US equity futures are flat even as the global equity rally extended into Europe, following Friday’s gains in Asia and Thursday’s record close on Wall Street. As of 8:00am, S&P futures are unchanged while Nasdaq 100 futures rise 0.1% after NFLX had a solid report, but market reactions were muted amid high expectations. Europe's Stoxx 600 initially rose 0.4% but has since erased gains, with Energy stocks outperforming and tracking a two-day advance in oil prices as Brent crude futures climb 1.2% to above $70 per barrel. Pre-market in the US, megacap tech sees NVDA up modestly (+0.4%), followed by AAPL and GOOGL. Consumer Staples and Financials are outperforming. The dollar and 2Y rates dropped after Fed Governor Christopher Waller repeated his recent view that the Fed should cut 25bps this month. Yields are lower and USD is weaker; 2-, 5-, 10-, and 30-year yields are down by 1-2bps. Commodities are mixed, with Oil and Precious Metals higher, while Base Metals are flat. The combined value of cryptoassets soared beyond $4 trillion for the first time, fueled by a surge in Ethereum and momentum from a legislative push to regulate the sector. Looking at today's calendar, the US economic data slate includes June housing starts (8:30am) and July preliminary University of Michigan sentiment (10am). Fed speaker slate includes only Waller, and Fed officials’ external communications blackout ahead of their July 30 decision starts Saturday

In premarket trading, Mag 7 stocks are higher (Nvidia +0.4%, Tesla +0.3%, Alphabet +0.4%, Microsoft +0.2%, Apple +0.1%, Amazon +0.1%, Meta Platforms +0.2%). Here are some other notable premarket movers:

The dollars dipped and treasuries advanced, with the 10-year yield down two basis points to 4.43%, after Fed governor Waller again backed a July interest-rate cut to support a softening labor market. The message failed to catch on in money markets, with swaps pricing less than a 60% chance of a quarter-point cut in September and assign no probability to easing this month. The cross-asset moves come at the end of a week marked by market jitters over speculation that President Donald Trump might fire Fed Chair Jerome Powell. And sure enough, Trump continued his Fed attacks on Friday, saying policymakers “are choking out the housing market with their high rate.”

Meanwhile, the week's market gains reflected strong economic data and optimism that US companies will post robust second-quarter figures, helping to soothe uncertainty stirred by Trump’s tariff war. Early results show S&P 500 earnings are on track to rise 3.2% for the second quarter, slightly ahead of pre-season expectations of 2.8%, according to data compiled by Bloomberg Intelligence.

And speaking of earnings, on Friday, 3M raised its profit forecast and beat Wall Street’s estimates as CEO William Brown’s effort to reinvigorate the company gained momentum. American Express's billed business on its cards and other products also beat forecasts. On Thursday, Netflix's results surpassed expectations across all key metrics and raised its full-year outlook for both revenue and profit margins. The stock slipped in premarket trading after a near 50% rally from its April low.

“All that helps to reinforce the bull case for equities, with this solid underlying economic momentum likely to see earnings growth remain healthy,” said Michael Brown, senior research strategist at Pepperstone.

In trade, EU purposed scrapping 10% duty on US cars if Trump lowers 25% tariff below 20%, crude is bid as the EU adopted its 18th sanction package against Russia capping oil price at $47 per barrel, and the US House passed the GENIUS ACT to regulate stablecoins which now heads to the President to sign.

Elsewhere, the share of global equity flows heading to the US has plunged in 2025, BofA's Michael Hartnett wrote, as the trade war raises doubts about so-called American exceptionalism. US stock funds attracted just under half of total flows so far this year, compared with 72% in 2024. For Mohit Kumar, chief European strategist at Jefferies International, risk assets are likely to remain well supported until next month, when US employment data may start to show some weakness.

“We remain positive on risky assets over the coming weeks, though we have taken some chips off the table,” Kumar noted. “Technicals will start to shift in August.”

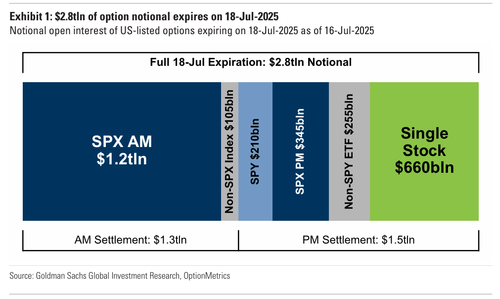

Also don't forget that today is a big option expiration Friday with over $2.8 trillion of notional options exposure will expire including $1.5 trillion of SPX options and $660 billion notional of single stock options. The notional open interest for this expiration is similar to that of last July. Next week we get ~23% of SPX mkt cap reporting and Powell speaking at a conference on Tuesday.

Europe's Stoxx 600 initially rose 0.4% but has since erased gains, with Energy stocks outperforming and tracking a two-day advance in oil prices as Brent crude futures climb 1.2% to above $70 per barrel. Mining stocks also outperform after BHP delivered an upbeat assessment of Chinese demand. US equity futures edged higher. Here are the biggest European movers:

Earlier in the session, Asian stocks gained for the week, helped by a jump in technology shares. Hong Kong’s equity market resumed a recent advance. The MSCI Asia Pacific Index rose as much as 0.6%, putting the gauge on track for its first weekly gain in three weeks. TSMC was the biggest boost to the index, with sentiment aided by the chipmaker’s bullish sales outlook a day earlier. The Hang Seng Index rose 1.3% to the highest level in more than three years, as tech and financial stocks led the charge. Elsewhere, Japanese stocks dipped as investors remained cautious ahead of Sunday’s upper house election, with polls suggesting a potential loss of majority for Prime Minister Shigeru Ishiba’s Liberal Democratic Party. Here Are the Most Notable Movers

In FX, the dollar slipped 0.2%, trimming this week’s rally after Fed Governor Waller said policymakers should cut rates by 25bps this month. The Swedish krona and Norwegian krone are leading gains against the greenback, rising 0.9% each. The yen dips slightly, as it remained under pressure ahead of an Upper House election in Japan on Sunday.

In rates, the 10-year Treasury yield slips 1bps to 4.44%; 2-year yield drops 1bp after Federal Reserve Governor Christopher Waller said late Thursday that policymakers should cut interest rates this month to support a labor market that is showing signs of weakness. He is scheduled to speak at 8am New York time in a Bloomberg TV interview. Traders are pricing a total of around 43bps of Fed easing through year-end, compared with around 49bps a week ago. The 2s10s curve steepens by less than 1bp. Despite Waller’s comments, swap contracts for the Fed’s July 30 rate decision price in no chance of a rate cut, with a combined 44bp of easing priced in by year-end.

In commodities, WTI crude oil futures advance almost 1%, adding to Thursday’s gains. Spot gold rises $14 to around $3,353/oz. Bitcoin falls back below $119,000.

Looking at today's calendar, the US economic data slate includes June housing starts (8:30am) and July preliminary University of Michigan sentiment (10am). Fed speaker slate includes only Waller, and Fed officials’ external communications blackout ahead of their July 30 decision starts Saturday. earnings releases include American Express and Charles Schwab.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were predominantly higher following the positive handover from Wall St where the S&P 500 and Nasdaq 100 rose to fresh record highs with sentiment underpinned by better-than-expected data. ASX 200 outperformed its regional peers and climbed to a fresh all-time high as advances were led by the Mining, Materials and Resources sectors with the former helped by gains in BHP following its Q4 production update and with Novonix shares up around 20% on plans to boost US graphite production as the US sets 93.5% anti-dumping duties on Chinese graphite. Nikkei 225 failed to sustain a brief return above the 40,000 level and pared its opening gains amid cautiousness heading into the upper house election on Sunday with Japan facing political uncertainty should the ruling coalition fail to retain its majority in the House of Councillors. Hang Seng and Shanghai Comp were underpinned in tandem with the gains across most of the Asia-Pac region and as participants shrugged off reports that the US is setting a 93.5% anti-dumping duty on graphite from China and that China threatened to block the Panama Ports deal unless its shipping giant COSCO is part of it.

Top Asian News

European bourses began the day with gains after constructive APAC and US sessions, and have since extended, helped by strong quarterly reports, mostly from Scandi-listed companies. European sectors opened almost entirely in the green, and retain this bias. The only sector in the red is Healthcare, which has been dragged lower by GSK (-6%) after Blenrep failed to win FDA panel support. Energy tops the pile, lifted by Vestas (broker upgrade) and BP (sold LS Power).

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Banks (All Times ET):

DB's Jim Reid concludes the overnight wrap

Markets have put in a decent performance over the last 24 hours, with the S&P 500 (+0.54%) and the NASDAQ (+0.74%) both reaching fresh all-time highs with the global rally mostly continuing this morning. The advance was driven by another batch of positive US data, including higher-than-expected retail sales, and then a 5th consecutive weekly decline in initial jobless claims. So that reassured investors that the US consumer was still resilient, and that the mid-Q2 jump in jobless claims was a blip rather than a permanent trend. With the stronger data and a continued rise in market inflation pricing, investors dialed down the amount of Fed rate cuts expected this year to 43bps, the lowest this has been since February. So collectively there is a growing sense of the US economy continuing to run hot, despite there being less than two weeks now until the August 1 tariff deadline. Overnight Fed Governor Waller, regarded as a potential candidate to succeed Powell, has expressed his preference for a 25bps reduction at the forthcoming late July meeting, citing escalating risks to the economy and the strong possibility that tariff-induced inflation will not lead to a sustained increase in price pressures. Furthermore, Waller cautioned that he has observed signs of strain in the labor market, reinforcing the argument for lower interest rates. He'll likely largely be on his own for July which is why there's only been a couple of basis point change in December pricing overnight alongside a 1.5 to 2bps UST rally across the curve. So notable comments but not enough at the moment to get close to swaying the committee, especially given the other Fed speak yesterday that we outline later.

Looking to the more immediate future, this Sunday will see the Upper House elections in Japan. Polls close at 8pm Tokyo time (12pm LDN) and final results are expected by the evening London time. Recent polls suggest that the ruling LDP-Komeito coalition may lose its Upper House majority with questions whether Prime Minister Ishiba would resign as a result. Rising prices have been a major policy issue for voters and opposition parties have called for more fiscal support, notably via consumption tax cuts. Prospects of looser fiscal policy have added to the recent rise in JGB yields so the election will influence whether this sell-off has further to run. You can see more from our Japan economist, including on the BoJ implications, here), while our FX strategists have noted the potentially binary implications of the election for the yen (see here).

Overnight Japanese core CPI increased by +3.3% year-on-year in June (compared to +3.4% anticipated). This rise was less than the +3.7% increase in May, primarily due to the resumption of gasoline subsidies. Core core CPI excluding fresh food and energy was up by 3.4% (from 3.3%) and a tenth above expectations. In fact the core CPI actually rose by 3.344%, just 0.006% short of consensus. So net net they are stronger numbers than initially meet the eye. See our economists' review of them here. 10 and 30yr JGBs are rallying by -3.5bps and -5bps respectively though.

Back to yesterday and that positive US data, headline retail sales rose +0.6% in June (vs. +0.1% expected), bouncing back after the previous two months of declines, while retail control grew +0.5% (+0.3% expected). Meanwhile, initial jobless claims fell to a three-month low of 221k in the week ending July 12 (vs. 233k expected). In turn, that took the 4-week average for claims down to a two-month low of 229.5k, which added to the sense that this was a durable trend.

This optimism provided a fresh boost to risk assets, with equities posting fresh gains on both sides of the Atlantic. In the US, the S&P 500 (+0.54%) was led higher by cyclical sectors, including banks (+1.40%), information technology (+0.88%) and industrials (+0.87%). The NASDAQ was up +0.74%, whilst the Magnificent 7 (+0.30%) posted a 7th consecutive advance for the first time in over a year. Meanwhile in Europe, there were even stronger gains, because the main indices had closed shortly before Trump’s denial that he was going to fire Fed Chair Powell, meaning they hadn’t recovered from the brief selloff yesterday. So that meant the STOXX 600 (+0.96%) ended a run of 4 consecutive declines, with a particular outperformance for the German DAX (+1.51%).

Over on the rates side, US Treasuries saw some further unwind of Wednesday’s moves when speculation mounted about Powell’s firing. So we got the reverse trend of a flatter yield curve, a higher dollar and higher equities, which was consistent with growing confidence about Powell’s position. Admittedly, Trump issued a fresh call for lower rates, posting “Too Late:” Great numbers just out. LOWER THE RATE!!!” But that was consistent with his remarks for several weeks, and wasn’t interpreted as a fresh challenge to Powell’s position.

That curve flattening yesterday also came as investors dialled back the likelihood of rapid rate cuts, as the strong data was interpreted in a hawkish light. So the probability of a cut by September fell to 54%, down from 58% the previous day, although we're back to around 58% post Wallet in thinner Asian markets. At the US close the amount of cuts priced by December came down -3.2bps on the day to 43bps, its lowest since February 20 although its edged back up a basis point post Waller

The problem for the Fed contracts are that there are growing concerns about inflation, not least amid questions over how much of the upside in retail sales was due to price increases versus volume growth. In fact, the 2yr US inflation swap (+4.2bps) closed above 3% for the first time since March 2023, at 3.02%. And that concern was extending to longer horizons too, with the 5yr inflation swap (+3.0bps) also at its highest since March 2023, right before the regional banking crisis kicked off with SVB’s collapse. Matters also weren’t helped by higher oil prices, with WTI up +1.75% yesterday to $67.54/bbl.

Back in Europe, the economic data painted a less robust picture, with UK unemployment up to 4.7% (vs. 4.6% expected) in the three months to May, marking its highest level since June 2021, back when the economy was still recovering from the pandemic. However, gilts still underperformed and investors dialled back the likelihood of BoE rate cuts, as there were pretty strong revisions to the previous month. So even though the headlines were negative, the employment picture actually looked a bit more solid than previously thought. Notably, the -109k decline in payrolled employees in May was revised down to only -25k, so a much less severe decline than thought, even if it was followed up with another -41k fall in June (vs. -35k expected). So that meant gilt yields moved up across the curve, with the 2yr yield up +5.1bps, and the 10yr yield up +1.5bps. That was a contrast with the rest of Europe, where yields on 10yr bunds (-1.3bps) fell back, alongside those on BTPs (-0.8bps).

In Asia markets are generally higher but the Nikkei (-0.31%) and the KOSPI (-0.43%) have both retraced earlier gains, while the Hang Seng (+0.63%), the CSI (+0.51%), and the Shanghai Composite (+0.34%) are higher. Australia’s S&P/ASX 200 stands out as the top performer, rising (+1.33%) to a record high following disappointing labour market data released earlier this week, which has intensified expectations that the RBA will need to further reduce interest rates in the upcoming months after a surprising hold in July. US equity futures are up just over a tenth of a percent.

To the day ahead now, and data releases include US housing starts and building permits for June, along with the University of Michigan’s preliminary consumer sentiment index for July. Otherwise, earnings releases include American Express and Charles Schwab.