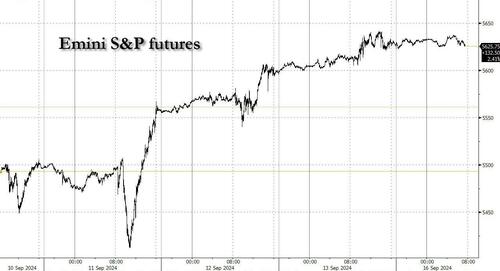

Futures are flat, erasing an earlier modest gain, ahead of a very busy week which will see the first Fed rate cut since March 2020. As of 7:45am, S&P futures were down fractionally, with small-caps outperforming following a trend from late last week as investors price in a 50bps rate cut on Wednesday. Nasdaq futures are down 0.3% as Semis lag and the Mag7 are mixed and AAPL slumps as much as 2.4% as noted analyst Ming-Chi Kuo notes that, based on his first weekend pre-order analysis, demand for the iPhone 16 Pro series is lower than expected. There was little reaction in markets to the second attempt to assassinate Donald Trump. Shares of Trump Media & Technology rose as much as 10% in premarket trading after the former president said he has “absolutely no intention of selling” his stake when a lockup expires this week. While JPM's Andrew Tyler asks rhetorically this morning "let's see if last week’s bid returns", it does not look very likely since we just entered the worst 2 week calendar period for the year, and stocks enter a buyback blackout, plus there is no tech conference to spike the euphoric AI narrative yet again. Bond yields are down as the curve bull steepens, pressuring the USD which slides for the 4th day in a row to its lowest level in more than eight months. The move was driven by strength in the yen, which touched the highest since July 2023 amid speculation this week’s slew of central bank decisions will lead to a narrowing interest rate differential between the US and Japan. Commodities are higher with Energy and Metals boosting the index. Today is a light macro day ahead of tomorrow’s Retail Sales and Weds’ Fed Mtg where the market remains split on 25 o5 50bps.

In premarket trading, Apple shares fall 2.2% as TF International analyst Ming-Chi Kuo notes that demand for the iPhone 16 Pro series is lower than expected, based on his pre-order analysis of the first weekend. Intel rose 1% as the chipmaker officially qualified for as much as $3.5 billion in federal grants to make semiconductors for the Pentagon, according to people familiar with the matter. Here are some other notable premarket movers:

Stocks have not reacted to the biggest news of the weekend, a second assassination attempt on Donald Trump, who is safe after his Secret Service detail opened fire at a man who was wielding an AK47 assault rifle at his West Palm Beach, Florida, golf course Sunday, in what the FBI called an apparent (second) assassination attempt. According to law enforcement officials, Secret Service officers clearing the golf course ahead of Trump spotted a man in the woods with a gun. The suspect — later identified as radical left-wing nutjob 58-year-old Ryan Routh who had previously fought in Ukraine against Russia — fled in a black car but was later detained after a chase.

The start of a long-anticipated US easing cycle takes center stage this week, part of a 36-hour monetary roller coaster that includes policy decisions in Brazil, South Africa the UK and Japan. It’s come down to a virtual coin toss for traders on whether the Fed will go for a 25 or 50 basis-point cut.

“There has rarely been so much uncertainty over central bank intentions,” analysts at Edmond de Rothschild wrote in a note. “They are caught between signs of economic weakness and inflation which is stubbornly resisting a return to the 2% target.”

For Joyce Chang, chair of global research at JPMorgan, the Fed has scope to make the bigger move and doing more now would probably send the right signal. “We are still sticking with a 50 basis-point call, but it is a debate, internally and within the broader market,” Chang said on Bloomberg TV. “When I talk to investors, 25 versus 50 isn’t so much the debate, but really how does the US growth story look.” That view was echoed by several other top Wall Street strategists, who suggested that the health of the US economy could have more bearing on stocks than the size of the Fed’s rate cut. The flipside, of course, is that a rate cut now with home prices once again rising, will spark another episode of runaway inflation, something which gold at a record $2580 is clearly anticipating.

“If the labor data weaken from here, markets can trade with a risk-off tone regardless of whether the Fed’s first move is 25 or 50 basis points,” Morgan Stanley’s Mike Wilson wrote in a note. On the other hand, if jobs were to strengthen, a series of 25 basis-point reductions into mid-2025 could prop up equity valuations further, he said. Goldman Sachs and JPMorgan analysts also warned that rates alone were less important for stocks, given the uncertain outlook for the economy.

The Bank of Japan, meanwhile, is expected to keep rates on hold after roiling global financial markets with an increase at its last meeting. “The communication from the BOJ will be critical to let market participants know exactly, as clear as they can be, what the next move and the particular timings of the next moves will be,” Katrina Ell, director of economic research Moody’s Analytics, told Bloomberg Television.

European stocks are little changed as mining shares provide a drag after data showed China’s economy lost momentum in August. Among single stocks Rexel and Ipsen are the biggest gainers, while the biggest Polish insurer PZU plunged as heavy flooding hit the country’s southwest region. Here are the biggest movers Monday:

Earlier, Asian equities climbed for a third day, bolstered by expectations of a rate cut by the US Fed this week. The MSCI Asia Pacific Index climbed 0.5%, with Hong Kong-listed tech stocks, including Tencent and Meituan, along with Australian lenders featuring among top gainers. Japan, Korea and China markets were closed for a holiday. In China, data published over the weekend showed industrial output recording its longest slowing streak since 2021, while consumption and investment were weaker than expected. That has bolstered expectations of more stimulus from the PBOC before year-end, adding to tailwinds from an expected Fed rate cut that might bring in larger emerging market flows.

“Support from fiscal policy, which has lagged throughout 2024, could step up,” Wei He, an analyst with Gavekal Research wrote in a note. “The government will probably introduce some additional stimulus measures in coming months.” Still, those measures are unlikely to convince market participants that nominal growth prospects are improving, she said.

In FX, the Bloomberg Dollar Spot Index falls 0.4% to the lowest since January as traders added bets on a 50bps interest-rate cut by the Federal Reserve this week while expectations of a narrowing rate differential between the US and Japan boosted the yen. The Japanese yen and Norwegian krone are the best performers among the G-10 currencies, rising 0.7% each.

In rates, Treasuries extended their gains, with the yield on the policy-sensitive two-year note falling to the lowest since September 2022 and outperformed as markets see higher odds that Wednesday’s Fed decision will be a half-point rather than a quarter-point rate cut. Front-end yields are richer by more than 2bp, longer maturities by 1bp-2bp; the 10-year yield is around 3.64% outperforming bunds and gilts slightly; 2s10s spread is ~1bp steeper on the day at ~8bp. Swap contracts price in around 37bp of easing for the September meeting and around 75bp by November, anticipating that one of the next two moves will be a a half-point cut. Corporate new-issue volume stands to be heavy Monday as borrowers aim to complete offerings ahead of the Fed decision. IG dollar issuance slate includes a couple of deals so far; around $25b of supply is expected this week, concentrated on Monday and Tuesday ahead of Wednesday’s FOMC decision. This week’s Treasury coupon supply includes $13b 20-year bond reopening Tuesday and $17b 10-year TIPS reopening Thursday

In commodities, oil prices advance, with WTI rising 0.8% to near $69.20 after its first weekly gain in a month as a drop in Libyan exports was offset by China’s economic woes. Meanwhile hedge fund traders are net short the oil complex for the first time on record. Spot gold rises $9 to around $2,586/oz. Bitcoin falls over 1%. gold rose to a fresh record high as markets waited for the Fed easing.

Looking at today's light calendar, the data includes only September Empire manufacturing at 8:30am; this week we get retail sales, industrial production, housing starts and existing home sales. Fed speakers are in self-imposed quiet period until the Sept. 18 policy decision

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed amid the holiday-thinned conditions with many key markets in the region closed and as participants braced for this week's central bank announcements including from the FOMC, BoE and BoJ. ASX 200 mildly gained as real estate and financials led the advances across most sectors aside from defensives. Hang Seng was dragged lower amid the absence of mainland participants and with underperformance seen in property developers after Chinese house prices further deteriorated, while the latest Chinese Industrial Production and Retail Sales also disappointed.

Top Asian news

European bourses, Stoxx 600 (U/C) began the session almost entirely in the red, albeit modestly so. As the morning progressed, sentiment gradually improved and now displays more of a mixed picture. European sectors hold a negative bias; Retail takes the top spot alongside Consumer Products whilst Basic Resources lags, largely a factor of the poor Chinese data over the weekend. US Equity Futures (ES +0.1%, NQ U/C, RTY +0.1%) are indicative of a flat/slightly firmer open, ahead of the FOMC Policy Announcement on Wednesday. Intel (+3.5%) gains after the Co. reached a deal to make chips for the US military; a deal worth as much as USD 3.5bln.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

This time last week we suggested that if we were going to get 50bps from the Fed on Wednesday we probably needed a media leak as we approached or entered this past weekend. Thursday's WSJ and FT articles certainly weren't smoking guns towards 50bps but they suggested the prospect was higher than where it was after Wednesday's slightly firmer CPI report. It's hard to know how informed the WSJ article was but as you will remember, the same author (Nick Timiraos) wrote a much firmer endorsement of a surprise 75bps hike just before the June 2022 FOMC which completely moved the needle at the time. There was little doubt that this was well informed. As you'll see from my CoTD on Friday, our economists and strategists put both WSJ articles (2022 vs 2024) from this same author into our proprietary AI tool (it’s not called ChatDBT but I'll refer to it that way) and it told us that "the June 2022 article conveys a strong sense of urgency and conviction regarding the need for a significant rate hike to combat inflation. The September 2024 article, while discussing the possibility of a rate cut, presents a more balanced and less decisive outlook, reflecting the Fed's cautious approach in navigating economic uncertainty". So it confirmed our prior about the fresh WSJ article that although this could be a signal that things were closer than we thought, there is no slam dunk here. We feel this is a good use case for AI as we all have our biases and its nice to see what the unbiased linguistic analysis suggests. I'll be typing everything my wife tells me into this now to ensure I get the true meaning not what my biases interpreted.

Back to the Fed, in the absence of any weekend articles that could have been sourced to the Fed, it really leaves the decision on Wednesday on a knife-edge, something that hasn't often been the case by the time we ultimately arrived at each FOMC in recent years. Normally its been fairly obvious that close to the meeting or the Fed have found a way of guiding the market to the eventual outcome. At the moment DB is expecting 25bps but with market pricing where it is (41bps priced in and up 3-4bps overnight), and if no Fed leaks push us back towards 25bps over the course of the next 12-24 hours, our economists could easily move to a 50bps today as they don't think the Fed will want to surprise the market too much on the day. We will see. As important as the 25 vs 50 debate will be the communication from the Fed. Would a 50bps be the start of 50s or a one off larger move to start the cycle? Would a 25bps mean the bar for subsequent 50s is high? There will be lots to digest.

It will be difficult to deviate the messaging too far away from the latest updated Summary of Economic Projections (SEP) and dot plots though. So in many ways that constrains the messaging unless we see large changes. Our economists think the Fed’s growth forecasts are likely to be little changed but the median core PCE inflation forecast could fall by a tenth or two. They believe the unemployment rate forecast will move higher this year – likely into the 4.3-4.4% range – but be mostly unchanged in subsequent years. If the Fed cuts by 25bps on Wednesday, they would expect a median of 75bps of cuts this year and if they cut by 50bps, they would expect the SEP to reflect 100bps of cuts through year-end.

Outside of the Fed the main highlights are tomorrow's US retail sales and industrial production, Wednesday's US housing starts and permits and UK inflation, Thursday's Bank of England decision (DB expect unchanged, see preview here), US existing home sales and initial jobless claims, and Friday sees the BoJ meeting (DB preview here, view is for unchanged), China decide on 1 and 5-yr prime rates, Japan's CPI, and German PPI.

Over the weekend, China's latest monthly data dump was weaker than expected across the board. Industrial Production (4.5% vs. 4.7% expected), Retail Sales (2.1% vs. 2.5% expected), the Jobless rate (5.3% vs. 5.2% expected) and Fixed Asset Investment (3.4% vs. 3.5% expected) were all soft alongside slightly lower than expected new and used home prices. Our economists have downgraded their GDP forecasts and believe YoY growth likely slipped to 3.7% in August from 4.6% in July.

We can't see the immediate market response as mainland Chinese markets (and South Korean) are closed until Wednesday with markets in Japan also closed today for a holiday. The Hang Seng opened -0.76% lower but has rallied back to -0.29% as I type. US equity futures are fairly flat and Treasuries aren't trading due to the Japanese holiday.

Another big story to break last night was what the FBI are calling a second assassination attempt on former President Donald Trump at his Florida golf course. This may steer the campaign in a different direction again over the next few days.

Recapping last week now, markets put in a very strong performance, with risk assets recovering the bulk of their losses from the previous week. Initially, that was driven by growing optimism about the economic outlook, with fears diminishing about a potential downturn in the US. Then by the end of the week, markets got a further boost as the prospect of a 50bp Fed rate cut this month came back into view, which provided a fresh uplift for equities and bonds. In many respects, it was the best of both worlds from a near-term market perspective, as the perceived likelihood of a 50bp rate cut went up, but unlike in early August, it wasn’t because of negative data surprises.

For equities, this was a very good combination, and the S&P 500 advanced every day last week to gain +4.02% (+0.54% Friday), leaving the index less than 1% beneath its all-time high from mid-July. Tech stocks helped to drive the gains, and the NASDAQ advanced +5.95% (+0.65% Friday). For both indices, this was their best weekly performance of 2024 so far. There were more modest equity gains around the world, with Europe’s STOXX 600 up +1.85% (+0.76% Friday), and Japan’s Nikkei up +0.52% (-0.68% Friday). However, Chinese equities underperformed, and the CSI 300 fell -2.23% last week (-0.42% Friday) to close at its lowest level since January 2019.

The growing prospect of a 50bp rate cut, which was 49% priced by the end of the week, was also very good for sovereign bonds. For instance, the 2yr Treasury yield was down another -6.5bps last week (-5.8bps Friday) to 3.58%, whilst the 10yr yield was down -5.7bps (-2.2bps Friday) to 3.65%, its lowest weekly close since May 2023. Illustrating a more dovish market perception of the Fed’s reaction function, the decline was even more noticeable for real yields, and the US 10yr real yield fell -10.3bps last week (-4.0bps Friday) to 1.57%. Meanwhile in Europe, sovereign bond yields fell slightly last week, with the 10yr bund yield down -2.3bps (-0.2bps Friday) to 2.15%.

Finally, it was an eventful week for oil prices, with Brent crude closing beneath $70/bbl on Tuesday for the first time since December 2021. But over the week as a whole, it was actually up by +0.77% (-0.50% Friday) to close at $71.61/bbl. Those gains were echoed across other commodities, and gold prices closed at an all-time high in nominal terms of $2,578/oz, having risen by +3.21% over the week (+1.06% Friday).