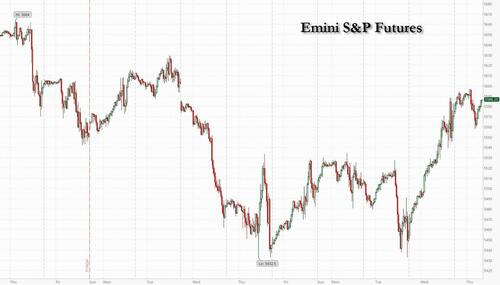

Futures extend on yesterday's post FOMC gains, but are off session highs, with tech outperforming and the Russell in the red, following the same trend seen late day yesterday. Futures have given up some of their earlier gains potentially on geopolitical headlines as fears of another imminent Iran-Israel conflict swirl, pushing oil to new highs. As of 8:00 am S&P futures are up 0.4% after the index recorded its biggest gain since February in the previous session; Nasdaq futures 0.5% higher led by META 7% higher following earnings with AAPL +60bps, AMZN +1.1% ahead of earnings after the close today. Semis are up small with NVDA +20bps. European stocks are mixed while in Asia, Japanese markets plunge as the yen surges following the inexplicably hawkish BOJ announcement even as Japan's economy is once again sinking, setting up the endgame of that particular monetary experiment. Bond yields are higher by 2-3bps which is boosting the USD to its best day in 2 weeks. Commodities are bid with Energy and base metals leading. Today’s macro data focus is on ISM-Mfg, while the market is likely to ignore jobs data ahead of tomorrow's NFP. AMZN/AAPL headline today’s earnings schedule.

In premarket trading, META rose more than 6% and contributed to the buoyant mood, extending the life cycle of the AI bubble after it projected to spend more on capex for the full year even though its actual capex spending for Q2 came below estimates. Expect the company's bullshit to hit a brick wall soon enough. Moderna shares sink 12% in premarket trading after the vaccine maker cut its revenue forecast for the full year. The company also said it expects lower sales of its Covid shot in Europe. Here are some other notable premarket movers:

Jobless claims data due later on Thursday and July’s unemployment print will provide further clues on the state of the US labor market. The Fed signaled on Wednesday that officials are on course to ease monetary policy next month unless inflation progress stalls.

“We’ll see tomorrow with payrolls if the Fed is right, but if it is, then the upward trend on equity markets is likely to continue,”said Amelie Derambure, a multi-asset portfolio manager at Amundi in Paris.

Earlier, the Bank of England lowered rates by 25 basis points to 5.0% in a narrow, 5-4 vote, as expected, while signaling further cautious reductions ahead. The pound extended declines to 0.8% while yields on 10-year gilts lowered six basis points. Investors will be watching earnings from Amazon.com Inc. after the close for further clues about returns from investments in AI. A report from Apple will give indicators of how the iPhone 16 is expected to perform in September.

For equities, the bullish mood in the US didn’t extend to Europe, where the regional benchmark dropped on a series of disappointing results from automakers and Societe Generale SA. The Stoxx 600 index dropped 0.2% after BMW’s earnings slowed and German rival Volkswagen AG’s margins declined, with both automakers suffering from weak demand in China. A poor performance in SocGen’s retail unit sent the stock plummeting 7.7%, dragging down European peers such as HSBC Holdings Plc and UniCredit SpA. The disappointing results serve as further evidence of building pressure for European companies on the back of softer demand and a macro backdrop that remains beset by challenges. The European benchmark has been trading sideways for the past two months after rallying in the year through May. Here are all the notable European movers Thursday:

“People are a bit more concerned that we will see a sharper slowdown than what’s currently priced in,” said Richard Flax, chief investment officer at digital wealth manager Moneyfarm. “We’ve seen downgrades to next quarter’s earnings. There’s also been some notable commentary from macro bellwethers about consumer spending. And that does give you pause.”

Earlier, Asian stocks declined, weighed down by a rout in Japanese shares as the yen soared after the BOJ raised interest rates on Wednesday. Chinese equities also pulled back after strong gains in the previous session. The MSCI Asia Pacific Index fell as much as 0.8%. Japanese stocks including Toyota Motor were among the biggest drags, offsetting gains in tech shares including TSMC that tracked advances in US peers. Benchmarks rose in Taiwan, South Korea and Australia.

Japan’s Topix plunged more than 3%, falling the most since April 2020 in a broad selloff, as the yen’s sharp rally weighed on exporters and the central bank’s interest rate hike dragged down real estate shares. A measure of property stocks led losses in the index plunging 7.3% while automakers slumped 6.6%. Department stores, which had been benefiting from booming tourist spending on the back of a weaker yen, also fell. The Nikkei 225 Stock Average, which entered a technical correction last week, lost 2.5%. The moves came after the Bank of Japan’s tightening was followed by comments from Jerome Powell that the Federal Reserve could cut rates “as soon as” September.

In FX, the dollar rose 0.2% against a basket of currencies after recording its worst day since May on Wednesday. The yen erased earlier gains to trade little changed.

In rates, treasuries are slightly lower across the curve, while gilts outperform after Bank of England cut interest rates by 25 basis points to 5% in a 5-4 vote split. In a close call, policy members were expected to vote for a rate cut. Treasury yields are cheaper by 1.5bp to 2bp across the curve with belly leading losses on the day, giving back some outperformance seen Wednesday. Treasury 10-year yields trade around 4.05%, cheaper by 2bp on the day with gilts outperforming by 6bp in the sector, bunds by 4bp. Leading into the Bank of England rate decision, Treasuries were already slightly lower across the curve, giving back some of Wednesday’s late gains into month-end. For US session, focus will switch back to data with initial jobless claims and manufacturing gauges expected. Following Wednesday’s Fed meeting, OIS markets price in around 27bp of rate cuts into the September policy meeting and roughly 72bp of cuts by the end of the year.

In commodities, oil extended gains after Iran reportedly ordered a retaliatory strike on Israel for killing a Hamas leader on its soil.

Looking at today's calendar, US economic data slate includes July job cuts (7:30am), 2Q preliminary nonfarm productivity and weekly jobless claims (8:30am), July S&P Global US manufacturing PMI (9:45am) and ISM manufacturing (10am). The next scheduled Fed speaker is Barkin on Friday (12pm)

Market snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as participants digested the latest key developments including strong tech earnings, Fed Chair Powell's dovish press conference and disappointing Chinese Caixin Manufacturing PMI data. ASX 200 was led higher by strength in the rate-sensitive sectors amid a softer yield environment. Nikkei 225 suffered heavy losses and briefly dipped beneath the 38,000 level alongside a firmer currency after the recent BoJ rate hike and as participants also digested earnings releases, while Toyota shares were heavily pressured after Japan's Transport Ministry announced that misconduct was discovered in an additional 7 Toyota models. Hang Seng and Shanghai Comp. were subdued after disappointing Caixin Manufacturing PMI which unexpectedly slipped into contraction territory for the first time in 9 months.

Top Asian News

European bourses are lower across the board, Stoxx 600 -0.3%, despite the initial modest optimism of futures overnight. Earnings dominate the breakdown this morning. Sectors are mixed, no overarching theme with earnings dictating; Retail outperforms on Next earnings, followed closely by Real Estate on the back of Vonovia. While Autos lag after BMW, Daimler Truck and Volkswagen with Banks pressured by BNP Paribas, Credit Agricole and ING all post-earnings. DAX 40 lags given the pressure in auto names, CAC 40 hit on SocGen and Credit Ag. While the FTSE 100 is the relative best performer given GBP weakness ahead of the BoE and also as the likes of Rolls-Royce and Shell lift post-earnings. Stateside, futures are mixed post-FOMC and into an after-market session with numerous heavyweights due incl. AAPL, AMZN & INTC; ES +0.2%, NQ +0.3%. Post-earnings, Meta +6.3% while QCOM now resides in the red.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar