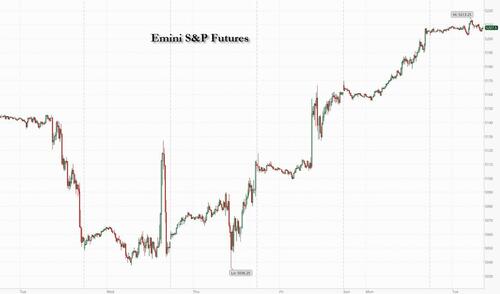

US stock futures are flat after the S&P 500 and Nasdaq 100 both closed 1% higher on Monday, helped by growing optimism among investors that the economy is finally slowing greenlighting earlier rate cuts by the Fed. As of 8:00am ET S&P futures were unchanged at 5,206, trading about 1% above its 50DMA, while Nasdaq futures were down 0.2% amid some mega-cap weakness. European stocks are higher, while indexes in Japan and the UK are catching up after being closed for holidays yesterday. Shares in Swiss bank UBS jumped after it returned to profit and showed more progress in its integration of Credit Suisse. Treasuries rise, with US 10-year yields falling 3bps to 4.46%. The Bloomberg Dollar Spot Index rises 0.1%. The yen weakens 0.4% against the greenback, pushing USD/JPY up to ~154.50. The Aussie falls 0.4% after the RBA kept rates on hold and maintained a neutral stance. Oil prices advance, with WTI rising 0.3% to trade near $78.70. Spot gold falls 0.4% and bitcoin traded in a range around $64,000 with the now daily European open/US slam down pattern. US economic data slate includes March consumer credit at 3pm, while Fed's Kashkari is scheduled to speak twice (11:30am, 1:20pm).

In premarket trading, Disney reported fiscal second-quarter profit that beat estimates, thanks to sharply narrower losses in its streaming TV business and higher ticket prices at theme parks. Still, the stock tumbled 6% after the company reported fewer subscribers to its Disney+ streaming service in the fiscal second quarter than analysts had projected. Here are some of the other notable US movers before the opening bell:

In a week light on data but heavy on Fedspeak, Minneapolis Fed President Neel Kashkari is set to appear Tuesday, one day after his Richmond President colleague Thomas Barkin said Monday said he expects high interest rates to eventually cool US inflation to the central bank’s 2% target. Despite the hawkish rhetoric, swaps traders are betting on about 45 basis points of Fed rate cuts by December, an increase vs before the disappointing jobs report.

“In this environment of growth not rolling over as much as we feared and potentially cuts coming in, there is upside for earnings going forward,” Beata Manthey, head of European equity strategy at Citigroup Inc., said in an interview with Bloomberg TV

"The market is taking a positive view about the US job data and anticipating that the Fed will indeed be able to cut rates," said Arnaud Girod, head of economics and cross-asset strategy at Kepler Cheuvreux in Paris.

European stocks rose for the third consecutive session, boosted by solid company earnings and renewed optimism the Federal Reserve will cut interest rates later this year. The Stoxx 600 is up 0.6%. UBS jumps more than 8% after it returned to profit and UniCredit climbed on better-than-forecast results. German semiconductor-maker Infineon Technologies AG cut its revenue forecast, signaling demand from the automotive industry remains weak.

Earlier in the session, Asia’s equity benchmark traded little changed on Tuesday as a catch-up rally in Korean and Japanese stocks on their return from a holiday was offset by declines in Hong Kong. The MSCI Asia Pacific Index rose 0.1% after capping a three-day gain on Monday. Technology was the best-performing sector in the region, much like in the US session overnight, amid rising hopes that the Federal Reserve may cut interest rates this year. Shares of Samsung Electronics and SK Hynix were the biggest contributors to gains on South Korea’s Kospi Index, which jumped 2%, the most in Asia. Shares in Hong Kong fell, with the Hang Seng Index snapping a 10-day winning streak that was the longest since 2018 amid some concern that the rally is overdone.

In FX, the Bloomberg Dollar Spot Index rose 0.1%, marking the second consecutive session of gains, as the greenback rose against most Group-of-10 currencies. The yen weakens 0.4% against the greenback, pushing USD/JPY up to ~154.50. The Aussie falls 0.4% after the RBA kept rates on hold and maintained a neutral stance.

In rates, treasuries rose with US 10-year yields falling 3bps to 4.46%. Treasuries were underpinned by bigger gains in core European rates after Germany factory orders unexpectedly declined, pointing to persistent economic headwinds. During Asia session, Treasury futures drew support from dovish reaction to RBA maintaining its neutral bias, keeping interest rates at 4.35%. Focal points of US session include 3-year note auction, ahead of 10- and 30-year sales Wednesday and Thursday. US yields richer by 2bp to 3bp with the curve extending Monday’s flattening move; 10-year around 4.46% is ~2.5bp richer on the day with bunds and gilts outperforming by 1bp and 5bp in the sector. Treasury auction cycle begins at 1pm New York time with $58b 3-year note sale; $42b 10-year and $25b 30-year new issues follow Wednesday and Thursday.

In commodities, oil prices advance, with WTI rising 0.3% to trade near $78.70. Spot gold falls 0.4%.

In crypto, Bitcoin firmer today and has reclaimed the USD 64k handle, with Ethereum now holding around USD 3.2k.

Looking at today's calendar, US economic data slate includes March consumer credit at 3pm. Fed members’ scheduled speeches include Kashkari (11:30am, 1:20pm). Elsewhere we get, German March trade balance and factory orders data, French Q1 wages and Eurozone March retail sales. And as the earnings season continues to wind down, releases include Walt Disney, BP, Arista Networks, Duke Energy, McKesson, and Ferrari.

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as the region only partly sustained the momentum from Wall St where the major indices extended on post-NFP advances amid rate cut hopes, while key markets returned from the long weekend. ASX 200 traded higher with a further boost in late trade after the RBA proved to be less hawkish than many feared. Nikkei 225 gained on return from holiday as it took its first opportunity to react to last week's NFP report and renewed US rate cut hopes. Hang Seng & Shanghai Comp were subdued with the former set to snap its 10-day win streak and longest consecutive run of gains since 2018, while the mainland index took a breather after yesterday's catch-up rally amid a lack of fresh catalysts.

Top Asian News

APAC DATA RECAP

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It was a bank holiday here in the UK and it didn’t stop raining. I had an early round of golf and half way round the greens were flooded and I was drenched. I may have called it a day but the alternative was childcare. Golf in a biblical downpour is more enjoyable that looking after three bored kids inside on a very wet day. The afternoon was proof of that.

The skies are reasonably bright in markets at the moment with the S&P 500 (+1.03% yesterday) extending its 3-day gain to +3.24% last night, the best such run since November. For 10-year yields, the 4-day decline (-19.3bps) is the largest since the start of February. The lack of a ceasefire in the Middle East hasn't so far impacted sentiment.

A strong close to the US session saw the Magnificent 7 (+1.68%) eke out a new all-time high, with the index up more than 10% from its recent low on April 19. Nvidia (+3.77%) and Meta (+3.04%) led the gains amid the mega caps, but the equity advance was broad-based with 76% of the S&P 500 higher on the day. Small caps also saw a modest outperformance, with the Russell 2000 up +1.23%. Europe’s equity markets recorded a more moderate rise earlier on, including for the Stoxx 600 (+0.53%), Dax (+0.96%), CAX (+0.49%), while FTSE MIB outperformed (+1.06%).

The equity move was helped along by the ongoing bond rally, as 10yr Treasury yields (-2.2bps) declined for a fourth consecutive session to 4.49%, their lowest level since the upside surprise in the March CPI print on April 10. The upcoming CPI print next Wednesday (May 15) will surely be key to the sustainability of this rally. The decline in yields did run out of steam at the front end, with 2yr yields up +1.5bps after falling by -21.8bps over the previous three sessions.

This came as Fed commentary largely echoed Powell’s tone last week, moving away from any signal on the timing of rate cuts but avoiding overtly hawkish messages. Richmond Fed President Barkin said he was “optimistic that today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target“, noting that “the full impact of higher rates is yet to come.” And New York Fed president Williams signaled eventual rate cuts, though with the timing of these to depend on “the totality of the data”.

We received the latest signal on the impact of the Feds’ earlier tightening with the latest quarterly Senior Loan Officer Survey. This showed the tightness in credit standards continuing to moderate for most loan categories, including mortgages and CRE lending. However, the improvement in conditions for commercial & industrial loans stalled, with credit standards for mid-size and large firms a little tighter (+15.6 vs. +14.5) and demand a little weaker (-26.6 vs. -25.0) than in the previous quarter. Nothing to get too concerned about, but some evidence to support the view that a good chunk of the impact from the tighter policy stance is yet to play out. The question is where will rates and credit standards be by the time borrowing needs accelerate.

Over in euro area, the final April PMIs added to the improving growth picture, with upward revisions to the services (53.3 vs 52.9 flash) and composite (51.7 vs 51.4 flash) readings. The euro area composite is at an 11-month high and has moved above the US one for the first time in 12 months. In other data, euro area PPI inflation for March came in line with expectations at -0.4% month-on-month. This did little to dissuade expectations of a June ECB cut, with ECB chief economist Lane noting in an interview that data since the April meeting “ improve my confidence that inflation should return to target in a timely manner ”. Overnight index swaps continued to price 74bps of ECB rate cuts this year, with a June cut 95% priced. 10yr bonds saw a similar modest rally in Europe as in the US, with yields on bunds (-2.7bps), OATs (-2.3bps) and BTPs (-2.2bps) all moving slightly lower.

In the commodity space, oil prices saw some volatility amid mixed Middle East headlines. Having opened higher on Monday, oil prices briefly fell to flat on the day following news that Hamas accepted a cease-fire proposal brokered by Egypt and Qatar . However, they rallied again soon after on reports that Israel’s’s war cabinet rejected the proposal as being “far from Israel’s necessary demands,” with Axios and AP reporting overnight that Israeli troops had entered the southern Gaza city of Rafah. After falling to a seven-week low on Friday, Brent crude ended Monday’s session +0.45% higher at $83.33/bbl, and is trading around another +0.30% higher overnight as I type. This backdrop also boosted gold, which gained +1.04% to $2,326/oz yesterday.

In Asia, the KOSPI (+1.91%) is leading gains hitting a one-month high with the Nikkei (+1.18%) also seeing notable gains as trading has resumed in both markets after a public holiday. Additionally, the S&P/ASX 200 (+1.25%) is spiking higher as we type after the RBA left rates on hold but could have been more hawkish than they were. The Aussie Dollar has weakened -0.40% with 3yr government bonds yields declining -8.6bps, to trade at 3.94% as I type.

Elsewhere, Chinese stocks are bucking the regional trend with the Hang Seng (-0.69%), the CSI (-0.12%) and the Shanghai Composite (-0.08%) all trading lower. US futures are flat and Treasury yields are edging slightly lower.

The Japanese yen (-0.38%) continues to drift lower trading at 154.50 against the dollar despite fresh warnings from Japanese officials following two rounds of suspected FX intervention last week. Notably, top currency official Masato Kanda indicated that the government will respond appropriately if there are excessive or disorderly movements in the FX market.

Central bank decisions will remain in focus for the rest of the week, most of all with the BoE on Thursday. Our UK economist expects this week’s meeting to set the stage for the first rate cut in June (see his preview here). Before that, tomorrow the Riksbank could deliver its first rate cut of the cycle. Finally, we have the accounts of April ECB meeting on Friday, and with plenty more ECB and Fed speak to digest before the end of the week. It will quieter be on the data front, with the University of Michigan consumer survey on Friday the arguable highlight given the recent softening in US consumer confidence indicators.

To the day ahead, data releases will include US March consumer credit, Germany March trade balance and factory orders data, France Q1 wages and Eurozone March retail sales. In central bank speak, we will hear from the Fed's Kashkari, and the ECB's De Cos and Nagel. And as the earnings season continues to wind down, releases include Walt Disney, BP, Arista Networks, Duke Energy, McKesson, and Ferrari.