US stock futures briefly fell to a session low - then quickly recovered - as Apple slumped in premarket trading after Goldman removed the company from its conviction buy list (but retained a buy rating). As of 8:00am, S&P and Nasdaq futures traded flat and European stocks retreated from their highs as the relief rally which sent US stocks to an all time high on Thursday encouraged by an in-line reading on core PCE faded, while New York Community Bancorp plunged more than 30% in Friday’s premarket after identifying “material weaknesses” in how it tracks loan risks. Europe’s Stoxx 600 gained 0.5%, reversing an earlier dip, after Euro area inflation printed hotter than expected. Treasury yields are lower, the dollar is flat, and bitcoin is higher and back over $62,000. Today, focus will be the ISM-Mfg report at 10am ET (exp. 49.5 survey vs. 49.1 prior). Keep an eye on ISM-Mfg Prices Paid: consensus sees prices to grow again: 53.2 vs. 52.9

In premarket trading, NYCB tumbled as much as 30% after the troubled commercial real estate lender said it discovered “material weaknesses” in how it tracks loan risks, wrote down the value of companies acquired years ago and replaced its CEO to grapple with the turmoil. Dell Technologies soared 21% after its results beat expectations, boosted by the buzz around artificial intelligence. Apple fell 0.6% as Goldman removed the stock from its conviction list, while keeping a buy rating. It also removed Merck and Vertex Pharmaceuticals from its conviction list, replacing them with Amgen, Monday.com and Vulcan Materials. Here are some other notable movers:

Equity sentiment turned more cautious following Thursday’s core PCE data - t he Fed's preferred inflation measure - which rose in January at the fastest pace in nearly a year, but matched economist forecasts. Traders were also comforted by jobless claims data that indicated labor-market softening. "The data came as a relief for those who were prepared for the worst,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

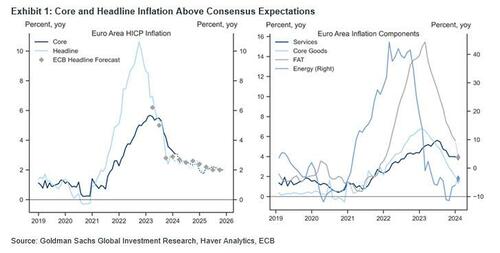

On the monetary policy front, euro-zone inflation eased less than anticipated in February — supporting European Central Bank officials who don’t want to rush into lowering rates. Meanwhile, Thursday’s US PCE report appeared not to dent the broader disinflationary trend underpinning rate-cut forecasts.

Federal Reserve Bank of San Francisco President Mary Daly said central bank officials are ready to lower interest rates as needed, but emphasized there’s no urgent need to cut given the strength of the economy. Her Atlanta counterpart Raphael Bostic said the central bank could begin cutting this summer. “For markets keenly focused on when the Fed will transition toward easing rates, this report will help restore confidence that it isn’t ‘if’ the Fed will begin to cut rates in 2024, but ‘when,’” said Quincy Krosby at LPL Financial.

Meanwhile, Bank of Americas's Michael Hartnett said Chinese stock funds saw the largest weekly outflow since October, as the government seeks to stem a decline in the equity market. About $1.6 billion was pulled from Chinese funds in the week through Feb. 28, Hartnett wrote citing EPFR Global data. Beijing is attempting to restore market confidence after years of decline and slowing growth following the pandemic. As the turmoil deepened in recent months, the authorities have stepped up measures to help bolster sentiment, including restricting short selling and cracking down on high-speed trading.

European stocks advanced 0.5%, reversed earlier weakness after Eurozone CPI came in hotter than expected; banks and automobile shares leading gains, while construction and media stocks are the biggest laggards. Here are the biggest European movers:

Earlier in the session, Asian stocks rose with Japan’s Nikkei 225 climbing 1.9% to its strongest-ever close near the 40,000 mark. Asian equities kickstarted March with gains after registering their best February performance in nine years, buoyed by a climb in Japan and China. The MSCI Asia Pacific Index rose as much as 0.5% , with technology and consumer discretionary stocks among the main advancers. Shares climbed on the mainland and Hong Kong ahead of next week’s crucial National People’s Congress meeting, where traders are awaiting more policy support from Beijing. Chinese authorities will likely display “a sense of urgency to show that there is no acceleration in this deflationary environment,” Xavier Baraton, global CIO at HSBC Global Asset Management in France, told Bloomberg television. “Valuations are extremely attractive, which means limited downside for us.”

In FX, the Bloomberg Dollar Spot Index rose 0.1%. The yen was the weakest of the G-10 currencies, falling 0.3% versus the greenback after Bank of Japan Governor Ueda told reporters the price target is not already in sight, reversing hawkish comments from one of his co-workers just the day before as the BOJ confirms it has no idea what it will do next. His comment tempered speculation the bank’s first rate hike since 2007 could come as early as March.

In rates, treasuries rose while European government bonds pared an earlier decline as US equity futures fall. US 10-year yields drop 4bps to 4.22% while European bonds recovered despite euro-area inflation slowing less than expected in February.

In commodities, oil was on track for a modest weekly gain as market gauges continued to show signs of strength, with OPEC+ set to decide early this month whether to extend supply cuts into the next quarter. WTI rose 1.1% to trade near $79.10. Spot gold rose 0.5%.

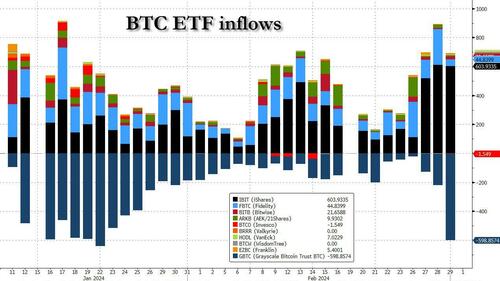

Bitcoin gained for a seventh day, trading above $62,000 as demand from exchange-traded funds continues. BlackRock Inc.’s iShares Bitcoin Trust netted a $604 million inflow on Thursday following a record $612 million on Wednesday.

Today's US economic data calendar includes February final S&P manufacturing PMI (9:45am), January construction spending, February final University of Michigan sentiment, February ISM manufacturing (10am) and February Kansas City Fed services activity (11am). Fed speakers scheduled include Barkin (8:30am), Goolsbee (10am, 4pm), Waller, Logan (10:15am), Bostic (12:15pm), Daly (1:30pm) and Kugler (3:20pm).

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with positive bias amid tailwinds from the US following an absence of any hawkish surprises in the PCE data, while participants also reflected on the latest Chinese PMI figures. ASX 200 printed fresh record highs and entered bull market territory after gaining over 20% from its 2022 low. Nikkei 225 extended on its best levels and advanced closer to the 40,000 level amid a weaker currency and after BoJ Governor Ueda said Japan's economy is not yet in a situation where sustained achievement of 2% inflation can be foreseen, which is in contrast with the prior day's hawkish rhetoric from board member Takata. Hang Seng and Shanghai Comp. lagged behind their regional peers although the Hong Kong benchmark clawed back initial losses with the help of tech strength, while the mainland was indecisive after the PBoC drained liquidity and as participants digested Chinese PMI data which was mostly encouraging although Official Manufacturing PMI remained in contraction territory for the 5th consecutive month.

Top Asian News

European bourses, Stoxx600 (+0.1%) began the session firmly in the green, though did succumb to some early morning pressure ahead of EZ inflation. Thereafter, European equities took another leg lower, with sentiment subdued following the hotter-than-expected print. However, the move came alongside marked uptick in EGBs, with the move seen across assets and has a risk-feel to it; though, it does appear to have been driven by the 'relief' in EGBs post-HICP which while hotter-than-expected continues the cooling narrative. European sectors hold a positive tilt; Autos is firmer, being propped up by post-earning gains in Daimler Truck (+12.8%). Energy has been lifted by recent strength in the crude complex; BP (+1.2%)/Shell (+1%). To the downside, Saint-Gobain weighs on Construction & Materials, after poor results. US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.4%) are entirely in the red. The RTY underperforms, largely hampered by regional banking fears after NYCB (-24% pre-market) announced it had identified weaknesses in internal controls.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US event calendar

DB's Jim Reid concludes the overnight wrap

You're not going to believe it but its March already! Since it’s the start of the month, we’ll shortly be releasing our monthly performance review, covering how different assets fared in February. In terms of the headlines, the Magnificent 7 posted its strongest performance in 9 months, which powered global equities up to all-time highs. But even as growth data remained resilient, fresh upside inflation surprises led to notable losses for bonds, and 2yr Treasury yields saw their biggest increase in 7 months since June as investors kept pushing out the timing of future rate cuts. See the full report in your inboxes shortly.

When it came to the last 24 hours, markets got a boost on a relief that the US PCE inflation report was in line with expectations, after the latest European inflation numbers fell back earlier in the day. That helped sovereign bonds rally on both sides of the Atlantic, while the S&P 500 (+0.52%) advanced to a new all-time high. The moves also leave the S&P just about on course to post another weekly advance (+0.15% so far this week). If it does hold on to this weekly gain, it would mark 16 out of 18 positive weeks for the first time since 1971, so it’s hovering around some big milestones. So no pressure today for the market!

With positive month-end sentiment dominating the end of yesterday’s session, it was not only the S&P 500 eking out yet another all-time high, but there was also a new record high for the NASDAQ (+0.90%), which moved above its previous peak from November 2021. Consistent with the narrative of the year so far, the Magnificent 7 outperformed (+1.22%), with Amazon (+2.08%) and Nvidia (+1.87%) leading the way. The equity picture had been more subdued in Europe, where the STOXX 600 ended the day unchanged, although the German DAX (+0.44%) continued to outperform yesterday. Indeed, yesterday’s advance was the 7th consecutive gain for the DAX, taking the index up to a fresh all-time high.

Looking at the main trigger of the optimism, the PCE inflation report showed headline PCE running at a monthly +0.3% as expected, which took the year-on-year measure down to 2.4%, and its lowest since February 2021. Core PCE was running above that, at a 12-month high of +0.42%, but markets weren’t too alarmed as it was in line with the +0.4% expected by the consensus. Nevertheless, the report added to signs that inflation was still lingering above target, and some of the 6-month measures (which had previously pointed to inflation being back at target) were no longer looking as favourable. For instance, core PCE had been running at +1.9% on a 6m annualised basis, but after this January report, it was up to +2.5% again. Likewise, headline PCE rose from +2.1% to +2.5% on a 6m basis. Interestingly outside the pandemic period, and the month after 9/11, the monthly core print of 0.42% was the highest since the early 1990s. However there were some odd potential one-offs in the report such as a surge in portfolio management charges. So for now the market is relaxed but inflation is proving a little sticky as we start the year. Perhaps the sanguine response is based on the fact that pretty much nobody now expects a March cut and a lot of water can flow under the bridge before June when the market expects the first one. So plenty of time to change mind on things or the data to change.

Over in the Euro Area, rates initially saw a modest sell off amid country-level flash CPI prints for February. But in the end these came largely in line with expectations, with a pattern of slowing, but still above target, inflation. German inflation was down to +2.7% on the EU-harmonised measure, whilst in France it was down to +3.1%, its lowest since September 2021. Both of these were in line with consensus, while Spain’s print was a touch above (+2.9% vs +2.8% exp.). This morning we’ll get the Euro Area-wide release, which will set the stage for the ECB’s next meeting on Thursday. With the available country prints, our economists see a marginal upside risk to the consensus expectations of +2.5% headline and +2.9% core inflation.

Against this backdrop, sovereign bonds posted a moderate rally yesterday, clawing back some of their losses over February as a whole. In the US, 10yr Treasuries yields fell -1.5bps to 4.25%, while 2yr yields retreated by -1.8bps. This was a decent turnaround, having been up by 5-6bps shortly before the US data. And over in Europe, yields on 10yr bunds (-4.8bps), OATs (-4.2bps) and BTPs (-4.1bps) all fell back by a larger amount.

Both 2yr and 10yr Treasuries had traded flat on the day around the US equity close, but saw a slight rally late on after New York Community Bancorp said it had identified “material weaknesses” in risk controls. NYCB also announced a $2.4bn goodwill impairment and replaced its CEO. Shares of the troubled regional bank fell more than 20% in extended trading, having already declined by 54% over the past month. So one to keep an eye on today.

Asian equity markets are higher this morning with the Nikkei (+1.82%) leading gains, hitting a fresh all-time high after a two-day losing streak while the Hang Seng (+0.75%), the CSI (+0.33%) and the Shanghai Composite (+0.10%) are also moving higher. South Korea is closed for a holiday. S&P 500 (+0.15%) and NASDAQ 100 (+0.21%) futures are edging higher.

Early morning data showed that China’s o fficial manufacturing PMI contracted for the fifth straight month in February but was broadly inline at 49.1 (v/s 49.0 expected) versus the 49.2 seen in January. Meanwhile, the official non-manufacturing PMI grew more than expected to 51.4 in February after a 50.7 reading in January. This saw China's composite PMI remain steady at 50.9 in February. Elsewhere, Japan ’s labour market remained tight as the jobless rate dropped to 2.4% in January, the lowest level since early 2020 as against December’s revised level of 2.5%.

The Japanese yen (-0.27%) weakened to 150.38 after the BoJ Governor Kazuo Ueda stated that he is still not confident the nation can sustainably attain the central bank's 2% inflation target while stressing the need to see the outcome of wage negotiations currently taking place, for confirmation of a positive wage-inflation cycle. He seems to be wanting to temper speculation that the BoJ could move as early as this month giving the BoJ some optionality. It is still likely that happens before the end of April though.

Back to yesterday, and on the inflation side, one ongoing theme is that short-term US inflation expectations have continued to move higher in recent days. In particular, the US 2yr breakeven was up +1.5bps yesterday to 2.79%, the highest since last March, and the 2yr zero-coupon inflation swap (+1.1bps) reached its highest since October at 2.445%. This comes as the recent uptick in oil prices continues to filter through to the real economy, with US gasoline prices up to a 3-month high of $3.319 per gallon on Wednesday.

Looking at yesterday’s other data, UK mortgage approvals rose to 55.2k in January (vs. 52.0k expected), which is their highest level since October 2022. Otherwise in the US, the weekly initial jobless claims rose to 215k over the week ending February 24 (vs. 210k expected), ending a run of 3 consecutive weekly declines. In the meantime, continuing claims were up to 1.905m in the week ending February 17 (vs. 1.875m expected), their highest level since November.

To the day ahead now, and data releases include the global manufacturing PMIs for February, along with the ISM manufacturing reading from the US. Over in the Euro Area, we’ll get the flash CPI inflation release for February, as well as the unemployment rate for January. Otherwise, central bank speakers include the Fed’s Barkin, Waller, Logan, Bostic, Daly and Kugler, the ECB’s Holzmann, and BoE chief economist Pill.