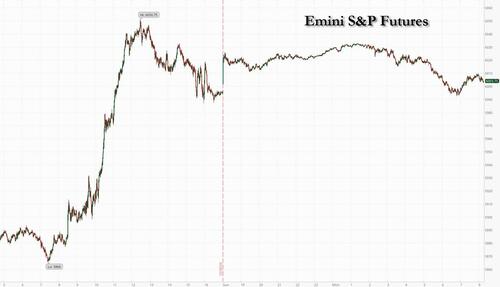

US equity futures entered the last week of 2024 gingerly and steady in subdued trading as traders, already on the ski slopes or in various warm, non-extradition countries, assessed the outlook for economic growth and interest rates. The dollar gained after a US government shutdown was averted in the last minute. As of 8:10am, contracts on the Nasdaq 100 added 0.4% and those on the S&P 500 were little changed, erasing an earlier gain, following a sharp rebound on Friday after the core PCE index increased at the slowest pace since May. Europe’s stock benchmark edged higher. Market gains will likely be capped by the continued rise in rates which has seen 10Y yields rise 2bps to 4.55%. Oil, gold and bitcoin all dropped while a Bloomberg gauge of the dollar rose after sliding 0.5% on Friday. Today's macro data include the Chicago Fed, Durable Goods, New Home Sales and the Conference Board Consumer Confidence.

In premarket trading, Qualcomm rose 2% as the company prevailed at trial against Arm Holdings Plc’s claim that it breached a license for chip technology that the world’s largest maker of mobile-phone processors acquired when it bought a startup in 2021. Arm slips 3%. Applied Therapeutics fell 3% after William Blair stepped away from its bullish rating due to increased uncertainty around the future of the Govorestat drug and a limited cash runway. Here are some other notable premarket movers:

As we close out the year, investors are taking a step back after a stream of robust US economic data saw the Federal Reserve scale back the number of cuts it anticipates in 2025. The PCE data reignited hopes of deeper rate cuts, though overall sentiment remains cautious as investors brace for the prospect of sweeping global tariffs imposed by US President-elect Donald Trump, and as China continues to see a lackluster economic recovery.

“Friday’s PCE data was enough to cheer the mood and reignite hopes about the possibility of lower inflation next year, which would allow the Fed to cut rates faster,” said Daniela Hathorn, a senior market analyst at Capital.com. “The avoidance of a US government shutdown over the weekend has also helped ease some of the negative pressure on stocks.”

“There are still hopes that the US stock markets in particular will end 2024 with a positive undertone,” Dana Malas, a strategist at SEB, wrote in a note. “After two explosive weeks of central banking and news, to say the least, it is time for the market to recharge batteries and update forecast models for the world that begins on January 20 with Donald Trump in the White House.”

Europe’s Stoxx 600 index turned higher as drugmaker Novo Nordisk A/S staged a partial recovery from the biggest slump in more than two decades on Friday. Among other individual movers, Evolution AB plunged after the UK Gambling Commission began a review of its Malta operations. Direct Line Insurance Group Plc shares rose after Aviva Plc agreed to buy the insurer in a deal valuing the firm at around £3.7 billion ($4.7 billion). Here are some of the biggest movers on Monday:

Earlier in the session, Asian stocks rose, rebounding from last week’s selloff, as tech shares rallied after US inflation data supported the case of further interest-rate cuts by the Federal Reserve next year. The MSCI Asia Pacific Index advanced as much as 1.4%, poised for its first gain in seven sessions, with TSMC and Toyota Motor among the biggest contributors to the benchmark’s move. Taiwanese stocks led gains in the region, after AI powerhouse Nvidia Corp.’s Friday rally and local media reports boosted investor sentiment. A below-than-expected reading on the Fed’s preferred inflation gauge helped cool investor concerns after the central bank’s relatively hawkish stance at its meeting last week. Still, expectations of further trade tariffs by Donald Trump and thin liquidity heading into the holiday season have kept a lid on overall sentiment.

In FX, a Bloomberg gauge of the dollar rose after sliding 0.5% on Friday, and Treasury yields ticked higher. President Joe Biden signed funding legislation to keep the US government operating until mid-March, avoiding a year-end shutdown and kicking future spending decisions into Trump’s presidency.

In rates, treasuries are slightly cheaper across the curve, following wider losses seen across core European bonds over early London session after ECB President Christine Lagarde said in an FT podcast that policymakers remain alert to lingering price pressures in the services sector. Treasury yields cheaper by around 0.5bp to 1.5bp across the curve with spreads broadly within one basis point of Friday’s close. US 10-year yields trade around 4.55% with bunds and gilts lagging by 0.5bp and 1bp in the sector. US session focus includes start of this week’s auctions which kick-off with 2-year note sale Monday, followed by 5- and 7-year notes Tuesday and Thursday. Busy data slate also includes durable goods orders and consumer confidence.

US economic data calendar includes November building permits, Chicago Fed national activity, durable goods orders (8:30am), November new home sales and December consumer confidence (10am). No Fed members are scheduled to speak on the day

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks opened firmer across the board on a holiday-thinned week, following a similar performance from Wall Street on Friday, with broad risk-on sentiment through the US afternoon, albeit with indices closing off peaks. ASX 200 saw its gains supported by gold miners following the rebound of the yellow metal, with IT also among the top performers after a similar stateside sectoral performance on Friday. Nikkei 225 conformed to the broader risk tone amid a lack of macro drivers, whilst a stable JPY also boded well for the Nikkei. Hang Seng and Shanghai Comp traded firmer alongside the region as sentiment from Wall Street reverberated through APAC. However, macro news flow remained quiet, and the indices drifted off their best levels.

Top Asian News

European bourses are generally sitting in negative territory, despite a mostly positive handover from overnight APAC trade. In recent trade, a couple of indices are attempting to climb into the green. European sectors opened with a strong negative bias, but are now mixed. Healthcare is by far the clear outperformer today, as Novo Nordisk (+6%) attempts to pare some of the hefty losses seen on Friday. Autos sits towards the lower half of the pile, but with downside in the sector pretty much in-fitting with peers. Volkswagen (-1%) initially opened higher after traders digested news that VW reached a deal with IG Metall to cut 35k jobs and avert a strike; though, did slip into negative territory thereafter. US equity futures are modestly firmer, with slight outperformance in the NQ, in a continuation of the gains seen on Wall St in the last trading day. Honda (7267 JT) and Nissan (7201 JT) announce the signing of the basic agreement to consider integration; Cos and Mitsubishi Motors (7211 JT) sign an MOU on collaborative considerations. Intend to set up the holding Co. in August 2026

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar