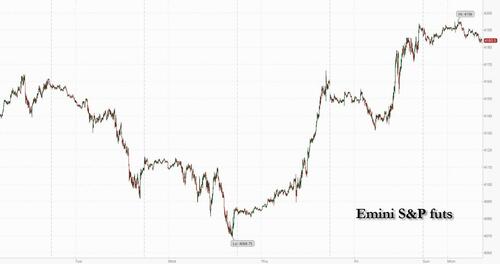

US stock futures were flat to start the busy new week in subdued trading with much of the world close for May 1 celebrations, as investors assessed the government-backstopped intervention which saw JPMorgan Chase acquire First Republic Bank ahead of this week’s Federal Reserve rates decision. Contracts on the S&P 500 were unchanged at 4,187 after the underlying benchmark gained sharply on Friday, rising 0.8% on the back of another painful gamma squeeze. The dollar dropped, alongside Treasuries which edged lower after a muted session in Asia. There was no trading in much of Europe to observe the May 1 holiday, with markets also shut in Asian centers like Hong Kong, Singapore and mainland China.

In premarket trading, First Republic tumbled 39% while JPMorgan advanced 2.9% as the already largest US bank became even bigger courtesy of billions in taxpayer funding. JPMorgan will take over First Republic’s assets, including about $173 billion of loans and $30 billion of securities, as well as $92 billion in deposits. JPMorgan and the Federal Deposit Insurance Corp., which orchestrated the sale, agreed to share the burden of losses, as well as any recoveries, on the firm’s single-family and commercial loans. But really the losses, which will be funded by US taxpayers leaving JPM with the best assets which it bought for pennies on the dollar and is why JPM stock is up 3% premarket. Here are the other notable premarket movers:

Meanwhile, investors are anticipating the Fed to hike interest rates for a 10th consecutive - and final - time on Wednesday as it combats still-stubborn inflation. The benchmark S&P 500 has climbed in the past two months even amid banking sector turmoil and recession concerns, as investors take comfort in better-than-feared earnings and expect any slowdown to be mild. However, “if the message delivered at this meeting is more hawkish, it could provide a near-term negative surprise for equities,” Morgan Stanley's permabear Michael Wilson wrote in a note, really scraping the bottom of the barrel on this one.

Shares in First Republic bank were halted after tumbling 46% in premarket trading. Regulators had worked into the evening on Sunday in Washington before announcing JPMorgan won the bidding to acquire the lender in an emergency government-led intervention. The collapse of First Republic was the second-biggest bank failure in US history. Private rescue efforts had failed to undo the damage from wrong-way investments and depositor runs that have roiled regional lenders.

As described earlier, JPMorgan acquired about $173 billion of First Republic’s loans, $30 billion of securities and $92 billion in deposits. JPMorgan and the FDIC which orchestrated the sale, agreed to share the burden of losses, as well as any recoveries, on the firm’s single-family and commercial loans, the agency said early Monday in a statement. JPMorgan shares rose 3.9% in premarket trade.

There was no trading in most of Europe to observe the May 1 holiday, with markets also shut in Asian centers like Hong Kong, Singapore and mainland China. What Asian markets were open saw stocks rise: benchmarks in Japan and Australia climbed, lifting the MSCI Asia Pacific Index 0.2% higher, with Japanese technology names NEC and Keyence among the top contributors to gains.

NEC surged 14% on strong results, helping boost the benchmark Topix to its highest since September 2021 even as Sony fell following disappointing guidance. Australia’s key gauge rose amid expectations the central bank will keep interest rates on hold when it meets Tuesday. The regional benchmark capped a 1.1% loss in April as geopolitical tensions and an uneven economic recovery spurred losses in Chinese equities. However, stocks in Japan capped a fourth-straight month of gains amid renewed investor interest, optimism over earnings and the central bank’s decision to maintain loose policy.

“The yen is trending somewhat toward depreciation, and we expect a somewhat positive impact on Japanese stocks, with scope for buying of bank stocks that were sold” recently, JPMorgan equity strategists led by Rie Nishihara wrote in a note Monday. Chinese stocks listed in Hong Kong will be in focus when trading resumes Tuesday, after data showing consumer spending surged while the housing market continued to rebound. Still, an unexpected contraction in manufacturing activity in April confirmed that the broader economic recovery remains uneven. Onshore markets will be shut through Wednesday

In FX, the Bloomberg dollar index dipped even as the slide in the yen continued following last week's dovish BOJ announcement.

Treasuries fell after a Friday rally. A sudden drop for Bitcoin dragged the cryptocurrency further below $30,000 after a stellar run this year.

Looking at the week ahead, interest rate decisions will be in focus this week. The Federal Reserve is expected to increase borrowing costs by 25 basis points to a range of 5% to 5.25%, a level not seen since 2007. The European Central Bank is also forecast to raise its key lending rates by 25 basis points. The Reserve Bank of Australia will likely keep interest rates on hold when it meets Tuesday.

Apple Inc. headlines another busy week of earnings that includes Advanced Micro Devices Inc. and Ford Motor Co. In Asia, banks including HSBC Holdings Plc and Macquarie Group Ltd. will deliver their profit reports. In Europe, Volkswagen AG and energy giants BP Plc and Shell Plc are on the docket.

Top Overnight News

Market Snapshot

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were positive in a holiday-quietened start to the risk-packed week with most indices in the region

closed for the Labour Day holidays, while weekend news flow was very light although the latest Chinese PMI data

showed the nation’s factory activity unexpectedly contracted last month. ASX 200 (+0.6%) traded higher with energy leading the gains although further advances were capped after weak manufacturing PMI data from Australia and its largest trading partner, China, while the Albanese government is set to conduct a review whereby hundreds of the prior Coalition government’s infrastructure projects could be scrapped. Nikkei 225 (+0.7%) climbed above the 29,000 level for the first time since August last year after Friday’s dovish reaction to BoJ Governor Ueda’s first policy meeting and as participants digested more earnings results, with SoftBank shares also among the notable gainers amid reports the Co.’s Arm unit filed confidentially for a US IPO on the Nasdaq. Elsewhere, US equity futures were steady and took a breather following their recent rally into month-end, with price action contained amid the mass holiday closures on Monday and ahead of this week’s key events including the RBA, FOMC and ECB rate decisions, Apple earnings and the latest NFP jobs data

Top Asian News

European markets closed for Labour Day.

Top European News

Geopolitics

US Event Calendar