Futures are flat with oil jumping after OPEC+ cut output by an extra 1mm bpd in a unilateral move by Saudi Arabia taking its production to the lowest level for several years.At 7:30am ET, S&P futures were flat, while Nasdaq futures were down 0.2% with some artificial-intelligence exposed stocks like Nvidia Corp. and C3.ai Inc. trading down. In contrast, Apple Inc. surpassed its previous closing record in premarket ahead of what’s expected to be its most significant product launch event in nearly a decade. Oil rose 2%, with oil giants such as Chevron and Exxon up in premarket trading. The Bloomberg dollar index is up as are 10Y yields now that the market's attention turns to the $1+ trillion deluge in new debt issuance. Gold dropped, as did bitcoin after the crypto currency got its usual Asian session rugpull.

Oil-related stocks rose in US premarket trading after Saudi Arabia announced it would scale back oil output by a further 1 million barrels a day in July, taking the OPEC+ member’s production to the lowest level for several years after a slide in crude prices. Saudi Energy Minister Prince Abdulaziz bin Salman said he “will do whatever is necessary to bring stability to this market”; with oil prices being weighed down by relentless shorting by hedge funds amid a softer economic outlook. The rest of the 23-nation OPEC+ group offered no additional action to buttress the current market, but did pledge to maintain their existing cuts until the end of 2024. Chevron, Exxon Mobil and Occidental Petroleum all rise more than 1%, as do Phillips 66 and Schlumberger.

Also in premarket trading, Apple rose 0.6% putting the shares on track to reach a new record high. The company is expected to launch a mixed-reality headset at the Worldwide Developers Conference on Monday, marking its most significant product launch in nearly a decade. Here are some other notable premarket movers:

With the debt ceiling now behind us, markets will now prepare for a deluge of issuance; BBG reports that bearish positioning in the S&P is highest since 2007 while bullish bets on NDX are near last year’s highs. Meanwhile, the steamrolling of the bears continues with S&P 500 is just 0.2% short of a 20% gain from its October low in the previous trading session; the Nasdaq 100 is already firmly in a bull market, as traders anticipate a pause in the Federal Reserve’s rate hiking cycle. Expectations that any slowdown in the US would be mild and optimism about developments in AI have also fueled the gains.

James Athey, investment director at Abrdn, said the advance toward a bull market focused on the small number of important but highly backward-looking economic readings that suggest the economy is doing well. “The broader data set shows much less strength and much more volatility and vulnerability,” he said. “But until jobs crack, I’m sure equities will choose to ignore.”

Strategists are split about the path forward for stocks from here. A Morgan Stanley team led by Michael Wilson said the likelihood of Fed rate cuts in 2023 and durable growth playing out simultaneously is low and they expect a tactical correction in equities before a durable recovery and a real bull market.

UBS Global Wealth Management strategists also said the risk-reward balance for stocks, especially in the US, remains unfavorable. On the flip side, Evercore ISI strategists raised their S&P 500 target as inflation easing likely signals a Fed pause.

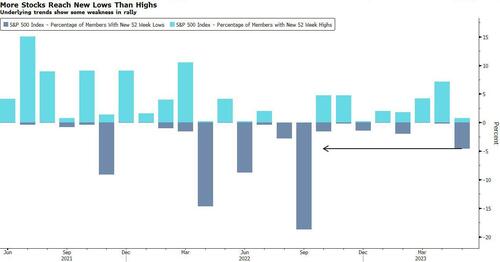

Meanwhile, frustration among bears has rarely been greater with more stocks making new 52-week lows in the S&P 500 than 52-week highs in May. “Breadth is awful,” Athey said, referring to the limited number of stocks contributing to the rally. “There’s very narrow leadership. It doesn’t look too healthy to me.”

In Europe, the Stoxx 50 is little changed while FTSE 100 outperforms peers, adding 0.6%, FTSE MIB lags, dropping 0.3%. Consumer products, tech and travel are the worst-performing sectors. The region continues to lose momentum from being the proxy for China’s reopening boom; do investors buy the dip with China looking to add stimulus? PMIs continue to slow and are at 3-month lows. Value is leading, Momentum is lagging; Defensives over Cyclicals. UKX +0.5%, SX5E -0.0%, SXXP +0.1%, DAX +0.0%. Here are some of the most notable European moves:

Earlier in the session, Asian stocks were mostly positive amid momentum from Friday's post-NFP gains on Wall Street and as participants digested stronger Chinese Caixin Services and Composite PMI data.

In FX, the Bloomberg Dollar Spot Index gained as much as 0.3%, taking gains into a second day, after last week’s jobs data added to the market’s view that the Fed will raise rates by 25 basis points next month. CAD and EUR are the strongest performers in G-10 FX, with the Canadian currency receiving some support as oil prices advance; SEK and GBP underperforms. BRL (1.1%), COP (1.1%) lead gains in EMFX, TRY (-1.1%) lags.

In rates, Treasuries were cheaper across the curve, following bigger losses in core European rates with S&P 500 futures steady near Friday’s highs. The two-year Treasury yield rises 4 basis points to 4.54%, rising toward a 2-1/2-month high of 4.64% touched just over a week ago. Yields higher by 4bp-6bp on the day with 2s5s30s fly wider by 2bp as belly underperforms; 10-year yields around 3.74% with bunds and gilts cheaper by 2bp and 1.5bp in the sector. Traders are pricing in a near 90% possibility that the Fed will hike rates to 5.5% in July; they see just the prospects of a June rise at around 30%. Elsewhere, gilts bear-flatten, Bunds bear-steepen. Peripheral spreads are mixed to Germany; Italy widens, Spain widens and Portugal tightens.

In commodities, Crude oil futures remain higher by about 2% after a 4.6% advance sparked by Saudi Arabia’s output-cut pledge at weekend’s OPEC+ meeting. Spot gold falls roughly $6 to trade near $1,942/oz.

US session includes factory orders data and ISM services gauge and Durable Goods/Cap Goods, while Fed speakers are in quiet period ahead of June 13-14 FOMC meeting.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive amid momentum from Friday's post-NFP gains on Wall Street and as participants digested stronger Chinese Caixin Services and Composite PMI data. ASX 200 was led higher by gains across nearly all sectors with early tailwinds in energy names following Saudi Arabia’s additional 1mln bpd output cut, while the RBA is seen to keep rates unchanged at tomorrow’s meeting. Nikkei 225 climbed above 32,000 for the first time since 1990 with exporters propelled by a weaker currency. Hang Seng and Shanghai Comp. were kept afloat following the encouraging Caixin PMIs but with gains capped amid US-China frictions and after China’s Cabinet noted that the foundation for the economic recovery is not solid, while property names were also pressured despite reports that China is mulling a support package for the property sector and bolster the economy.

Top Asian News

European equities trade flat with not much in the way of weekend newsflow to guide prices following Friday’s solid session for the region, whilst the FTSE 100 narrowly outperforms. Equity sectors are a mixed bag with Telecoms top of the leaderboard, followed closely by Energy and Real Estate, while Tech, Travel & Leisure, and Consumer Products & Services reside at the bottom. US equity futures are flat following Friday’s session of gains (ES -0.1%, NQ -0.2%, RTY +0.1%)

Top European News

FX

Fixed Income

Commodities

OPEC+ Meeting