US equity futures held on to post-holiday gains as traders awaited tomorrow's inflation data for clues about whether the Fed's tightening cycle is done or if it will hike once more in May (currently market odds are 74% after Friday's strong jobs report) and also prepared for the start of the first-quarter earnings season when the big banks report on Friday. S&P 500 contracts were flat as of 7:40 a.m. ET, fading earlier gains after the underlying benchmark pulled off another late recovery on Monday as investors shrugged off fears of one more Fed rate hike in the wake of Friday’s strong US employment data. Nasdaq 100 futures dipped 0.2% after rising modestly earlier.

Overnight, China printed slowest annual CPI pace since Sept 2021. Also last night, Fed Pres Williams said he doesn’t worry if market view on rates is different than the Fed’s view and rejected arguments that rate hikes are to blame for banking sector turmoil. ECB member De Cos (historically leans dovish) said that the central bank’s baseline scenario would allow for further hikes. BOJ Governor Ueda held his inaugural press conference where he reiterated the need to maintain easy monetary policy.

European stocks rose to a 5 week high after reopening from a long holiday; Japanese equities also climbed after a Nikkei report that Warren Buffett plans to boost investments in Japan and on new Bank of Japan Governor Kazuo Ueda’s dovish remarks on monetary policy; Japanese trading companies including Mitsubishi Corp. rose after Nikkei reported that Warren Buffett is weighing investment beyond his stakes in trading houses, which he recently increased. Treasury yields retreated across the curve, but rebounded from session lows. Oil dipped and gold climbed.

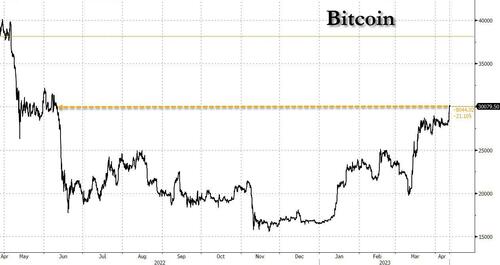

The most notable overnight move came in crypto where in a broad thrust late on Monday, bitcoin breached the key $30,000 level for the first time since June on Tuesday...

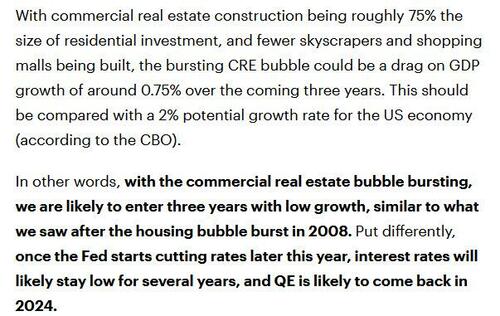

... adding to its steady gains as investors raised bets that the Fed will not only soon end its aggressive monetary tightening campaign, but will start rate cuts and - according to Apollo chief economist, Torsten Slok, who like us believes the CRE crash will send the economy into a tailspin - launch QE in 2024.

In premarket trading, Tilray Brands shares slumped as much as 9.9% after the cannabis producer reported net revenue for the third quarter that missed the average analyst estimate. The company also announced the acquisition of Hexo Corp. Analysts were positive about the deal, but cautioned that challenges remain for the cannabis industry. Hexo shares declined 21% in US premarket trading. Gold miner Newmont Corp. lost 2.3% after it sweetened its bid for Australia’s Newcrest Mining. Here are some of the biggest US movers today:

While the S&P 500 has gained 7% year-to-date amid growing bets that the Fed’s rate-hiking campaign is coming to an end, dashing countless bearish hopes that stocks should trade far lower because a recession is looming, Wednesday’s CPI reading is seen as key for policy makers as they consider such a decision.

“It’s an important number, it’s really among the data which will determine whether the Fed pivots,” said Jean-François Robin, head of global market research at Natixis. “The big risk for markets would be for the data to crush that narrative and then tech and financial stocks would get a beating.”

A scenario where the Fed halts rate hikes in May, which markets had briefly entertained last month as fragility in banks raised recession fears, looks increasingly remote after Friday's unexpectedly strong jobs report. “The Fed has maintained its resolute inflation narrative despite banking sector stress, switching to liquidity tools to tackle the funding squeeze, and keeping its monetary policy toolkit intact,” Mizuho International Plc strategists including Evelyne Gomez-Liechti wrote in a note.

After May, though, markets are pricing in a pivot to easier policy. Tighter financial conditions following the failure of Silicon Valley Bank could pave the way. Investors predict rates will peak below 5%, with the Fed then cutting by roughly 50 basis points before end 2023.

Investors are also readying for an earnings season that some forecast could be the worst since the depths of the pandemic. Friday will provide a major test of sentiment when JPMorgan, Wells Fargo and Citigroup all report after weeks of market stress across the US banking sector following the failure of Silicon Vally Bank.

Meanwhile, cracks in 2023’s equity advance are appearing, as hedge funds and other speculators amass the deepest short position since November 2011 when the US sovereign credit rating was cut. In other words, another short squeeze is imminent.

“It remains a very tricky trading environment,” Chris Turner, a strategist at ING Bank wrote in a note to clients. “Experienced commentators are refusing to dismiss last month’s events as a one-off and instead prefer to see bank failures as a harbinger of forthcoming stress in the global financial system.”

European stocks returned from the Easter holiday on the front foot and risen to their best level in five weeks. The Stoxx 600 is up 0.6% with miners, autos and retailers the best performing sectors. Here are some of the biggest movers on Tuesday:

Earlier in the session, Asian stocks rose, on track for a third day of gains, amid a report Warren Buffett plans to boost investment in Japan while the Bank of Korea kept interest rates on hold. The MSCI Asia Pacific Index climbed as much as 1.1%, with Alibaba Group and South Korea’s LG Chem among the biggest contributors. Japanese stocks gained after the Nikkei reported Buffett is weighing investment beyond his stakes in trading houses, which he recently increased. “Clearly, this news is having a significant impact on stock prices,” said Hiroshi Namioka, chief strategist at T&D Asset Management Co Ltd. “This may encourage foreign investors to invest in Japanese stocks, especially in value stocks.”

South Korean shares advanced as the central bank held policy, though it said it intends to remain in “restrictive” territory to combat inflation. Australian equities were also among the biggest regional gainers as data showed strong consumer confidence and business sentiment. Benchmarks edged higher in Hong Kong while Chinese stocks slipped as weak China inflation data suggested more monetary or fiscal stimulus may be needed. Investors will be watching US inflation data later this week for further signals on the Federal Reserve’s policy. The Fed isn’t “close to being done,” Catherine Yeung, an investment director at Fidelity International, told Bloomberg Television. While the US equity market has “basically traded sideways” the past ten months, Chinese and Asian equity markets are “looking a lot more appealing,” she added.

Stocks in India rose as forecast of a normal monsoon later this year eased concerns over growth, while a risk-on mood in Asian equities also boosted sentiment. Key stock gauges extended their winning run to the seventh session, the longest gaining streak this year, helping them rebound about 5% from their March lows. “While bond yields are still more attractive, the correction in Indian listed equities seems overdone,” Rajesh Cheruvu, managing director and chief investment officer, LGT Wealth said in a note. The S&P BSE Sensex rose 0.5% to 60,157.72 in Mumbai, while the NSE Nifty 50 Index advanced 0.6% to 17,722.30. Kotak Mahindra Bank contributed the most to the Sensex’s gain, increasing 5% as analysts expect the stock’s weighting in MSCI indexes to rise. TCS was among the biggest losers ahead of the technology major’s fourth quarter earnings announcement on Wednesday. Out of 30 stocks in the index, 21 rose and nine fell.

Japanese equities climbed amid a report that Warren Buffett plans to boost investments in Japan and on new Bank of Japan Governor Kazuo Ueda’s dovish remarks on monetary policy. The Topix Index rose 0.8% to 1,991.85 as of market close Tokyo time, while the Nikkei advanced 1% to 27,923.37. Sony Group Corp. contributed the most to the Topix Index gain, increasing 1.5%. Out of 2,158 stocks in the index, 1,610 rose and 438 fell, while 110 were unchanged. Japanese trading companies including Mitsubishi Corp. rose after Nikkei reported that Warren Buffett is weighing investment beyond his stakes in trading houses, which he recently increased. Meanwhile, Ueda said yield curve control and negative interest rates are appropriate amid the current economy. Buffett’s investment “had a moderately positive effect in the intermediate to long term regarding foreign perceptions of Japan’s market,” said John Vail, Chief Global Strategist at Nikko Asset Management. “It also supports domestic optimism, too.”

Australian stocks rose to a 3 month high; the S&P/ASX 200 index rose 1.3% to 7,309.90, boosted by miners and banks to cap its best session since Jan. 4. The advance came as Asian equities and European stock futures gained following a late recovery in post-holiday trading on Wall Street. Read: Stocks Climb Amid Buoyant Sentiment; Dollar Slips: Markets Wrap Australia’s consumer confidence surged and business sentiment showed ongoing resilience after the country’s central bank left its key interest rate unchanged for the first time in its almost yearlong tightening cycle. In New Zealand, the S&P/NZX 50 index was little changed at 11,873.58. Meanwhile, house sales fell to a record low in the three months through December as interest-rate hikes and plunging property prices pushed buyers to the sidelines

In FX, the Bloomberg Dollar Spot Index is down 0.3% with the euro and pound both rising ~0.5% versus the greenback; the Norwegian krone is the only G-10 currency that trades in the red versus the dollar, meeting a fresh round of selling from early New York flows. USD/NOK up by 0.7% to 10.6037, highest since March 21; EUR/NOK rallies 1.3% to 11.5748, a level last seen in April 2020, Real money demand sends EUR/NOK higher, while the common currency also hits fresh cycle highs versus the kiwi and the Aussie.

In rates, treasuries gained with 10-year yields falling 2bps to 3.40%, inside Monday’s selloff ranges. Most yields slid to session lows during the London morning as bund and gilt yields pared their moves; however they have since erased much of the move. Yields rose when trading resumed after a four-day weekend following Friday's strong jobs report. US yields are lower by 2bp-3bps, led by the 3Y despite auction of that tenor ahead at 1pm New York time — the first of three Treasury coupon sales this week; the 10Y yield was down 2bps to 3.40% after earlier dipping to 3.38%. Treasury yields reached their highest levels in several days Monday as Fed swaps priced in higher odds of a 25bp May rate hike; little changed at around 75%. IG credit issuance slate includes only Mitsubishi UFJ Financial Group $benchmark so far; four high-grade offerings totaling about $2b were priced Monday. German 10-year yields have risen 6bps while the UK equivalent adds 7bps as they react to Friday’s US jobs data for the first time.

In commodities, oil extended Monday’s loss, with West Texas Intermediate dipping back below $80 a barrel after briefly crossing it. Gold was slightly higher and near $2,000 an ounce.

As noted above, Bitcoin surpassed the $30k mark, rising as high as $30,430 intraday high before paring modestly back towards the figure.

Looking to the day ahead, the event calendars is light, with just the NFIB small business confidence (90.1, exp. 89.8, Last 90.9) on deck, however things pick up tomorrow when the March CPI report and minutes of the Fed’s March policy meeting are ahead as well as auctions of 10-year notes and 30-year bonds over the next two days.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following the recovery seen on Wall Street and as some major markets returned from the long weekend. ASX 200 saw its first session of the week propped up by mining names after Newmont upped its offer for Newcrest Mining. Nikkei 225 reclaimed 28k+ status with the index underpinned by the recent Yen weakness. Hang Seng and Shanghai Comp were mixed with Hong Kong playing catch-up, whilst the latter overlooked cooling inflation data and traded subdued throughout the session amid heightened tensions over Taiwan.

Top Asian News

European bourses are mostly in the green, Euro Stoxx 50 +0.7%, continuing the positive APAC handover on their return to the market with newsflow otherwise limited. Sectors are similar and feature outperformance in Basic Resources while Food, Beverage and Tobacco names lag. Stateside, futures are steady with a slight positive bias, ES +0.3%, with action elsewhere playing catch-up to the late-Monday US upside. China Vehicle sales (Mar): 9.7% YY (prev. 13.5% in February), via Industry Association; NEVs +34.8% YY

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Henry Allen concludes the overnight wrap

Welcome back and hope you all enjoyed the long weekend. Most European markets have been closed over the last couple of sessions, but there’s been a bit more trading in the US, where last week’s risk-off tone moderated somewhat. Indeed, the S&P 500 traded lower for the majority of yesterday’s session before recovering to close up +0.10%, and both Asian equities and US equity futures have seen further gains this morning. In the meantime US Treasuries sold off, with the 10yr yield up by another +2.6bps yesterday to 3.417%, which comes on the heels of an +8.6bps increase last Friday.

In many respects it's been a fairly quiet period since our last edition, but one of the biggest stories was last Friday’s US jobs report, which showed another decent gain in nonfarm payrolls of +236k in March (vs. +230k expected). Furthermore, the unemployment rate fell back a tenth to 3.5% (vs. 3.6% expected) and the participation rate hit a post-Covid high of 62.6% (vs. 62.5% expected), so there was plenty of good news to digest.

With another strong jobs report in hand, investors have responded by dialling up the probability of another Fed rate hike at the next meeting. That’s now only three weeks from tomorrow, and since the jobs report, the odds of another 25bp hike have risen from a near-even 53% to a stronger 71% this morning. In addition, futures further out the curve are pricing in their most hawkish rate path for the Fed since the SVB collapse, with the year-end rate priced at 4.40% by yesterday’s close. That’s the highest it’s been in a month, even if it’s still over a full point beneath its pre-SVB level of 5.56%.

This sense that we might get a more hawkish Fed was bolstered by the New York Fed’s latest Survey of Consumer Expectations which came out yesterday. That showed inflation expectations rising in March at both the 1yr and 3yr horizons for the first time in 5 months. For instance, the 1yr expectation was up half a point to 4.7%, and the 3yr expectation rose a tenth to 2.8%. Nevertheless, there were some more dovish details in report, including that the share of households saying it was harder to obtain credit than a year ago rose to 58.2%, the highest since the survey began a decade ago.

Speaking of more dovish signals, the jobs report did actually contain several indicators pointing to a cooling labour market, even if the market’s main focus was on how it made a May hike more likely. For instance, the monthly gain in nonfarm payrolls of +236k was actually the slowest since December 2020. On top of that, average hourly earnings were up by +0.3% on a monthly basis, which took the annual change down to its lowest since June 2021, at +4.2% (vs. +4.3% expected). Another detail that caught our eye was the decline in the temporary help services category, which has historically been a leading indicator in previous cycles. That category has now seen a decline in payrolls of -4.1% relative to a year earlier, and whilst the data only goes back to 1990, on every occasion they’ve fallen by that much before, the US has either been in or near a recession.

This morning in Asia, equities are mostly positive following lower trading volumes in the region over the last couple of sessions. Currently, the KOSPI (+1.38%) is leading gains in the region, which follows the Bank of Korea’s decision to maintain interest rates at 3.5% as expected. And the Nikkei (+1.34%), the S&P/ASX 200 (+1.31%) and the Hang Seng (+0.07%) have all seen gains as well. By contrast, the CSI 300 (-0.25%) and the Shanghai Composite (-0.35%) both losing ground. That comes on the back of China’s March inflation data showing CPI fell to an 18-month low of +0.7% (vs. +1.0% expected). Looking forward, US equity futures are pointing a bit higher, with those on the S&P 500 up +0.11%, whilst Bitcoin has just surpassed the $30,000 mark for the first time since last June.

Staying on Asia, yesterday also brought a noticeable weakening in the Japanese Yen, which fell -1.08% against the US Dollar. That followed a press conference from new BoJ Governor Ueda, who said that “given the current economic, price and financial conditions, I think it’s appropriate to keep up the current yield curve control”. That was a more dovish tone than had been expected by some, since there had been anticipation that Ueda might seek to move away from the yield curve control policies of his predecessor.

Looking forward to this week now, the focus will likely remain on the Fed’s next decision, since tomorrow sees the release of the US CPI report for March. The February release showed that inflation was still running reasonably fast, with core CPI at a 5-month high of +0.45%, and this time around our US economists expect core inflation to come off a bit to +0.39%, although that would still leave the year-on-year change up a tenth at +5.6%. For headline inflation, they see a lower rate of +0.24%, taking the year-on-year rate down to +5.2%. Remember this month that there’ll be unusually large base effects at play, since the March 2022 surge in energy prices after Russia’s invasion of Ukraine will be dropping out of the annual comparisons.

Speaking of the Fed, we should get another window into their thinking from the release of the FOMC minutes for March tomorrow. That meeting took place shortly after the market turmoil, which created some doubt as to whether they would proceed with a rate hike at all. Indeed, it was reported by Nick Timiraos in the Wall Street Journal that it was “their closest call” in years and that the decision was only made to proceed with a hike two days beforehand. So it’ll be interesting to see their thoughts on how far they should keep hiking rates. Otherwise, this week’s main central bank policy decision comes from the Bank of Canada tomorrow. They announced a pause in rate hikes at their January meeting, so investors are expecting that rates will remain unchanged.

Elsewhere this week, global policymakers will be gathering in Washington for the IMF/World Bank spring meetings. As part of that, the IMF will be releasing their latest economic forecasts later today, and G20 finance ministers and central bank governors will also be meeting this week. Plenty of officials will be speaking publicly whilst there as well, including BoE Governor Bailey and Bundesbank President Nagel.

Finally, the other important thing to watch out for will be the start of earnings season. Several US financials will be kicking things off on Friday, including JPMorgan Chase, Citigroup, Wells Fargo and BlackRock. US banks have already had a very weak start to the year given the market turmoil, with the KBW Banks Index now down by -19.60% on a YTD basis.