US futures are flat, with European and Asian stocks red, as concern about local government debt in China and hawkish language from a US central banker put traders in a risk-off mood. Meanwhile, in the latest diplomatic fiasco from Joe Biden, the US president blasted China’s economic problems as a “ticking time bomb” and referred to Communist Party leaders as “bad folks,” his latest barb against President Xi Jinping’s government even as his administration seeks to improve overall ties with Beijing. As of 7:45am ET, S&P futures were flat while Nasdaq 100 futs were down 0.1%. Treasurys yields are 1-4bps lower led by the front-end with 10Ys at 4.10%; the USD reversed an earlier gain and was last trading near session lows. Commodities are mixed with oil reversing earlier losses and following gold higher. Today, the macro focus will be PPI and U of Mich survey: the Street expects PPI to print 0.2% MoM vs. 0.1% prior, while U of Mich Consumer Sentiment is expected to drop to 71.3 consensus from 71.6 prior.

In premarket trading, mega cap tech are mostly lower. UBS rose as much as 5.9% after the Swiss bank said it would end an agreement with the Swiss government to cover Credit-Suisse- related losses, a move which analysts said was very reassuring. Virgin Galactic shares rose as much as 3.7% in premarket trading on Friday, after the company, founded by billionaire businessman Richard Branson, said it aims to launch its next space tourist mission in early September. Cano Health shares plummet as much as 53% in US premarket trading, after the healthcare provider issued a going concern warning and said it is exploring a sale. Citi downgrades Cano’s rating on the stock to hold, while TD Cowen describes the fall in 2Q Ebitda as “stunning.” Here are some other notable premarket movers:

Markets were on edge after SF Fed President Mary Daly said the Fed still has “more work to do” to combat rising prices, damping the impact of broadly positive inflation data on Thursday. Meanwhile, as noted earlier, China moved to bailout as much as 1 trillion yuan in local government debt, LGFV, a key threat to the nation’s financial stability, while property developer Country Garden Holdings predicted a multibillion-dollar loss for the first half of this year. The MSCI Asia Pacific Index dropped to the lowest level in a month.

“There may be other accidents waiting to happen as a result of sharply higher rates that we just haven’t seen come through yet,” said Richard Flax, chief investment officer at European digital wealth manager Moneyfarm. “Policymakers seem to be trying to signal to investors that they may be too optimistic to be looking for early rate cuts.”

Perhaps anticipating the next market drop, this week has seen a marked move into haven assets and out of stocks, according to Bank of America Corp. strategists. Cash funds attracted $20.5 billion of inflows, while investors poured $6.9 billion into bonds in the week through August 9, according to Bank of America, citing data from EPFR Global. In the meantime, US stocks had their first outflow in three weeks at $1.6 billion.

The Stoxx 600 index dropped 0.8%, snapping two days of gains and trimming its fourth weekly advance in five. Mining and energy stocks are leading declines although all 20 sectors are in the red except for telecommunications. The British pound led gains among G-10 currencies against the dollar after the strongest quarterly growth in more than a year. Here are the most notable European movers:

Earlier in the session, Asian equities dropped, on course for a second weekly loss, as concerns about the property sector spurred a broader selloff in China. The MSCI Asia Pacific excluding Japan Index declined as much as 0.8%, with Country Garden Holdings among the biggest decliners on the gauge after saying it expects to post net losses for the first half of the year.

“A lot of the moves in China this week are Country Garden credit-driven” and CSRC needs to come out with a more forceful response or framework to rescue the company and thereby minimize fallout, said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management. Investors remain concerned over China’s flagging economy following weak data earlier in the week and with the potential worsening of its property sector. Still, strong earnings from Alibaba may be a positive sign of a pick-up in the broader consumption space. Gains in the nation’s online shopping leader helped offset some of the losses in its peers including Tencent and Meituan.

Chipmakers continued to slide after some firms reported earnings. Brokers downgraded Hua Hong Semiconductor, China’s second largest chip foundry, following weak guidance for future sales. A Bloomberg gauge of semiconductor stocks in Asia slumped to its lowest level since May 25.

In FX, the Bloomberg Dollar Spot traded around flat, on track for its fourth week of gains, the longest streak since February. The pound, Australian dollar and yen rose, offsetting a drop in the Norwegian krone and Swedish krona. GBP/USD rose 0.4% to $1.27 after stronger-than-anticipated second quarter GDP data boosted gilt yields. USD/JPY slipped 0.1% to 144.58 as the persistently wide interest-rate gap kept the yen close to the psychological 145 level.

In rates, Treasuries curve were steeper with long-end yields cheaper on the day while front-end and belly of the curve outperform. US 10-year yields around 4.10%, slightly richer on the day with gilts lagging by 11bp in the sector following UK GDP data and bunds cheaper by around 7bp vs Treasuries. Treasury long-end yields were cheaper by around 2bp on the day with front-end and belly richer by 2bp, steepening 2s10s and 5s30s spreads by 1.5bp and 3bp vs Thursday closing levels. Gilts lag sharply in an aggressive bear-steepening move after the UK economy unexpectedly grew 0.2% in the second quarter. US session includes July PPI and University of Michigan sentiment gauge.

In commodities, crude futures decline with WTI falling 0.6% to trade near $82.30. Spot gold adds 0.3%.

Looking ahead to today, in the US we will get the PPI print for July, which will be monitored in part for components that feed into core PCE (such as airfares and medical), and also the August University of Michigan consumer survey. In the UK, we will get the Q2 GDP print– our UK economist expects a 0.0% qoq print, in line with consensus – and accompanying monthly activity data. In the euro area, we get final July inflation prints in France and Spain, Germany June current account balance and France Q2 unemployment.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly lower after the post-CPI dovish unwinding seen stateside and amid Chinese developer concerns, with trade also hampered by thinned conditions with Japanese participants away for Mountain Day. ASX 200 was lackluster with the upside in consumer stocks negated by the losses in the commodity-related sectors, while RBA Governor Lowe’s testimony provided very little in the way of fresh insight in which he reiterated that further tightening may be required. Hang Seng and Shanghai Comp declined with developers pressured including Country Garden after it flagged a loss of up to CNY 55bln for H1 and hired CICC for debt restructuring. Furthermore, shares in Fantasia Holdings dropped more than 50% on resumption of trade after being halted since March last year, while participants await details from the securities regulator’s emergency meeting with developers and financial institutions. Conversely, Alibaba, China Mobile and Li Ning were among the best performers in Hong Kong following their results including the beat on top and bottom lines by China’s e-commerce giant.

Top Asian News

European bourses are under modest pressure as benchmarks gradually dip in catalyst thin trade, Euro Stoxx 50 -0.7% Sectors are mainly in the red with Telecoms and Financial Services slightly firmer, the former aided by a source report re. Telecom Italia. Stateside, futures are near the unchanged mark with drivers limited pre-PPI/UoM; ES +0.1%.

Top European News

FX

Fixed Income

Commodities

Geopolitic

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I'm off on holiday today, driving to the French Alps with iPads fully charged across the back seat and with Brontë very grumpy for 14 hours further back in the car. Long-term readers will remember this journey from around 7 years ago when as my wife was feeding 6 month old Maisie I took Brontë for a walk around a motorway service station. I let her off lead in what I thought was an enclosed pen, only for her to escape under the fence and run wild across and around the motorway for 2 hours. It was petrifying. My wife and I celebrate 10 years of marriage next week while we're away and this event 7 years ago was the only time she's asked for a divorce. I probably would have taken that low hit rate back in August 2013 and hopefully we can laugh about it over dinner on our anniversary, although it might be too soon for her. So I'll see you towards the end of the month. Henry will be in the hot seat for the next couple of weeks but with Peter Sidorov stepping in on Monday. Be gentle on him as he has twins younger than mine, no doubt running rings round him.

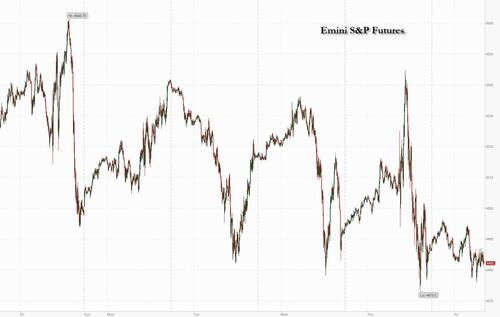

Before my hols, yesterday we saw the second of the four big prints we needed to get through before September's FOMC. We had the payrolls report last Friday and a US CPI print yesterday. They have generally been supportive of the view that the Fed has hiked for the last time in this cycle. Neither were complete slam dunks though but haven't changed anyone's opinions with terminal rate pricing still in a remarkably tight 7bps range for the last six weeks versus the 93bps range it was in the pre- and post-SVB period. Risk immediately liked the CPI report but soon fell below levels seen immediately before the report and struggled for direction for the rest of the day (S&P 500 +0.03%). With commodity prices rising of late and yields and breakevens remaining elevated there is no certainty that a last hike in the cycle would mean easier policy anytime soon. On the yield front, late in the session a tough 30-year auction undid some of the positivity from the decent 3 and 10yr auctions earlier in this first week of the new larger refunding wave. That led to 10yr US yields +9.5bps on the day and after the auction, but 16.7bps higher than the lows shortly after the CPI print. So another volatile but ultimately negative day for US bonds.

In more detail now, the July US CPI print saw monthly headline inflation come in at +0.17% (+0.18% prev.) and core inflation at +0.16% (+0.16% prev). So in line with the 0.2% mom consensus for both but with unrounded numbers on the lower side. As a result, annual headline inflation came in +3.2%, a touch below consensus of +3.3%, while core was in line at +4.7%. The CPI print marked the third month in a row for headline, and the second month in a row for core, that monthly inflation has been near a 2% annualised pace.

In terms of details, goods prices were helped lower by used cars (-1.3%) as well as other products, such as a record -2.9% mom decline in prices of toys (I need to move to the US). Meanwhile, airfares (-8.1%) have now seen the sharpest 2-month decline (-15%) outside the initial Covid lockdown period which seems a little strange. Nevertheless, this will add some more attention to the US PPI print today, as it is the PPI airfares measure that is used for core PCE (also relevant for medical services which were low in the CPI print). So if one wanted to search for a more alarmist take, core services excluding airfares and medical remained elevated, a reminder of inflation persistence risks. We do see drivers of structurally higher inflation as something to be a wary of (see Henry’s note on the topic last month here), but it could be a mistake to ignore the volatile downward components now, much as it proved wrong to treat sharp spikes in specific goods in 2021 as transitory. Our US economics team reviewed the release here and suggest that overall this report was necessary but not yet fully sufficient to cement a September pause.

Indeed, we heard a cautious take on the CPI print from San Francisco Fed President Daly, who said that the “CPI data came in largely as expected but not a data point that says victory is ours" and that “if core services ex housing stalls out, that would be concerning”. Overall, she struck a clearly data dependent tone without giving any view on the September meeting. She added that the conversation about cuts will be had next year, leaning against any prospects of an imminent Fed pivot.

Bonds initially rallied on the CPI print, with 10yr treasuries down more than -6bps at one point. However, this reversed into a bear steepening over the course of the day, with 10yr yields closing +9.5bps higher and 2yr yields up +3.4bps. Much of the sell-off came after a soft 30yr auction that saw $23bn of bonds issued at 4.189% with the highest primary dealer take up since February. 30yr yields closed at 4.25% (+8.2bps). So refunding questions resurfacing after strong 3yr and 10yr auctions the previous two days. With markets continuing to price a low probability of a September hike (from 12% to 10% yesterday), it was 2024 pricing that saw intra-day volatility, with December 2024 futures trading -10bps lower in the morning but closing +6.4bps higher at 4.11%.

In Europe, bonds saw a modest sell-off, with 10yr bunds up +3.1bps. OATs (+3.0bps) saw a similar move in France, while BTPs outperformed (-0.1bps). There was little change in ECB pricing, with a 40% likelihood of a 25bp hike priced for September, while Jun-24 pricing was up +3.5bps on the day.

Equities took a strongly positive initial view of the CPI print, with the S&P 500 trading over +1.3% higher in morning trading, before paring back this gain to close near flat (+0.03%) with only one of the 24 industry groups seeing a move of more than 0.5%. Small cap stocks underperformed with the Russell 2000 (-0.42% yesterday) now down -4.02% since the start of August.

Over in Europe, the STOXX 600 rose by +0.79%, closing before the full US reversal. France’s CAC outperformed (+1.52%) as news that China would end its ban on outbound international group tours supported travel and luxury stocks (LVMH and Hermes each rose by over 3%). The DAX (+0.91%) and FSTE MIB (+0.94%) also posted solid gains. The FTSE 100 underperformed in the UK (+0.41%) though this was in part due to ex-div effects on the index. European banks continued to recover (+1.69%) from their sharp fall on Tuesday, while industrials (-0.11%) underperformed amid disappointing results from Vestas (-4.05%) and Siemens (-3.11%).

In the commodities space, oil prices retreated from their multi-month highs, with Brent Crude down -1.31% to $86.40 and WTI -1.87% to $82.82.

Asian equity markets are mostly trading lower this morning after the rally on Wall Street last night fizzled out towards the end of the session. Sentiment has also been hurt by fresh concerns amongst some large Chinese housebuilders. In terms of specific moves, China’s CSI 300 is lower (-1.40%) followed by the Shanghai Composite (-1.19%) and the Hang Seng (-0.62%). That comes even as stock in Alibaba (e-commerce titan) has rallied after it posted its strongest quarterly revenue growth in almost two years. Elsewhere, the KOSPI (+0.12%) is bucking the regional trend while the markets in Japan are closed for a public holiday. Signs of an economic slowdown are growing in Singapore as the island state’s GDP grew just +0.5% yoy in Q2 – lower than the +0.7% estimate. The official growth forecasts for the full year in 2023 were also lowered to between +0.5% and +1.5% from the prior range of +0.5% to +2.5%. Outside of Asia, US equity futures are seesawing between gains and losses with those on the S&P 500 (-0.06%) just below flat while those tied to the NASDAQ 100 (+0.07%) trading marginally higher.

In central bank news, the Reserve Bank of Australia (RBA) outgoing Governor Philip Lowe in his speech indicated that the worst was over for inflation while reiterating “it is possible that some further tightening of monetary policy will be required”, depending on incoming data and evolving risks. Early morning data showed that factory activity in New Zealand contracted at its fastest pace for the year in July, as the manufacturing PMI came in at 46.3 deteriorating further from a revised level of 47.4 while marking the sector’s fifth consecutive contraction this year.

In other data yesterday, we received slightly less encouraging news on the US labour market, as initial weekly jobless claims jumped to +248k (+230k exp, +227k prev), their highest since late June. However, continuing claims eased to 1684k (1707k exp.) and the jump in initial claims was driven by only a few states. Over in Europe, it was quiet day for data, with Italy’s July inflation print revised a touch lower, from 6.4% to 6.3% yoy.

Looking ahead to today, in the US we will get the PPI print for July, which will be monitored in part for components that feed into core PCE (such as airfares and medical), and also the August University of Michigan consumer survey. In the UK, we will get the Q2 GDP print– our UK economist expects a 0.0% qoq print, in line with consensus – and accompanying monthly activity data. In the euro area, we get final July inflation prints in France and Spain, Germany June current account balance and France Q2 unemployment.