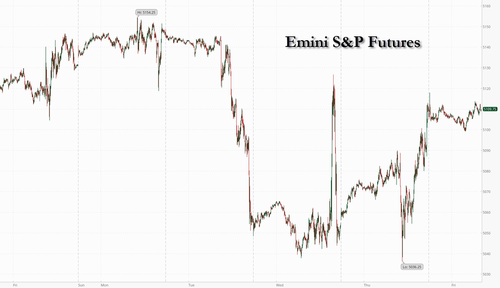

US stock futures pointed to further strength on Wall Street ahead of the April jobs report after solid earnings and a record buyback announcement from Apple As of 8:00am, S&P futures rise 0.3% while Nasdaq 100 contracts add 0.6% thanks to a 6% surge in Apple in premarket trading. The dollar weakened for a third day, while Treasuries were steady. The US 10-year yield is down about 9 basis points this week at 4.57%, its first weekly drop since March, after Powell struck a less hawkish tone than feared. Traders have also pulled forward expectations for the Fed’s first full interest-rate cut by a month to November.

In premarket trading Apple jumped .2% after the company posted stronger-than-expected sales last quarter and predicted a return to growth in the current period, sparking optimism that a slowdown is easing. Amgen soared 14% after its CEO said he was “very encouraged” by early results from a study of the company’s experimental obesity drug, MariTide. Here are some other notable premarket movers:

Traders will be watching this morning's jobs report for clues about renewed slowing in the economy (full preview here). Non-farm payrolls data is the next big trigger for markets after Federal Reserve chief Jerome Powell effectively laid concerns about a potential rate hike to rest. The forecast gain of 240,000 jobs would be the weakest since November.

“NFP gains have likely slowed, but to a level that has remained strong,” wrote Credit Agricole CIB strategists led by Sébastien Barbé. “The ‘higher for longer’ narrative should remain well in place, but is largely priced in by the market at this stage.”

If the Labor Department’s report shows fewer than 125,000 jobs were added in April, and the average hourly earnings rose more than 0.4% from the previous month, that would be a “stagflation risk-off print,” according to Bank of America Corp. strategist Michael Hartnett. On the other hand, if payrolls were to rise by more than 225,000 and average hourly earnings by less than 0.2%, it would be interpreted as “Goldilocks back on and risk back on,” he wrote.

European stocks have tracked a tech-driven rally in Asia after Apple forecast a return to sales growth and announced the largest stock buyback plan in US history. The Stoxx 600 is up 0.4% as it looks to snap a three-day losing streak. While tech stocks led gains, pharmaceuticals lagged with Novo Nordisk A/S retreating more than 5% on competition concerns. Here are the most notable European movers:

Earlier in the session, Asian stocks gained with the Hang Seng Index surging 1.5% to cap a ninth straight session of gains, the longest winning streak since 2018. Chinese technology giants Alibaba Group Holding Ltd. and Tencent Holdings Ltd. were among the top contributors to the advance.

In FX, the dollar declined 0.2% against all its Group-of-10 peers, with the Bloomberg dollar index heading for a 0.9% loss this week as traders pulled forward expectations for the first Fed rate cut to November ahead of today’s jobs report. its worst since early March. The yen strengthened as traders mulled news that authorities had likely spent about $23 billion in their second suspected currency intervention this week; Japan markets were shut for a local holiday. The Norwegian krone climbed after the nation’s central bank said tight policy may be needed somewhat longer, as it held the key interest rate steady at 4.5%, in line with expectations.

Treasuries are narrowly mixed with the yield curve flatter ahead of the April jobs report, holding most of the past two days’ steepening rally. 7- to 30-year yields are lower by ~1bp with shorter tenors little changed; 2s10s spread flattens ~2bp, unwinding less than half of Thursday’s steepening move. 5s30s spread remains near top of Thursday’s range at ~15bp. 10-year yield 4.57%, slightly outperforming bunds and gilts in the sector.

Oil prices are flat, with WTI trading near $79 a barrel. Spot gold falls 0.2% to around $2,300/oz.

Looking at today's calendar, US economic data slate includes April jobs report (8:30am), S&P Global US services PMI (9:45am) and ISM services (10am). Fed members’ scheduled speeches include Chicago’s Goolsbee (10:30am and 7:45pm) and New York’s Williams (7:45pm)

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global market courtesy of Newsquawk

APAC stocks took impetus from Wall St where equities extended on post-FOMC gains and futures were also lifted by Apple's earnings beat, but with upside capped in the region amid key market closures including in Japan and Mainland China. ASX 200 traded higher as real estate led the outperformance in the rate-sensitive sectors. Hang Seng extended its rally after having recently entered a bull market and following stronger GDP data.

Top Asian News

European bourses, Stoxx600 (+0.2%) are entirely in the green, and with price action fairly muted as participants await the US Employment report at 13:30 BST / 08:30 EDT. European sectors hold a strong positive tilt, with Media taking the top spot, lifted by post-earning gains in JCDecaux (+12.5%) and UMG (+2.5%). Healthcare is found at the foot of the pile, dragged lower by Novo Nordisk (-4.5%), after recent Amgen updates. US Equity Futures (ES +0.3, NQ +0.6%, RTY -0.2%) are mixed, with clear outperformance in the NQ lifted by pre-market gains in Apple (+5.7%) after its earnings.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US event calendar

DB's Jim Reid concludes the overnight wrap