markets have put in a mixed this performance this morning. In Japan, the Nikkei (-0.41%) is on track to fall for a second day, and in China the Shanghai Composite (-0.24%) has also lost ground. But other indices have posted a better performance, with the Hang Seng (+2.23%) surging, whilst the KOSPI (+0.50%) and the CSI 300 (+0.40%) have also advanced. US equity futures are pointing higher as well, with those on the S&P 500 up +0.37%.

Otherwise this morning, the Japanese Yen has weakened -0.37% against the US Dollar after Bank of Japan Governor Ueda referred to “weakness in some household spending data”, even though he said “my view is that the gradual recovery continues.” That led to a bit more doubt about the prospect of a shift away from negative interest rates at next week’s meeting, and the 2yr JGB yield is down -0.1bps this morning at 0.19%. Overnight index swaps have also lowered the prospect of a shift by the April meeting from 87% to 84%. That said, the PPI inflation data for February came in a bit stronger than the consensus expected, with year-on-year PPI up to +0.6% (vs. +0.5% expected).

Whilst lots of assets struggled yesterday, Bitcoin (+3.87%) was an exception as it reached another all-time high, surpassing the $72,000 mark for the first time in trading. Remember that we’re still not quite at the all-time high in real terms though, as in November 2021, Bitcoin peaked at $68992, which is above $76,000 in today’s prices if you adjust for CPI inflation. As a reminder, Marion Laboure and Cassidy Ainsworth-Grace put out a report last week (link here) on why Bitcoin is trading at a record and why they expect prices to continue to go even higher this year.

To the day ahead now, and the main highlight will be the US CPI release for February. Other US releases include the NFIB’s small business optimism index for February, and the monthly budget statement for February. In the UK, there’s also the monthly labour market data. Central bank speakers include the ECB’s Holzmann and the BoE’s Mann. Lastly, there’s also a 10yr US Treasury auction.