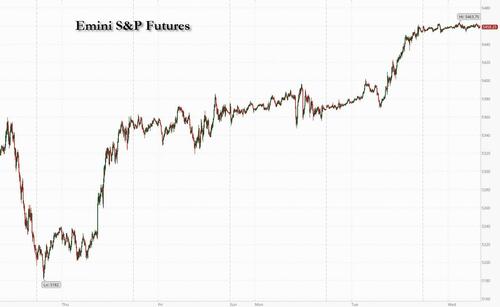

Futures are flat, after trading in a narrow range overnight which saw Asian stocks gain and European bourses trade mostly higher, with tech down small and small-caps/Russell leading with bond yields up 1bps in the front of the yield curve. As of 7:45am, S&P futures are unchanged at 5,459 after soaring 1.7% on Tuesday, fueled by cooler-than-forecast PPI data while Nasdaq futures are down 0.1% with the Mag7 mixed as NVDA boosts Semis. 10Y yields are down again, sliding to 3.83%, and pushing the USD lower. Commodities are mixed with Energy/Precious higher and Base lower; China’s largest steelmaker warns of 2008-like downturn given the slump in domestic consumption. The macro focus is on CPI (our full preview is here) and Retail Sales tomorrow.

Alphabet shares dropped 1% in US premarket trading after Bloomberg News reported that the Justice Department is considering a push to break up Google. Kellanova rallied as Mars agreed to buy the Pringles chips maker for nearly $36 billion. Victoria’s Secret soared 15% as the company is poaching the top executive from Rihanna’s lingerie brand to lead the retailer’s turnaround. Here are some other notable premarket movers:

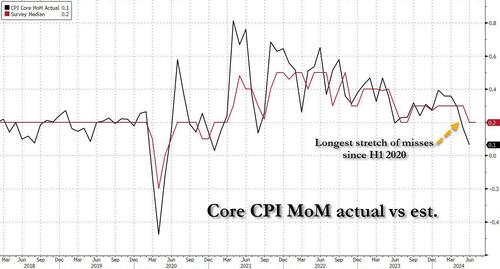

Turning to the main event, it’s CPI day in the US and, after three consecutive misses, forecasters expect a modest 0.2% increase in both the consumer price index and the core gauge excluding food and energy which would mark the smallest three-month rise for the latter since early 2021. That would leave the headline rate unchanged at 3%. Our full preview is here.

The easing of price pressures in the US has bolstered confidence that officials can start lowering borrowing costs and refocus on supporting the labor market.

“We think inflation is no longer going to be an issue for the Fed and they will be able to cut,” said Lilian Chovin, head of asset allocation at Coutts. “Growth is shifting down a gear after a very strong first half of the year, but that’s what the Fed wanted, and they’re about to achieve it. That is very positive news for market participants.”

The latest gains on Wall Street have pushed the S&P 500 closer to a key technical level, with the index just notching its biggest four-day rally this year.

“Earnings season has been quite good in the US and decent in Europe,” said Chovin at Coutts. “Revisions from analysts are turning positive across most regions which should support equities going forward.”

Europe’s Stoxx 600 Index was 0.2% higher, advancing for a second day as investors awaited US CPI data for clues on the health of the economy, and after UK inflation rose less than expected. Travel and leisure gains the most as Flutter surges. UBS rose after the bank’s second-quarter profit beat estimates. Basic resources lag and miners dropped as iron ore slumped to the lowest since May 2023 amid worries over demand in China. Here are the most notable European movers:

Earlier in the session, Asian stocks climbed for a fourth straight day, on track for its longest string of gains in over a month, ahead of a key US consumer price report. The MSCI Asia Pacific Index climbed 0.7%, with Toyota, TSMC and Samsung among the top contributors to the advance. Japanese stocks climbed to the highest since early August, after Prime Minister Fumio Kishida said he won’t run for a second term as leader of his party.

In FX, a Bloomberg gauge of the dollar slipped, trading around a four-month low. The pound fell against the dollar and UK government bonds jumped as British inflation data came in below forecasts. Consumer prices rose 2.2% in July against economists’ expectations of 2.3%. Traders fully priced a half-point of further Bank of England rate cuts by year-end for the first time since Aug. 5. The yen and Japanese stocks fluctuated as traders digested news that Prime Minister Fumio Kishida won’t run for a second term as leader of the long-ruling Liberal Democratic Party in September. The kiwi fell by over 1% after New Zealand’s central bank cut rates by 25 basis points, embarking on an easing cycle much sooner than previously indicated.

In rates, treasuries gained again supported by wider gains seen in gilts, where the UK curve bull steepens after headline, core and service CPI all rose less than expected in July and front-end BOE swaps subsequently added to the pricing of rate cut premium. Treasury yields slightly richer across the curve and near lows of the day heading into early US session. US 10-year yields around 3.83% and 1bp richer vs. Tuesday close with bunds lagging by 2.5bp in the sector and gilts outperforming by 3bp. US session focus switches to the July CPI print expected at 8:30am New York. July US CPI data is expected to be soft, driven by housing rents, user-car prices and discounts in discretionary services; bond market remains long heading into the data, as traders look for an aggressive pricing of Fed easing to be maintained. Fed-dated OIS is pricing in around 107bp of rate cuts for the year with roughly 37bp of easing priced into the September policy decision.

In commodities, oil first rose as an industry report pointed to a sizable drop in US crude stockpiles and tensions simmered in the Middle East, but then dipped ahead of the CPI report. Gold climbed toward a record high approaching $2500/oz. The weakness in iron ore deepened after the world’s biggest steel producer warned that China’s steel industry is facing a crisis more serious than the downturns of 2008 and 2015, likening conditions to a “severe winter.”

In crypto, Bitcoin continues to edge higher and now back above $61k.

US data slate includes only July CPI at 8:30am and no Fed speakers scheduled for the session

Market Snapshot

Top Overnight News

Central Bank Decisions: RBNZ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks only partially sustained the momentum from Wall St where risk sentiment was underpinned by softer-than-expected PPI data, while the region digested the RBNZ rate cut and PM Kishida's decision to not join the LDP leadership race. ASX 200 advanced amid a slew of earnings including from index heavyweight and largest bank CBA. Nikkei 225 wiped out initial gains with trade driven by currency moves and after PM Kishida announced to step down. Hang Seng and Shanghai Comp. were subdued ahead of key earnings from Alibaba and Tencent, while participants also digested weaker-than-expected Chinese new loans and aggregate financing data.

Top Asian News

European bourses, Stoxx 600 (+0.4%) are entirely in the green, continuing the optimism seen on Wall St in the prior session. European sectors hold a strong positive bias; Travel & Leisure takes the top spot, propped up by significant post-earning gains in Flutter. Financial Services is also towards the top of the pile, after UBS reported strong Q2 earnings. Basic Resources lags given the weakness in the metals complex. Futures are mixed, and price action has been rangebound ahead of today’s key risk event, US CPI.

Top European News

FX

Fixed Income

Commodities

Geopolitics - Middle East

Geopolitics - Ukraine

US Event Calendar