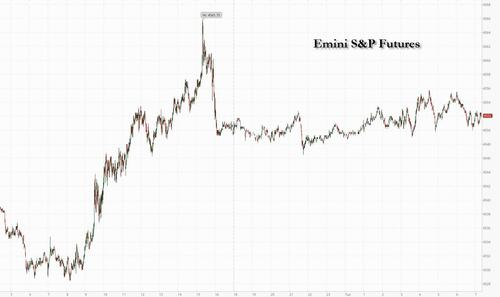

US equity futures were trading flat on Tuesday as Bank of America unveiled solid second-quarter earnings (and Morgan Stanley on deck), with retail sales also due this morning (expect a miss as noted last night) giving the latest insight on the health of American consumers. Contracts for the S&P 500 and the Nasdaq 100 futures were fractionally lower at 4,551 as of 7:15 a.m. ET. Treasury yields declined across maturities, while the dollar weakened. A rally in European bonds gained steam Tuesday after prominent ECB hawk Klaas Knot raised hopes that the end of the rate-hiking cycle is in sight. Gold, bitcoin and oil prices rose, whereas iron ore was down slightly.

In premarket trading, Microsoft and Activision Blizzard dropped slightly after Bloomberg reported that their $69 billion deal was unlikely to close by its Tuesday deadline. Here are some other premarket movers:

A reprieve in inflation is prompting dovish talk among central bankers and speculation they’re ready to back down from the fastest pace of hikes in four decades. Yields tumbled across the region, with those on Italian debt sinking 13 basis points after ECB Governing Council member Klaas Knot said monetary tightening beyond next week’s meeting is anything but guaranteed. The yield on 10-year German securities fell as much as 8 basis points to 2.4%, a two-week low. Meanwhile, ECB Governing Council member Ignazio Visco said inflation may come down more quickly as lower commodity prices start to trickle through the economy. Consumer price index reports are due out of the Eurozone and UK Wednesday, after data last week showed US price pressures cooled more than economists had forecast.

Analysts have described the current equity rally as a bet on receding inflation allowing the US Federal Reserve to end its tightening monetary cycle. To that end, Treasury Secretary Janet Yellen said in a Bloomberg TV interview on Monday that the US was on a “good path” to bringing down inflation while avoiding a recession, a view with which 68% of fund managers in Bank of America’s July global survey agreed (more on that in a latter post).

“It’s clear that it’s the receding inflation narrative which is driving everything,” said Gilles Guibout, a portfolio manager at Axa Investment Managers in Paris. Guibout added that in his view, the market’s direction of travel upwards was due to a general sense of optimism rather than hard data.

“Investors are feeding on hope: hope that US rates will get down sooner and hope that China will launch a stimulus package to beef up consumption,” he said, arguing that the lack of evidence on both fronts explained some of the wait-and-see positioning palpable across the market.

Equities also staged a recovery from the steepest losses in more than a week Monday, as the Stoxx Europe 600 rose 0.2%, as health care, chemicals and media are the best performing sectors while telecommunications fall. Ocado Group Plc shares rose as much as 16% after the UK online grocer’s first-half earnings topped estimates. Novartis AG climbed after raising its profit outlook and announcing plans for a share buyback of up to $15 billion. Here are some other notable European movers:

Earlier in the session, Asian stocks declined, on course for a second day of losses, as Hong Kong played catch-up following weaker-than-expected Chinese economic growth. The MSCI Asia Pacific Index slipped as much as 0.3%, with Tencent and Alibaba among the biggest drags. Hong Kong’s benchmark dropped 2% with property stocks among the biggest losers as the market reopened after a typhoon cancelled Monday’s session. Equities fell in mainland China for a second day, with Taiwan, South Korea and Australia also posting notable declines. The main Asian stock benchmark has stumbled for the past two days after its best weekly rally since January. The gauge is up 8% this year, underperforming key US and global measures amid concerns over China’s slow recovery.

China’s stuttering recovery is leading to disquiet as investors consider the knock-on effects from a slowdown in the world’s growth engine. “Investors will be much more interested to understand the outlooks for Q3, as macro continues to deteriorate, mainly in Europe, and China’s expectation of a sudden recovery is faltering,” Luca Fina, head of equity at Generali Insurance Asset Management, wrote in a note to clients.

Investors are looking for possible announcements of further stimulus from Beijing after the slower-than-expected growth data for the second quarter. Joyce Chang, JPMorgan’s global research chair, said in an interview with Bloomberg TV that she expected “modest” measures and better third-quarter growth figures from Asia’s largest economy. Despite the weakness in Chinese equities, HSBC remains upbeat on the long-term outlook for the offshore market, “given the prospects for earnings growth and policies aimed at stimulating growth in China,” according to Raymond Liu, an equity strategist at the firm.

In FX, the dollar remained near its 15-month low on mounting expectations the Federal Reserve is set to wind down its hiking macrocycle. The Bloomberg Dollar Spot Index is down 0.1% while the kiwi is the weakest of the G-10’s, falling 0.5% versus the greenback. The euro pared a gain after Knot’s remarks, but remains on track for its longest winning daily streak since October 2004.

In rates, treasuries advanced with 10-year futures exceeding Monday session highs, led by bunds after dovish comments from Klaas Knot, hawkish member of the ECB Board, who pushed back on expectations for a September rate hike. The Dutch central bank governor is widely known as one of the most hawkish members of the Governing Council but seemed to push back against market pricing for two more quarter-point interest rate hikes. German two-year yields are down 10bps at 3.09%, while US yields were richer by 3bp to 6bp across the curve with gains led by belly, extending Monday’s steepening move in 5s30s spread by an additional 2.5bp on the day; 10-year yields at ~3.75% are richer by 5bp vs Monday close with bunds outperforming by 2bp in the sector. Swap contracts linked to Fed policy meetings edge closer to fully pricing in a quarter-point rate increase on July 26 for the first time since the June meeting; an additional increase after July continues to be about one-third priced in. The US session includes a raft of economic data led by retail sales and industrial production.

In commodities, crude futures advanced, with WTI rising 0.7% to trade near $74.70. Spot gold rises 0.4%.

Bitcoin is a touch firmer but has slipped below the $30K mark despite the softer USD with catalysts light and the tone very much one of anticipation ahead of earnings and data.

To the day ahead now, and data releases include US retail sales, industrial production and capacity utilisation for June, along with the NAHB’s housing market index for July. Meanwhile in Canada, we’ll get the June CPI release. From central banks, we’ll hear from Fed Vice Chair for Supervision Barr. Finally, earnings releases include Bank of America and Morgan Stanley.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower after the region failed to sustain the momentum from Wall St where tech and small caps outperformed after NY Fed Manufacturing data softened the blow from recent Chinese data. ASX 200 was subdued as participants digested the RBA Minutes from the July 4th meeting which noted that the Board agreed some further tightening may be required and will reconsider at the August meeting, while it also noted the economy had slowed considerably and that consumer spending is seen weak in Q2. Nikkei 225 initially advanced on return from the long weekend but then suffered a reality check and momentarily faded all of its gains amid weakness in its peers. Hang Seng and Shanghai Comp were lower with property stocks leading the declines in Hong Kong after the long-delayed results from the world’s most indebted developer Evergrande which suffered a net loss of CNY 476bln and CNY 105.9bln for 2021 and 2022, respectively. The US-China relationship also remained in focus with amicable comments in talks between US Climate Envoy Kerry and China’s top diplomat Wang Yi, although this was somewhat negated by reports the US aims to propose China investment limits by the end of next month and that President Biden is weighing new curbs on chips and semiconductor-making devices.

Top Asian News

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I'll be wearing a hard hat and steel capped boots in the office today. No I'm not giving my team their appraisals but am going to have a look around Deutsche Bank's brand new London HQ which is currently in the last few months of being built. The CGI mock ups look phenomenal and there is everything you could possibly want in one building (apart from a golf simulator). However I do remember when I moved from the City to Canary Wharf in around 1996 at my old firm, we were each given a promo video for the move that included doing horse riding, rowing, dragon boat racing and feeding farmyard animals in your lunch break. It's fair to say none of that ever materialised. The place was a ghost town for a few years!

Investors in certain pockets of the market had to don hard hats themselves yesterday as weak Chinese data dominated markets during a weak Asia and European session. Risk sentiment improved during US hours with the S&P 500 (+0.39%) and NASDAQ (+0.93%) managing to hit fresh 15-month highs, while European stocks most exposed to China suffered.

As a reminder, China’s Q2 GDP growth came in at +6.3% on a year-on-year basis (vs. +7.1% expected), which added to the series of underwhelming data there over recent months. On the back of the release, our China economists have lowered their GDP growth view for 2023 from +6.0% to +5.3%, and for 2024 from +6.1% to +5.0%, noting evidence of lacklustre domestic consumption demand and a deterioration in the property sector. They expect additional monetary easing to come through in H2 2023, and see the need for fiscal easing as well. See their report here for more.

The data weighed in particular on European equities, being generally more exposed to China than their US counterparts. Most notably, the CAC 40 (-1.12%) was the biggest underperformer, because the French index has a concentration in luxury goods that are more affected by demand from China, whilst the Swiss Market Index was down -1.21% as well. In turn, that dragged down the broader STOXX 600 (-0.63%), with LVMH (-3.73%) and Hermès (-4.21%) among the worst performers.

This weakness wasn’t anywhere near as obvious in the US, where the S&P 500 (+0.39%) posted a decent advance that took it to another 15-month high. However, if you looked at the NASDAQ Golden Dragon China Index (-0.17%), which covers US-traded stocks where a majority of business is conducted in China, there was a visible underperformance. Indeed, that index is now only up +5.77% on a YTD basis, which is some way beneath the +17.80% gain for the S&P 500. That said, broader US equities had a positive day, with the NASDAQ (+0.93%) also hitting a 15-month high and the FANG+ index of tech megacap stocks (+1.21%) outperforming to reach a new all-time high.

Aside from the effect on equities, the more cautious outlook for China led investors to dial back their expectations of future rate hikes. The moves were fairly modest, but futures pricing for the Fed’s terminal rate in November came down -0.5bps to 5.40%, and is down another -1.3bps this morning to 5.39%. Looking further out, the rate for the June 2024 meeting fell -3.3bps to 4.64%, with another -1.8bps fall this morning to 4.62%. That helped yields to decline across most of the curve, with the 2yr Treasury yield down -2.7bps to 4.74%, whilst the 10yr yield was down -2.4bps to 3.81%. That trend was further supported by a decline in commodity prices, with Brent Crude oil prices (-1.72%) down to a one-week low of $78.50/bbl.

When it came to the ECB, there was also a bit more caution about the near-term hiking profile. For instance, markets continue to remain very confident in the likelihood of a hike next week, with a 94% chance of a move priced in. But there’s more caution about the meeting after that in September, where a 70% chance is priced of a second hike. That was echoed again in ECB commentary, with Bundesbank President Nagel saying yesterday that “we have to hike next time”. However, he remained more cautious about September, saying that “we will see what the data will tell us”. So a clearly data dependent tone from one of the most hawkish Governing Council members.

This trend helped European sovereign bonds, with yields on 10yr bunds (-3.5bps), OATs (-3.2bps) and BTPs (-1.8bps) all coming down. UK gilts were a relative underperformer, but the 10yr yield still fell -1.1bps on the day. That comes ahead of tomorrow’s CPI print for June, which will be closely watched for whether the BoE will deliver another 50bp hike in August. Remember that the last 4 CPI prints in a row have all seen upside surprises, so that’ll be one to watch when it comes out.

On the geopolitical side, there was significant news after Russia suspended its participation in the grain deal with Ukraine, the previous extension of which ran until yesterday. The move will be bad news for food prices given Ukraine’s role as a key exporter, although our EM economists note that volumes exported under the deal had already declined in recent months. There was a market reaction in response, with wheat prices spiking higher, before paring back the gains to end the day up +1.91%.

Overnight in Asia, equities have seen further declines this morning, despite an announcement from China’s Ministry of Commerce to support household consumption. That includes encouragement for financial institutions to strengthen credit support. In part, that’s down to more negative news on the earnings side, with Evergrande posting a full-year loss for 2022 of 105.9bn yuan, which has led to a decline among Chinese developers overnight.

In terms of the specific moves, the Hang Seng (-2.17%) is the biggest underperformer, with the CSI 300 (-0.30%) and the Shanghai Comp (-0.35%) also losing ground. That’s been echoed for the KOSPI (-0.44%), although the Nikkei (+0.08%) has been the exception with a modest gain. Looking forward, US equity futures are also pointing lower, with those on the S&P 500 down -0.09%.

Elsewhere overnight, the minutes from the Reserve Bank of Australia’s latest meeting on July 4 policy meeting pointed away from another hike in the near term, saying that the case to leave rates on hold was the “stronger one”. Their next meeting is on August 1, but overnight index swaps are only pricing in a 22% chance of another 25bp hike then.

There was very little data to speak of yesterday, although one release was the Empire State manufacturing survey from the US. That saw the headline general business conditions index fall to 1.1 in July, which was slightly better than the -3.5 reading expected by the consensus. There were some positive trends on inflation as well, with the prices paid component down to 16.7, and the prices received component down to 3.9. The last time either were that low was back in the summer of 2020, so it adds to the positive signal from last week’s CPI report.

To the day ahead now, and data releases include US retail sales, industrial production and capacity utilisation for June, along with the NAHB’s housing market index for July. Meanwhile in Canada, we’ll get the June CPI release. From central banks, we’ll hear from Fed Vice Chair for Supervision Barr. Finally, earnings releases include Bank of America and Morgan Stanley.