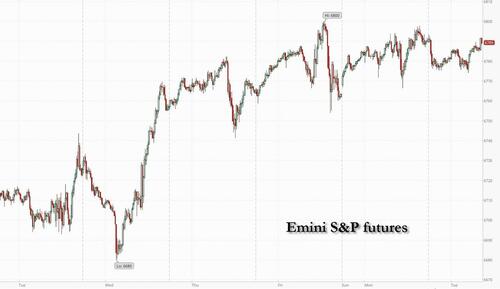

Futures are flat after the S&P, Nasdaq and Russell all made new ATHs yesterday, driven by the AI theme and a broad-based rally. As of 8:15am, S&P futures are unchanged while Nasdaq futures eke out a 0.1% gain as trader keep an eye on TSLA’s new car announcement with Mag7 names mixed pre-mkt but Semis seeing a bid led by AMD (+3.6%), MU (+2%). Bond yields are higher while the USD gained for a second day as President Trump sent mixed messages about the state of talks with Democrats on their biggest demand to end the shutdown; the stronger dollar may pressure international/ADR plays today according to JPM. There are four Fed speakers today and a 3Y bond auction with the shutdown pausing official data.

In premarket trading, Mag 7 stocks are mixed (Tesla -0.6%, Nvidia +0.3%, Alphabet -0.5%, Microsoft -0.2%, Apple -0.3%, Amazon +0.1%, Meta Platforms +0.2%).

In corporate news, Tesla is said to plan unveiling a cheaper version of the Model Y today. Ford faces months of disruptions to its business after a major fire at an aluminum plant in New York, the WSJ reported. Elon Musk named a former Morgan Stanley executive as the CFO of xAI, the FT reported.

After hitting yet another AI-driven record high, stocks are seeing some fatigue as the rally runs on fumes. It's hardly surprising, after the latest meltup, as traders contemplate the government shutdown stretching into a second week, political shocks overseas and the latest tariffs. Even tech might struggle, with Citi strategists cautioning that investors may want to cash in.

The market's latest winning streak has been fueled by AI euphoria and optimism about earnings, but those drivers could reach a limit. “Profit-taking risks have rapidly risen across markets, and are particularly elevated for Nasdaq, potentially hampering further upside,” according to Citi’s Chris Montagu. Meanwhile, AI valuations are nearing extremes, with the SOX Index’s forward P/E ratio approaching three standard deviations above the 15-year average. Still, tech news keeps coming, and it seems like anything OpenAI touches turns to gold.

Monday’s AMD deal was the latest big-budget data center agreement this year. It follows last month’s announcement that Nvidia Corp. was planning to invest as much as $100 billion in OpenAI amid demand for tools like ChatGPT and the computing power needed to make them run. Tech firms are spending hundreds of billions of dollars on advanced chips and data centers, and the final bill may run into the trillions. The financing is coming from venture capital, debt and, lately, some more unconventional arrangements that have raised eyebrows on Wall Street.

While equities worldwide have surged to successive record highs, worries over the US government stalemate and the political crisis in France have driven investors toward alternative assets such as gold and Bitcoin, sending both to new peaks in what has been dubbed the “debasement trade.” At the same time, a flurry of AI-related deals among chipmakers has propelled shares higher and fueled some concerns of a speculative bubble reminiscent of the late-1990s dot-com era.

“Enthusiasm for stocks is starting to wane after another record-breaking start to the week for Wall Street,” said Kathleen Brooks, research director at XTB Ltd. That keeps the debasement trade in play, she said. “As global political risks rise, this is continuing to drive demand, and we think that the early morning pullback in the gold price is likely to be used as a buying opportunity.”

In political news, the government shutdown extends into a 7th day and Trump said he would negotiate with Democrats over health care subsidies, a move that could open the door to resolving the shutdown. Carlyle Group is releasing its own estimates of US data to fill the void. The investment manager estimates that just 17,000 jobs were created in September, among the weakest results since the US economy emerged from the 2020 recession.

Meanwhile, Citadel’s Ken Griffin warned that investors are starting to view gold as a safer asset than the dollar, a development that the billionaire investor called “really concerning.”

Not everyone is concerned about the AI bubble however: there are the usual commission-based traders whose paycheck depends on a continuation of the status quo, like Pepperstone's Michael Brown. The Mag 7 group of tech giants that have powered the bulk of the S&P 500 rally in recent years are trading at valuations in line with their five-ear averages, he said.

“If you’re now about to tell me that they’ve been expensive for five years, well those seven stocks have delivered a total return of >300% in that period of time, and look set to rally even further in the coming months,” Brown said. “In fact, the path of least resistance for the market at large continues to lead to the upside, as earnings growth remains strong, the underlying economy remains resilient, and as the monetary policy backdrop becomes increasingly loose.”

Elsewhere, Europe’s Stoxx 600 benchmark edged higher. France’s CAC 40 reversed an early decline as President Emmanuel Macron made a last-ditch effort to salvage the government after Prime Minister Sebastien Lecornu’s resignation on Monday. Truckmakers including Volvo AB and Daimler Truck Holding AG fell after US President Donald Trump said 25% duties on medium- and heavy-duty trucks would begin next month. Here are the biggest movers Tuesday:

Asian shares traded steady after a six-day rally, as Japanese markets failed to hold initial gains amid an indecisive mood across global peers. The MSCI Asia Pacific Index gained as much as 0.4% before giving up the advance to trade little changed. Tech-heavy Taiwan shares were among key gainers, while stocks in Singapore and India also gained. Japanese shares ended flat. Markets in China, Hong Kong and South Korea remained closed for holidays. Australian stocks fell, bucking the broader region’s advance. A financial regulator approved Cboe Global Markets’ application to conduct local stock listings, spurring a decline in shares of the nation’s main exchange operator ASX Ltd. Stocks in India rallied for fourth straight session as the central bank’s recent credit easing measure boost local lenders.

In FX, the Bloomberg Dollar Spot Index rises 0.2% and stronger against most G-10 currencies, New Zealand dollar lags as investors ramp up bets on cuts by the central bank, which announces its latest decision on Wednesday.

In rates, treasury yields continue to grind higher led by long-end tenors, extending Monday’s curve-steepening selloff. Bunds underperform along with French bonds, which extend declines as President Macron seeks last-ditch talks to avoid a government collapse, giving outgoing Prime Minister Sebastian Lecornu 48 hours to negotiate. US yields are 1bp-3bp cheaper on the day with 2s10s and 5s30s curves steeper by less than 1bp; 10-year near 4.17% is up about 2bp vs Monday’s close with Germany’s cheaper by an additional basis point. Treasury auction cycle begins at 1pm New York time with $58 billion 3-year new issue, to be followed by $39 billion 10-year and $22 billion 30-year reopenings Wednesday and Thursday. Focal points of US session include 3-year note auction, first of this week’s three coupon sales, and several Fed speakers.

In commodities, gold swooned after hitting another record, but recovers to trade little changed at $3,959/oz. Oil prices falling, with Brent trading around $65.20/barrel.

The US economic calendar — still subject to delays from the ongoing government shutdown — includes August trade balance (8:30am), New York Fed 1-year inflation expectations (11am) and consumer credit (3pm). Fed speaker slate includes Bostic (10am), Bowman (10:50am), Miran (10:30am, 4:05pm) and Kashkari (11:30am).

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed despite the tech-led advances on Wall St with several holiday closures including Mainland China, Hong Kong and South Korea, while Japanese stocks rallied again as the post-LDP election euphoria persisted. ASX 200 was subdued amid losses in Telecoms, Consumer Discretionary and Tech, with sentiment also not helped by weaker Consumer Confidence. Nikkei 225 printed fresh record highs once again amid ongoing tailwinds from the dovish expectations associated with the incoming Takaichi government, while Japanese Household Spending also topped forecasts.

Top Asian News

European bourses (STOXX 600 -0.2%) opened mostly lower, albeit with very marginal losses. Though, soon after the cash-open sentiment slipped a touch to display a more negative picture in Europe, but without a clear driver. European sectors are showing a slightly more negative picture vs initially opening mixed. Food Beverage & Tobacco takes the top spot, boosted by a couple of reasons. Firstly, Imperial Brands (+3%) helps to prop up the sector after the Co. announced a GBP 1.45bln share buyback and confirmed its FY25 guidance. Secondly, alcohol names opened higher in a read-across following strong Q2 metrics from US-listed Constellation Brands (+3.2% pre-market); the Co. beat on its top- and bottom-lines, where it cited continued demand for its beer portfolio. The likes of Diageo (+1%) and AB InBev (+0.7%) both move higher. Energy and Telecoms complete the top three; the former is helped by Shell (+1.7%) after the Co. said it expects “significantly higher” gas trading in Q3, with its outlook for that quarter also positive.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

Central Banks (All Times ET):

DB's Jim Reid concludes the overnight wrap

Markets have had an eventful start to the week, with political surprises cascading across different asset classes. The biggest headlines came from France, where markets were weak yesterday after PM Lecornu announced his resignation, which reopened fears around the country’s debt trajectory. So that pushed the Franco-German 10yr spread to a 9-month high of 85bps, whilst the CAC 40 (-1.36%) posted a big decline. By contrast, Japanese equities are continuing to edge ahead after Sanae Takaichi’s victory in the LDP leadership contest, with the Nikkei up another +0.37% this morning, building on its huge +4.75% surge yesterday. And over in the US, the S&P 500 (+0.36%) posted a 7th consecutive advance to hit a fresh record, even as the government shutdown showed no sign of ending.

Lecornu’s departure came only 27 days after taking office, making him the shortest-serving prime minister in the history of the Fifth Republic. His downfall followed failed attempts to form a stable coalition and criticism that his new cabinet looked too similar to the previous one. The centrist alliance’s partners in Les Républicains ultimately withdrew support, leaving the government unable to pass a budget or advance deficit-reduction plans. Macron has asked Lecornu to continue consultations with party leaders to “define a platform for stability” and report back by tomorrow evening, but the political arithmetic remains unforgiving even if there's an outside chance he salvages something.

With parliament deeply divided after last year’s snap election, Macron’s options are limited. He could appoint another prime minister, potentially from the left, but that would not change the parliamentary gridlock that toppled Lecornu and his predecessors. A second more likely option is to call fresh legislative elections—now possible since more than a year has passed since the last vote—but that risks shrinking Macron’s centrist bloc even further. A presidential resignation appears unlikely: Macron has ruled it out repeatedly, and the next election is not due until 2027. If the president does call new elections, polling suggests they would likely strengthen Marine Le Pen’s National Rally, which now commands about 35 % of first-round voting intentions. Markets have been fearful of such an outcome but are hoping that, if elected, the RN would follow a path similar to Italy’s Giorgia Meloni and become more mainstream and on debt offer limited but EU-compliant fiscal consolidation to preserve market access. So there is a scenario that fresh elections does help encourage a more market friendly outcome. The main market risks are that the RN don’t evolve like Meloni’s Brothers of Italy (Fdl) party or that the left’s influence increases and the pressure on the budget increases again.

The resignation led to an immediate reaction among French assets, with France’s 10yr yield spiking by +5.9bps yesterday to 3.567%, well above the +1.2bps increase for 10yr bunds. So investors are continuing to view France as an increasingly risky sovereign relative to its peers, and the Franco-German 10yr spread hit a 9-month high of 85bps. Notably, the Franco-Italian 10yr spread moved up to 2.7bps as well, which is its biggest gap so far since the two crossed over last month. Meanwhile for equities, France’s CAC 40 (-1.36%) underperformed, with bigger losses for banks including Société Générale (-4.23%), Crédit Agricole (-3.43%) and BNP Paribas (-3.21%). And in turn, that dragged down the Europe-wide indices, with the STOXX 600 (-0.04%) slipping back from its record high on Friday.

Whilst European markets were clearly affected by political developments yesterday, US markets continue to be unfazed by matters in Europe or the ongoing shutdown. Indeed, the S&P 500 (+0.36%) and the NASDAQ (+0.71%) both moved up to new record highs. That was in part down to a huge surge for AMD (+23.71%), which came after the news that OpenAI had agreed to purchase tens of billions of dollars of chips from them. So that easily left AMD as the top performer in the S&P 500, with the index posting a fresh gain, even as just over half its constituents moved lower on the day. After the US markets had closed, the US announced that it would be taking a 10% stake in Trilogy Metals, a Canadian mining company based in Vancouver (the stock was 215% higher in after-market trading). The mining company has claims in remote areas of Alaska and comes as the Trump administration continues to focus on critical minerals, including a similar deal with Lithium America Corps last week.

In terms of the government shutdown, last night saw a fresh vote on a stopgap bill to reopen the government. The vote failed as expected, with a margin of 52-42. Republican leadership needed 60 votes to advance the bill. Late on Monday, President Trump told reporters that he was open to negotiating with Democrats over the healthcare subsidies, saying “We are speaking with the Democrats, and some very good things could happen with respect to health care.” While Senate Minority Leader Schumer denied that claim, he remained open to discussing the subsidies. The comments indicated there was a potential path to a deal, but betting markets continue to see a large divide. So on Polymarket for example, it now suggests there’s a 68% chance of the shutdown not ending until at least October 15, that is down from 74% before President Trump’s comments. Polymarket is pricing in a 22% chance that this shutdown breaks the 35-day record. In the meantime, US Treasuries lost further ground given the earlier Japanese move and general risk-on tone in the US, with the 10yr yield (+3.3bps) moving up to 4.15%. We're half a basis point lower across the curve this morning.

Asian equity markets are mixed this morning, as trading volumes remain subdued due to market holidays in China, Hong Kong, and South Korea. Across the region, Japanese stocks are continuing to climb, reaching fresh record highs, following yesterday +4.75% surge, marking its best performance since April, when it responded to the 90-day reciprocal tariff extension. As I check my screens, the Nikkei (+0.37%) is edging higher, while the S&P/ASX 200 (-0.22%) is lower. S&P 500 (-0.06%) and NASDAQ 100 (-0.04%) futures are a touch lower.

Early morning data indicated that Japanese household spending increased at a faster rate than anticipated in August, suggesting that consumers are feeling relatively optimistic, which is a positive indicator for the recovery of private consumption. Consumer spending rose by +2.3% year-on-year in August, marking the fourth consecutive month of growth and significantly surpassing the median market forecast of a +1.2% increase.

Meanwhile, the Japan 30-year auction saw stronger demand than its 12-month average, alleviating investor concerns following Sanae Takaichi’s election victory over the weekend. Yields on the 30-year JGBs have decreased by -2.6bps, trading at 3.28%, while the 10-year JGBs are down by -0.5bps, currently standing at 1.68% as we go to press.

Finally yesterday, the rapid ascent for gold prices in 2025 continued, rising another +1.92% to $3,961/oz. The latest move now means they’re up more than +50% on a YTD basis, leaving them well on track for their fastest annual gain since 1979, when they rose +127% amidst a surge in inflation after the oil crisis that year. Elsewhere, Bitcoin (+2.03%) also hit a new record, closing above the $125,000 mark for the first time at $125,260.

To the day ahead now, and data releases include the US trade balance and German factory orders for August. Otherwise, central bank speakers include ECB President Lagarde, the ECB’s Nagel, and the Fed’s Bostic, Bowman, Miran and Kashkari.