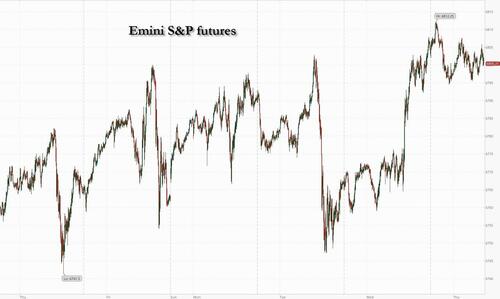

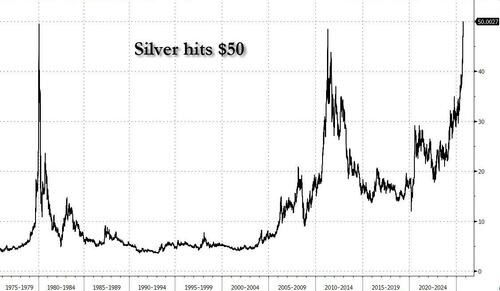

US equity futures are flat, as the main indexes closed at fresh record highs overnight amid a melt-up that shows no signs of abating, with every small dip being bought and volatility staying low. While plenty of investors have doubts about the AI-driven rally and the tense geopolitical backdrop, the year-end FOMO is the only driver for now. As of 8:30am, S&P futures are flat, while Nasdaq futures trade fractionally in the red, although we are confident the dip-buying algos will promptly pounce on the opportunity. In premarket trading, Delta Air Lines climbed more than 5% after reporting profits that beat estimates. PepsiCo gained on stronger-than-expected revenue and flagged a turnaround at its US beverage unit. Nvidia rose after the US approved several billion dollars worth of its chip exports to the United Arab Emirates. Shares of other Mag 7 names were mixed. Bond yields are higher by 1-2bp across the curve ahead of today's 30Y auction, with USD flat following a 1.2% move WTD. Ahead of Trump / Xi meeting later this month China expanded its rare earths curbs. In commodities, Energy is mixed with distillates higher and crude/natgas lower. Oil slipped and gold stalled near a record high above $4,000 as traders focused on cooling tensions in the Middle East; Silver topped $50 for the first time and PGMs are stronger. Today's session has seven Fed speakers and a 30Y bond auction; yesterday's 10Y auction required a concession. Macro data is delayed again due to the government shutdown.

In premarket trading, Mag 7 stocks are mixed (Microsoft little changed, Alphabet -0.2%, Meta little changed, Apple -0.1%, Amazon -0.2%)

In corporate news, Warner Music Group is said to be close to an agreement with Netflix to create a slate of movies and documentaries based on the label’s artists and songs. Jefferies has come under scrutiny for its relationship with First Brands.

As we said yesterday, and the day before, and the day before that, and so on, stocks around the world have soared to a fresh record as traders looked past worries of a potential bubble in high-profile tech names and instead focused on corporate resilience and the possibility of further US interest-rate cuts. The optimism now faces another test as earnings season gets underway, with Wall Street banks Goldman Sachs and Citigroup due to report next week. Tesla is the first of the Magnificent Seven set to report on Oct. 22, followed by Alphabet, Microsoft and Meta Platforms Inc. on October 29.

“A liquidity glut and the AI boom keep the party going for equities,” said Barclays strategist Emmanuel Cau. Still, the reluctant bulls driving the rally have plenty of lingering worries, such as Nassim Taleb’s warning that investors should insure against a stock-market crash due to structural issues such as the US debt burden.

“Given how lopsided the expectations have become, given how lofty the valuations have become, I think investors are laser focused on earnings,” Aidan Yao, a strategist at Amundi Investment Institute, said on Bloomberg TV. “They are trying to see if earnings are really catching up into the valuations.”

Elsewhere, the Fed minutes revealed that many members have expressed caution — driven by concerns over percolating US inflation. And traders have been slowly backing away from bets on the trajectory of rate cuts. Gold is taking a breather from its record run, while silver just topped $50 for the first time

In geopolitical news, Trump said Israel and Hamas have signed off on the first phase of a peace plan. A ceasefire in Gaza has gone into effect, Israel Deputy Foreign Affairs Minister Sharren Haskel said subsequently. If the agreement holds, it would mark a major step toward ending the conflict that erupted after Hamas attacked Israel on Oct. 7, 2023 and threw the Middle East region into crisis. Canadian PM Mark Carney pushed back against Trump’s protectionism in the auto industry, saying that the US-Mexico-Canada Agreement strengthens the US industry. China unveiled broad new curbs on its rare earth exports.

European stocks are mixed. The CAC 40 adds 0.3% while the DAX climbs to a fresh record. The FTSE 100 falls 0.4% as HSBC shares slump after the bank proposed taking its Hong Kong subsidiary private. Here are some of the biggest European movers today:

Earlier in the session, Asian stocks rose, as an AI-fueled tech rally resumed following a brief pause and shares in mainland China gained as the market reopened after the Golden Week holidays. The MSCI Asia Pacific Index rose as much as 0.6%, poised for its first gain in three sessions. A sub-gauge of tech shares was the top performer among sectors, rebounding from Wednesday’s declines. It had risen for seven straight days before that. TSMC was the biggest boost to the MSCI Asia measure after a US index of chip stocks jumped to a fresh all-time high on AI euphoria. China’s CSI 300 Index advanced 1.5% to its highest since January 2022 as investors got up to speed on headlines from OpenAI deals to gold’s climb above $4,000. Benchmarks in Japan and Taiwan climbed to fresh records.

In FX, the Bloomberg Dollar Spot Index is flat, in early London trade it pushed up to its highest level since Aug. 5. EUR/USD was slighly lower at 1.1623; its selloff has slowed as French President Emmanuel Macron is set to name a new prime minister by Friday evening, avoiding the need to call a snap election for the time being. USD/JPY steadies around an eight-month high of 153.22; investors contemplate how much the Japanese currency must weaken before authorities intervene again

In rates, treasury yields are within a basis point of Wednesday’s closing levels following similarly rangebound price action in core European bonds. Focal points of US session include 30-year bond reopening, last of three coupon auctions this week. Fed Chair Powell delivers pre-recorded welcoming remarks at its community bank conference at 8:30am New York time, with text release expected. US 10-year, little changed near 4.12%, trades marginally cheaper vs German and UK counterparts; curve spreads are marginally flatter on the day. $22 billion 30-year bond reopening at 1pm New York time follows Wednesday’s middling 10-year note auction, which tailed by 0.8bp. WI 30-year yield near 4.7% is ~5bp cheaper than last month’s, which stopped on the screws.

The Bloomberg Dollar Spot Index . Spot gold loses a few dollars but remains firmly above $4,000/oz.

In commodities, oil slipped and gold stalled near a record high above $4,000 as traders focused on cooling tensions in the Middle East. Israeli markets staged a broad rally, sending the shekel to a three-year high. The Tel Aviv Stock Exchange 35 Index added 1.7%, notching a fresh all-time high, while bond yields fell across the board. WTI crude futures fall 0.2% to $62.40 a barrel. Bitcoin falls 1%.

Looking at today's calendar, wholesale trade/inventories for August are scheduled for 10 am ET, but govt. data releases are likely to be impacted by the shutdown. Fed’s Bowman, Goolsbee, Barr, Kashkari and Daly are scheduled to speak and Fed Chair Powell gives pre-recorded remarks at Fed community bank conference.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were predominantly higher following the tech rebound stateside, where the S&P 500 and NDX notched fresh record levels, while participants were encouraged by an agreement on the first phase of a Gaza ceasefire deal, and with Chinese traders returning from the National Day Golden Week holiday. ASX 200 eked mild gains with strength in mining and materials, while tech and the top-weighted financial industry lagged. Nikkei 225 resumed its recent rally with the ascent spearheaded by tech advances following the strength in US counterparts. Hang Seng and Shanghai Comp were somewhat mixed as the Hong Kong benchmark took a backseat to the Mainland Chinese markets, which reopened for the first time this month, while there were also divergences between some banks as Hang Seng Bank was the biggest gainer after jumping more than 26% and with HSBC in the red after proposing to take the former private.

Top Asian News

European bourses (STOXX 600 -0.2%) opened mostly on a firmer footing, but sentiment has slipped a touch to display a bit more of a mixed picture in Europe. European sectors are mixed. Telecoms and Basic Resources takes the top spot, with the latter boosted by a few broker upgrades from within the sector alongside strength in underlying metals prices. Banks are found towards the foot of the pile, with losses in HSBC (-6.4%) driving the sector lower after it proposed to privatise Hang Seng Bank. Elsewhere, Lloyds (-2.9%) dips after the Co. warned of a "material" hit related to the FCA's latest motor finance ruling.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Banks (All Times ET):

DB's Jim Reid concludes the overnight wrap

Markets recovered their poise yesterday, with global equities at new highs as investors remained unfazed by the ongoing political uncertainty in various countries. So the S&P 500 (+0.58%) and the NASDAQ (+1.12%) both hit an all-time high, despite the government shutdown. And over in Europe there was an even stronger performance, even before news that President Macron has avoided a snap election for now by promising to name a new prime minister by the end of the week. Moreover, this rally was clear across multiple asset classes, with global bonds rallying on both sides of the Atlantic, oil prices picking up again, and gold prices (+1.44%) at another record of $4,042/oz.

In terms of those political various stories, last night was the deadline given to France’s outgoing PM Lecornu to seek a way through the impasse. In the end President Macron’s office announced that he would but forward a new Prime Minister by Friday evening. This puts off the risk of snap elections for the time being. Investors were fairly optimistic during the trading session, as the outgoing PM Lecornu continued to insist a path forward was possible and that the deficit target for 2026 should be below 5% of GDP. And in turn, that led to a positive market reaction, with the Franco-German 10yr spread (-2.4bps) falling back to 83.5bps, whilst the CAC 40 (+1.07%) was the best performer among the major European indices. The attention now will shift to whether this new PM can form a cabinet, or whether Macron will eventually have to call for parliamentary elections. Polymarket has the implied probability of another election by year-end down to 51% overnight from nearly 80% earlier yesterday.

Over in the US, the focus remained on the government shutdown, amidst mounting speculation that it might even drag on to next month. That came as Republicans and Democrats showed no sign of publicly shifting their positions, with Democratic Senate Minority Leader Chuck Schumer saying that their position on healthcare subsidies remained the same. Republican Senate majority leader Thune said that the Senate Republicans are prepared to bring individual appropriations bills forward in order to reopen the government department by department in what would be a long process. Speaker Johnson has not been receptive to this idea however, according to reporting from Axios. Nevertheless, US equities continued their historic pattern of shrugging off the effects, and both the S&P 500 (+0.58%) and the NASDAQ (+1.12%) moved up to new records. And once again, that was driven by tech and semiconductor companies. The Philadelphia Semiconductor Index (+3.98%) was up to a new record of its own led by AMD (+11.4%) which continues to rise after the OpenAI headlines from earlier this week.

Rate markets had a busy afternoon in the US with the Fed minutes and a 10yr auction within an hour of each other. The minutes showed that most FOMC members at the September meeting “judged that it likely would be appropriate to ease policy further over the remainder of this year.” This aligns with the dot plot as well as recent fedspeak. There was clearly a level of caution throughout the minutes as “Participants generally assessed that recent readings of these indicators did not show a sharp deterioration in labor market conditions.” However, on inflation, the majority of members emphasised upside risks. 10yr yields were nearly flat on the day before the minutes and then closed -0.7bps lower at 4.117%. 10yr yields had been stronger earlier in the session but were potentially weighed down by a late auction concession ahead of a $39bn 10yr note sale an hour before the Fed minutes. The auction metrics were solid with decent demand even as the primary dealer award ticked up from last month’s record low. Today we’ll get another test of duration demand with a $22bn 30yr auction.

Meanwhile, the spotlight on gold continued after spot prices (+1.43%) closed above $4000 for the first time. A lot of the investor moves towards gold have been led by both official central bank and ETF demand as the US government shutdown continues. In fact, total holdings of gold ETFs have already seen their highest point since September 2022, back when we had surging inflation globally and the Fed were hiking by 75bps per meeting to get it under control again. This flow into gold and other alternatives like Bitcoin (also up +0.73%) is something to keep an eye on, although yesterday we also saw the dollar index (+0.34%) hit a two-month high.

Back in the rest of Europe, equities also posted a strong advance, with the STOXX 600 (+0.79%), the FTSE 100 (+0.69%) and the DAX (+0.87%) all rising to fresh records. We did get a bit of data, including from the UK’s ONS, who announced that it had revised down the government’s borrowing for the current fiscal year by £2bn, leaving the budget deficit at £17.7bn in August. Nevertheless, gilts still underperformed, with the 10yr yield only down -1.0bps, compared to larger falls for 10yr bunds (-3.1bps), OATs (-5.5bps) and BTPs (-6.0bps).

In terms of data yesterday, we did get some small misses on Swedish headline CPI inflation (+0.9% y/y vs 1.0% y/y expected) and CPIF ex-energy (2.7% y/y vs 2.8% y/y expected) relative to consensus for September, but they were firmly in line with the Riksbank’s fresh forecasts, and are unlikely to change the central bank’s mind from holding rates for now. Today in Europe, we’ll also get the ECB’s account of their September decision, and several speakers including ECB President Lagarde and BoE Governor Bailey.

Asian equity markets are largely reflecting the overnight gains observed on Wall Street, primarily driven by increases in technology shares, as ongoing optimism regarding AI has spurred investment in chipmaking and related sectors. Throughout the region, mainland Chinese markets are leading the way, rebounding after a week-long holiday, with the CSI index rising by (+1.61%) and the Shanghai Composite index also experiencing a significant increase of (+1.24%). In Japan, markets have continued their upward trend, with the Nikkei index climbing (+1.40%) and the Topix index increasing by (+0.24%), both approaching record high closing levels due to gains in the technology sector. South Korean markets are closed for a holiday, while the S&P/ASX 200 index in Australia is seeing slight gains (+0.11%) with the Hang Seng moving back to flat after experiencing a decline of as much as -1.0% earlier pressurised by losses in health tech and healthcare stocks following a report from the Wall Street Journal indicating that tech giant Microsoft intends to make significant investments in AI-driven healthcare. US equity futures are flat.

To the day ahead, and data includes Germany’s August trade balance. Central bank speakers include the Fed’s Kashkari and Barr, the ECB’s Villeroy, and the BoE’s Mann, and we’ll also get the ECB’s account of their September decision. Earnings include Delta Air Lines and Pepsi. Lastly, there’s the US 30yr bond auction.